Provident Fund (PF) is a mandatory retirement savings scheme which is managed by the Government of India. It is quite similar to the Social Security scheme in the USA. Under the PF scheme, employers and employees contribute a fraction of their salaries which is paid to the employes upon retirement. This article is a PF helpline, in which we shall look at the 10 most common queries related to PF and their solutions.

Table of Contents

PF Helpline 1: While withdrawing PF, only Form 31 is available, not 19 and 10C

Ideally when trying to withdraw PF online, employee should get the options to check Form 19 and Form 10C. But sometimes only Form 31 is available on the options given. This is because that the employer has not marked the employee’s date of exit from the company. This could either be due to the employee still being a current worker there or due to the employer’s negligence. It can be resolved by having the employer mark the employee’s date of exit on the employer’s PF portal.

Check out our video on online PF withdrawal process here for more information.

PF Helpline 2: What form needs to be filled to withdraw full PF and Pension amount?

Form 19 needs to be filled for PF claim and Form 10C needs to be filled for Pension claim.

PF Helpline 3: How to change Father’s name on EPFO portal?

The only method to correct or edit the employee’s Father name and some such important personal details is through a Joint Declaration Form. Check out our following video & our blog for an in-depth tutorial on what is a Joint Declaration Form and the format to create one.

PF Helpline 4: Is PAN card mandatory for PF?

No, having a PAN card is not mandatory for your PF account but it serves as a boon to save yourself from some tax. If your PF fund is less than Rs. 50,000 then you need not worry about getting any tax deductions. But if your PF fund is more than Rs. 50,000 then you need to submit your PAN card details to avoid getting TDS deductions. If in case you do get TDS deducted then also it will be 10% only which can be claimed in your ITR.

Check out our video on how to save tax on your PF withdrawal here.

PF Helpline 5: Can I withdraw money from an old PF account, while currently working?

No. If you are still currently working somewhere then legally you are not allowed to withdraw money from your old PF account. What you can do though is that you can transfer your old PF account to your new PF account, so that both get merged and none of your earlier money is lost.

You can check out the simple process in our video here or our blog here.

PF Helpline 6: What to do when the employer is not updating the date of exit and not approving the KYC?

Even after repeated requests and complaints if your date of exit and KYC are not getting updated by your employer then you can write a Complaint Letter to the Regional EPFO Commissioner of your Regional PF Department. Mention your Company’s Name, Establishment ID, other details and the number of requests you have made. The matter will be quickly escalated and the EPFO shall look into the matter.

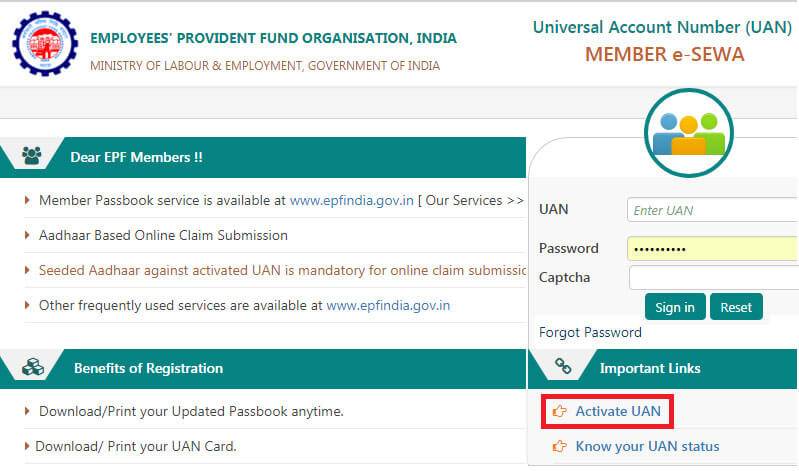

PF Helpline 7: How to reset PF portal password, if the mobile number is not available?

Usually, you get the option of “Forgot Password” on the PF portal, which sends an OTP to your registered mobile number. This OTP can then be used to reset your PF portal password. But in the case that you have lost both your PF portal password and your mobile number, you need to first change your mobile number and then reset your PF password. This is explained in the following video.

PF Helpline 8: While withdrawing PF why do we see this error: “Your establishment is exempted from EPF, contact your trust”?

This statement implies that your PF account is being handled by your company itself and not by the EPFO. In such a case, you need to contact your company’s HR or your owner to withdraw your PF balance. On the other hand, your Pension can be claimed online since that stay with EPFO only.

PF Helpline 9: When will the interest on PF for the current fiscal be credited?

According to our, approx. 30% people claimed that they had received their PF for the fiscal year 2017-2018. Generally, PF is issued unanimously to all employees. Hence, try updating and downloading your passbook once again to insure whether your PF for the current fiscal has been credited or not.

If it is still not showing as credited then you should submit a complaint via the EPFO Grievance Portal.

PF Helpline 10: If the EPFO staff is not helping, then where can we file a complaint against them?

The first step would be to file a complaint on the PF Grievance Portal as your first proof. Don’t forget to make a note of the Grievance Number and the Date of submission of the complaint.

The second step would be to write a complaint email to your Regional PF Commissioner. To find the email ID of your Regional PF Commissioner, check out our video here. Make sure to keep a copy of the complaint you have filed.

If neither of the above two work, then file a Right To Information (RTI) against your EPFO. The EPFO needs to reply to this RTI within a period of 30 days. Otherwise, they would be fined a large penalty.

The last option would be to file a case at the Consumer Court based on the report generated by the Central Information Commissioner on your RTI filed.

If you still have any queries then please find our video on PF helpline below:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!

Some more PF related engaging and important content for you:

EPF KYC Update Online & Verification Process Explained

Register Employees on EPF in 2 minutes

FAQs About EPF Registration

5 Rules for Easy EPF Calculation