EPF (Employee Provident Fund) is a monthly savings scheme for an employee to provide financial stability during his retirement. Both employee and employer contribute to this scheme. EPF is mandatory for all companies having above 20 employees. The deadline for submitting the EPF of your employee for one month is the 15th of the next month. Hence, if you have to deposit EPF for your employee for January 2023 then it has to reflect in their EPF account by the 15th of February 2023. Otherwise, the EPF payment is considered late. As an employee, you can check your EPF balance and download the EPF passbook in a few simple steps as explained below.

Table of Contents

What is a Member Passbook?

The Employees’ Provident Fund Organisation (EPFO) is the statutory agency within the Government of India’s Ministry of Labour and Employment in charge of the regulation and supervision of provident funds in India. The EPFO’s highest decision-making authority is the Central Board of Trustees (CBT), a legislative body established by the (EPF&MP) Act of 1952.

Recently, Shri Bhupender Yadav, Union Minister for Labour and Employment, has introduced an electronic passbook (e-passbook) for Employees’ Provident Fund Organisation (EPFO) members. This new project aims to make life easier for members by allowing them to examine additional details about their accounts via graphical representations. This service is intended to allow EPFO members to examine their transaction history and balance statements online without having to visit the EPFO office. The necessity of redesigning the passbook was highlighted during stakeholder meetings with 13,200 employees and more than 2,200 companies.

What is E-passbook?

The e-Passbook is a digital statement of a PF account that EPFO members can browse and download online at any time. It is a document that provides all of the vital facts of an individual’s EPF account, such as employer and employee payments, interest collected, and the total amount deposited in the account.

What are the features of the new Passbook?

- It displays proper information

- It provides information relating to transactions in various EPF accounts linked to UAN

- Provides calculators for working out the benefits due at present and in the future under the three schemes

- Last, but not least, it gives a history of all EPF accounts

What is the procedure to Login?

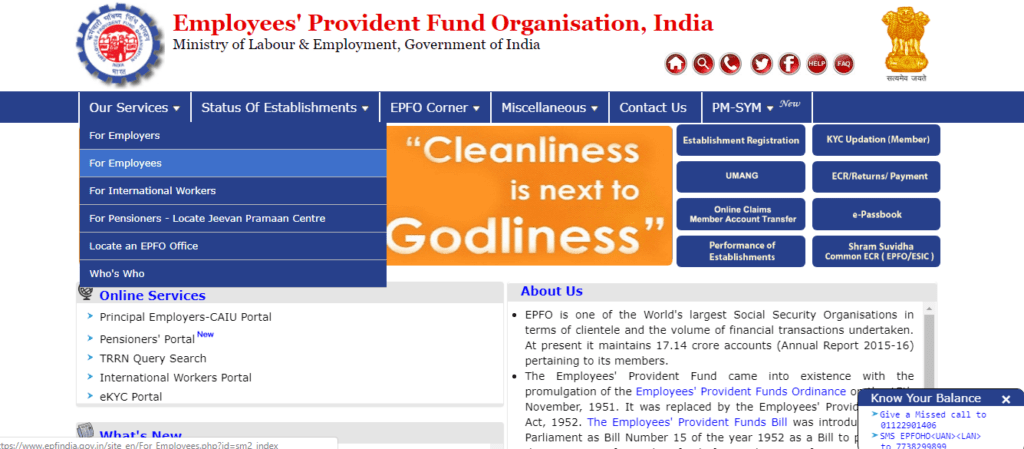

1. First, the employee must go to the EPFO website.

2. The employee must then select the ‘e-Passbook’ option appearing on the right side.

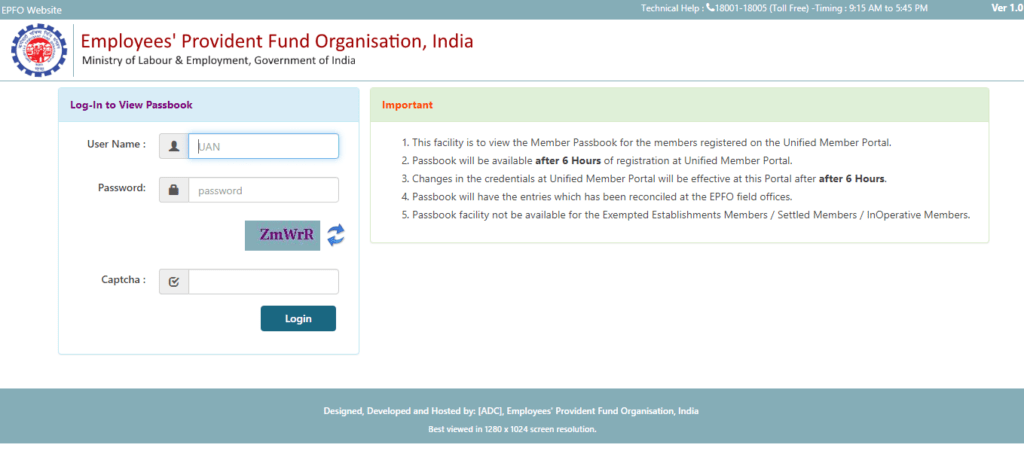

3. The employee must enter his/her UAN, password, and captcha details in the new tab.

4. The employee must then click the ‘Login’ button.

5. On the following page, the employee’s Member ID will be presented. If the employee has multiple Member IDs, they will all be displayed on the screen.

