If an employee works in an organization for a period of five years or more, before leaving by way of resignation or retirement, then such an employee receives a lump-sum amount of money from this organization called Gratuity. During earlier times, when an employee left an organisation, his employer would pay him a handsome amount of money in appreciation of his past services as gratuity money. But this amount was not fixed and was at the sole discretion of the employer. Due to having no rules for gratuity calculation, there arose rifts between the employer and the employee. This compelled the Indian Government to bring out a law on this matter and hence The Gratuity Act, 1972 was formed and enforced. The Gratuity Act, 1972 stated the rules and regulations for gratuity calculation formula and on whom gratuity would be applicable.

Table of Contents

Rules and Applicability of The Gratuity Act, 1972

The Gratuity Act, 1972 is applicable on as per following rules:

- an organization which consists of more than 10 employees.

- on employees who have completed full 5 years or more of service in an organization.

- Per the recent amendment, a ceiling has been put on the amount of gratuity payable, which is Rs 20 lakh. Many companies pay a higher amount as a gratuity to their employees which is not denied by the government. But an employer cannot pay below Rs 20 lakh if the employee should be getting more. In the opposite scenario, where the employee should be receiving less, then the decision lies with the employer, whether he wants to pay him a lesser amount or an increased one.

- If during employment an employee dies then the above rule of minimum 5 full years of completed is relaxed and this employee is entitled to gratuity for the number of years for which he has worked for the organization.

Understanding labor laws can significantly enhance your knowledge about your rights and obligations in the workplace. Our Online Labour Law Course offers a comprehensive dive into various laws, including the Gratuity Act, ensuring you’re well-equipped to navigate the complexities of employment regulations. Whether you’re an employee wanting to know your benefits or an employer aiming to comply with the law, this course is for you.

Understanding your salary structure is crucial when calculating potential gratuity benefits. Our guide on CTC vs Gross vs In-hand Salary breaks down these concepts to help you comprehend how your total earnings are categorized. Knowing the difference can aid in better financial planning and understanding how gratuity fits into your overall compensation package.

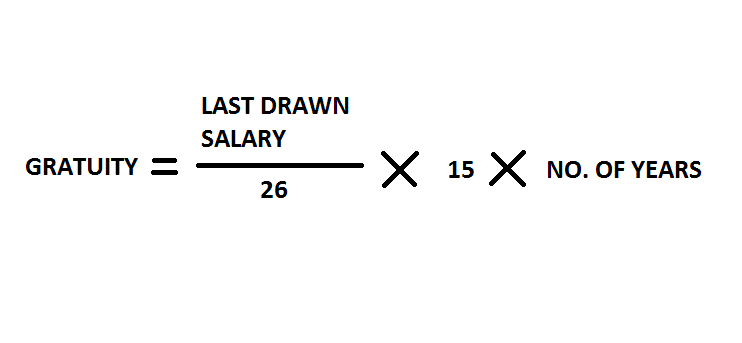

Gratuity Calculation Formula as per The Gratuity Act

where,

- Gratuity limit = Rs 20 lakh

- Last drawn salary = Basic + Dearness Allowance (D.A.)

- Tenure of working/No. of years of service = 5 or more years. The time period in months is taken on the higher side if it is more than 5 months. For example, if an employee completes 7 years and 5 months in an organization, then for the purpose of gratuity calculation formula, his no. of years of service will be 7 years. Similarly, if an employee complete 7 years and 8 months of service, then for gratuity calculation formula, we take it as 8 years.

Gratuity Calculation Formula for Deceased Employee

In case of the untimely death of an employee during employment, he is entitled to gratuity as follows:

Qualifying Service | Rate |

Less than 1 year | 2 times of basic pay |

| 1 year or more but less than five years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| Twenty years or more | Half of the emoluments (salary) for every completed 6 monthly periods subject to a maximum of 33 times of emoluments |

The full eligible amount paid as a gratuity to an employee is completely tax-free and thus attracts no tax at all. Additionally, the word “eligible” means the amount to which an employee is legally entitled to as per the gratuity calculation formula. It means that if an employee is entitled to a sum of Rs 15 lakhs as gratuity, but his employer pays him Rs 17 lakhs, then this extra amount of Rs 2 lakhs (Rs 17 – 15 lakhs) to which the employee is not legally entitled to, attracts a tax. Furthermore, the employee has to pay a certain amount on this extra earned money calculated as a certain percentage.

