Owning a house is a dream that many of us cherish, a dream that often comes with the financial challenge of securing a home loan. In this journey, understanding the dynamics of loan repayments is crucial. Let’s delve into a real-life scenario to demystify the concept of outstanding loan balances.

Scenario:

- Loan Amount: ₹30 Lakhs

- Loan Tenure: 20 Years

- Interest Rate: 8%

- Monthly EMI: ₹25,093

- Total EMIs Paid: 60 (5 years)

- EMI Calculation: The monthly EMI on a ₹30 lakh loan with an 8% interest rate for 20 years amounts to ₹25,093. For the first 5 years, you faithfully pay this amount every month, summing up to ₹15 lakhs.

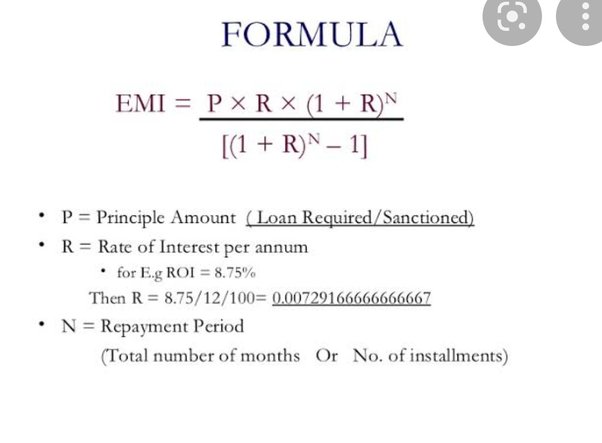

EMI, or Equated Monthly Installment, is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. The EMI includes both principal and interest components, and it is calculated based on the loan amount, interest rate, and loan tenure.

In your example, you have a ₹30 lakh loan with an 8% interest rate for 20 years. The monthly EMI is calculated to be ₹25,093. This means that for every month over the 20 years, you would pay ₹25,093 to cover both the principal and interest on the loan.

For the first 5 years, you’ve faithfully paid this EMI every month, and the total payment over this period sums up to ₹15 lakhs. Let’s break down why this amount is reached:

The total payment over 5 years can be calculated by multiplying the monthly EMI by the number of months in 5 years. There are 12 months in a year, so for 5 years, it’s 5 * 12 = 60 months.

Total payment = Monthly EMI * Number of months Total payment = ₹25,093 * 60 = ₹15,05,580

Therefore, after paying the EMI every month for the first 5 years, you would have paid ₹15,05,580. This amount consists of both the principal repayment and the interest accrued on the outstanding loan amount over those 5 years. Remember that the principal repayment increases gradually over time, while the interest component decreases as the outstanding loan amount reduces.

- Common Misconception: A common misconception is that after 5 years of regular payments, the outstanding loan balance should be half of the total loan amount. Let’s reconsider this notion.

The misconception that the outstanding loan balance should be half of the total loan amount after 5 years arises from a simplified view that assumes equal principal repayment throughout the loan tenure. However, in most loan amortization schedules, the repayment structure is front-loaded with more interest being paid in the initial years.

In the early years of a loan, a larger portion of the EMI goes towards paying off the interest, and the remaining amount is used to reduce the principal. As you continue making regular payments, the interest component decreases, and more EMI contributes to principal repayment. This is because the interest is typically calculated on the remaining outstanding balance.

Let’s illustrate this with a simple example:

Suppose you have a ₹30 lakh loan with an 8% interest rate for 20 years, and the monthly EMI is ₹25,093. After 5 years, you would have paid a total of ₹15,05,580, as calculated earlier. However, the outstanding loan balance at the end of 5 years may not necessarily be half of the total loan amount.

For instance, the outstanding balance after 5 years might still be relatively high, say around ₹27 lakhs, with a substantial portion of the payments going towards interest during the initial years. The exact outstanding balance depends on the specific terms of the loan and its amortization schedule.

To get a clearer picture of the outstanding balance at any point in the loan tenure, it’s essential to refer to the loan amortization schedule provided by the lender. This schedule outlines the breakdown of each monthly payment into principal and interest components, showing how the loan balance evolves. The amortization schedule dispels the misconception that the outstanding loan balance should be half after a certain number of years and provides a more accurate understanding of the loan repayment process.

- Understanding Outstanding Loan Balance: The outstanding loan balance is not a linear reduction from the principal amount. In the initial years of a loan, a significant portion of the EMI goes towards interest payments, and only a fraction contributes to reducing the principal amount.

The outstanding loan balance is not a linear reduction from the principal amount because of the way loan amortization works. Amortization refers to the process of gradually repaying a loan through periodic payments, and these payments are typically composed of both principal and interest components.

In the initial years of a loan, a substantial portion of the Equated Monthly Installment (EMI) goes towards paying off the interest, while only a smaller fraction is allocated to reducing the principal amount. This distribution is because interest is usually calculated on the remaining outstanding balance of the loan.

Here’s a breakdown of how this process occurs:

- Interest-Heavy Payments Early On

- In the early years of the loan, the outstanding balance is higher, leading to higher interest charges.

- A larger proportion of the EMI is used to cover these interest charges, leaving less for principal repayment.

- Reducing Outstanding Balance

- As you continue making regular payments, the outstanding loan balance gradually decreases.

- With a lower outstanding balance, the interest calculated on it also decreases.

- Increasing Principal Repayment

- With a decreasing interest component, a larger share of the EMI is then directed towards reducing the principal amount.

- Balanced Repayment in Later Years

- Towards the end of the loan tenure, when the outstanding balance is much lower, a more significant portion of the EMI goes directly towards principal repayment.

This structure is a result of the way interest is calculated on the outstanding balance, which is commonly referred to as compound interest. It leads to an “amortization curve” where the early payments are interest-heavy, and as time progresses, a larger proportion of each payment is applied to the principal.

Borrowers need to understand this dynamic, as it affects the rate at which the loan is paid down and the overall interest paid over the life of the loan. Borrowers can refer to the loan amortization schedule provided by the lender to see a detailed breakdown of each monthly payment and how it contributes to both principal and interest repayment over the loan term.

- Calculation of Outstanding Loan Balance after 5 Years: To find the outstanding loan balance after 5 years, subtract the total amount paid (₹15 lakhs) from the original loan amount (₹30 lakhs). However, this calculation oversimplifies the reality, as a substantial portion of the EMI in the early years goes towards interest.

The method of subtracting the total amount paid from the original loan amount to determine the outstanding loan balance after 5 years is an oversimplification. As mentioned earlier, a significant portion of the Equated Monthly Installment (EMI) in the initial years goes towards interest payments, and only a fraction contributes to reducing the principal amount.

To understand why this approach is oversimplified, consider the following:

- Interest Accumulation

- In the early years of the loan, when the outstanding balance is higher, the interest component of the EMI is more substantial.

- Subtracting the total amount paid from the original loan amount doesn’t account for the interest payments made during this period.

- Principal Reduction

- The oversimplified calculation assumes that the entire EMI contributes to principal reduction, which is not the case.

- A portion of the EMI is used to cover the interest charges, and only the remaining amount is applied to reduce the principal.

- Amortization Schedule

- The accurate way to determine the outstanding loan balance after 5 years is to refer to the loan’s amortization schedule.

- The schedule provides a month-by-month breakdown of each payment, specifying how much goes towards interest and how much towards the principal.

- Interest on Outstanding Balance

- The interest is typically calculated on the remaining outstanding balance, and as this balance decreases over time, the interest charges also decrease.

To get a more precise figure for the outstanding loan balance after 5 years, it is recommended to consult the loan amortization schedule provided by the lender. This schedule will give you a detailed picture of how each payment contributes to both principal and interest and how the outstanding balance evolves. It’s a valuable tool for understanding the true progress of loan repayment and helps avoid misconceptions about the distribution of EMI components.

