In a world where digital transactions and online banking have become an integral part of our daily lives, it’s hard to imagine a scenario where banks take a collective holiday. Yet, if such an event were to unfold, the consequences would be profound, highlighting banks’ undeniable impact on our financial independence.

- The Essence of Banking:

To understand the significance of banks, we turn to the definition provided by Section 5 of the Banking Regulation Act. Banking, as outlined in this legislation, involves the acceptance of deposits from the public for lending and investment, with the commitment to return the money on demand. This succinctly captures the essence of what we know as banking – a system that not only safeguards our savings but also fuels economic growth through lending and investment.

The essence of banking, as encapsulated in Section 5 of the Banking Regulation Act, revolves around a fundamental set of activities that banks perform. According to this definition, banking involves three key elements:

- Acceptance of Deposits from the Public

- Banks act as custodians for individuals, businesses, and other entities to deposit their money into various types of accounts (such as savings accounts, current accounts, fixed deposits, etc.).

- This deposit-taking function is crucial as it provides a safe and secure place for people to store their money. The trust in banks stems from the belief that these institutions will protect and manage deposited funds effectively.

- Lending

- Banks use the deposited funds to provide loans to individuals, businesses, and other borrowers.

- Through the lending process, banks facilitate economic activities by making capital available for various purposes such as starting or expanding businesses, purchasing homes, or funding education.

- Investment

- Banks also engage in investment activities, utilizing the funds they hold to invest in financial instruments, securities, and other assets.

- These investments contribute to the overall growth of the economy by channeling funds into different sectors and supporting development.

- Commitment to Return the Money on Demand

- A distinctive feature of banking is the commitment to return deposited money to account holders on demand. This means that depositors can withdraw their funds whenever they need them.

- This commitment is essential for maintaining confidence in the banking system and ensuring the stability of financial markets.

The essence of banking lies in its role as a financial intermediary that connects those with surplus funds (depositors) to those in need of funds (borrowers). By accepting deposits, providing loans, making investments, and ensuring the availability of funds on demand, banks play a pivotal role in fostering economic growth and stability within a financial system. The regulatory framework, such as the Banking Regulation Act, provides guidelines to govern and oversee these crucial functions to safeguard the interests of both depositors and the broader economy.

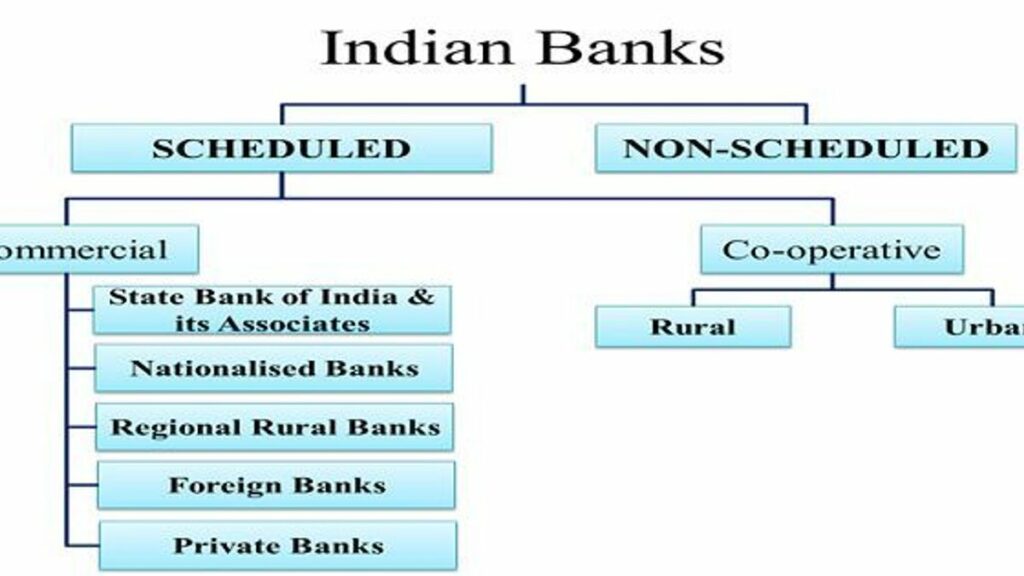

- The Categories of Banks

In the Indian financial landscape, banks fall into two broad categories: scheduled banks and non-scheduled banks. Scheduled banks, as listed in Schedule II of the Reserve Bank of India Act, 1934, are the key players. These banks, regulated by the RBI, form the backbone of the country’s financial infrastructure. The distinction between scheduled and non-scheduled banks is pivotal in understanding the regulatory framework that ensures the stability and reliability of the banking sector.

In the Indian financial system, banks are categorized into two main groups: scheduled banks and non-scheduled banks. This classification is crucial for understanding the regulatory environment and the significance of different banks in the country’s financial landscape.

- Scheduled Banks

- Definition: Scheduled banks are financial institutions that are included in the Second Schedule of the Reserve Bank of India (RBI) Act, 1934. This schedule is maintained by the RBI, and banks listed in it are considered scheduled banks.

- Regulation: Scheduled banks are subject to the regulations and guidelines set forth by the Reserve Bank of India (RBI), which is the central banking authority in the country. The RBI plays a crucial role in overseeing and regulating the operations of scheduled banks to ensure the stability and integrity of the financial system.

- Key Players: Scheduled banks are major players in the Indian banking sector and play a vital role in the country’s financial infrastructure. These include both public-sector banks (government-owned) and private-sector banks.

- Non-Scheduled Banks

- Definition: Non-scheduled banks are financial institutions that are not listed in the Second Schedule of the RBI Act, 1934. As they are not included in the schedule, they are referred to as non-scheduled banks.

- Regulation: While non-scheduled banks are not subject to the same level of regulation as scheduled banks, they are still required to adhere to certain regulatory standards set by the RBI. However, the regulatory oversight for non-scheduled banks may be comparatively lighter.

- Role: Non-scheduled banks may include smaller financial institutions, cooperative banks, and other entities that do not fall under the category of scheduled banks. While they may not have the same systemic importance as scheduled banks, they still contribute to the overall diversity of the banking sector.

Understanding the distinction between scheduled and non-scheduled banks is essential for comprehending the regulatory framework that governs the functioning of banks in India. The RBI, as the central bank, plays a pivotal role in maintaining financial stability and ensuring the smooth operation of scheduled banks, which form the backbone of the country’s financial infrastructure.

- A Week Without Banks

Now, let’s envision a scenario where all banks worldwide take a week-long holiday: no ATMs, no debit or credit cards, and no online banking. Simple tasks, such as recharging your mobile or paying your electricity bill, suddenly become monumental challenges. This hypothetical situation sheds light on the indispensable role banks play in our day-to-day transactions and highlights the need for a reliable and efficient banking system.

A Week Without Banks would be a scenario where all traditional banking activities come to a halt for a week. This means no access to ATMs, no debit or credit card transactions, and no online banking services. The impact of such a situation would be significant, as banks are integral to the modern economy and play a crucial role in facilitating various financial transactions.

Here’s a breakdown of the potential challenges and consequences during a week without banks:

- Cash Dependency: In the absence of electronic transactions, people would heavily rely on physical cash for their daily expenses. This could lead to challenges in ensuring there’s enough physical currency available to meet the sudden surge in demand.

- Limited Access to Funds: Without ATMs and online banking, individuals might face difficulties accessing their funds. This could be especially problematic for those who need to make urgent payments or withdrawals.

- Business Operations Disruption: Many businesses rely on electronic transactions for their daily operations. A week without banks could disrupt payment processes, supply chain transactions, and salary disbursements, impacting the overall functioning of businesses.

