The EPFO has extended the deadline for submitting applications for higher pensions under the Employees’ Pension Scheme (EPS) for the third time!

Originally, the Supreme Court had set the deadline for applications to March 3, 2023, following its judgment on November 4, 2022. However, due to the EPFO’s delay in issuing appropriate circulars, the deadline was first extended to May 3, 2023. It was later extended a second time to June 26, 2023, and the third time to July 11, 2023, and then the fourth time to September 30, 2023 and the fifth time to December 31, 2023.

Now, as per a press release, issued by the EPFO on January 03, 2024, the deadline has been extended again to May 31, 2024. The press release stated that this is the last opportunity for employees to submit their joint application form for a higher pension from EPS. The application form must be submitted within these 15 days to get a pension on higher wages.

This extension applies to retired employees who retired before September 1, 2014, and who opted for a higher pension but had their requests denied by the PF authorities.

The EPFO issued a circular for existing employees on February 20, 2023, which initially gave eligible employees less than 15 days to submit the application. Additionally, the circular mentioned that another circular clarifying the method of pension computation would be issued.

Due to the short time frame given to employees to submit their applications and the impending circular on pension computation, the deadline was extended.

This information was issued in a fragmented manner, with a notification clarifying additional contributions coming on May 3, 2023, and the method of pension computation being released on June 1, 2023.

In the press release, EPFO further encouraged any eligible pensioner/member who is facing difficulty in submitting an online application due to issues with KYC updation to lodge a grievance on EPFiGMS for resolution by selecting the category of ‘Higher Pensionary benefits on higher wages’.

If you’re encountering issues with your EPF or pension application, knowing how to effectively use the EPF Grievance Portal can be a game-changer. Our guide walks you through the process of submitting grievances online, ensuring your concerns are addressed promptly. Whether it’s KYC updation troubles or other application challenges, understand how to navigate the grievance system for quicker resolutions here.

For employers, the EPFO has provided an additional three months for uploading wage details online, extending the deadline to September 30, 2023. This comes as a relief to employers who were facing practical challenges in collating and filing wage details for the entire period of employment.

The decisions made in the Central Board of Trustees meetings significantly impact pension policies and member benefits. Our coverage of the PF Pension Decisions made during the Central Board of Trustees Meeting offers a deep dive into the outcomes of these gatherings, including critical decisions that affect your pension benefits. Staying informed about these decisions can help you better understand and navigate the pension application process.

Table of Contents

EPFO Issues New Guidelines for Compliance with the Supreme Court’s Judgement on Pension Scheme

The Employees’ Provident Fund Organisation (EPFO), under the Ministry of Labour & Employment, Government of India, has released instructions in accordance with the Supreme Court’s judgement dated November 4, 2022. The guidelines direct all additional Central Provident Fund Commissioners (CPFCs) and Regional Provident Fund Commissioners (RPFCs) to implement the Court’s directions within the specified timeline.

As per the judgement, employees who had exercised the option under paragraph 11(3) of the 1995 Pension Scheme and were still in service on September 1, 2014, will follow the amended provisions of paragraph 11(4). Those who did not exercise the option under the pre-amendment scheme but were entitled to do so will be allowed to exercise a joint option under paragraphs 11(3) and 11(4) within an extended period of four months.

The extended option period applies to employees and employers who had contributed under paragraph 26(6) of the EPF Scheme on salaries exceeding the wage ceiling of Rs. 5,000 or Rs 6,500, did not exercise the joint option under the pre-amendment scheme, and were members of the scheme before September 1, 2014.

To apply for the joint option, employees must submit the required forms and declarations to the concerned Regional Office. The Regional PF Commissioner will then provide a facility for processing the applications. Applications will be registered, digitally logged, and verified by the employer before further examination.

The concerned Assistant PF Commissioner or RPFC-II will examine each case and notify applicants of the decision via email, post, or telephone. Weekly monitoring reports will be sent by the Regional Offices to their respective Zonal Offices, which will report the aggregate position to the Pension Division at the Head Office.

In case of grievances, applicants can register on the EPFiGMS portal after submitting their joint option form and any necessary payments. These grievances will be addressed and disposed of at the level of the Nominated Officer and will be monitored by the Officer-in-charge of the Regional and Zonal Offices.

These guidelines are issued in addition to earlier instructions dated December 29, 2022, and January 5, 2023, and must be implemented immediately in compliance with the Supreme Court’s judgement.

While navigating the complexities of pension withdrawals and applications, you might encounter challenges or have queries that need addressing. Our guide on EPFO Pension Withdrawal Calculation & Grievance provides insights into how you can calculate your pension withdrawals and effectively use the grievance mechanism to resolve any issues. Understanding these aspects can ease your process of applying for higher pension benefits.

What is the procedure for applying for higher pension?