- The Reality Check: After 5 years of consistent payments, you may be surprised to find that your outstanding loan balance is not necessarily ₹15 lakhs. Due to the interest component dominating the initial EMIs, the reduction in the principal amount is comparatively modest.

Outstanding loan balance after 5 years may indeed be higher than expected due to the dominance of the interest component in the initial Equated Monthly Installments (EMIs). The reality of loan amortization is that the reduction in the principal amount during the early years is relatively modest, as a significant portion of your monthly payment goes towards covering the interest charges.

Here’s a breakdown of why the outstanding loan balance is not necessarily ₹15 lakhs after 5 years:

- Interest-Heavy Initial Payments

- In the early years of the loan, a substantial part of your monthly EMI is allocated to paying off the accrued interest.

- Because the interest component is higher in the beginning, the reduction in the principal balance is slower.

- Principal Repayment Increases Gradually

- While a portion of each EMI contributes to principal repayment, the ratio increases gradually over time.

- As the outstanding balance decreases, the interest charged on it also decreases, allowing more of the EMI to be applied to reduce the principal.

- Amortization Schedule Dynamics

- The loan amortization schedule provides a month-by-month breakdown of how each payment is allocated between interest and principal.

- Examining this schedule reveals the real distribution of your payments over time.

- Interest on Remaining Balance

- The interest is typically calculated on the remaining outstanding balance.

- As you progress through the loan term, the interest component decreases, allowing more of your EMI to directly reduce the principal.

To avoid surprises, borrowers should be aware of these dynamics and not rely solely on a simplified subtraction of total payments made from the original loan amount. The loan amortization schedule is a valuable tool for gaining insight into how your payments are applied and understanding the actual outstanding balance at any point in time. It’s a more accurate reflection of the loan repayment process and helps in managing expectations regarding the reduction of the principal amount over the loan

Table of Contents

Unveiling Loan Repayment & Decoding Your EMI

Entering into a loan agreement is a significant financial commitment that requires careful consideration. However, hidden surprises may await borrowers, as demonstrated by a scenario where the loan tenure mysteriously extends without clear communication from the lender. In this blog post, we unravel the complexities of a loan repayment situation, shedding light on an unexpected twist that many borrowers may encounter.

Let’s break down the information and analyze the scenario:

- Original Loan Details

- Loan Amount: Rs. 30 lakhs

- Total Interest: Rs. 30 lakhs

- Total Repayment Period: 20 years

- Balance after 5 Years (End of 2028)

- Outstanding Balance: Rs. 26 lakhs

- Interest Rate Change

- Original Interest Rate: 8%

- New Interest Rate: 11% after 5 years

- Creating a New Loan

- New Loan Amount: Rs. 26 lakhs

- New Interest Rate: 11%

- New Repayment Period: Initially planned for 15 years

- EMI Calculation for New Loan (as per the original plan)

- Using the formula for EMI: EMI=P x R x (1+R)^N / [(1+R)^N-1]

- Where P is the principal amount (Rs. 26 lakhs), r is the monthly interest rate, and n is the total number of monthly payments (15 years initially).

- Surprising Discovery

- Actual EMI: Rs. 25,000

- The term was extended to 28 years without informing the borrower.

Now, let’s go through the points:

- Loan Restructuring

- After 5 years, with an outstanding balance of Rs. 26 lakhs, a new loan was initiated with an 11% interest rate and initially planned for a 15-year tenure.

- EMI Calculation Mismatch

- The calculated EMI for the new loan with the original 15-year tenure and 11% interest rate is Rs. 29,552.

- Surprisingly, the actual EMI presented by the bank is Rs. 25,000.

- Unannounced Term Extension

- The shocking revelation is that the 15-year tenure has been extended to 28 years without proper communication from the bank.

- Despite the extended tenure, the EMI is reduced to Rs. 25,000, creating confusion for the borrower.

Let’s begin with a snapshot of the loan details. You initially took a loan of Rs. 30 lakhs, with an interest of Rs. 30 lakhs, resulting in a total repayment amount of Rs. 60,22,368 over 20 years. Fast forward to the end of 2028, after 62 months, your outstanding balance stands at Rs. 26 lakhs.

In the realm of personal finance, the decision to embark on a loan agreement demands thoughtful consideration and a keen understanding of the associated terms. However, the financial landscape is not always as straightforward as it seems, and borrowers might find themselves grappling with unexpected twists and turns that can significantly impact their repayment journey.

In our scenario, you initiated a loan amounting to Rs. 30 lakhs, coupled with an interest component of Rs. 30 lakhs. This arrangement implied a total repayment obligation of Rs. 60,22,368, spread across 20 years. As we fast forward to the close of 2028, precisely 62 months into the repayment schedule, the outstanding balance on your loan is recorded at Rs. 26 lakhs.

At this juncture, the unsuspecting borrower stumbles upon a startling revelation. Despite diligently adhering to the agreed-upon terms for five years, an unforeseen development emerges. The interest rate on the loan, which was initially set at 8%, has clandestinely risen to 11%.

With this newfound information, a decision is made to embark on a fresh loan of Rs. 26 lakhs to accommodate the adjusted interest rate. The intention is to continue the repayment journey for the remaining 15 years, bringing the borrower to a total repayment period of 20 years.

However, what follows is a mismatch between expectations and reality. Calculations based on the revised interest rate and the remaining tenure indicate that the Equated Monthly Installment (EMI) should amount to Rs. 29,552. Yet, to the borrower’s surprise, the actual EMI deducted from their account is a mere Rs. 25,000.

A closer examination reveals the crux of the matter. The loan tenure, which the borrower assumed to be 15 years, has extended inexplicably to 28 years. What adds a layer of complexity to this situation is the absence of clear communication from the lending institution regarding this substantial extension.

This unexpected twist significantly alters the trajectory of the loan repayment. Originally conceptualized as a 20-year commitment, the borrower now finds themselves bound to a prolonged 28-year journey. The financial implications of this undisclosed extension are far-reaching, with an increased overall interest burden and potential repercussions for the borrower’s financial well-being.

This scenario serves as a cautionary tale, underscoring the importance of borrowers remaining vigilant and well-informed throughout their loan repayment journey. Transparent communication from lenders is paramount to fostering trust and ensuring that borrowers are equipped to navigate the complexities of their financial commitments.

- Shocking Revelation: After diligently paying off the loan for 5 years, you discover that the interest rate has stealthily increased from 8% to 11%. To adjust to this change, you decide to take a new loan of Rs. 26 lakhs at the revised interest rate for a remaining tenure of 15 years.

- Mismatched Expectations: Calculating the new Equated Monthly Installment (EMI) based on the revised interest rate and remaining tenure yields a figure of Rs. 29,552. However, to your surprise, the actual EMI deducted from your account is only Rs. 25,000. This sparks confusion and raises questions about the discrepancy between the expected and actual repayment amounts.

- Extended Loan Tenure: Upon closer inspection, you discover that the loan tenure has mysteriously increased from the initially agreed upon 15 years to a staggering 28 years. The shocking part? The bank did not provide any explicit notification regarding this substantial extension in the loan term.

- Analyzing the Impact: This unannounced extension has a profound impact on the total repayment amount. While the original plan was to repay the loan in 20 years, the unexpected 13-year extension significantly increases the overall interest paid, contributing to a potentially burdensome financial situation for the borrower.

- Impact of Changes:

- The borrower initially expected to pay a total of Rs. 60 lakhs, as per the original loan terms.

- However, due to changes made by the bank, the revised total repayment has increased to Rs. 84 lakhs, with a substantial increase in the interest component.

- The loan, initially planned for 20 years, now extends to 33 years in total.

- Communication Gap:

- The borrower, making monthly payments of Rs. 25,000, might not have been aware of the significant changes in the loan terms.

- The lack of communication from the bank about the extension of the repayment period to 28 years and the increase in interest to Rs. 58 lakhs raises concerns about transparency and proper disclosure.