- Payment Challenges: Making routine payments, such as utility bills, rent, or loan repayments, would become challenging without the convenience of online banking. This could result in late payments, penalties, and potential service disruptions.

- Impact on Investments: Investors who regularly engage in stock trading, forex transactions, or other investment activities would find it difficult to execute trades without access to online platforms and banking services.

- Financial Services Sector Stress: The financial services sector, including insurance companies and brokerage firms, heavily depends on banking infrastructure. A week without banks could stress these institutions and disrupt the broader financial ecosystem.

- The emergence of Alternative Systems: In response to the banking hiatus, alternative systems might emerge. Barter systems, peer-to-peer transactions, or the use of alternative currencies could become more prevalent as people seek ways to meet their financial needs.

- Economic Impact: The sudden cessation of banking activities for a week could have broader economic implications. It might lead to a temporary economic slowdown, affecting GDP, employment, and overall economic stability.

This hypothetical scenario underscores the critical role that banks play in maintaining the smooth functioning of daily life and the economy. It also highlights the need for a reliable and efficient banking system to ensure the stability of financial transactions and services. While advancements in technology have introduced alternative forms of payment, the week without banks emphasizes the current dependence on traditional banking infrastructure.

- Financial Independence and Banking

The idea of financial independence is closely intertwined with our banking system. Most of our savings find a home within the secure walls of a bank. This financial sanctuary allows us not only to accumulate wealth but also to access credit for investments or unforeseen circumstances. However, it also raises questions about the dependency that arises from such a centralized system.

Financial independence refers to the ability of an individual or household to meet their financial needs and goals without being overly reliant on external sources of income or support. Achieving financial independence often involves saving and investing wisely, reducing debt, and building a sustainable income stream.

Banks play a crucial role in the financial lives of individuals seeking financial independence. Here’s how the concept of financial independence is closely intertwined with the banking system:

- Savings and Security

- Accumulating Wealth: Banks provide a secure and regulated environment for individuals to deposit and store their savings. This is often done through savings accounts, fixed deposits, or other savings instruments.

- Financial Security: Having savings in a bank provides a safety net in case of emergencies or unexpected expenses. This financial cushion is essential for maintaining stability and reducing the risk of falling into debt.

- Access to Credit

- Investments: Banks offer various financial products, including loans and credit lines, which can be utilized for investments such as starting a business, buying a home, or pursuing education. This access to credit is a key enabler for wealth-building activities.

- Unforeseen Circumstances: In times of unexpected financial challenges, individuals may rely on credit facilities provided by banks to navigate through tough periods without jeopardizing their overall financial stability.

- Investment Opportunities

- Wealth Accumulation: Banks often offer investment products such as mutual funds, certificates of deposit, and retirement accounts. These products allow individuals to grow their wealth over time and work towards financial independence.

- Diversification: Banking services also facilitate the diversification of investments, reducing risk and enhancing the potential for long-term financial success.

However, the dependency on a centralized banking system raises some concerns:

- Vulnerability to Economic Changes

- Interest Rates: Changes in interest rates can impact savings and investment returns. A heavily centralized dependence on banking may make individuals vulnerable to economic fluctuations.

- Dependency on Credit

- Debt Trap: While access to credit is essential, overreliance on loans without a solid repayment plan can lead to a debt trap, undermining the goal of financial independence.

- Regulatory Risks

- Regulatory Changes: Changes in banking regulations can affect the terms and conditions of savings and investment products, potentially impacting the financial strategies of individuals.

While banks provide essential services for wealth accumulation and financial security, achieving true financial independence may involve diversifying one’s financial portfolio beyond traditional banking products. This could include exploring alternative investment options, developing multiple income streams, and having a well-rounded financial strategy that goes beyond reliance on a centralized banking system.

- Challenges and Opportunities

While the hypothetical week without banks emphasizes our dependence on traditional banking, it also prompts us to explore alternative financial avenues. Decentralized finance (DeFi), cryptocurrencies, and other innovations have emerged as potential alternatives, offering both challenges and opportunities. Exploring these options can foster a greater sense of financial independence by diversifying our financial strategies.

Let’s delve into the challenges and opportunities associated with the hypothetical week without banks and the exploration of alternative financial avenues such as decentralized finance (DeFi) and cryptocurrencies.

- Challenges

- Lack of Regulation and Security Concerns

- In the absence of traditional banking, individuals might face challenges related to the lack of regulatory oversight in the decentralized financial space. This could expose users to potential fraud, scams, and security breaches.

- Volatility and Risk

- Cryptocurrencies, a significant component of DeFi, are known for their price volatility. Users may experience substantial financial losses if the value of their crypto assets decreases suddenly. Managing this risk becomes crucial in decentralized financial systems.

- User Education

- Many people are not familiar with the intricacies of DeFi and cryptocurrencies. The lack of understanding can hinder widespread adoption and lead to mistakes in managing digital assets.

- Technological Barriers

- Accessing and utilizing DeFi platforms often require a certain level of technological proficiency. Individuals who are not comfortable with digital technologies may find it challenging to navigate and use these alternative financial systems.

- Opportunities

- Financial Inclusion

- DeFi and cryptocurrencies have the potential to provide financial services to individuals who are unbanked or underbanked. This can foster greater financial inclusion by reaching people in remote or underserved areas.

- Reduced Dependency on Traditional Institutions

- Exploring alternative financial avenues reduces dependence on traditional banking systems. This can be empowering, especially in regions where people face limitations or restrictions with conventional banking services.

- Smart Contracts and Automation

- DeFi often leverages smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation can streamline financial processes, reduce costs, and increase efficiency.

- Global Accessibility

- Cryptocurrencies and DeFi platforms operate on a global scale without the need for intermediaries. This allows for cross-border transactions and financial interactions without the limitations imposed by traditional banking systems.

- Diversification of Financial Strategies

- The exploration of alternative financial avenues encourages diversification. Individuals can choose from a variety of financial instruments and strategies, spreading risk and potentially enhancing overall financial resilience.

As we reflect on the week when banks took a collective holiday, we recognize the profound impact of these institutions on our daily lives. Our financial independence is intricately connected to the stability and efficiency of the banking system. However, it also serves as a reminder to explore and embrace innovative financial solutions that can provide resilience and diversity in an ever-changing landscape. The quest for true financial independence involves not just understanding the current banking system but also being open to the possibilities that the future holds.

Table of Contents

What is the distinction between Schedule Banks and Payments Banks?

The banking sector in India plays a pivotal role in the country’s economic development and financial stability. Regulated by the Reserve Bank of India (RBI), banks are mandated to adhere to a comprehensive set of rules and regulations. In this blog, we’ll delve into the diverse forms of schedule banks, with a focus on public sector banks, private sector banks, and the unique category of Payments Banks.

- Public Sector Banks: The Pillars of Economic Growth

Public sector banks, also known as nationalized banks, are instrumental in driving economic growth and financial inclusion. Institutions like the State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda (BOB) are among the key players in this segment. As entities under government ownership, public sector banks serve a crucial role in implementing government policies, fostering financial inclusion, and catering to the diverse needs of the population.

Public sector banks play a pivotal role in the economic development of a country, serving as key pillars for several reasons:

- Government Ownership and Control

- Public sector banks are owned and controlled by the government. This ownership ensures that these banks align their operations with national economic priorities and policies.

- Government control allows these banks to be used as instruments to implement various economic and social development initiatives.

- Implementation of Government Policies

- Public sector banks play a crucial role in executing government policies related to economic development, poverty alleviation, and financial stability.