What are the Gratuity rules of 2022?

On July 1, 2022, the new labour law went into effect for all businesses and organisations. The working hours, Provident Fund, and in-hand salary were decreased in accordance with the new labour law. This law will have the most effect on take-home salaries. According to the new gratuity rules of 2022, employers must make sure that basic pay makes up 50% of an employee’s CTC (cost to the company) and that employee allowances, house rent, and overtime make up the remaining 50%.

Additionally, any additional allowances or exemptions that the corporation grants that go beyond 50% of the CTC will be regarded as compensation. The law restricts the highest basic pay to 50% of CTC, which raises the required gratuity bonus for employees. Based on a significant wage basis that comprises basic pay and allowances, the gratuity amount will be decided. Further, the new rules state that when an employee works overtime, which is now defined as working for 15 minutes or more, then they are paid extra for it. The work capacity is capped at 48 hours, according to the government.

As part of their remuneration package, salaried workers are entitled to gratuities. The Payment of Gratuity Act of 1972 regulates the payment of gratuities, which are defined benefits given to employees in a lump sum upon retirement. It resembles a thank-you present given to employees as a parting gesture. When a person has worked for an organisation for five years in a row, they are eligible for a gratuity payout. As a result, gratuity may be paid at the time of retirement or termination or to the employee’s legitimate heir in the event of death.

However, the 5-year continuous rule condition is not required in case of an employee’s death. The Centre recently passed an amendment in 2019 that raised the gratuity cap. Since Section 10(10) of the Income Tax Act raised the previous limit of Rs 10 lakh, it is now tax-exempt up to Rs 20 lakh. The exemption limit of Rs 20 lakh will be applicable to employees in the event of retirement, death, resignation, or disability on or after March 29, 2018, according to CBDT Notification No. S.O. 1213(E), dated March 8, 2019.

According to Section 10(10) of the Income Tax Act, both government and non-government employees are entirely liable for any gratuities they receive while working. Any gratuity received during work is fully taxable in the hands of the employee. However, the government employees, the Centre, or the state, are exempt from paying tax on the gratuity amount received by the government. However, statutory corporations are not exempted. Employees who get a death-cumulative-retirement gratuity, however, can be divided into three groups. Government employees, those protected by the Payment of Gratuity Act, 1972, and other employees are all included in this division.

Frequently Asked Questions

1. Whether an employer is permitted to withhold gratuity during the pendency of disciplinary proceedings against a superannuated employee?

In the case of Chairman-cum-Managing Director, Mahanadi Coalfields Ltd. v. Sri Rabridranath Choubey,[1] the Supreme Court of India observed that the provisions of Section 4(6) of the Payment of Gratuity Act, 1972, which contains a non-obstinate clause, provides for recovery or forfeiture of gratuity, where services of employee have been terminated for the reasons prescribed in Section 4(6)(a) and 4(6)(b) of the Payment of Gratuity Act, 1972. As the forfeiture is conditional upon the delinquent employee being terminated or dismissed from the services, no forfeiture is possible where the employee is not capable of being dismissed, presumably upon being superannuated.

However, the situation is different, where the relevant provisions, such as Rule 34 of the Conduct, Discipline & Appeal Rules, 1978 of the company, in this case, contain a deeming provision of continuation of employment to enable dismissal from service even post superannuation. The Supreme Court observed that the Payment of Gratuity Act, makes no provision with respect to departmental inquiries and hence, no fetter is caused upon operation of Rule 34.2 of the CDA Rules providing for a continuation of the inquiry and deemed continuation of the employee in service after the age of superannuation.