- Social Media Impact:

- A girl shared her experience on Instagram, expressing her concern about unexpected changes to her loan terms.

- The reel gained substantial attention with 1.5 million views and 43,000 likes, indicating that many people resonated with the perceived injustice or lack of transparency in loan practices.

In summary, the borrower is facing a situation where changes in loan terms, without proper communication, have led to a significant increase in the total repayment amount and an unexpected extension of the repayment period. The impact has not only affected individual borrowers but has also garnered attention on social media, highlighting the importance of transparency and clear communication in financial transactions.

The story highlights the importance of thorough scrutiny and awareness when dealing with loan agreements. Borrowers must remain vigilant about potential changes in interest rates and loan tenures, ensuring that they are well-informed throughout the repayment period. Transparent communication from financial institutions is crucial to maintaining trust and preventing unwelcome surprises in the already complex realm of loan repayment.

What are the key changes in RBI’s new home loan rules, and how do they affect borrowers and lenders?

In the ever-evolving landscape of financial regulations, the Reserve Bank of India (RBI) has recently introduced new home loan rules that can significantly impact borrowers. These rules emphasize transparency and require individuals to disclose crucial information to banks. In this blog post, sponsored by South Indian Bank, a financial institution with a legacy spanning over 94 years, we will delve into the basics of home loans, specifically focusing on Equated Monthly Installments (EMI) and the recent changes that can benefit borrowers.

- Understanding EMI: EMI, short for Equated Monthly Installment, is a fixed amount deducted from your bank account every month throughout the loan tenure. It serves as a comprehensive repayment plan, ensuring that borrowers gradually pay off their loans. To grasp the dynamics of EMI, it’s crucial to recognize that it comprises two components: principal payment and interest payment.

- EMI Definition

- EMI stands for Equated Monthly Installment.

- It is a fixed amount deducted from the bank every month.

- Loan Repayment Process

- Paying EMI for the entire loan tenure will eventually lead to the loan’s full repayment.

- The loan amount decreases gradually as EMI is paid.

- Distribution of EMI

- EMI consists of two parts: principal payment and interest payment.

- A portion of the EMI goes towards reducing the outstanding balance (principal), and the rest covers interest.

- Principal vs. Interest: The principal amount is the sum borrowed from the bank, and interest is applied to this amount. The goal is to decrease the outstanding balance over time so that the loan eventually gets repaid in full. The division between principal and interest payments in an EMI is a key factor in understanding the progress of loan repayment.

Principal vs. Interest Distribution Example

- Using an example of a 30,00,000 loan with an 8% interest rate for 20 years and an EMI of 25,000 rupees.

- After a year, only 5,000 rupees out of the 25,000 rupees EMI goes towards the principal, while 20,000 rupees covers interest.

- This results in 80% of the EMI going to interest and 20% to the principal in the given example.

Let’s consider an example to illustrate this point. Suppose you take a loan of ₹30,00,000 with an 8% interest rate for 20 years, resulting in an EMI of ₹25,000. If you diligently pay your EMI for an entire year (12 months), a closer look at the breakdown reveals that only ₹5,000 goes towards the principal, while ₹20,000 accounts for the interest. This implies that a staggering 80% of your initial payment contributes to interest, leaving a mere 20% for principal repayment.

- Implications of Payment Allocation: After 14 EMIs, totaling ₹3.5 lakh, only ₹75,000 has been allocated to reducing the principal amount of the loan. This means that, despite making substantial payments, you have covered a mere 2.5% of the total loan amount. This breakdown underscores the importance of understanding the allocation of your EMI payments to ensure effective loan repayment strategies.

- Loan Repayment Progress

- After 14 EMIs, which is equivalent to paying 3.5 lakh rupees, only 75,000 rupees have been utilized to pay off the 30 lakh loan.

- This means that only 2.5% of the loan amount has been repaid.

- Importance of Understanding Basics

- Emphasizes the importance of going back to basics to explain concepts clearly.

- Highlights the significance of understanding how much of the EMI goes towards principal and interest.

The recent changes in home loan rules by RBI call for increased transparency and understanding of loan dynamics. Borrowers should be aware of how their EMI payments are distributed between principal and interest to make informed financial decisions. This blog has aimed to simplify these concepts, shedding light on the nuances of home loan repayment. As you embark on your homeownership journey, knowledge is indeed your most powerful tool.

What factors influence the evolution of loan repayment regarding principal and interest?

Taking out a loan can be an exciting yet daunting decision, often accompanied by a lack of awareness about the intricacies of loan repayment. In this blog, we’ll delve into a crucial aspect of loans that many overlook—the evolving distribution of payments towards principal and interest over time. A recent incident involving a viral reel serves as a testament to the lack of understanding among people, as evidenced by the 50,000 likes it garnered. Let’s break down the stages of loan repayment and unravel the dynamics that borrowers might not be aware of.

- Initial Excitement and 20% Principal Repayment

When individuals decide to take out a loan, it is often driven by a sense of excitement and anticipation, as they look forward to fulfilling immediate needs or achieving specific goals. This could range from buying a home, starting a business, or pursuing higher education. However, amidst this enthusiasm, borrowers might not be fully aware of how the repayment process unfolds.

In the early stages of repaying a loan, a substantial portion of each monthly installment is designated to cover the principal amount. The principal is the initial amount borrowed from the lender. Allocating around 20% of the installment towards the principal means that a fifth of the borrower’s payment is directly contributing to reducing the original loan amount.

This initial emphasis on principal repayment serves several purposes:

- Building Equity: Repaying the principal starts building equity in the financed asset. For example, in a mortgage, early principal payments contribute to increasing the borrower’s ownership stake in the home.

- Interest Reduction: By allocating a portion to the principal, borrowers begin to reduce the outstanding balance on which interest is calculated. This can lead to a gradual decrease in the overall interest payments over time.

- Long-term Savings: While the focus is often on immediate needs, understanding and appreciating the allocation to principal in the early stages of repayment can lead to long-term financial benefits. It sets the foundation for a more favorable distribution of payments as the loan progresses.

It’s crucial for borrowers to recognize and appreciate this early allocation towards the principal as it lays the groundwork for the evolving dynamics of loan repayment. As time progresses, this allocation will undergo changes, and borrowers should be aware of the gradual shift in the distribution of payments between principal and interest. This awareness empowers borrowers to make informed financial decisions and navigate the entire loan repayment journey more effectively.

- Gradual Transition to 50-50 Split

The gradual transition to a 50-50 split between principal and interest payments is a crucial aspect of loan repayment that borrowers should be aware of. Let’s break down this phenomenon to better understand how it unfolds over time:

- Initial Period – Higher Interest Allocation

- In the early stages of the loan, a significant portion of each monthly payment goes towards paying off the interest accrued on the principal amount.

- This is because the interest is calculated on the outstanding balance of the loan, which tends to be higher at the beginning.

- Principal Reduction Over Time

- As borrowers consistently make payments, the outstanding balance of the loan begins to decrease.

- A lower outstanding balance means that the interest accrued on the remaining principal is also reduced over time.

- Increasing Principal Payments

- With a decreasing outstanding balance, a larger portion of each payment is directed towards repaying the principal.

- This transition happens gradually as the loan progresses, and borrowers continue to meet their monthly obligations.

- Balanced 50-50 Distribution

- Over time, typically reaching a midpoint in the loan’s term, the allocation of payments experiences a significant shift.

- The principal and interest payments move closer to a balanced 50-50 distribution.

- Factors Influencing the Transition

- The specific timeline for this transition varies based on the terms of the loan, such as the interest rate, loan amount, and repayment period.

- Loans with longer tenures may take more time to reach a 50-50 split, while shorter-term loans may achieve this balance sooner.

- Impact on Borrowers

- Understanding this transition is crucial for borrowers, as it affects their financial planning and budgeting.