- They act as intermediaries for disbursing subsidies, loans, and other financial benefits as per government programs.

- Financial Inclusion

- Public sector banks have a mandate to promote financial inclusion by reaching out to the unbanked and underbanked sections of society.

- Through a vast network of branches and banking services, these banks bring a large segment of the population into the formal financial system.

- Catering to Diverse Needs

- Public sector banks cater to the diverse financial needs of individuals, businesses, and other entities, irrespective of their economic status.

- They offer a wide range of banking and financial products, including savings accounts, loans, and investment options, contributing to overall economic growth.

- Stability and Trust

- Public sector banks are perceived as more stable and trustworthy due to their government backing. This trust is essential for attracting deposits and investments.

- Stability in the banking sector is critical for maintaining overall economic stability.

- Infrastructure Development

- Public sector banks play a vital role in financing infrastructure projects, which are essential for the long-term economic growth of a nation.

- By funding projects in sectors such as transportation, energy, and telecommunications, these banks contribute to the creation of a robust economic infrastructure.

- Social Responsibility

- Public sector banks often engage in corporate social responsibility (CSR) activities, contributing to community development and social welfare.

- These banks may fund initiatives in education, healthcare, and other areas that align with the socio-economic development goals of the government.

- Counter-Cyclical Role

- During economic downturns, public sector banks can play a counter-cyclical role by increasing lending to stimulate economic activity.

- Their stability allows them to continue providing credit even when private sector banks might become more risk-averse.

In summary, public sector banks, being under government ownership, act as crucial agents for economic development by implementing government policies, promoting financial inclusion, catering to diverse financial needs, ensuring stability, and contributing to infrastructure development. Their role extends beyond profit-making, encompassing broader socio-economic objectives.

- Private Sector Banks: Navigating Through Market Dynamics

In contrast to public sector banks, private sector banks operate with a more market-driven approach. While they share similarities with public and nationalized banks, private sector banks have the flexibility to innovate and adapt to changing market dynamics swiftly. However, they are not exempt from RBI regulations, especially when it comes to controlling loan sizes. These regulations are in place to ensure financial stability and prevent undue risks in the banking sector.

Private sector banks and public sector banks are two distinct types of financial institutions that operate within the banking sector. The key difference lies in their ownership and management.

Ownership and Management

- Public Sector Banks: Public sector banks are owned and operated by the government. The government holds a majority stake in these banks, which means it has significant control over their operations, policies, and decision-making processes. The primary objective of public sector banks is often aligned with government priorities, which may include financial inclusion and support for specific sectors of the economy.

- Private Sector Banks: Private sector banks, on the other hand, are owned and managed by private individuals or entities. They operate with a profit motive and are driven by the goal of maximizing shareholder value. Private sector banks are subject to the same regulatory framework as public sector banks but have more autonomy in their day-to-day operations.

Market-Driven Approach

Private sector banks operate with a more market-driven approach, meaning they are driven by market forces, competition, and the pursuit of profitability. This approach allows them greater flexibility to innovate, introduce new products and services, and respond quickly to changing market dynamics.

Flexibility and Innovation

- Innovation: Private sector banks can introduce innovative financial products and services more swiftly than public sector banks. This agility is often attributed to their streamlined decision-making processes, which are less bureaucratic compared to public sector banks.

- Adaptability: The flexibility of private sector banks allows them to adapt to changes in the economic environment and customer preferences more rapidly. This adaptability is crucial in a dynamic market where staying ahead of the competition is essential.

Regulatory Oversight

While private sector banks enjoy a higher degree of operational autonomy, they are not exempt from regulatory oversight, especially by the Reserve Bank of India (RBI). The RBI sets guidelines and regulations to ensure the stability of the financial system and protect the interests of depositors.

Loan Size Regulation

One specific area where regulatory oversight is evident is in controlling loan sizes. The RBI imposes regulations on the maximum size of loans that banks can extend to borrowers. This is done to mitigate the risk of non-performing assets (NPAs) and ensure that banks maintain a healthy financial position.

In summary, private sector banks operate with a market-driven mindset, allowing them to be more agile and innovative. However, they must adhere to regulatory guidelines, particularly in areas such as loan size, to maintain financial stability and prevent excessive risk-taking. The balance between autonomy and regulatory compliance is crucial for the sustainable and responsible functioning of private sector banks in the financial ecosystem.

- MSMEs and the Birth of Payment Banks: A Specialized Approach

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of any economy, contributing significantly to employment generation and industrial growth. Recognizing the unique financial needs of MSMEs, the concept of Payments Banks emerged. These banks focus primarily on catering to the financial requirements of MSMEs, offering small loans to facilitate their growth and sustainability.

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in the economic development of any country. They contribute to employment generation, foster innovation, and drive industrial growth. However, MSMEs often face challenges in accessing financial services, especially small loans that can fuel their expansion and ensure sustainability. Traditional banks may find it economically unviable to offer small-ticket loans to MSMEs due to high transaction costs and perceived risks.

To address the unique financial needs of MSMEs, the concept of Payments Banks emerged. Payment banks are a specialized category of banks that focus on providing basic financial services, particularly to the unbanked and underbanked segments of the population, including MSMEs. These banks operate on a leaner and more cost-effective model compared to traditional banks, allowing them to offer services that are tailored to the requirements of small businesses.

Here’s how Payments Banks contribute to supporting MSMEs

- Small Loans: One of the primary services offered by Payments Banks to MSMEs is the provision of small loans. These loans are designed to meet the specific working capital and growth needs of micro and small businesses. The streamlined operations of Payments Banks enable them to process loan applications quickly and efficiently, making it easier for MSMEs to access funds when needed.

- Financial Inclusion: Payment banks play a vital role in promoting financial inclusion by reaching out to segments of the population that are traditionally underserved by mainstream banking institutions. By offering simplified account opening procedures and basic financial services, these banks bring MSMEs into the formal financial system, helping them build credit histories and access a broader range of financial products.

- Digital and Mobile Banking: Payment banks leverage technology to provide digital and mobile banking services, making it convenient for MSMEs to manage their finances. This is especially important for businesses in remote or rural areas that may have limited access to physical bank branches. Digital banking also facilitates quicker and more cost-effective transactions for MSMEs.

- Reduced Transaction Costs: Payment banks typically have lower operational costs compared to traditional banks, allowing them to offer financial services at more affordable rates. This is particularly advantageous for MSMEs, as they can access credit and other financial products without incurring exorbitant fees, making the overall cost of doing business more manageable.

- Customized Financial Solutions: Payment banks understand the specific needs and challenges faced by MSMEs. As a result, they can design customized financial solutions, including flexible repayment terms and tailored loan products, to suit the varying requirements of different businesses within the MSME sector.

In summary, Payments Banks have emerged as a specialized approach to addressing the financial needs of MSMEs. By focusing on simplicity, cost-effectiveness, and digital innovation, these banks contribute to the growth and sustainability of MSMEs, ultimately bolstering the overall economic development of a country.

- Payments Banks: Navigating Constraints for Financial Inclusion

Payment banks are a distinctive category of banks that operate with a specific focus on facilitating transactions and providing basic financial services. Unlike traditional banks, Payments Banks are restricted in terms of the loan sizes they can offer. This limitation is in place to maintain a balance between financial inclusion and risk management. By concentrating on smaller loans, payment banks aim to empower MSMEs and contribute to the broader goal of inclusive economic development.

Payment banks are a unique category of financial institutions that differ from traditional banks in their primary focus and operational constraints. These banks are designed to primarily facilitate transactions and offer basic financial services, rather than providing a comprehensive range of banking services like loans and credit typically offered by traditional banks.

