PF funds are managed by either EPFO or exempted trust. This article details the process involved in withdrawing or transferring PF from exempted trust.

Some companies with over 50 lakh employees manage their own PF contributions instead of sending them to the EPFO. Such companies form their own PF trusts and are known as Exempted Trust. These companies obtain an exemption from the EPFO to manage their own PF funds, which in certain cases may be over Rs 1 crore. They also get special permission from the Income Tax department to manage their own PF trust. There are about 1500 such companies in India. These companies generally have a large number of employees. TCS, Hindustan Unilever (HUL), Wipro, Reliance, BHEL, all fall under this category of exempted trust.

These exempted trusts have the same rules as the EPFO. All members get a UAN. The employee and employer contribute 12% of their monthly salary to their PF. However, 8.67% of the employer’s contribution to pension goes to the EPS managed by the EPFO and is not kept under the exempted trust. Since exempted trusts do not have the permission to keep pension amount. However, there are two such companies which manage their own pension funds as well in a pension trust.

Instead of an administration charge of 1.1% that PF members pay to the EPFO, PF trust members have to pay only 0.18% as an inspection charge. The PF trust members though cannot view a PF passbook. This is because PF passbooks are maintained by the EPFO. But here, EPFO does not handle the PF funds for the exempted trusts. Meanwhile, in the case of EDLI, the EPFO gives the option to companies to keep the EDLI amount as well if they can give their employees the same EDLI benefits. Else, the EPFO can handle EDLI contributions and benefits for them.

Table of Contents

Why is there a need for exempted trust?

The main reason for having PF exempted trust is the ease of operation. As stated earlier, these 1500+ companies have over 50 lakh employees in them. To maintain and transfer the monthly documentation of all these employees to the EPFO would be a nightmare of sorts. If some of these employees from each company were to go to the EPFO for their PF claims, withdrawals and other services, it would cause a huge waitlist.

So, to unburden an already overburdened system of PF, these companies opt to have exempted trust. Here, the PF amount stays with the company itself. So, all the employee has to do is go to their HR and avail the PF services by filling in some company forms instead of having to file EPFO forms. This makes the whole service period quick and hassle-free as well. Hence, it saves time and energy for both the EPFO and the employees.

What are Exempted PF Trust Contributions?

Over 1,000 companies in India have their own PF trust. Hindustan Unilever (HUL), TCS, Reliance, Wipro, Bharat Heavy Electricals (BHEL), and others are examples. The operation of exempted or private PF trusts is identical to that of the EPF. It follows the same principles as EPF, and members are assigned a Universal Account Number (UAN).

In the same way that EPF, both the employer and the employee contribute 12% of their salary (Basic + Dearness Allowance) to the Exempted PF Trust. The Employee Pension Scheme, on the other hand, receives 8.33% of the employer’s contribution. The EPFO is in charge of EPS, not the exempted PF trust.

The administration charge for an EPF member is roughly 1.1%, but the inspection charge for an exempted PF trust member is around 0.18%. This could save money in the long run. Because PF trusts oversee employee contributions, they must pay the same or a greater interest rate than EPFO.

Are there any drawbacks for exempted trust members?

There are absolutely no drawbacks of being an exempted trust member instead of a regular PF member. Since exempted trust members can avail all the same benefits as PF trust members. Exempted trust members also get a PF account number and a UAN. Furthermore, when they change employments, their PF account number changes while their UAN stays the same. Additionally, exempted trust members enjoy the same PF interest as regular PF members. The EPFO had stated that employees should not receive any fewer benefits in exempted trusts.

To ensure that the companies do their PF jobs correctly, the EPFO has a rating system. It rates the companies on six parameters, depending on how fast and efficiently they do their PF services. The companies get points out of 100 for each parameter. It is also important for companies to maintain a minimum score. Hence, this helps in regulating the work of exempted trusts.

What things occur differently for exempted trust members?