- Initially, more funds go towards covering interest costs, and as the split becomes more balanced, a larger portion contributes to reducing the principal, building equity in the asset financed by the loan.

In summary, the gradual transition to a 50-50 split in principal and interest payments is a natural progression in loan repayment. Borrowers should be mindful of this evolution, as it signifies progress toward reducing the overall debt and ultimately achieving financial freedom.

- Tipping Point in 2035

The year 2035 serves as a significant milestone in the journey of loan repayment, marking a pivotal moment where the distribution of payments between principal and interest undergoes a notable transition. This tipping point holds crucial implications for borrowers, and understanding its significance is paramount in appreciating the long-term commitment associated with a loan.

- Even Distribution of Payments

- In the lead-up to 2035, borrowers witness a gradual shift in the allocation of their monthly payments.

- Unlike the initial years where a substantial portion primarily goes towards servicing the interest, the structure becomes more balanced.

- Transition to Equal Principal and Interest Repayments

- By the time 2035 arrives, borrowers find themselves in a scenario where the repayment structure is nearly evenly divided between repaying the principal amount and covering the accrued interest.

- This equilibrium signifies a critical juncture in the life of the loan, as it represents a departure from the initial years where interest payments dominated.

- Unawareness Among Borrowers

- A common challenge is that many borrowers may not be fully aware of this impending shift in payment dynamics.

- The lack of awareness can lead to misconceptions and potential surprises, especially for those who assumed the loan would maintain a consistent distribution throughout its duration.

- Emphasis on Long-Term Commitment

- The tipping point in 2035 underscores the importance of understanding the long-term commitment inherent in loan agreements.

- Borrowers need to appreciate that the structure of their repayments evolves over time, and anticipating these changes is vital for effective financial planning.

- Financial Literacy and Informed Decision-Making

- Increasing financial literacy is crucial in ensuring that borrowers make informed decisions and understand the nuances of their loan obligations.

- Education about the changing nature of payments can empower individuals to plan, budget effectively, and avoid potential financial strain.

In conclusion, the tipping point in 2035 represents a watershed moment in the life of a loan, where the distribution of payments becomes more balanced between principal and interest. It serves as a wake-up call for borrowers to actively engage in financial education, fostering a better understanding of the evolving nature of loan repayments and reinforcing the need for a thoughtful, long-term commitment to financial responsibility.

- Reversal of Roles Towards the End

In the latter years of a loan, there is a notable shift in the allocation of payments between the principal and interest. This reversal of roles occurs due to the way amortization schedules are structured. Let’s break down the dynamics of this reversal:

- Amortization Schedule

- When you take out a loan, the lender provides you with an amortization schedule. This schedule outlines each monthly payment, specifying how much goes towards the principal and how much towards the interest.

- Front-Loading Interest

- In the early stages of a loan, a larger portion of each monthly payment is allocated to interest. This front-loading of interest is a common feature in many loan structures.

- Principal Reduction Over Time

- As you consistently make payments, the outstanding principal amount decreases. With a lower principal, the interest accrued on the remaining balance also decreases over time.

- Towards the End

- In the latter years of the loan term, the outstanding principal has reduced significantly.

- With a smaller principal, the interest accrued on it becomes proportionally smaller.

- Increased Principal Repayment

- As a consequence of the reduced interest, a more substantial portion of each monthly payment is now directed towards repaying the principal.

- Approximately 80% Principal, Fraction Towards Interest

- During this reversal of roles, it’s not uncommon for around 80% of the monthly payment to be applied towards reducing the remaining principal.

- The remaining fraction represents the diminishing interest component.

- Accelerated Principal Repayment

- This phase is advantageous for borrowers as it accelerates the reduction of the overall loan amount.

- It also signifies that the borrower is closer to complete repayment and eventual loan closure.

- Financial Implications

- For borrowers, the reversal towards allocating a significant majority to the principal is a positive development. It means that a more substantial part of each payment is contributing directly to reducing the borrowed amount, leading to a quicker path to full loan repayment.

Understanding this reversal of roles is crucial for borrowers to anticipate and plan for the changing dynamics of their loan repayments, helping them make informed financial decisions and potentially save money on interest in the long run.

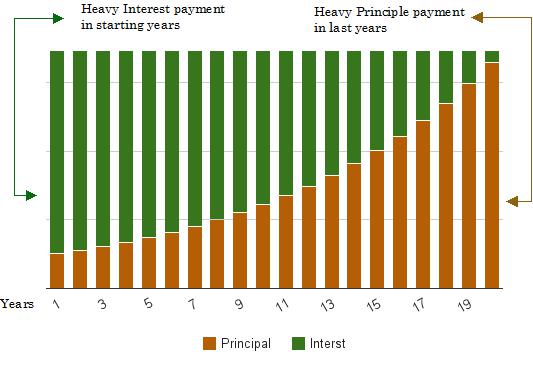

- Graphical Representation of Loan Repayment

In the latter years of a loan, there is a notable shift in the allocation of payments between the principal and interest. This reversal of roles occurs due to the way amortization schedules are structured. Let’s break down the dynamics of this reversal:

- Amortization Schedule

- When you take out a loan, the lender provides you with an amortization schedule. This schedule outlines each monthly payment, specifying how much goes towards the principal and how much towards the interest.

- Front-Loading Interest

- In the early stages of a loan, a larger portion of each monthly payment is allocated to interest. This front-loading of interest is a common feature in many loan structures.

- Principal Reduction Over Time

- As you consistently make payments, the outstanding principal amount decreases. With a lower principal, the interest accrued on the remaining balance also decreases over time.

- Towards the End

- In the latter years of the loan term, the outstanding principal has reduced significantly.

- With a smaller principal, the interest accrued on it becomes proportionally smaller.

- Increased Principal Repayment

- As a consequence of the reduced interest, a more substantial portion of each monthly payment is now directed towards repaying the principal.

- Approximately 80% Principal, Fraction Towards Interest

- During this reversal of roles, it’s not uncommon for around 80% of the monthly payment to be applied towards reducing the remaining principal.

- The remaining fraction represents the diminishing interest component.

- Accelerated Principal Repayment

- This phase is advantageous for borrowers as it accelerates the reduction of the overall loan amount.

- It also signifies that the borrower is closer to complete repayment and eventual loan closure.

- Financial Implications

- For borrowers, the reversal towards allocating a significant majority to the principal is a positive development. It means that a more substantial part of each payment is contributing directly to reducing the borrowed amount, leading to a quicker path to full loan repayment.

Understanding this reversal of roles is crucial for borrowers to anticipate and plan for the changing dynamics of their loan repayments, helping them make informed financial decisions and potentially save money on interest in the long run.

The 50,000 likes on the reel highlight a prevalent lack of awareness regarding the evolving nature of loan repayments. Borrowers need to recognize that the initial years may heavily favor interest payments, but with time, the balance tips in favor of repaying the principal. As we navigate the complex world of loans, being informed about these dynamics ensures that borrowers make well-informed decisions and avoid potential regrets down the road. Remember, the orange may dominate in the beginning, but the green takes over toward a financially secure future.

What are the dynamics of floating interest rates?

Entering into a loan agreement with a bank often entails a commitment to a specific interest rate, tenure, and loan amount. However, the financial landscape can change, and borrowers may find themselves facing unexpected adjustments in their loan terms. This blog aims to demystify the complexities of floating interest rates and the factors influencing fluctuations, using a scenario where a borrower’s interest rate increased without prior notice.

- Understanding Loan Terms

When individuals decide to take out a loan, they enter into a formal agreement with a lender, often a bank or financial institution. This agreement is documented in a loan contract, which outlines the terms and conditions of the loan. Understanding these loan terms is crucial for borrowers to make informed financial decisions. Let’s break down the components of loan terms:

- Loan Amount

- The loan amount is the sum of money that the borrower is borrowing from the lender. It is typically determined based on the borrower’s needs, financial capacity, and the purpose of the loan (e.g., home purchase, education, or business investment).