One key constraint for Payments Banks is the limitation on the size of loans they can offer. Unlike conventional banks that can provide large loans to businesses and individuals, Payments Banks are restricted in this aspect. This limitation serves several purposes, with a primary focus on balancing the goals of financial inclusion and risk management.

The restriction on loan sizes ensures that Payments Banks concentrate on providing smaller loans. This approach aligns with the broader objective of promoting financial inclusion, especially for Micro, Small, and Medium Enterprises (MSMEs). MSMEs often face challenges in accessing credit from traditional banks due to various reasons, including lack of collateral or a limited credit history. By offering smaller loans, Payments Banks aim to cater to the financial needs of such businesses and individuals who may be excluded from mainstream banking services.

The emphasis on smaller loans also aligns with the goal of inclusive economic development. By empowering MSMEs with access to financial services, Payments Banks contribute to the growth and sustainability of these smaller businesses, which, in turn, has a positive impact on the overall economy. In many economies, MSMEs play a crucial role in job creation, innovation, and economic development, making them a focal point for financial inclusion initiatives.

While Payments Banks face constraints in terms of loan sizes, their specialized focus on facilitating transactions and offering basic financial services allows them to cater to specific segments of the population that may be underserved by traditional banks. This targeted approach supports the broader mission of promoting financial inclusion and inclusive economic development, addressing the unique challenges faced by smaller businesses and individuals in accessing financial services.

The banking landscape in India is multifaceted, with scheduled banks playing a pivotal role in shaping the country’s economic trajectory. Public sector banks, private sector banks, and payment banks each contribute uniquely to the financial ecosystem. As regulatory bodies like the RBI continue to refine and adapt their policies, the banking sector remains dynamic, resilient, and essential for fostering economic growth and financial inclusion in India.

What are the differences between scheduled and non-scheduled banks?

The banking sector plays a pivotal role in any economy, serving as the backbone for financial transactions and economic development. In India, the Reserve Bank of India (RBI) governs and regulates the banking industry, categorizing banks into scheduled and non-scheduled entities. This classification holds significant implications for their operations and the services they can offer to the public.

- Scheduled Banks: The Backbone of the Indian Financial System

Scheduled banks in India form the core of the country’s financial system. These banks, including both public and private entities, are granted specific rights and privileges by the RBI. One crucial aspect is their ability to accept deposits from the public up to a prescribed limit. This limit ensures a controlled and regulated inflow of funds into the banking system.

Among the scheduled banks, there are different categories such as commercial banks, cooperative banks, foreign banks, and regional rural banks. Each category serves a unique purpose and caters to diverse segments of the population.

- Commercial Banks: These are the traditional banks that offer a wide range of financial services to individuals, businesses, and the government. They are further classified into public sector banks, private sector banks, and foreign banks operating in India.

- Cooperative Banks: These banks operate on a cooperative basis, to serve the financial needs of their members. They play a crucial role in rural and urban cooperative credit structures.

- Foreign Banks: International banks that operate in India fall under this category. They bring a global perspective to the Indian banking landscape, contributing to the diversification and internationalization of financial services.

- Regional Rural Banks (RRBs): RRBs are designed to cater to the banking needs of rural areas. They play a vital role in promoting financial inclusion and supporting agricultural and rural development.

- Payment Banks: A Special Category

In addition to the conventional scheduled banks, India introduced the concept of payment banks to further enhance financial inclusion. These banks have a distinct role in the ecosystem, focusing primarily on facilitating transactions and providing basic financial services, including remittances, bill payments, and savings accounts.

However, payment banks have limitations when compared to traditional scheduled banks. They cannot issue loans or credit cards beyond a specified limit, highlighting the specialized nature of their operations.

- Non-Scheduled Banks: Entities Outside the Banking Framework

Entities not included in the list of scheduled banks, as maintained by the RBI, do not have the right to operate as banks. This exclusion ensures that only well-regulated and authorized institutions undertake banking activities. Non-scheduled entities lack the privileges and responsibilities associated with scheduled banks, emphasizing the importance of regulatory oversight.

Understanding the distinctions between scheduled and non-scheduled banks is crucial for comprehending the intricacies of India’s banking sector. The diverse categories within scheduled banks cater to various economic sectors, contributing to the overall growth and development of the nation. As the financial landscape continues to evolve, the RBI’s regulatory framework ensures a stable and secure environment for both banks and the public they serve.

What is DICGC in India and how does it play a role in safeguarding savings through deposit insurance?

In the dynamic world of banking and finance, individuals and businesses alike entrust their hard-earned money to banks with the expectation of safety and security. However, uncertainties in the financial sector can pose risks to these deposits. This is where the Deposit Insurance and Credit Guarantee Corporation (DICGC) in India steps in, providing a safety net for depositors and ensuring the stability of the financial system.

- Understanding Deposit Insurance

Deposit insurance is a crucial component of financial stability, offering protection to depositors against the potential risks associated with bank failures. In India, the Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of the Reserve Bank of India (RBI), plays a pivotal role in safeguarding the interests of depositors.

- Key Features of DICGC Deposit Insurance

- Coverage Limit: DICGC offers insurance coverage to deposits in the event of a bank failure. As of the latest information available, the coverage limit is set at ₹5 lakh per depositor per bank. This means that if an individual has multiple accounts across different branches of the same bank, the total coverage remains ₹5 lakh.

- Types of Deposits Covered: DICGC covers a variety of deposits, including savings accounts, fixed deposits, current accounts, and recurring deposits. The insurance applies to both principal and interest amounts accrued on these deposits.

- Coverage Period: The coverage period begins the moment a deposit is made in a bank account. It extends up to 90 days from the date of liquidation or cancellation of the bank’s license, whichever comes first.

- Prompt Payment: One of the notable features of DICGC deposit insurance is the commitment to prompt payment. In the unfortunate event of a bank failure, DICGC ensures that depositors receive their insured amount (up to the prescribed limit) within 15 days.

- Exclusions: Certain types of deposits are not covered under DICGC insurance. Examples include deposits by other banks and financial institutions, government deposits, and deposits of foreign governments.

- Importance of Deposit Insurance

- Instilling Confidence: Deposit insurance is instrumental in instilling confidence among depositors, assuring them that their funds are protected even in the face of unforeseen circumstances.

- Financial Stability: By safeguarding the interests of depositors, DICGC contributes to the overall stability of the financial system. This ensures that individuals and businesses continue to trust the banking sector, promoting economic growth.

- Encouraging Banking Participation: Knowing that their deposits are protected up to a certain limit, individuals are more likely to participate in formal banking systems. This, in turn, helps in reducing the reliance on informal and potentially risky financial channels.

In the complex landscape of finance, deposit insurance emerges as a vital mechanism for mitigating risks associated with bank failures. The Deposit Insurance and Credit Guarantee Corporation in India stands as a beacon of reassurance for depositors, offering protection and ensuring the resilience of the financial system. As depositors, it is crucial to be aware of the coverage limits, types of deposits covered, and the prompt payment commitment provided by DICGC, ultimately empowering individuals to make informed decisions about their financial well-being.

How can banking terms be demystified, and how can financial security be ensured?

In the fast-paced world of finance and banking, understanding key terms and ensuring the safety of our hard-earned money is crucial. From insurance coverage to digital payment methods, there’s a plethora of concepts that individuals should be familiar with to navigate the financial landscape confidently. In this blog, we’ll delve into the significance of DICGC insurance, explore common banking terms, and shed light on the convenience of virtual payment addresses (VPAs).