6. The employee must click on the Member ID whose PF statement he or she wishes to download.

7. Then, when the employee clicks on the Member ID, all PF account details are displayed, including the name of the organisation, the employee’s name, the location of the office, the employer and employee’s share, and the contribution made to the Employees’ Pension Scheme (EPS) account.

8. The employee can download and print the PF statement in PDF format.

EPF Contributions & Current Establishment Details | Member-Wise Balance

This is a graphical representation of the memberwise balance sheet showing the share of EPF by both the employer and employee.

EPF Contributions & Current Establishment Details | Establishment Details

You will need the following current establishment credentials to view the EPF contributions, as illustrated in the image below.

EPF Member Service Details

This is a complete data and graphical depiction of an EPF member’s service details and history.

KYC & Employee Basic Details

EPF members who have linked their KYC details in the portal typically have their claims, withdrawals, transfers, and so on processed considerably faster.

Passbook Chart

This is the visual representation of the EPF contribution (segregated by Employee, Employer, and Interest Earned).

Month-Wise Contributions Statement

Transactions made in an employee’s EPF account can be traced both by date and by month using the online e-passbook.

Members Claims History

This history includes the subject of the claim, what caused the damage, the amount paid by the insurance, and other such facts as shown below.

Claim Settlement Details

This clearly depicts the claim description along with the receipt date, form type, total amount, and approved date which makes it easy for a member to keep track.

Rejected Claims Details

Here, it is about claims that have not been settled or have been denied in the above case.

How to Download EPF Passbook?

- Visit the EPFO India website.

- You can view the option of checking your EPF balance via the Umang app. The only condition for this is that you should have access to the mobile number registered to your PF account or UAN since you will receive an OTP for logging in on it. To learn more details about the Umang app, click on this video or this blog.

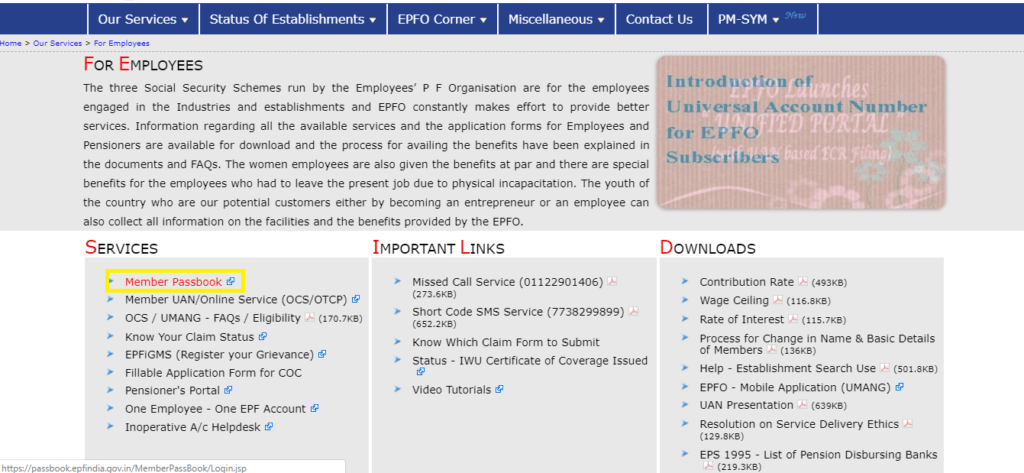

- Now to download your EPF passbook online via the EPFO website, click on Our Service on the top left corner of the homepage and choose For Employees option.

- Under the Service section, on the bottom left of the page, choose the Member Passbook option.

- This will open a new webpage asking for your Username and Password. Fill in both your UAN and password received upon UAN activation. You can learn that process here or here. Now enter the Captcha given and click on Submit.

- On the new page, under the column Select Member ID To View Passbook, choose your PF member id. This will display a new PDF with all the details of your month-wise PF and Pension contribution. To download this PDF just click on the download button on the top right corner of the file.

You can also check out the video on this tutorial below:

Also, if you want some more interesting and important PF-related content, you can check out our course.