- Interest Rate

- The interest rate is the cost of borrowing money and is expressed as a percentage. It represents the additional amount the borrower must pay on top of the principal (loan amount). Interest rates can be fixed or floating, impacting the predictability of monthly payments.

- Tenure

- The tenure, also known as the loan term, is the period over which the borrower agrees to repay the loan. It is usually measured in years. The tenure is a critical factor influencing the amount of each monthly installment; longer tenures may result in lower monthly payments but higher overall interest costs.

- Sense of Stability in Financial Planning

- Committing to specific loan terms provides borrowers with a sense of stability in their financial planning.

- Knowing the loan amount helps in budgeting for the intended use of funds, such as purchasing a home, starting a business, or pursuing education.

- The fixed or floating nature of the interest rate determines how much interest will be paid over time and influences the predictability of monthly payments.

- The tenure allows borrowers to plan the duration of their financial commitment, considering factors like income stability, future expenses, and long-term financial goals.

- Predictable Monthly Payments

- Having a clear understanding of the loan terms enables borrowers to anticipate and plan for monthly payments.

- Fixed interest rates ensure that the interest remains constant throughout the loan term, providing predictability.

- Floating interest rates, while subject to market changes, may offer flexibility but can introduce uncertainty in monthly payments.

- Long-Term Financial Commitment

- Loan terms signify a long-term financial commitment between the borrower and the lender.

- Borrowers commit to repaying the loan over the specified tenure, and lenders agree to provide the necessary funds under the agreed-upon terms.

In summary, comprehending and committing to specific loan terms—loan amount, interest rate, and tenure—provides borrowers with the stability and clarity needed for effective financial planning. This understanding allows individuals to manage their budgets, plan for future financial obligations, and make informed decisions that align with their overall financial goals.

- Difference Between Floating and Fixed Interest Rates

- Dynamic Nature

- Floating interest rates are not fixed; instead, they fluctuate over time based on changes in market conditions.

- Tied to Market Fluctuations

- The primary characteristic of floating rates is their correlation with market dynamics. They are influenced by changes in the overall interest rate environment, economic conditions, and monetary policy.

- Influenced by External Factors

- Various external factors impact floating interest rates. These factors can include economic indicators, inflation rates, and, notably, the central bank’s monetary policy.

- Repo Rate Connection

- One significant factor influencing floating rates is the repo rate. The repo rate is the interest rate at which commercial banks borrow money from the central bank (Reserve Bank of India – RBI, in this context). Changes in the repo rate can lead to adjustments in floating interest rates.

- Flexibility for Borrowers

- Floating rates offer a level of flexibility for borrowers. When market interest rates are low, borrowers benefit from lower interest payments. However, in periods of rising interest rates, monthly payments may increase.

- Potential for Cost Savings

- In times of economic stability or downturns, floating rates may result in lower overall interest costs for borrowers, making them an attractive option.

- Fixed Interest Rates

- Constant Throughout the Loan Tenure

- Fixed interest rates, as the name suggests, remain unchanged for the entire duration of the loan.

- Predictable Monthly Payments

- Borrowers with fixed-rate loans benefit from predictable monthly payments. Regardless of market fluctuations, the interest rate and, consequently, the monthly installment remain constant.

- Insulation from Market Volatility

- Fixed rates provide a shield against the uncertainties of market interest rate movements. Borrowers are protected from sudden increases in interest rates that could lead to higher monthly payments.

- Less Affected by Central Bank Policies

- Fixed rates are less influenced by short-term changes in the central bank’s policies or fluctuations in the repo rate. Borrowers are shielded from the impact of monetary policy adjustments.

- Certainty for Long-Term Planning

- Borrowers who prefer stability in their budgeting and financial planning often opt for fixed interest rates. This is especially beneficial for those who want a consistent and foreseeable financial commitment over the life of the loan.

- Potential Opportunity Costs

- While fixed rates provide stability, borrowers may miss out on potential cost savings during periods of declining market interest rates.

In summary, the primary distinction between floating and fixed interest rates lies in their responsiveness to market fluctuations. Floating rates offer flexibility but come with the uncertainty of changing monthly payments, whereas fixed rates provide stability and predictability but may potentially limit cost savings in favorable market conditions. Borrowers choose between these options based on their risk tolerance, financial goals, and the prevailing economic environment.

- Repo Rate and Its Impact

The repo rate, or repurchase rate, is a key monetary policy tool used by central banks, including the Reserve Bank of India (RBI). It plays a crucial role in influencing interest rates in the broader financial market. Let’s break down the impact of the repo rate:

- Definition of Repo Rate

- The repo rate is the interest rate at which commercial banks borrow money from the central bank (in this case, the RBI) by selling their securities. It is a short-term lending arrangement where banks pledge government securities as collateral and agree to repurchase them at a future date.

- Benchmark for Market Interest Rates

- The repo rate serves as a benchmark for short-term interest rates in the financial market. Changes in the repo rate have a cascading effect on various interest rates throughout the economy.

- Banks as Borrowers from RBI

- When the RBI reduces the repo rate, borrowing becomes cheaper for commercial banks. This incentivizes banks to borrow more funds from the central bank to meet their short-term liquidity needs.

- Transmission to Consumer Interest Rates

- Banks, in turn, adjust their lending rates based on the prevailing repo rate. A reduction in the repo rate generally prompts banks to lower their lending rates for consumers, making loans more affordable.

- Covering Operational Costs and Profit Margins

- Banks borrow money from the RBI at the repo rate, but when they lend to customers, they charge slightly higher interest rates. The margin between the repo rate and the lending rate helps cover the banks’ operational costs and contributes to their profit margins.

- Influence on Consumer Loans

- The repo rate directly impacts interest rates on various loans that consumers may avail themselves of, such as home loans, car loans, and personal loans. When the repo rate decreases, banks may reduce the interest rates on these loans, making borrowing more attractive for consumers.

- Impact on Economic Activity

- Changes in the repo rate influence the overall economic activity. A lower repo rate encourages borrowing and spending, stimulating economic growth. Conversely, a higher repo rate may be used to control inflation by making borrowing more expensive, thus slowing down economic activity.

- Monetary Policy Tool

- The RBI, through adjustments in the repo rate, exercises control over the money supply and credit conditions in the economy. It is a powerful tool for achieving the central bank’s monetary policy objectives, including price stability and economic growth.

In summary, the repo rate serves as a benchmark for interest rates in the market, influencing the cost of borrowing for banks. Banks adjust their lending rates based on changes in the repo rate, impacting the overall interest rate environment. This, in turn, has significant implications for consumer loans, economic activity, and the broader financial landscape.

- Impact of Economic Changes

- Economic events, such as the aftermath of the COVID-19 pandemic, can lead to changes in the repo rate.

- In times of economic downturn, like during COVID-19, the RBI may reduce the repo rate to stimulate borrowing and spending.

- Cheapest Home Loans Era

- Following a reduction in the repo rate, banks may offer home loans at lower interest rates to attract borrowers.

- Borrowers benefit from these periods as they secure loans at comparatively lower interest rates.

- Fluctuations in the Repo Rate

- As economic conditions change, the RBI may adjust the repo rate upwards, impacting the interest rates offered by banks.

- Unforeseen Interest Rate Hikes

- In the scenario presented, the borrower experienced an unexpected increase in the interest rate from 8% to 11% after five years.

- This indicates the floating nature of the interest rate, where changes are influenced by fluctuations in the market.

- Extended Loan Tenure

- Alongside the interest rate hike, the loan tenure increased from the initially planned 15 years to an extended 28 years.

- This elongation is a consequence of the higher interest rate, resulting in a recalculated amortization schedule.

- Borrower Awareness and Financial Planning

- Borrowers must be vigilant about the terms of their loans, especially when on a floating interest rate.