- DICGC Insurance: Safeguarding Your Deposits

The Deposit Insurance and Credit Guarantee Corporation (DICGC) plays a pivotal role in securing the funds deposited in banks. The assurance that deposits up to a certain amount (₹ lakh) are protected provides peace of mind to account holders. In the event of unforeseen circumstances affecting a bank, the DICGC steps in to guarantee the specified amount, assuring customers that their money is safe.

- Common Banking Terms: A Quick Primer

Navigating the world of finance becomes more manageable when you are familiar with common banking terms. Some terms are likely well-known, while others may be new to you. Let’s explore a few key terms that can enhance your financial literacy:

a. Interest Rate: The percentage at which a borrower is charged or a depositor is paid for the use of money.

b. Collateral: Assets pledged by a borrower to secure a loan, mitigating the lender’s risk.

c. ATM: Automated Teller Machine, a device that allows individuals to perform basic banking transactions outside of a bank branch.

d. Credit Score: A numerical representation of an individual’s creditworthiness, influencing loan approvals and interest rates.

- Virtual Payment Address (VPA): Facilitating Seamless Transactions

In the era of digital finance, virtual payment addresses (VPAs) have emerged as a secure and convenient way to transfer funds. Unlike traditional banking methods, VPAs eliminate the need for sharing sensitive information such as bank account numbers. Instead, users can transact using a unique identifier linked to their bank accounts. This not only enhances security but also streamlines the payment process, as seen in Person 2’s immediate transfer of ₹420 using a VPA.

As we navigate the complex world of finance, staying informed about banking terms, understanding the protective measures in place, and leveraging digital advancements contribute to a more secure and efficient financial experience. The DICGC insurance acts as a safety net for deposits, common banking terms empower individuals to make informed decisions, and virtual payment addresses offer a streamlined approach to transactions. By embracing these concepts, individuals can navigate the financial landscape with confidence and safeguard their financial well-being.

What are the conveniences associated with UPI, and how does it complement the power of stable money investments in unlocking financial freedom?

In the fast-paced digital era, financial transactions have undergone a revolutionary transformation, bringing convenience and accessibility to the forefront. Among the myriad of financial tools available, UPI (Unified Payments Interface) stands out as a game-changer, allowing seamless and instantaneous transactions. In this blog, we’ll explore the ease of UPI transactions and the significance of Stable Money investments, offering a blend of financial convenience and growth.

UPI: Any Time Money in Your Pocket

Imagine the convenience of accessing your funds anytime, anywhere – that’s the promise of UPI. Whether it’s splitting bills, making online purchases, or transferring money to a friend, UPI simplifies transactions with just a few taps on your smartphone. The phrase “ATM means Any Time Money” takes on a new meaning with UPI, as it eliminates the need for physical cash withdrawals and enables swift, secure transactions at your fingertips.

The versatility of UPI extends beyond personal transactions; businesses, too, have embraced UPI for its efficiency and speed. Small entrepreneurs and freelancers find UPI particularly beneficial for receiving payments promptly, contributing to the growth of the digital economy.

The Journey to Financial Growth with Stable Money

As we delve into the world of financial convenience, let’s not overlook the importance of making our money work for us. Stable Money, a platform revolutionizing the investment landscape, offers an opportunity to enhance financial well-being through Fixed Deposits (FDs).

With Stable Money, booking bank FDs becomes a breeze, taking only three minutes of your time. This user-friendly platform not only prioritizes simplicity but also ensures that your investments are backed by a high-interest rate. Currently, Stable Money is offering an interest rate exceeding 8.5%, providing a competitive edge in the market.

Moreover, the security of your investments is paramount. Rest easy knowing that Stable Money’s bank FDs are protected by a 5 lakh insurance provided by the Reserve Bank of India (RBI). This adds an extra layer of assurance, making it an attractive option for those seeking a reliable and secure investment avenue.

A Symbiotic Relationship

As we embrace the era of Time Money with UPI, it’s equally crucial to explore avenues that allow our money to grow sustainably. The partnership between the ease of UPI transactions and the growth potential of Stable Money investments creates a symbiotic relationship, offering both convenience and financial empowerment.

So, the next time you consider withdrawing cash from the ATM, think about the possibilities that UPI unlocks. And when you contemplate where to invest your money, consider the simplicity and growth potential offered by Stable Money. After all, in this digital age, financial freedom is not just about having Time and Money but also making the most of it for a stable and prosperous future.

In the ever-evolving landscape of personal finance, finding a reliable avenue to grow your wealth is crucial. One such promising option is Stable Money, a unique marketplace that channels your investments directly into Fixed Deposit (FD) accounts with competitive interest rates. This blog explores the features and benefits of Stable Money, shedding light on its limited-time offer that could potentially transform your financial future.

- Stable Money: A Singular Marketplace for Stable Returns Stable Money distinguishes itself as a marketplace solely focused on Fixed Deposits. The concept is simple yet powerful – when you invest through Stable Money, your money is securely placed in the bank’s FD account. This approach ensures stability and reliability, aligning with the preferences of investors seeking a secure and predictable avenue for their funds.

- Unlocking High Returns: The 9% Effective Interest Rate The centerpiece of Stable Money’s allure lies in its commitment to delivering returns that surpass the 9% mark. In an era where traditional savings accounts offer minimal interest, achieving an effective rate of more than 9% is a game-changer for investors. This not only outpaces inflation but also presents an opportunity to grow your wealth at a rate that few other financial instruments can match.

- Exclusive Limited-Time Offer: ₹2,000,000 on Your First FD To sweeten the deal, Stable Money is currently running a limited-time offer that could significantly boost your initial investment. Investors stand to receive ₹2,000,000 on their first FD in a designated bank and branch. This exclusive incentive adds a compelling layer to the proposition, providing an extra financial cushion as you embark on your investment journey.

- Seamless Transactions: From FD Account to Primary Account Stable Money ensures a hassle-free investment experience. When you choose to withdraw your funds, the process is straightforward – the money seamlessly transitions from the bank’s FD account to your primary account. This level of convenience eliminates unnecessary complexities, making Stable Money an accessible option for both seasoned investors and those new to the financial landscape.

Decoding the “C” in the IFSC Code In the realm of banking, acronyms and codes are part of the language. While discussing Stable Money, it’s worth noting a unique interpretation of the term “IFSC code.” Here, “C” stands for code, transforming it into “IFC code.” This distinction adds a touch of creativity to the narrative, showcasing Stable Money’s commitment to presenting financial concepts in a user-friendly and engaging manner.

Stable Money emerges as a promising player in the financial market, offering a specialized approach to wealth creation through Fixed Deposits. With a commitment to delivering an effective interest rate of more than 9% and an exclusive limited-time offer of ₹2,000,000 on your first FD, this platform beckons investors seeking stability and lucrative returns. As you navigate the intricate world of personal finance, consider Stable Money as your gateway to a more secure and prosperous financial future.

The Indian Financial System Code (IFSC) is a unique alphanumeric code that is assigned to each bank branch in India by the Reserve Bank of India (RBI). This code is crucial for electronic funds transfer in the country and plays a key role in identifying the sender and receiver banks during transactions.

The structure of the IFSC code is standardized, making it easy to interpret. The code is 11 characters long and consists of a combination of letters and numbers. Let’s break down the structure:

- First Four Characters (Alphabetic): These represent the bank code. These characters uniquely identify the bank to which the branch belongs. For example, in the IFSC code “HDFC0001234,” the first four characters “HDFC” indicate that the branch belongs to HDFC Bank.

- Fifth Character (Numeric): The fifth character is always a ‘0’ and is reserved for future use. It remains constant in all IFSC codes.

