With the onset of zero brokerage firms such as Upstox, Zerodha, etc., there has been an increase in the number of people now investing in equity funds with the click of their mobile phone. But what one does not understand is that the purchase and selling of shares leads to capital gain or capital loss and how to recover from the losses. The Government charges taxes on five income sources – TDS on income from salary, business income, capital gain, house property and other sources. This article takes an in depth look at tax on capital gain specifically and dives into equity and debt investments regulations.

Table of Contents

What is Capital Gain?

A capital gain occurs when any asset is sold at a higher price than its purchase price. This typically happens when one purchases an asset at price A, keeps it for a few years and then sells it at a higher price B. Capital gain usually occurs on sale of land, gold, shares, etc.

For asserting what is qualified as capital gain, one needs to look at the purpose of purchasing an asset. If the purpose is to sell it immediately to make a profit then it is a business income source. But if the purpose is to keep it with yourself and maybe sell it after several years when the price is comparatively higher than its purchase value, then it becomes capital gain.

For example, a builder sells houses but that is his business income source because it is the business he is doing for his income. Meanwhile, a normal person purchasing and selling a property/flat is capital gain, because that is not his source of income.

Types and tax on capital gain

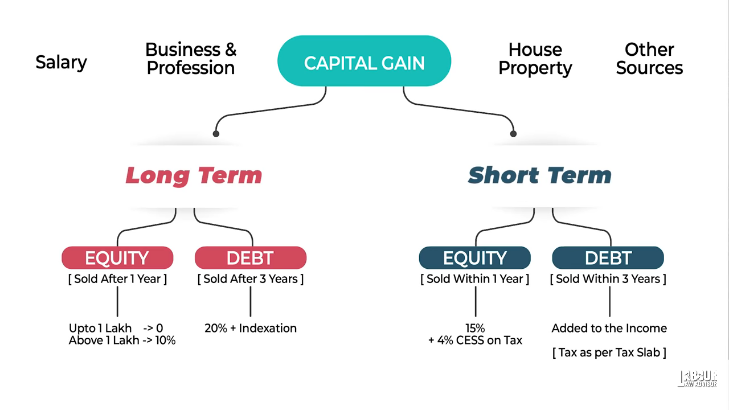

There are two types of capital gain:

1. Short Term Capital Gain

Short term capital gains occur on assets held for one year or less. These gains are taxed as ordinary income based on the individual’s tax filing status and adjusted gross income.

Equity

These include investments in the stock market in the form of individual shares or mutual funds with a basket of shares. If one purchases an equity asset and sells it within less than a year of buying it and makes a profit on its sale then it is considered a Short Term Capital Gain (STCG). This STCG incurs a tax of 15% and cess of 4%.

Debt

These include investments in debt mutual funds, bonds, debentures, gold or gold related bonds (ETF). If one purchases a debt asset and sells it within 3 years of its purchase while making a profit on it, then it is called a Short Term Capital Gain. This STCG incurs a high tax rate for income earners in the higher tax slab brackets as it is added to the income and taxed as per the tax slab rate. Hence, it is advisable to hold debt investments for longer than 3 years to reduce the tax incurred on it plus get indexation benefit. For people in the lower tax slab rates, this does not make much difference.

2. Long-Term Capital Gain

Long Term Capital Gain (LTCG) occurs on assets held for over a year. They are usually taxed at a lower rate than regular income.

Equity

For equity investments, LTCG is considered for assets held for over a year and there is no tax if profit is under Rs 1 lakh. For profits above Rs 1 lakh, 10% tax is paid and there is no indexation benefit.

Debt

For debt investments, LTCG is considered for assets held for more than three years. This incurs 20% tax and indexation benefit.

What is Indexation?

Indexation is a system used by the government to bridge the gap of inflation and connect the prices with asset values in real time. The system of indexing involves linking an adjustment to the price of a good/service in current value with a predetermined index. This is also called escalating.

To understand the process of indexation with capital gain, suppose one bought a plot of land at Rs 10 lakh and sold it off after 40 years at Rs 1 crore. The capital gain here is Rs 90 lakh and without indexation, tax will have to be paid on Rs 90 lakh which would be a huge value. But because of indexation, the government looks at the value of land in today’s time, where Rs 10 lakh would equal to Rs 60 lakh. This indexation is done with the help of Cost of Living Index (CLI) and Rs 60 lakh is called the indexed price. Therefore, the actual capital gain will be counted as the difference between Rs 1 crore and Rs 60 lakh, which is Rs 40 lakh. Hence, tax will be paid on Rs 40 lakh only, which is comparatively lower than on Rs 90 lakh.

The CLI is calculated with the help of the indexation table as given below.

Indexation benefits are received for debt funds, bonds, debentures, real estate but not on equity funds.