- Understanding economic indicators, like the repo rate, empowers borrowers to anticipate potential changes and plan their finances accordingly.

The scenario presented highlights the importance of comprehending the distinction between fixed and floating interest rates. Borrowers on floating rates should stay informed about economic shifts, especially changes in the repo rate, to anticipate potential adjustments in their loan terms. Vigilance and financial planning are key to navigating the ever-changing landscape of interest rates and ensuring a secure financial future.

What are the dynamics of floating interest rates?

Taking out a home loan is a significant financial decision, and borrowers often face the challenge of choosing between fixed and floating interest rates. In this blog, we’ll explore a scenario where the interest rate on a home loan increases after a few years, and discuss a strategic approach to loan management that can potentially save borrowers substantial amounts in interest payments.

- Understanding the Interest Rate Scenario

- Borrowers often experience fluctuations in interest rates, influenced by factors such as economic conditions, central bank policies, and global events, as demonstrated by the aftermath of the COVID-19 pandemic.

- Impact on Loan Terms

- Interest rate changes can lead to loan term adjustments, affecting both the interest rate itself and the loan tenure.

- Case Study: Interest Rate Hike After 5 Years

- Illustrating the scenario, let’s consider a 20-year home loan of 30 lakhs at an 8% interest rate. After 5 years, the interest rate increases to 11%, and the tenure extends to 28 years. This results in higher overall interest payments.

- Strategic Approach: Restructuring the Loan

- Borrowers have the option to proactively manage their loans by reevaluating and restructuring the terms when faced with an interest rate hike.

- Contacting the bank to negotiate a return to the initial tenure can be a strategic move, even if it means paying a slightly higher EMI.

- Impact of Restructuring

- By opting for a higher EMI and maintaining the original tenure, borrowers can significantly reduce the total interest payable over the life of the loan.

- The example presented demonstrates that paying a slightly higher EMI can result in substantial savings, making it a financially prudent choice.

- Balancing EMI Affordability and Loan Tenure

- Borrowers should carefully assess their financial capacity to determine an optimal EMI amount. While stretching towards the higher end is possible, it should align with overall income and other financial obligations.

- Considerations for Fixed and Floating Interest Rates

- While fixed interest rates provide stability, they often come at a slightly higher cost. The decision between fixed and floating rates involves weighing the predictability of fixed rates against the potential cost savings of floating rates.

- Risk and Reward in Fixed Rates

- Opting for a fixed interest rate carries the risk of potentially missing out on cost savings if market rates decrease. It’s a gamble that requires careful consideration based on the borrower’s risk tolerance and market predictions.

- Strategic Advantage of Floating Rates

- The blog author shares a personal experience, emphasizing the strategic advantage of floating interest rates. The flexibility to benefit from market rate decreases provides an inherent advantage, especially if interest rates are anticipated to decline over time.

- The Middle Ground: Evaluating the Current Scenario

- The author acknowledges the uncertainty in predicting future interest rate movements and suggests a middle-ground approach. It involves careful consideration of the current economic climate and individual risk preferences.

In the dynamic landscape of home loans, borrowers can navigate interest rate fluctuations strategically. By understanding the impact of rate hikes, proactively managing loan terms, and considering the advantages of floating rates, individuals can optimize their financial outcomes. The key lies in staying informed, assessing personal financial capacity, and making decisions that align with both short-term affordability and long-term savings.

The world of home loans is inherently dynamic, marked by ever-changing interest rates influenced by economic fluctuations, central bank policies, and global events. In this essay, we will explore how borrowers can strategically navigate these fluctuations by understanding the impact of rate hikes, proactively managing loan terms, and considering the advantages of floating rates. The ultimate goal is to optimize financial outcomes by staying informed, assessing personal financial capacity, and making decisions that balance short-term affordability with long-term savings.

1. Understanding the Impact of Rate Hikes

- Interest rate hikes are a reality that borrowers may face during the tenure of their home loans. These hikes can lead to adjustments in monthly payments and overall loan terms.

- Borrowers must comprehend the potential impact of rate hikes on their financial obligations, such as increased monthly EMIs and extended loan tenure.

2. Proactively Managing Loan Terms

- Proactive management involves engaging with the lending institution to renegotiate and restructure loan terms when faced with interest rate hikes.

- Negotiating a return to the initial loan tenure, even with a slightly higher EMI, can be a strategic move. This approach aims to limit the overall interest payable over the life of the loan.

3. Considering the Advantages of Floating Rates

- Floating interest rates, while subject to market fluctuations, offer a unique advantage – the potential to benefit from rate decreases.

- Illustrating this advantage, consider a scenario where a borrower takes a home loan at a floating rate. If the market interest rates decrease, the borrower can experience lower EMIs and potentially save on interest payments.

Illustrative Scenario

- Let’s take a 20-year home loan of 30 lakhs at an 8% interest rate. After 5 years, the interest rate increases to 11%, leading to an extended tenure of 28 years.

- If the borrower chooses to restructure the loan, opting for a slightly higher EMI to maintain the original tenure, the total interest payable can significantly reduce compared to the extended tenure scenario.

4. Staying Informed

- Key to making informed decisions is staying abreast of economic conditions, central bank policies, and market trends that influence interest rates.

- Regularly tracking financial news and developments allows borrowers to anticipate potential rate changes and take timely actions to safeguard their financial interests.

5. Assessing Personal Financial Capacity

- Each borrower has a unique financial capacity and risk tolerance. Assessing one’s ability to afford higher EMIs and considering future financial goals are crucial aspects of making well-informed decisions.

- Balancing short-term affordability with long-term financial goals is essential to ensure sustainable financial management.

6. Making Decisions Aligned with Financial Goals

- The key to financial optimization lies in making decisions that align with both short-term affordability and long-term savings goals.

- Borrowers should carefully evaluate the trade-offs between fixed and floating interest rates, considering stability versus potential cost savings.

In the ever-evolving landscape of home loans, borrowers can empower themselves by strategically navigating interest rate fluctuations. Understanding the impact of rate hikes, proactively managing loan terms, and considering the advantages of floating rates provide a roadmap for financial optimization. Staying informed, assessing personal financial capacity, and making decisions aligned with both short-term affordability and long-term savings are the keys to ensuring a secure and well-managed financial future. By adopting a proactive and informed approach, borrowers can successfully navigate the complexities of the home loan market and make decisions that lead to financial well-being.

What are some tips for reducing interest on a home loan?

In the quest for the perfect home loan, one institution stands out for its seamless and transparent process – South Indian Bank. Offering a generous 90% of the home loan value, coupled with overdraft facilities and attractive interest rates, South Indian Bank streamlines the borrowing experience. This essay will walk you through the five easy steps to securing a home loan with South Indian Bank and also provide ninja tips to save interest on your mortgage.

Step 1: Swift Application Submission

Submitting your home loan application to South Indian Bank is the initial step in this hassle-free process. Alongside your application, furnish your income statement to kickstart the evaluation process. This first step sets the stage for a seamless journey toward homeownership.

The first step in securing a home loan with South Indian Bank is the swift submission of your application. This crucial phase marks the initiation of a hassle-free and efficient process towards achieving homeownership. Here’s a detailed breakdown of Step 1:

- Application Submission: The process begins with you submitting your home loan application to South Indian Bank. This application typically includes essential information about yourself, your financial status, and the details of the property you intend to purchase or refinance.

- Accompanying Income Statement: Alongside the application, it is imperative to furnish your income statement. This document provides a comprehensive overview of your financial health, including details about your sources of income, expenses, and any existing liabilities. The income statement acts as a crucial component in evaluating your repayment capacity, helping the bank assess the risk associated with granting you a home loan.

- Kickstarting the Evaluation Process: The submission of both the application and income statement initiates the evaluation process. South Indian Bank’s professionals will carefully analyze the provided information to gauge your eligibility for a home loan. This evaluation considers factors such as your creditworthiness, income stability, and the value and condition of the property in question.

