The Government of India made it mandatory in 2018 for every individual to do KYC process for the PF account. This is necessary for both employees and employers. PF KYC means linking your PF account to all of these three documents – your Aadhaar details, your Bank Account details, and your PAN details. PF KYC procedure can be done by either the employee or the employer, via their individual portals.

While filling the details of your KYC document, you have to make sure that there are no discrepancies with regard to the details that you have entered from your KYC documents such as Aadhaar card, Passport, PAN card, driver’s license and so on. After you have uploaded your document, the process of approval from your employer will take 2-3 days roughly.

EPF members who have their KYC details linked in the portal usually get their claims, withdrawals, transfers, etc., approved much faster and the process is simpler for both, the employee and the employer.

Table of Contents

PF KYC Update Online Benefits:

- No employer attestation is required to withdraw any money from PF account. View here.

- No employer attestation is required for transferring of funds from old PF to new PF account. View here.

- Monthly alerts are sent to an employee when EPF amount is credited by an employer.

- SMS alerts are sent whenever any withdrawal is made, to ensure account safety.

- In the case of multiple PF accounts, it is easy to merge all of them together.

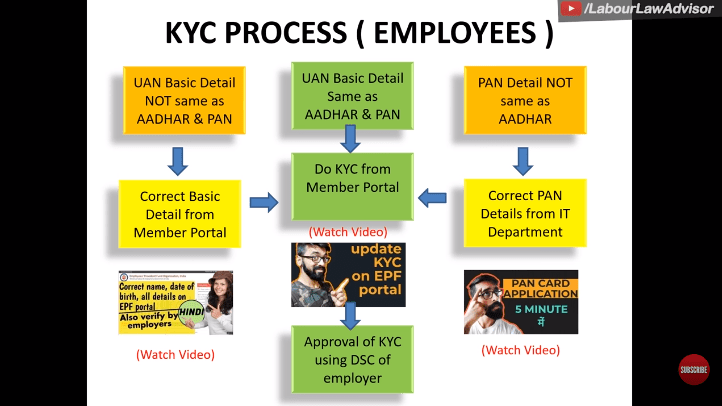

PF KYC Process for Employees:

1. When UAN basic details are same as Aadhaar and PAN details:

- Go to your PF member portal and update your Aadhaar, PAN and bank account details. The process is given in this video and this blog.

- Once details are updated by the employee, the employer needs to verify them via his digital signature on the employer’s member portal. This can only be done by the employer. View the process in this video and this blog.

2. When UAN basic details are not the same as Aadhaar and PAN details:

- Go to your PF member portal and rectify your details. Additionally, view the process via this video or blog.

- Proceed to do your PF KYC on the member portal and then get it digitally approved by the employer.

3. When PAN details are not same as Aadhaar details:

- Firstly, go to the Income Tax Department and get your PAN details rectified.

- You can also apply for a PAN card by checking this video.

- Then do your PF KYC process and get employer’s approval.

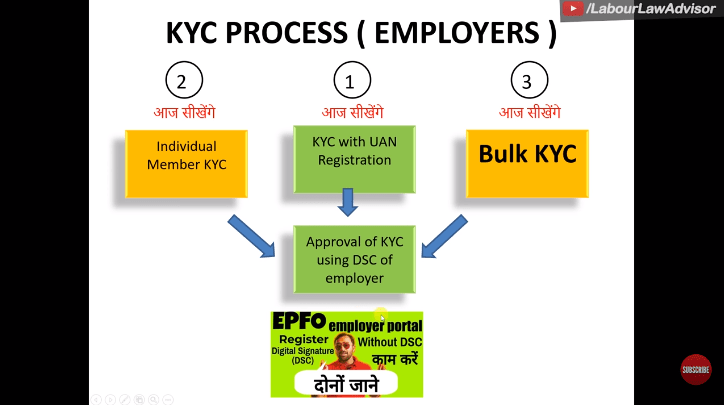

PF KYC Process for Employers:

- KYC with UAN registration: KYC can be done simultaneously while registering any member to EPF. View here.

- Individual member KYC: Employer can individually verify member KYC details. View here.

- Bulk KYC approval: Employer can verify all employee KYC in bulk. View here.

- Post any of the above, the employer has to approve the KYC using his digital signature, in the same process as mentioned previously.

View the video tutorial below:

Some more PF related engaging and important content for you:

EPF KYC Update Online & Verification Process Explained

Register Employees on EPF in 2 minutes

FAQs About EPF Registration

5 Rules for Easy EPF Calculation

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!