After referring to various decisions, the Supreme Court observed that it was apparent under Rule 34.2 of CDA Rules that inquiry could be held in the same manner as if the employee had continued in service and the appropriate major and minor punishment commensurate to guilt can be imposed including dismissal as provided in Rule 27 of the CDA Rules and in case pecuniary loss had been caused, that can also be recovered. Gratuity can be forfeited wholly or partially. Specifically, by relying on the Full Bench decision in the case of State Bank of India v. Ram Lal Bhaskar,[2] the Co-ordinate Bench of Supreme Court ruled that, where the relevant disciplinary rules permit continuation of disciplinary proceeding against a superannuated employee and imposition of penalty of dismissal as if the employee had continued to be in employment:

- It is permissible in law for the employer to withhold the payment of gratuity to the employee after retirement from service on account of pendency of the disciplinary proceedings against him; and

- It is permissible for the disciplinary authority to impose penalty of dismissal after the employee stood retired from service.

The Supreme Court has further overruled the Division Bench decision of Jaswant Singh Gill v. Bharat Coking Coal Limited,[3] on the grounds that:

- The order of termination was not questioned, nor the authority under the Payment of Gratuity Act, had jurisdiction to deal with it,

- The validity or enforceability and vires of CDA Rules 34.2 and 34.3 were not questioned and,

- It did not consider the scope of provisions of the Payment of Gratuity Act and provisions of CDA Rule 34.2, provide a legal fiction of an employee deemed to be in service even after superannuation.

2. Whether an employer can withhold gratuity in case of commencement of departmental proceedings as well as judicial proceedings against an employee?

In the case of Shoma Sen v. State of Maharashtra,[4] the Bombay High Court held that since no charge-sheet has been drawn up in connection with the departmental proceedings, it cannot be concluded that departmental proceedings has been initiated against the employee. Thus, the employer was not entitled to withhold the gratuity of such an employee. Further, the court distinguished the ratio laid down by the Supreme Court in the case of Chairman-cum-Managing Director, Mahanadi Coalfields Limited v. Sri Rabindranath Choubey,[5] by virtue of the peculiar facts of the instant case.

The court thus observed that, the Supreme Court in the aforesaid case was called upon to decide whether gratuity could be withheld because of pendency of disciplinary proceedings, however, the ratio of the said case is inapplicable in the instant case since neither departmental proceedings nor judicial proceedings were pending as on date on which the petitioner had retired on superannuation.

3. Whether the determination of appropriate Government has any bearing for determination of the ceiling up to which gratuity is payable under the Payment of Gratuity Act?

In the case of Samir Kumar Ghosh v. State of Tripura,[6] the Tripura High Court held, by relying on the case of Bhupati Debnath v. State of Tripura,[7] that when the question pertains to payment of gratuity, the distinction of government being Central or the State Government being an “appropriate Government” in relation to different classes of establishments, has no effect, especially pursuant to the amendment by Payment of Gratuity (Amendment) Act, 2018, whereby the power to prescribe such ceiling has been vested in the Central Government, to be exercised by issuing a notification in this regard.

4. Whether gratuity is payable upon resignation by the employee, despite regulation providing otherwise?

In the case of B.S. Rawat v. Shyam Lal College,[8] the Delhi High Court held, by relying on the case of University of Delhi v. Ram Prakash,[9] that in light of overriding effect of the Payment of Gratuity Act in view of Section 14 (Act to override other enactments, etc.) of Payment of Gratuity Act, there could be no dispute that, irrespective of a contrary provision provided in any other enactment or regulation, an employee would be entitled to gratuity even if he had resigned, in terms of Section 4 of Payment of Gratuity Act.

[1] Civil Appeal No. 9693 of 2013

[2] (2011) 10 SCC 249

[3] (2007) 1 SCC 663

[4] Writ Petition No. 1857 of 2020

[5] Civil Appeal No. 9693 of 2013

[6] W.P. (C) No. 1091/2017

[7] W.P. (C) No. 1050/2019

[8] W.P. (C) No. 3147/2020

[9] 2015 SCC Online Del 8634

To see a few examples of the gratuity calculation formula, with an explanation, check the video below:

Starting a new job brings with it the challenge of understanding various employment benefits, including gratuity. Our article for new employees in India provides essential tips for navigating your initial days in the workplace, understanding your compensation package, and ensuring you’re aware of your rights and benefits from day one.

Was this insightful? if yes, then do not forget to check our Labour Laws and Compliance online courses with exclusive discounts!