EPFO in a circular on February 20, 2023, outlined the guidelines for employee eligibility, required documentation, and the application process for higher pension. This move comes in response to the Supreme Court’s directive for increasing pensions for eligible employees.

Online Applications by Members: A step-by-step Guide

According to the circular, only employees who were members of EPF before September 1, 2014, and continued to be members on or after September 1, 2014, and did not opt for a higher pension under the EPS 95 scheme are eligible to apply for a higher pension.

The application process, as prescribed in the circular dated February 20, 2023, remains the same as the earlier circular dated December 29, 2022.

Step-by-Step Online Application Process:

To submit an online application for a higher pension, follow these steps:

1. Visit the EPFO Member interface “EPFO Member interface” on Google.

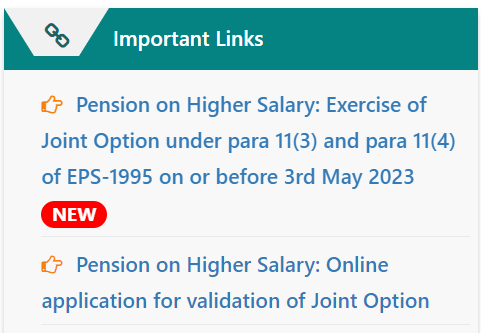

2. Scroll down and you will see two different links as flash options:

i) Exercise of Joint Option under para 11(3) and 11(4)

ii) Online application for validation of Joint Option

3. Click on the correct option as per your eligibility.

For those exercising Option 1:

4. For those clicking on “Pension on Higher Salary: Exercise of Joint Option under para 11(3) and 11(4) of EPS – 1995 on or before 3rd May 2023”, the following option will be seen next.

5. Click on the “Click Here” option. The next screen will look like this:

6. Enter the required details: UAN, Name, Date of Birth, Aadhaar No., Aadhaar linked Mobile Number, Captcha, and tick the declaration box. Click “Get OTP.”

For those exercising Option 2:

7. For those clicking on “Pension on Higher Salary: Online application for validation of Joint Option”, the following option will be seen next.

8. Click on the “Click Here” option. The next screen will look like this:

9. Enter the required details: PPO No. (if applicable), Name, Date of Birth, Aadhaar No., Aadhaar linked Mobile Number, Captcha, and tick the declaration box. Click “Get OTP.”

For both types of members:

10. The Application Form will be displayed.

11. Click on the Disclaimer and provide the member’s details, such as mobile number, and email, and attach the Joint Option Form & undertaking by the trust (for exempted establishments).

12. Provide the contribution details and attach documentary evidence as per Para 6(vii) of the circular dated 20.02.2023, i.e., Proof of remittance of employer’s share in PF on higher wages, etc.

13. Read the declaration carefully and submit the application.

Joint Application Forms by Regional PF Commissioners

Processing of Joint Application Form by Regional PF Commissioner: The circular also prescribes the following procedures for the Regional Provident Fund Commissioner (RPFC) to process joint application forms:

1. Each application will be registered, digitally logged, and assigned a receipt number.

2. Employers will receive separate login credentials, and all employee applications will be directed to the employer’s login.

3. The employer’s verification with a digital signature is mandatory for further processing.

4. After examination by the pension authorities, the decision will be communicated to the employee via email, post, or SMS.

Amendments to the Employees’ Provident Funds Scheme, 1952

The Ministry of Labour and Employment issued a notification on February 13, 2023, announcing amendments to the Employees’ Provident Funds Scheme, 1952. The changes have been made in accordance with the powers conferred by Section 5, along with sub-section (1) of Section 7 of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

The new regulations will be called the Employees’ Provident Funds (Amendment) Scheme, 2023, and will come into effect from the date of their publication in the Official Gazette.

The key amendment in the Employees’ Provident Funds Scheme, 1952, pertains to paragraph 11(1), which outlines the frequency of meetings for the Central Board of Trustees, the Executive Committee, and the Regional Committee. According to the new provision, the Central Board of Trustees must meet at least twice in each financial year. At the same time, the Executive Committee and the Regional Committee are required to convene at least four times in each financial year.

These amendments aim to enhance the functioning and oversight of the Employees’ Provident Funds Scheme, ensuring better management and improved outcomes for its members.

For our Hindi-speaking audience, understanding every aspect of your EPF, including managing payment receipts, is essential. Our article on EPF Payment Receipt in Hindi provides step-by-step guidance on accessing and understanding your EPF payment receipts. This knowledge is vital for ensuring all your contributions are correctly recorded and accessible when needed.

Stay on top of your EPF and pension planning by keeping informed with the latest updates and guides. Subscribe to our newsletter – ‘The Success Circle‘ for timely insights, updates on EPFO decisions, and comprehensive guides to navigating your pension and EPF queries. Empower yourself with knowledge directly in your inbox. Subscribe now and ensure you’re making the most informed decisions regarding your retirement benefits.