- Last Six Characters (Alphanumeric): These represent the branch code. They are unique to each branch of a particular bank. In the example “HDFC0001234,” the last six characters “001234” specify the branch code.

It’s important to note that the IFSC code is used primarily for electronic fund transfer mechanisms like NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

Changes in IFSC codes often occur during bank mergers or restructuring. When two banks merge, their individual IFSC codes may be redefined to reflect the changes in the organizational structure. Customers must stay updated on these changes, especially if they engage in electronic transactions or use online banking services.

For instance, if a branch of HDFC Bank in Bihar undergoes a merger, the IFSC code for that branch may be modified to align with the new entity’s structure. In such cases, customers are typically informed by their respective banks about the changes to ensure a smooth transition in financial transactions.

The RBI oversees the assignment and maintenance of IFSC codes, ensuring a systematic and standardized approach to electronic transactions across the vast network of banks and branches in India.

- Savings Account

Purpose: This type of account is designed for individuals looking to save money with fewer regular transactions.

Features: Account holders earn interest on the deposited amount, albeit at a relatively lower rate. It is suitable for personal savings and day-to-day transactions.

A savings account is a financial product designed for individuals who wish to save money while minimizing the number of regular transactions associated with their account. Unlike checking accounts, which are more suitable for frequent transactions, a savings account is geared towards long-term savings goals and individuals looking to accumulate funds over time.

One key feature of a savings account is the ability for account holders to earn interest on the deposited amount. The interest rate, although typically lower than what is offered on other financial products like certificates of deposit or certain investments, provides an incentive for individuals to keep their money in the account. This interest is usually calculated on a monthly or quarterly basis and added to the account balance, contributing to the overall growth of the savings.

Savings accounts are particularly well-suited for personal savings goals and day-to-day transactions that do not require constant access to the funds. While savings accounts allow account holders to make withdrawals, they often come with certain restrictions or limits on the number of transactions allowed each month. This encourages users to maintain a more disciplined approach to their savings, discouraging excessive spending.

Additionally, savings accounts are considered a safe and secure way to store money. They are typically offered by banks and financial institutions, providing a reliable and regulated environment for individuals to entrust their funds. Many savings accounts also come with the added benefit of federal deposit insurance, which protects a certain amount of the deposited funds in case of bank failure.

In summary, a savings account is a valuable financial tool for individuals looking to save money with fewer regular transactions. The interest earned on the deposited amount, coupled with the safety and security offered by banks, makes it an ideal choice for personal savings and achieving long-term financial goals.

- Current Account

FD (Fixed Deposit) or RD (Recurring Deposit) Account

Purpose: These accounts are specifically for individuals looking to invest a lump sum amount (Fixed Deposit) or make regular deposits over a period (Recurring Deposit).

Features: Both FD and RD accounts offer higher interest rates compared to savings accounts. They are considered low-risk investment options, and the deposited amount is locked for a predetermined period in the case of FD.

Fixed Deposit (FD) and Recurring Deposit (RD) accounts are popular investment options for individuals who want to grow their savings with a fixed and secure return. These accounts cater to different preferences and financial habits, allowing individuals to choose the one that aligns with their investment goals.

Fixed Deposit (FD) Account

Purpose: Fixed Deposit accounts are designed for individuals who have a lump sum amount of money that they want to invest. This lump sum, known as the principal amount, is deposited in the FD account for a fixed tenure.

Features

- Higher Interest Rates: FDs typically offer higher interest rates compared to regular savings accounts. The interest rate is determined at the time of opening the FD and remains constant throughout the maturity period.

- Fixed Tenure: One of the distinctive features of FDs is the fixed tenure, during which the deposited amount remains locked. The depositor cannot withdraw the funds before the maturity date without incurring penalties.

- Low-Risk Investment: FDs are considered low-risk investments, making them a preferred choice for conservative investors. The principal amount is secured, and the interest earned is predetermined.

Recurring Deposit (RD) Account

Purpose: Recurring Deposit accounts are suitable for individuals who want to make regular deposits over a specified period. It is an ideal option for those who may not have a lump sum amount to invest initially but can commit to making periodic contributions.

Features

- Regular Deposits: RDs allow account holders to make fixed monthly deposits into the account. The sum is predetermined and agreed upon at the time of opening the RD.

- Flexible Tenure: Unlike FDs with a fixed tenure, RDs offer flexibility in choosing the investment period. The tenure can range from a few months to several years, depending on the financial goals of the investor.

- Accumulated Interest: Similar to FDs, RDs also offer higher interest rates compared to regular savings accounts. The interest is calculated on the accumulated amount, which includes both the principal and the interest from previous months.

Both FD and RD accounts provide a secure way to grow savings with predictable returns. Choosing between the two depends on individual preferences, financial goals, and the availability of a lump sum amount for investment. While FDs are suitable for those with a lump sum amount and a fixed time horizon, RDs cater to individuals looking for a disciplined way to save through regular contributions over a flexible tenure.

- Loan Account

Purpose: This type of account is opened to repay loans.

Features: Loan accounts are used to manage the repayment of loans taken by individuals. Regular payments, including interest and principal amounts, are made from this account as per the agreed-upon terms of the loan.

A Loan Account is a specialized financial account that is specifically designated to repay loans. When individuals borrow money, whether for personal, educational, or business reasons, a loan account is established to facilitate the systematic repayment of the borrowed funds. This type of account is an integral part of the overall loan management process and plays a crucial role in keeping track of payments and ensuring compliance with the terms and conditions of the loan agreement.

Here are some key features and aspects of a Loan Account

- Purpose

- The primary purpose of a Loan Account is to serve as a dedicated platform for managing the repayment of loans.

- It provides a centralized and organized mechanism for both borrowers and lenders to track and process payments.

- Loan Repayment

- Regular payments are made from the Loan Account to fulfill the obligations outlined in the loan agreement.

- These payments typically include both the interest and principal amounts, ensuring a gradual reduction of the outstanding loan balance over time.

- Agreed-upon Terms

- The terms of the loan, including the interest rate, repayment schedule, and any other specific conditions, are agreed upon by the borrower and the lender at the time of loan approval.

- The Loan Account is structured to adhere to these agreed-upon terms, and any deviations may be subject to penalties or adjustments.

- Payment Frequency

- Payments from the Loan Account may be scheduled at regular intervals, such as monthly, quarterly, or annually, depending on the terms of the loan.

- The frequency of payments is designed to align with the borrower’s financial capacity and the overall duration of the loan.

- Recordkeeping

- The Loan Account serves as a comprehensive recordkeeping tool, documenting all transactions related to loan repayments.

- Both borrowers and lenders can refer to the account statements to monitor the progress of loan repayment, view payment history, and track outstanding balances.

- Loan Closure

- The Loan Account remains active until the entire loan amount, including interest, is repaid in full.

- Once the final payment is made, the loan is considered closed, and the borrower has fulfilled their financial obligation.

In summary, a Loan Account is a specialized financial tool designed to facilitate the structured repayment of loans. It ensures transparency, accountability, and adherence to the agreed-upon terms, benefiting both borrowers and lenders in the effective management of financial obligations.

- NRE (Non-Resident External) or NRI (Non-Resident Indian) Account

Purpose: These accounts are designed for non-resident individuals or NRIs.

Features: NRE accounts are maintained in Indian Rupees and are fully repatriable, meaning funds can be freely transferred abroad. They are ideal for NRIs looking to manage their finances in India. The interest earned on these accounts is tax-free.

