It is commonly seen during interviews that companies promise a certain CTC to a person but at the time of salary payment, the amount actually received is significantly less than promised. So why and what causes this discrepancy? In this article we sat down with Mr Parth Mehta, a prominent Labour Law Advisor of the country, to decode the the difference between CTC vs gross vs in-hand salary.

Table of Contents

What is CTC vs Gross vs In-Hand Salary?

CTC:

CTC or Cost To Company is the expense that the company incurs upon hiring an employee. The CTC includes a number of variants such as – direct benefits (basic salary, dearness allowance, conveyance allowance, house rent allowance, medical allowance, leave travel allowance, vehicle allowance, telephone allowance, incentives/bonuses, special allowances), indirect benefits and savings contributions. CTC is a variable pay since it varies on many factors. Accordingly, there are variations on the in-hand salary.

CTC = Direct Benefits + Indirect Benefits + Savings Contributions

Gross salary:

Gross salary is the EPF and Gratuity deducted from the CTC. Thus, gross salary is the amount the employee receives before the deduction of taxes. Gross salary is also inclusive of holiday pay, overtime pay, bonuses and other differentials.

In-Hand or Net or Take-Home Salary:

In-hand salary is the actual

Net Salary = Gross Salary – Income Tax – Public Provident Fund – Professional Tax

How to compute in-hand salary?

There has never been any mention of CTC in any Labour Laws Act. It is a corporate myth that one should join a company based on the CTC. CTC is what the company internally calculates for hiring an employee. It is always recommended to negotiate on the gross salary, basic salary and in-hand salary, rather than on CTC, and then decide upon joining a company.

Case Study:

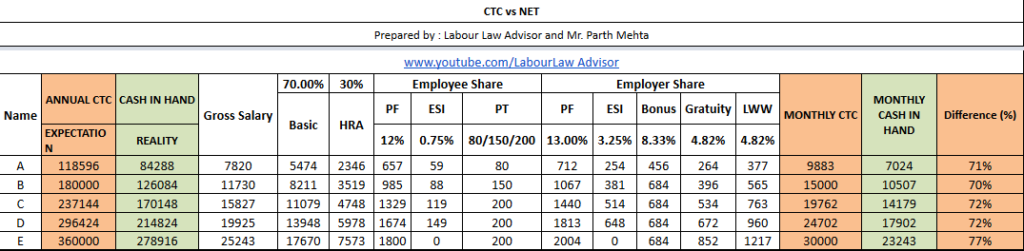

CTC vs gross vs in-hand salary calculation excel sheet

The excel sheet lays out the exact amount under each parameter that forms one’s CTC. As seen in the above excel sheet, the CTC is calculated on the gross salary. This gross salary is divided into a standard 70% basic allowance and 30% HRA. This happened after the Supreme Court judgement, which you can read all about here. The employee’s share of PF, ESI and PT is again deducted from the gross salary, and not from the CTC. Similarly, the employer’s share is calculated on the gross salary. Bonus, Gratuity and LWW percentages are taken tentatively here, which can further vary by 0.2%. Hence, for a certain CTC, one can see the tentative amounts they will receive for each parameter.

Furthermore, you can receive your PF money as well as bonus and LWW. But the ESI and PT are not going to transfer to you in cash. Plus, you will receive the gratuity amount only if you complete five years of service in a company. Additionally, one can subtract 30% of the CTC to guess how much in-hand salary they will receive approximately.

Implication:

Furthermore, we see, the lesser a person earns, the more deduction they receive on their salary. On the other hand, the more a person earns, the lesser their salary deduction. This is quite opposite to what happens with income tax. It also seems quite counter-intuitive.

Watch our video with complete explanation of CTC vs gross vs in-hand salary calculations below.

Learn some more financial tips through our following blogs:

Franchise Business | Low Investment High-Profit Business Idea

Income Sources | Financial Advice To Earn More Money

EasyPlan – Investment Solutions

Meesho App – Earn Money Online Without Any Investment

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!