- Setting the Stage for Homeownership: By completing Step 1 successfully, you set the stage for a seamless journey towards homeownership. The swift submission of your application and income statement not only expedites the loan approval process but also reflects your proactive approach to the home loan application, signaling commitment and readiness.

In essence, Step 1 is about promptly delivering the necessary documents to South Indian Bank, creating a foundation for a transparent and efficient home loan process. By being thorough and timely in this step, you contribute significantly to the overall smoothness of your home loan application experience with South Indian Bank.

Step 2: Financial Sanction for Approval

Once your application is submitted, South Indian Bank swiftly moves to the financial sanction stage. Here, your loan amount gets the green light, bringing you one step closer to your dream home. The bank’s efficient approval process ensures you are not kept waiting, making the entire experience time-effective.

After you’ve submitted your home loan application and accompanying income statement in Step 1, South Indian Bank promptly advances to the crucial stage of financial sanction. This step involves a thorough evaluation of your financial eligibility and the approval of your loan amount. Here’s a breakdown of the process:

- Evaluation of Financial Eligibility: With your application in hand, the bank conducts a meticulous assessment of your financial standing. This includes a comprehensive review of your credit history, income stability, debt-to-income ratio, and other relevant financial factors. The goal is to ascertain your ability to repay the loan amount requested.

- Loan Amount Approval: Based on the assessment, South Indian Bank determines the suitable loan amount that aligns with your financial capacity and the value of the property. This financial sanction essentially provides the “green light” for your home loan, indicating that the bank is willing to approve the specified amount for your housing needs.

- Bringing You Closer to Your Dream Home: The approval of the loan amount at the financial sanction stage is a significant milestone. It brings you one step closer to realizing your dream of homeownership. This approval demonstrates the bank’s confidence in your ability to manage the loan responsibly.

- Efficient Approval Process: South Indian Bank is known for its efficiency in the approval process. The swift transition from application submission to financial sanction reduces the waiting time for applicants. This time-effectiveness is a notable aspect of the overall experience, ensuring that you can move forward with your home-buying plans without unnecessary delays.

By streamlining the financial sanction process, South Indian Bank demonstrates its commitment to providing a customer-centric and time-efficient home loan approval journey. This stage is pivotal in the progression towards your dream home, as it signifies the bank’s formal approval and support for your housing aspirations.

Step 3: Rigorous Property Document Verification

The third step involves a meticulous verification of your property documents. South Indian Bank goes the extra mile to ensure the property’s legitimacy and assess its value accurately. This scrutiny not only safeguards the interests of the bank but also assures you of the soundness of your investment.

Upon successful financial sanction in Step 2, South Indian Bank moves forward to the critical stage of rigorous property document verification in Step 3. This step is designed to ensure the legitimacy of the property being financed and to accurately assess its value. The meticulous scrutiny during this phase serves to protect the interests of both the bank and the loan applicant. Here’s a detailed explanation:

- Meticulous Verification Process: South Indian Bank employs a thorough and meticulous process to verify the property documents submitted by the loan applicant. This includes scrutinizing legal documents related to the property, such as title deeds, sale deeds, property tax receipts, and other relevant paperwork.

- Ensuring Legitimacy: The primary objective of this step is to ensure the legitimacy of the property being financed. The bank verifies that the property is free from any legal disputes, encumbrances, or other issues that could potentially pose a risk to the loan transaction. This scrutiny protects the bank from potential legal complications in the future.

- Accurate Assessment of Property Value: In addition to verifying the legal aspects, South Indian Bank assesses the value of the property accurately. This assessment involves evaluating the market value, location, condition, and potential for appreciation. An accurate valuation ensures that the loan amount aligns with the true worth of the property.

- Safeguarding Interests: The rigorous property document verification process serves as a safeguard for both the bank and the loan applicant. For the bank, it minimizes the risk of lending against a problematic or undervalued property. For the applicant, it provides assurance regarding the soundness of their investment, reducing the likelihood of future disputes or complications.

- Transparent Transaction: By going the extra mile in property document verification, South Indian Bank upholds transparency in the loan transaction. The applicant is kept informed about the details and progress of the verification process, fostering trust and confidence in the overall home loan experience.

In conclusion, Step 3 is a critical phase where South Indian Bank ensures the authenticity of the property being financed and conducts a meticulous assessment of its value. This rigorous verification process adds a layer of security and transparency to the home loan transaction, benefitting both the bank and the loan applicant.

Step 4: Digital Documentation Convenience

Embracing the digital era, South Indian Bank allows you to complete the home loan documentation process from the comfort of your home. This not only adds convenience to the entire procedure but also minimizes paperwork, contributing to an eco-friendly and efficient process.

In Step 4, South Indian Bank embraces the digital era, providing applicants with the convenience of completing the home loan documentation process from the comfort of their homes. This modern approach not only adds convenience to the entire procedure but also minimizes paperwork, contributing to an eco-friendly and efficient process. Here’s a detailed explanation:

- Embracing Digital Solutions: South Indian Bank leverages digital technology to streamline the documentation process. Applicants are no longer required to visit physical branches or deal with extensive paperwork. Instead, they can utilize digital platforms to submit and manage their documents.

- Convenience for Applicants: By allowing digital documentation, South Indian Bank prioritizes the convenience of its customers. Applicants can complete the necessary paperwork from the comfort of their homes, eliminating the need for time-consuming visits to the bank. This flexibility is particularly beneficial for those with busy schedules or those residing in geographically distant locations.

- Reduced Paperwork: The shift to digital documentation significantly reduces the reliance on traditional paperwork. This not only saves time for both the bank and the applicant but also contributes to a more sustainable and eco-friendly process. Minimizing paper usage aligns with modern environmental consciousness and reduces the ecological footprint associated with the home loan application process.

- Efficiency Gains: Digital documentation speeds up the overall processing time. Documents can be submitted, verified, and processed more efficiently through online platforms. This not only expedites the loan approval process but also enhances the overall efficiency of the banking services.

- Enhanced Security: Digital documentation often comes with advanced security measures, ensuring the confidentiality and integrity of sensitive information. Encryption and secure channels protect applicants’ data, adding an extra layer of security to the entire process.

- User-Friendly Interfaces: To further enhance the experience, South Indian Bank likely provides user-friendly interfaces for document submission. This ensures that applicants, regardless of their technological proficiency, can navigate the digital platforms with ease.

By embracing digital documentation, South Indian Bank not only modernizes its processes but also places customer convenience at the forefront. This step marks a departure from traditional, cumbersome paperwork, contributing to a more efficient, eco-friendly, and user-centric home loan application experience.

Step 5: Disbursement Without Paperwork

The final step, disbursement, marks the culmination of your home loan journey with South Indian Bank. Remarkably, this process is devoid of cumbersome paperwork. Your loan is disbursed efficiently, reflecting the bank’s commitment to a hassle-free experience for its customers.

In the fifth and final step of securing a home loan with South Indian Bank, the disbursement process takes center stage. Notably, this phase is marked by its efficiency and the absence of cumbersome paperwork, underlining the bank’s commitment to providing a hassle-free experience for its customers. Here’s a breakdown of this pivotal step:

- The culmination of the Home Loan Journey: Step 5, the disbursement stage, represents the culmination of your home loan application journey with South Indian Bank. It’s the moment when the bank fulfills its commitment to provide the funds required for your home purchase or refinancing needs.

- Efficient Disbursement Process: South Indian Bank is known for its efficient disbursement process. Once all the necessary checks and verifications are complete, the bank moves swiftly to release the loan amount to the appropriate parties. This efficiency ensures that there are minimal delays in accessing the funds needed for your housing endeavor.

- Devoid of Cumbersome Paperwork: One standout feature of the disbursement process with South Indian Bank is the absence of cumbersome paperwork. Unlike traditional loan disbursement procedures that might involve extensive documentation, South Indian Bank’s commitment to a streamlined experience means that the final stage is as smooth and paperless as possible.