NRE (Non-Resident External) and NRI (Non-Resident Indian) accounts are specialized financial instruments designed to cater to the banking needs of individuals who reside outside of India. These accounts offer NRIs a convenient and effective way to manage their finances in their home country.

- NRE Account

An NRE account is maintained in Indian Rupees and is fully repatriable, which means that the funds deposited in this account can be freely transferred abroad. NRIs can deposit foreign income into the NRE account, and the balance in the account is freely convertible into any foreign currency. This makes it an ideal choice for NRIs who want to keep their funds in India, yet have the flexibility to move them across borders as needed.

One significant feature of NRE accounts is that the interest earned on the deposited amount is tax-free. This makes NRE accounts an attractive option for NRIs seeking a tax-efficient way to grow their wealth. The tax exemption applies to both the principal amount and the interest earned, providing an added financial benefit.

- NRI Account

NRI accounts, in general, cater to the banking needs of non-resident Indians. These accounts include various types, such as NRE, NRO (Non-Resident Ordinary), and FCNR (Foreign Currency Non-Resident) accounts. While NRE accounts are designed for managing funds in Indian Rupees, NRO accounts are meant for managing income earned in India.

The NRI account category recognizes the unique financial requirements of individuals living abroad, allowing them to maintain a connection with their home country’s banking system. These accounts facilitate the smooth handling of income earned in India, enabling NRIs to manage their finances, investments, and other monetary transactions efficiently.

In summary, NRE accounts are specifically tailored for NRIs who want to maintain their financial presence in India, with the added advantage of tax-free interest and full repatriability. These accounts provide a seamless way for NRIs to manage and grow their wealth while enjoying the flexibility of transferring funds internationally.

- NR (Non-Resident) or NRO (Non-Resident Ordinary) Accounts

Purpose: Similar to NRE accounts, these are for non-resident individuals or NRIs.

Features: NRO accounts are for managing income earned in India, and they can be in Indian Rupees. The interest earned on NRO accounts is subject to taxation. Unlike NRE accounts, the funds in NRO accounts are not fully repatriable, meaning there are restrictions on transferring funds abroad.

Non-Resident (NR) or Non-Resident Ordinary (NRO) accounts are financial instruments designed for non-resident individuals or Non-Resident Indians (NRIs) who have financial interests in India. These accounts cater to the specific needs and regulations governing the financial activities of individuals residing outside of India.

Purpose: Similar to NRE (Non-Resident External) accounts, NR or NRO accounts serve the purpose of facilitating financial transactions and managing income earned in India for non-residents. These individuals may include NRIs, PIOs (Persons of Indian Origin), or foreign citizens with financial ties to India. NRIs often use these accounts to hold and manage their income from various sources in India.

Features

- Currency and Taxation

- NRO accounts allow account holders to maintain their funds in Indian Rupees. This feature is beneficial for managing income generated within the country.

- Interest earned on NRO accounts is subject to taxation in India. The applicable tax rates are determined by Indian tax laws, and the financial institutions handling these accounts may withhold taxes at source.

- Repatriation Restrictions

- Unlike NRE accounts, where funds are freely repatriable (can be transferred abroad without restrictions), NRO accounts have certain limitations on repatriation. The funds held in NRO accounts are not fully repatriable, meaning there are restrictions on transferring the entire balance abroad.

- Repatriation from NRO accounts is subject to certain conditions and limits set by the Reserve Bank of India (RBI). Account holders may need to follow specific procedures and obtain approvals for repatriating funds from their NRO accounts.

- Permissible Credits

- NRO accounts can receive various types of credits, including income earned in India, such as rent, dividends, or pension. It is a suitable account for managing multiple sources of income within the country.

- Joint Accounts

- NRO accounts can be held individually or jointly with another NRI or resident Indian. This flexibility allows individuals to manage their finances according to their preferences and needs.

NRO accounts cater to the financial requirements of non-residents with income sources in India. While they offer the convenience of managing funds in Indian Rupees, account holders must be aware of the taxation implications and the restrictions on repatriation. These accounts provide a practical solution for NRIs to handle their financial affairs in India while adhering to the regulatory framework.

In summary, Indian banks offer a range of accounts to cater to the diverse financial needs of individuals, businesses, and non-resident individuals. Each type of account serves a specific purpose and comes with its own set of features and benefits.

What are the dynamics of joint accounts in business?

In the intricate world of business partnerships, the establishment of a joint account serves as a pivotal step toward streamlined financial management. This blog aims to shed light on the significance of joint accounts, drawing from the real-world experience of Mandip and I, co-founders of an LLP. Exploring the nuances of the Know Your Customer (KYC) process, we will unravel the layers of responsibility and compliance associated with joint accounts in the financial realm.

- The Genesis of Joint Accounts

A joint account is no ordinary financial vessel; it is a shared space where the financial destinies of multiple individuals or entities intertwine. In our entrepreneurial journey, Mandip and I recognized the importance of a united front in managing the income and expenses of our LLP. This realization prompted the inception of a joint account, a symbolic agreement to navigate the financial seas together.

- KYC: Unveiling the Identity

The opening of a bank account, be it individual or joint, is not a mere formality; it is a process deeply rooted in the ‘Know Your Customer’ (KYC) framework. The KYC process ensures that the bank has a comprehensive understanding of the account holder’s identity, enabling a secure and transparent financial ecosystem. It is not a one-time affair but an ongoing commitment that requires periodic updates in alignment with the guidelines set forth by regulatory bodies such as the Reserve Bank of India (RBI).

- Periodic KYC Updates

In the dynamic landscape of business, change is the only constant. Individuals evolve, organizations grow, and financial landscapes shift. Recognizing this, the RBI mandates periodic updates to the KYC information associated with bank accounts. These updates serve as a mechanism to validate and verify the accuracy of the account holder’s details. Non-compliance with these updates can lead to serious repercussions, including the freezing of the account.

- The Ripple Effect of Non-Compliance

The consequences of non-compliance with KYC requirements are not to be taken lightly. Banks are obligated to enforce strict measures to ensure the integrity of the financial system. In cases where account holders fail to adhere to the prescribed KYC updates, the bank may resort to freezing the account. This drastic step is taken to mitigate the risk associated with unidentified or unverified account holders, safeguarding the financial interests of all stakeholders involved.

In the intricate dance of business partnerships, a joint account emerges as a symbol of trust and collaboration. The KYC process, with its periodic updates, acts as the guardian of this financial union, ensuring transparency, accountability, and compliance with regulatory standards. As Mandip and I continue our entrepreneurial journey, our joint account stands as a testament to the importance of understanding and adhering to the KYC framework. In the ever-evolving landscape of business, embracing the responsibility that comes with financial collaboration is not just a choice but a necessity for a robust and secure financial future.

What is the importance of adding a nominee to your bank account?

Opening a bank account is a crucial step in managing one’s finances, and it marks the beginning of a financial relationship between an individual and a financial institution. Whether you choose a public bank with its standardized 11-digit account numbers or a private bank offering customizable 12 to 14-digit account numbers, the significance of safeguarding your financial assets cannot be overstated. In this blog, we will explore the importance of adding a nominee to your bank account in India, highlighting the practices and implications of this essential step.

- The Account Holder and the Vital Role of an Account Number

When an individual opens a bank account, they become the account holder. The account number, the first piece of information provided to them, serves as a unique identifier, linking them to their financial holdings. Public banks in India typically issue 11-digit account numbers, while private banks may opt for longer sequences, ranging from 12 to 14 digits. Some private banks even offer the option of customizing account numbers, allowing individuals to use familiar numbers like their phone numbers.

