Online transactions have been on a rise for the last 5 years or so. People hardly go to their banks these days to get things done. Shopping, bill payments, funds transfer or even applying for a loan now only requires a smartphone and a few clicks. In this new era of miraculous technology, if you still struggle to under the difference between NEFT and IMPS, then you’re in the right place. Let’s bring you up to speed my friend.

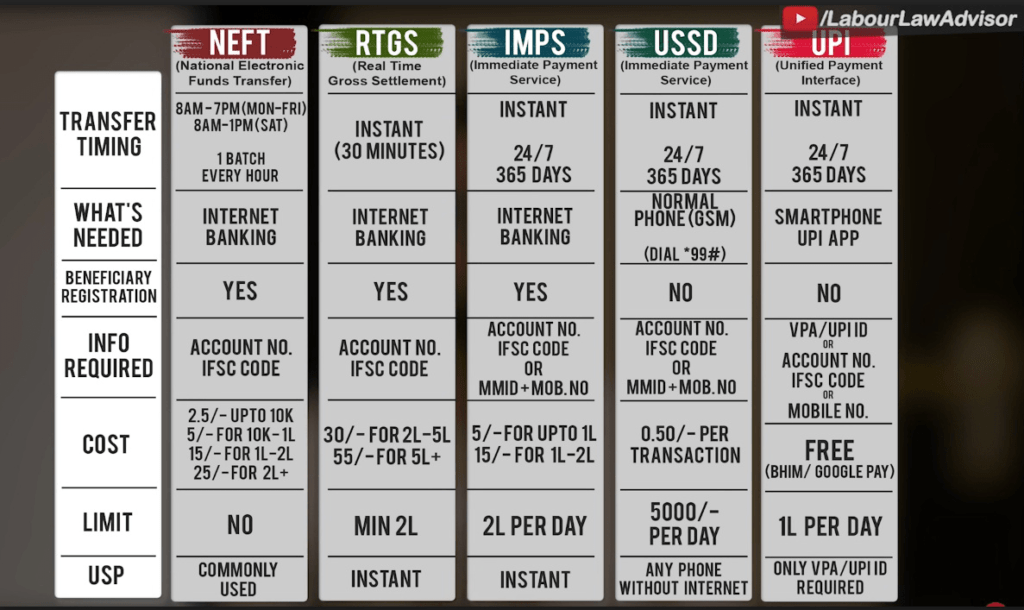

In this article, you will learn about the 5 most common ways of online funds transfer: NEFT, UPI, IMPS, RTGS, and USSD. Which of these methods are free of cost, which of these get the get the job done instantly and other details are explained below.

Table of Contents

The difference between NEFT and IMPS, UPI, USSD and RTGS

All about NEFT: National Electronic Funds Transfer

- Timing:

You will get this facility available from Monday to Friday from morning 8 AM till evening at 7 PM every day. The service is also available on Saturday wherefore, the timing is from morning 8 AM up to 1 PM in the afternoon.

Funds transfer will take place within the 12 settlement periods and only a batch every hour.

For example, you transfer a sum of money at 8:05 AM. Thereby, the transaction will be carried out at 9:00 AM which is the next settlement period. Added, there is a free slot during the period. Otherwise, the settlement will take place in the next time slot. - What all you need?

A computer with internet banking enabled by your bank or mobile phone will suffice the purpose. You first have to Log in to your bank account and a beneficiary.

To do this you will need his account number, name and IFSC code. Then, you just have to make the payment to the successfully-added beneficiary. - Cost Involved in NEFT

Fund transfer up to Rs 10,000 = Rs 2.5 Service charge

Fund transfer of Rs 10,000 up to Rs 1Lac = Rs 5 Service charge

Rs 15 Service charge for Fund transfer of Rs 1Lac up to Rs 2Lac

Fund transfer of more than Rs 2Lac = Rs 25 Service charge - Transaction Limit in NEFT

There is no limit of this particular type of funds transfer and the advantage of the same; it is the most commonly used method of transferring funds online.

Second, in line is RTGS. It stands for Real Time Gross Settlement.

- Timing:

Unlike NEFT the fund transfer takes places on a real-time basis. The fund transfer almost happens instantaneously. - What all you need?

For this, the requirements are pretty much the same as NEFT. Internet banking or a Smartphone having internet access will solve the purpose. The procedure for RTGS is also similar to that of NEFT. Add the beneficiary with the account number, name and IFSC code and choose the RTGS option to transfer the funds. - Cost Involved in RTGS

Fund transfer of Rs 2 Lac up to Rs 5 Lac = Rs 30 Service charge.

Fund transfer for more than Rs 5Lac = Rs 55 Service charge. - Transaction Limit in RTGS

The limit of RTGS funds transfer is Rs 2Lac minimum, and the benefit is the transfer initiates immediately.

IMPS or Immediate Payment Service

- Timing:

This is available (24 x 7) x 365 days. - What all you need?

For this, the requirements are pretty much the same as NEFT or any other fund transfer in that case. Internet banking or a Smartphone along with internet access is a must.

You can add the beneficiary with the account number and IFSC code. Also, you can use MMID or mobile number for IMPS funds transfer. - Cost Involved in IMPS

Fund transfer up to Rs 1 Lac = Rs 5 Service charge.

Fund transfer of Rs 1 Lac up to Rs 2 Lac = Rs 15 Service charge. - Transaction Limit in IMPS

However, there is a limit to this transaction. You are allowed to only transfer up to Rs 2 Lac on a single day.

UPI or Unified Payment Interface

- Timing:

The service has become quite popular in recent days. Just like IMPS, this service is available (24 x 7) for 365 days. The need for adding a beneficiary is not applicable in this case. - What all you need?

All users have to do is install the Smartphone application in his/her phone and enjoy this service.

VPA or virtual payment address, UPI ID, Account Number with IFSC code and mobile number all stand valid to initiate a fund transfer in this process. - Cost Involved in UPI

The service is entirely free of cost. Only install a UPI based application on your phone like BHIM or Google Pay and witness the magic of online transactions. - Transaction Limit in UPI

The limit for UPI is Rs 1 Lac per day and the best part of this process of funds transfer; is a user, does not require the account details for the transaction.

USSD is also an immediate payment service for the ones who don’ have a smartphone.

- What all you need?

To transfer the fund, you have to dial *99# and follow the on-screen procedures. The requirement to add a beneficiary does not exist here. However, the account details or the mobile number is a must to initiate the transaction. - Cost Involved in USSD

0.50 Paisa per transaction. - Transaction Limit in USSD

We hope that now you have a basic idea between the difference between NEFT and IMPS, UPI, USSD, and RTGS. Which is one the fastest and which one is free? We are sure that it will be easier for you from now onwards to decide the correct method to transfer funds.

Do check out our Labour Law Advisor blog for other such important articles.

Understand the difference between NEFT, UPI, RTGS, IMPS and USSD in this video:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!