What is the Grandfathering Concept?

During Budget 2018, Section 112A was imposed by withdrawing the earlier Section 10(38). This proposed to impose tax on the LTCG of – Shares, Equity-oriented funds and Business trusts. The LTCG tax is applicable at a rate of 10% on gains over and above Rs 1 lakh a year, and there is no benefit of indexation.

This made a lot of people unhappy, as they held shares from several years ago, the prices of which had since then multiplied and they would suddenly need to pay taxes on it. To overcome this issue, the government introduced the Grandfathering Concept.

Under this concept, the cost price of any share would be taken as their Deemed Price on 31st January 2018, instead of the original cost price. For example, one bought a share in 1995 at a cost price of Rs 100, the value of which in 2020 is Rs 5000. The capital gain on this without Grandfathering Concept would be Rs 4500 and tax of 10% without indexation would be levied on it. But with Grandfathering Concept, the cost price will change to the price of the share on 31st January 2018, i.e. Rs 4500, which is called the Deemed Cost. Now the capital gain on the share would be Rs 500, and 10% tax without indexation will be charged on it.

Tax on Intraday Trading

For intraday trading, where equity shares are bought and sold the same day, the profit is not considered as capital gain at all. Instead it is seen as business income under speculative income. All other trading which is more than one day is seen as capital gain though.

What is Capital Loss?

When trading in the stock market, it is not always a profit making business and people may suffer a loss at times too. This Capital Loss can be treated with Set-Off Concept in certain cases in STCG. So the total Capital Loss can be set-off by the Capital Gain. The difference will be considered as the actual profit for the term.

For example, a person makes ten transactions in a year out of which eight transactions resulted in a profit of Rs 50000 and two transactions resulted in a loss of Rs 45000. Thus, the government allows you to set-off your short term capital loss against your STCG. Additionally, the difference of Rs 5000 will be the actual amount you have to pay taxes on.

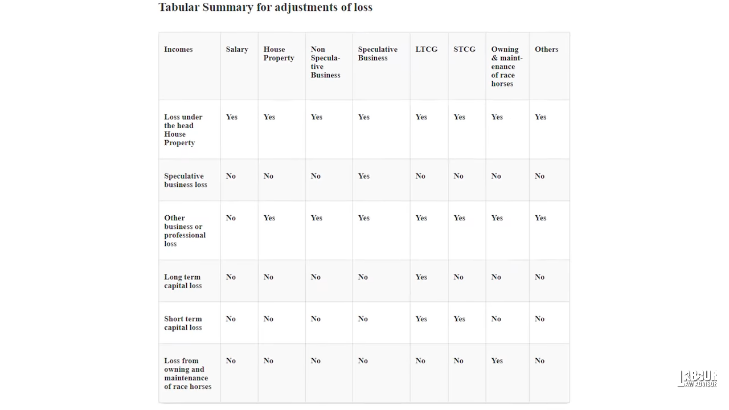

But there are certain predetermined rules for set-off concept, and one has to adhere to them. Each and every capital loss cannot be set-off against every capital gain.

If for any year, there has been overall loss even after set-off adjustments, then the loss can be carried forward to the next year. Here again, there are rules to be followed and this can only be done if the loss has been shown in your ITR filing.

Tax on dividend

Before April 2020, there was no tax applicable on dividends paid by companies to their shareholders. Since earlier, companies themselves would deduct 15% dividend distribution tax and pay it to the shareholder. Additionally, for small investors receiving under Rs 10 lakh as dividends in a year, their dividend income was completely tax free.

But from April 2020 onwards, the dividends will be added to one’s income from other sources and they need to pay taxes on it as per the applicable tax slab rate. Moreover, the company will deduct 10% TDS on the dividend paid to you if it is more than Rs 5000 annually. But since the onset of Covid-19, this TDS on dividend has been reduced to 7.5% until March 2021.

ITR

All citizens of the country need to file their Income Tax Return (ITR). Through this the government comes to know of one’s taxable income. Salaried employees usually have to file ITR 1 which is easy to do. But for showing capital gain, one needs to file ITR 4 and others for other income sources. This is easier done with the help of a CA.

Watch the details in the video below.

What is Tax Harvesting?

The government allows capital gain of upto Rs 1 lakh to go tax-free. Taking advantage of this fact, one can apply the concept of tax harvesting and save some money. Let us take an example to understand this concept.

Examples

Case Study 1

Suppose person A and B have equity investments worth Rs 10 lakh. In one year they earn 10% return on it. A lets this money stay in the account and roll over to next year. Meanwhile, B sells all his Rs 11 lakh worth of shares as soon as it completes one year. The next day, B purchases them again for Rs 11 lakh. This actually transfers the money into his bank account.