- These members cannot view their passbook on the EPFO website. Since EPFO does not handle their PF amount, they cannot update the monthly passbook of these trust members. Although the EPFO has instructed companies to inform their employees on a yearly basis of their contributions, deductions, interests and balance. Hence, such employees can contact their company or view the company website to avail their information.

- If such members want to withdraw their PF amount then they need to contact their company HR rather than the EPFO. Thus, they will apply in the company for PF withdrawal and not the EPFO.

How to check for an exempted trust?

To find out if one’s company falls under the exempted PF trust, one has to go to the PF establishment search feature on the EPFO website. We have already explained this feature in details previously. You can view PF Establishment Search | New Feature Details to figure out your company’s standing.

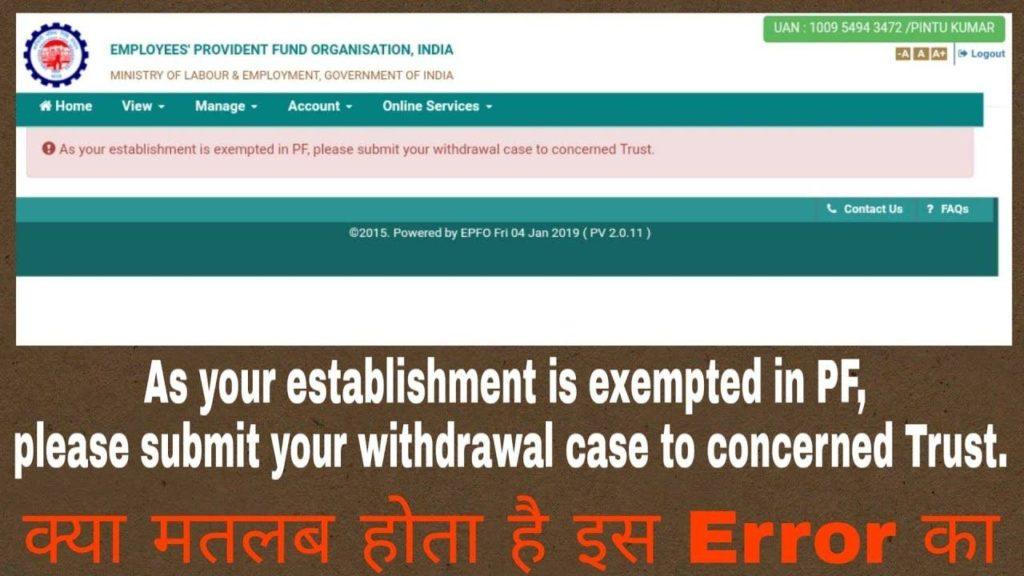

PF withdrawal from an exempted trust

If your company is an exempted trust, then you will need to contact your HR for your PF withdrawal. It is also your HR’s responsibility to give you your PF withdrawal fund along with the interest it accrues. If your PF withdrawal takes over 10 days then you can lodge a complaint on the EPF Grievance Portal. Learn how to do that in EPF Grievance Portal | Submit PF Complaint Online.

What happens when you switch jobs and need to transfer PF from an exempted trust?

You will need to contact the HR of your current company with the PF trust and inform them that you are joining a new firm. Then your HR has to provide you with the following four things. Firstly, your EPF account statement, which shows your monthly contributions. Secondly, Annexure K, which has all your EPF account details like date of joining, date of exit, PF balance, service period, etc. Thirdly, a letter to your new company, stating that their employee (i.e., you) are leaving this company and his PF fund needs to be transferred from the PF trust to the EPFO or the new company’s exempted trust, whichever may be the case. Lastly, a cheque of your EPF balance addressed to the regional PF office of your new company.

You need to take these four documents to your new company’s HR. The new HR will again write a covering letter to their Sub-Regional PF Commissioner, stating that this new employee has left the said firm and joined their firm. Hence, the new employee’s PF funds need to be transferred from the old PF trust to the Regional PF office.

You also need to send an application to the EPFO website, in Transfer Claim under Online Services. This application will help in updating your service history. This is important for your pension calculation.

Watch two comprehensive videos on the above details below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!