The Significance of a Nominee: A nominee is a person designated by the account holder to inherit and manage the account in the event of the account holder’s demise. This crucial step ensures the seamless transfer of ownership and prevents financial complications for the family and loved ones left behind. While it may seem like a routine administrative task, adding a nominee serves as a protective measure, providing peace of mind and financial security.

- Understanding the Nominee and Their Role

In the world of banking, the unexpected can happen. Life is unpredictable, and it is essential to plan for unforeseen circumstances. This is where the concept of a nominee comes into play. A nominee is an individual chosen by the account holder to inherit the financial assets in the event of the account holder’s demise. It is a crucial practice to add a nominee to your account, ensuring that your hard-earned money doesn’t face unnecessary complications or legal hurdles in the unfortunate event of your passing.

- Reasons to Add a Nominee

- Smooth Transition of Assets: Adding a nominee streamlines the process of transferring ownership in the event of the account holder’s demise. This ensures that the financial assets seamlessly pass on to the designated nominee without unnecessary delays.

- Avoiding Legal Complications: Without a designated nominee, the legal process of transferring ownership can be lengthy and complicated. Adding a nominee simplifies this process, sparing your loved ones from potential legal hassles during an already challenging time.

- Financial Security for Loved Ones: Adding a nominee is an act of financial responsibility. It demonstrates your commitment to securing the financial well-being of your loved ones, ensuring that they have access to the funds they may need in your absence.

- Customization and Convenience: Some private banks offer the convenience of customizing account numbers, allowing individuals to use easily memorable combinations such as their phone numbers. This not only personalizes the banking experience but also facilitates quicker identification of the account.

In conclusion, adding a nominee to your bank account is a prudent and responsible financial practice. It provides peace of mind, ensuring that your hard-earned money is protected and that your loved ones can access the funds without unnecessary complications. As you embark on your financial journey, take the time to consider the importance of nominating someone you trust, and secure your financial legacy for the benefit of those you care about most.

What are the key differences between traditional current accounts and zero-balance alternatives?

In the world of banking, managing a current account comes with its set of rules and responsibilities. One such crucial aspect is the concept of minimum balance. Many individuals may find themselves wondering about the significance of this requirement and the penalties associated with it. This blog aims to shed light on the dynamics of minimum balance, the implications of falling below it, and the concept of zero balance accounts as an alternative.

- Understanding Minimum Balance

A current account is a financial tool that allows individuals and businesses to manage their day-to-day transactions. Unlike savings accounts, current accounts are designed for frequent transactions and do not typically offer interest on the deposited amount. However, they come with a crucial condition known as the minimum balance.

The minimum balance is the amount that an account holder is required to maintain in their current account. This balance is set by the bank and varies from institution to institution. For example, if the minimum balance for a particular account is ₹1,000,000, the account holder must ensure that their account balance never falls below this specified amount.

The minimum balance requirement is a condition set by banks for maintaining a specific amount of money in a current account at all times. This condition ensures that the account holder has a certain level of funds available for transactions and fees, and it helps the bank cover the costs associated with managing the account.

Here are some key points to understand about the minimum balance in a current account

- Purpose: The primary purpose of imposing a minimum balance is to ensure that account holders have a stable financial standing and can cover any fees or charges associated with the current account. It also helps banks in managing their liquidity and maintaining a stable deposit base.

- Varies by Bank and Account Type: The minimum balance requirement is not universal and can vary between banks and even among different types of current accounts offered by the same bank. Some accounts may have higher minimum balance requirements than others.

- Penalties for Falling Below Minimum Balance: If the account balance falls below the specified minimum, banks often impose penalties or fees. These fees can be a fixed amount or a percentage of the shortfall. Account holders need to be aware of these penalties and strive to maintain the required minimum balance.

- Calculating the Minimum Balance: The minimum balance is calculated based on the average balance over a specified period, such as a month. Some banks may have different criteria for calculating the minimum balance, so account holders must understand the specific terms and conditions.

- Non-Interest Bearing: Unlike savings accounts, current accounts typically do not offer interest on the deposited amount. The focus of a current account is on facilitating frequent transactions rather than serving as a savings tool.

- Flexibility in Transactions: Despite the minimum balance requirement, current accounts offer a high degree of flexibility for transactions. Account holders can write checks, make electronic transfers, and perform various other transactions without restrictions within the available balance.

- Negotiation: In some cases, especially for business accounts or high-value customers, banks may be open to negotiating the minimum balance requirements. It’s worth discussing with the bank to see if there’s room for flexibility based on your financial situation and relationship with the bank.

Understanding and adhering to the minimum balance requirement is crucial for avoiding unnecessary fees and ensuring the smooth operation of a current account. It’s advisable for account holders to regularly monitor their account balance and take proactive steps to maintain the required minimum.

- Penalties for Falling Below Minimum Balance

If the account balance dips below the minimum required amount, banks impose penalties on the account holder. These penalties can be in the form of fees or charges, and they serve as a deterrent to encourage account holders to maintain the stipulated minimum balance. The purpose behind this requirement is to ensure that banks can cover the costs associated with managing the account and providing various services.

Falling below the minimum required balance in a bank account often results in penalties imposed by the bank on the account holder. The minimum balance requirement is a predetermined amount set by the bank that account holders are expected to maintain in their accounts at all times. This requirement varies from bank to bank and can depend on factors such as the type of account, account activity, and the bank’s policies.

When an account falls below the specified minimum balance, banks typically levy penalties as a way to encourage account holders to keep their balances above the required threshold. These penalties can take the form of fees or charges, and they serve multiple purposes:

- Covering Costs: Banks incur operational costs in managing and servicing individual accounts. These costs include administrative expenses, transaction processing, customer service, and more. The minimum balance requirement helps ensure that the bank can cover these costs through the funds maintained in the account.

- Encouraging Financial Responsibility: Imposing penalties for falling below the minimum balance serves as a deterrent, encouraging account holders to manage their finances responsibly. It encourages individuals to monitor their account balances and take appropriate actions to avoid incurring penalties.

- Maintaining Profitability: Banks, like any other business, aim to be profitable. Penalties contribute to the bank’s revenue stream, especially if a significant number of account holders occasionally fall below the minimum balance. This additional income helps offset the costs of providing banking services.

- Risk Mitigation: Maintaining a minimum balance requirement can also be a risk management strategy for banks. It ensures that there is a buffer of funds in accounts, reducing the risk of overdrafts and unpaid fees.

It’s important for account holders to be aware of the minimum balance requirements associated with their accounts and to manage their finances in a way that avoids falling below these thresholds. This may involve regularly monitoring account balances, setting up alerts for low balances, or exploring account options with lower minimum balance requirements if available. Understanding and adhering to these requirements can help account holders avoid unnecessary penalties and maintain a positive banking relationship.

- The Account Balance vs. Usable Balance

It’s essential to differentiate between the account balance and the usable balance. The account balance is the total amount present in the account, including both deposited and withdrawn funds. On the other hand, the usable balance is the amount that account holders can use for transactions without incurring penalties. Understanding this difference is crucial for effective financial management.

- Zero Balance Accounts – A Hassle-Free Alternative

In response to the challenges posed by minimum balance requirements, some banks offer zero-balance accounts. As the name suggests, these accounts do not mandate a minimum balance. This type of account is especially beneficial for individuals who may find it challenging to maintain a specific balance due to fluctuating income or other financial constraints.

Zero balance accounts provide a hassle-free banking experience by eliminating the worry of penalties for falling below a predetermined amount. While they may have certain limitations compared to regular current accounts, such as fewer perks and services, they are an attractive option for those seeking simplicity and flexibility in their banking.