The Indian tax system does not believe in seeing gains just on paper. Rather only when the money is received in the bank does one need to pay taxes on it. Hence, as soon as B sells his Rs 11 lakh worth of shares, he gets Rs 1 lakh capital gain. This is tax-free under LTCG. So, he ends up saving money on taxes like this every year. Doing this process every year for capital gain upto Rs 1 lakh is known as tax harvesting.

Case Study 2

Person A buys a share at Rs 1 lakh. The share price rises by Rs 1 lakh every year for the next 10 years. At the end of 10 years, person A sells the share, now priced at Rs 10 lakh.

Thus, the LTCG = 10 lakh – 1 lakh = Rs 9 lakh

Taxable amount = 9 lakh – 1 lakh (exemption) = Rs 8 lakh

Therefore, actual tax paid = 10% of 8 lakh = Rs 80,000

However, if person A uses tax harvesting, he will sell the share in the second year, priced at Rs 2 lakh to get Rs 1 lakh capital gain, which is exempt from tax. Following this, he will purchase back the same shares at Rs 2 lakh again and sell it at the end of third year at Rs 3 lakh. Thus, capital gain is again Rs 1 lakh which is exempt from tax. Similarly, he will sell and repurchase the share at the end of each year till the 10th year.

Therefore, total capital gain = Rs 9 lakh

Total tax paid = 0, since the LTCG recorded each year will be exempt from tax completely.

Does tax harvesting impact compounding?

Since all shares of a company are of the same value, it does not matter if one sells a company’s share and repurchases it the next day. The shares will still be of the same value and will not have any difference monetarily or physically between each other. As long as the shares are sold and bought within a short interval so that there is no change in the share price in the share market. Therefore, tax harvesting for accounting purposes does not impact the power of compounding at all.

Steps to implement tax harvesting

- Open the demat account and download the transaction history.

- From the stocks one has in their portfolio, shortlist the stocks bought over a year ago.

- From the shortlisted stocks, select the ones which are showing a profit and sell them to get tax harvesting profit.

- It is however important to note that one has the available liquidity to repurchase the stocks immediately after selling them. This ensures that the stock prices do not change and one does not suffer a loss when repurchasing the same stocks.

- Ideally, one must first put a buy order for the same stocks before selling them within the same day market hours. This will ensure that the stocks remain at the same price for efficient tax harvesting.

- The same procedure can be applied to mutual funds tax harvesting as well.

- If transaction records show that one has capital gain of under Rs 1 lakh then they can wait to come to the threshold.

FIFO Rule for selling shares

Suppose one has bought 100 shares each in January, February and March. In April they sell 150 shares. Thus, the rule of First In First Out (FIFO) will be applied here. The shares bought first will always be sold first as well. Hence, applying this rule, 100 shares from January and 50 shares from February will get sold in this case. Moreover, capital gain will get calculated separately on 100 shares from January and 50 shares from February.

Next, if one sells 80 shares in May, then remaining 50 shares from February will get sold first followed by 30 shares from March. Capital gain will again be calculated separately for each month. Same FIFO rule is also applied when selling mutual funds units.

The limit of Rs 1 lakh for tax-free capital is the total of both shares and mutual funds. So one needs to keep this in mind when tax harvesting both mutual funds and shares together.

When is the best time time for tax harvesting?

Ideally, one must not wait till the end of financial year for tax harvesting. One can rather do some tax harvesting every couple of months. This will be beneficial since it will take the load off of having a big amount of liquidity for tax harvesting at the end of financial year. Secondly, by the end of financial year the share price may drop, and one may not achieve their planned capital gain upon tax harvesting.

What about exit load?

To discourage investors from selling their mutual funds in short term, some mutual funds charge an exit load. Thus, some mutual funds charge 1% as exit load for selling them under a year. It is important here to pick those mutual funds which do not charge an exit load after one year to avoid loss.

What is tax loss harvesting?

To understand this concept, suppose person B has capital gain worth Rs 5 lakh in a financial year. But he also has some stocks worth Rs 3 lakh loss unrealised in his portfolio. To avoid paying Rs 50,000 capital gain tax at 10% on Rs 5 lakh, person B will sell the stocks running a loss as well. Thus, the Rs 5 lakh capital gain gets offset with Rs 3 lakh loss, totaling to ultimately Rs 2 lakh gain. From this, another Rs 1 lakh is exempt from tax hence final tax is paid on only Rs 1 lakh which is equal to Rs 10,000.

Therefore, tax loss harvesting saves person B Rs 40,000 in taxes. However, long term capital loss can only be offset with long term capital gain. But short term capital loss can be offset with both long term and short term capital gain.

Learn more about tax harvesting in the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!