- Commitment to Hassle-Free Experience: The emphasis on a paperwork-free disbursement underscores the bank’s commitment to providing a hassle-free experience for its customers. By minimizing bureaucratic processes and paperwork, South Indian Bank aims to simplify the final steps of the home loan journey, reducing stress and ensuring a positive overall experience.

- Customer-Centric Approach: The seamless disbursement process reflects a customer-centric approach. South Indian Bank prioritizes the convenience and satisfaction of its customers, recognizing that a smooth disbursement experience contributes significantly to the overall impression of the banking relationship.

- Transparency and Communication: Throughout the disbursement process, South Indian Bank likely maintains transparent communication with the loan applicant. Keeping the applicant informed about the progress of the disbursement ensures that there are no uncertainties, contributing to a positive and trusting relationship between the bank and the customer.

In conclusion, Step 5 is the final chapter in the home loan journey with South Indian Bank. The disbursement process stands out for its efficiency and the absence of cumbersome paperwork, aligning with the bank’s commitment to providing a hassle-free and customer-friendly experience from application to fund access.

Understanding your loan repayment strategy is crucial, but equally important is knowing your CIBIL score, as it plays a pivotal role in the approval or rejection of your loan application.

After understanding the crucial role of CIBIL scores in loan approvals, it’s also beneficial to dive deeper into the banking world. ‘The 50 things that banks don’t tell you | ULTIMATE Banking Masterclass’ offers insightful revelations and tips that can further enhance your banking knowledge and experience.

SIB Mirror Plus App for Existing Customers

For existing customers of South Indian Bank, accessing a home loan is even more convenient through the SIB Mirror Plus app. This user-friendly application simplifies the request process, providing a seamless extension of services to loyal customers.

Ninja Technique to Save on Interest

Beyond the streamlined process with South Indian Bank, here’s a ninja technique to save on interest – make consistent prepayments. By paying a little extra each month or making occasional lump-sum payments, you can significantly reduce the interest accrued over the loan tenure. This small ninja move can translate into savings amounting to lakhs over the life of your home loan.

Securing a home loan doesn’t have to be a daunting process. South Indian Bank’s transparent and seamless approach, coupled with the ninja technique of strategic prepayments, ensures not only the realization of your homeownership dream but also substantial savings. As you embark on this journey, consider the holistic benefits offered by South Indian Bank and the prudent financial strategy to slash interest costs.

What strategies can be employed for mastering home loan repayment?

Home loans, spanning 20-30 years, are a significant financial commitment. However, the traditional monthly EMI payments can lead to substantial interest payouts. This blog unveils a ninja technique – pre-payment – to save lakhs on your home loan. By strategically pre-paying a portion of your loan amount, you can accelerate the repayment process and minimize interest costs.

- Understanding the Power of Pre-payment

Home loans often start with a significant portion of the EMI going towards interest rather than the principal. Pre-payment allows you to directly reduce the outstanding principal amount, resulting in substantial interest savings.

Home loans are intricate financial arrangements, typically spanning over 20 to 30 years. During the initial years of a home loan, a substantial portion of the Equated Monthly Installment (EMI) is allocated toward paying off the interest, leaving a comparatively smaller portion for the principal repayment. This imbalance is a common characteristic of long-term loans and can lead to borrowers paying a significant amount in interest over the loan tenure.

1. Interest-Heavy Initial EMIs

- In the early stages of a home loan, the lender predominantly applies a larger portion of the monthly installment towards interest payments.

- This front-loaded interest structure is designed to compensate the lender for the risk associated with lending over an extended period.

2. Impact on Outstanding Principal

- Due to this structure, the reduction in the outstanding principal amount of the loan is relatively slow in the initial years.

- A significant proportion of the borrower’s initial payments primarily serves to cover the interest accrued on the outstanding balance.

3. Enter Pre-payment

- Pre-payment is a strategic financial move where the borrower voluntarily pays an additional amount towards the principal, outside the regular EMI schedule.

- The uniqueness of pre-payment lies in its direct impact on the outstanding principal amount, irrespective of the traditional interest-heavy EMI structure.

4. Direct Reduction in Principal

- When you make a pre-payment, the entire amount is directly subtracted from the principal balance.

- Unlike regular EMIs, where a substantial portion initially goes towards interest, the pre-payment focuses entirely on reducing the principal owed to the lender.

5. Resulting in Substantial Interest Savings

- By reducing the principal early on, subsequent interest calculations are based on the updated lower outstanding balance.

- This strategic move results in substantial interest savings over the remaining tenure of the loan.

6. Accelerated Loan Repayment

- The direct reduction in the principal through pre-payment accelerates the overall repayment process.

- This can lead to the borrower paying off the loan in a shorter duration than originally stipulated in the loan agreement.

7. Financial Empowerment

- Pre-payment empowers borrowers to take control of their financial trajectory.

- It allows for proactive steps to minimize the overall interest burden, contributing to long-term financial well-being.

In essence, understanding the power of pre-payment involves recognizing its ability to circumvent the interest-heavy nature of initial EMIs. By strategically reducing the outstanding principal early in the loan tenure, borrowers can unlock significant interest savings and pave the way for a more financially secure future.

- Demonstrating the Impact with a Scenario

Consider a home loan of 30 lakhs at 8% interest for 20 years. Regular EMIs for 14 months accumulate interest of 30,22,000 rupees. However, a pre-payment of 1 lakh rupees in the 14th month reduces the interest by 3 lakh rupees. This showcases the significant impact of timely pre-payments.

Let’s delve into a practical scenario to illustrate the tangible impact of pre-payment on a home loan. Consider a hypothetical home loan of 30 lakhs with an 8% interest rate, spanning over 20 years. After making regular EMIs for 14 months, we can evaluate the accrued interest and the effect of a timely pre-payment.

1. Initial Loan Details

- Loan Amount: 30 lakhs

- Interest Rate: 8%

- Loan Tenure: 20 years

2. Regular EMIs for 14 Months

- In the initial 14 months of regular EMIs, a substantial portion of each installment primarily contributes to interest payments, given the front-loaded nature of the loan structure.

- The total interest accrued during this period amounts to 30,22,000 rupees.

3. Introduction of a Timely Pre-payment

- In the 14th month, a strategic decision is made to make a pre-payment of 1 lakh rupees towards the outstanding principal.

4. Impact of Pre-payment

- The pre-payment of 1 lakh rupees is directly subtracted from the outstanding principal balance.

- Unlike regular EMIs, where only a fraction goes towards the principal in the initial months, the entire pre-payment amount directly reduces the principal.

5. Resulting Interest Reduction

- With the introduction of the 1 lakh rupee pre-payment, the accrued interest is substantially reduced by 3 lakh rupees.

- The interest savings are a direct result of lowering the outstanding principal on which future interest calculations are based.

6. Significant Impact on Financial Savings

- The scenario showcases the significant impact of timely pre-payments in terms of interest savings.

- The borrower, by strategically reducing the principal in the 14th month, has effectively saved 3 lakh rupees in interest payments over the loan’s remaining tenure.

7. Demonstrating the Power of Proactive Repayment

- This example highlights how a relatively modest pre-payment, made strategically in the early stages of the loan, can yield substantial interest savings.

- It emphasizes the power of proactive financial decisions to minimize the overall cost of borrowing.

In conclusion, the scenario demonstrates that timely pre-payments have a direct and impactful effect on the interest accrued during the loan tenure. By understanding the dynamics of loan structures and taking strategic actions, borrowers can significantly enhance their financial well-being and expedite the path to debt freedom.

- The Magic of Early Pre-payments

The key to maximizing interest savings lies in making pre-payments early in the loan tenure. By doing so, you save on the interest that would have accumulated over the entire loan period. Even small annual pre-payments can lead to substantial savings.