An income tax return is the tax form/forms which individuals use to file income tax with the Income Tax Department. The income tax return is mostly in a worksheet format where the income tax figures used to calculate the tax liability are noted down into the documents themselves. According to the law, income tax returns have to be filed each year by individuals and businesses who received any income during that year. The income tax return also has to be filed within a specific date. If the income tax return shows that extra tax has been paid during the given year, then the assessee is eligible for a tax refund, subject to the department’s discretion. In this blog, we will show how you can do your income tax return filing on your own, without the help of a Chartered Accountant.

Table of Contents

Income tax return filing process:

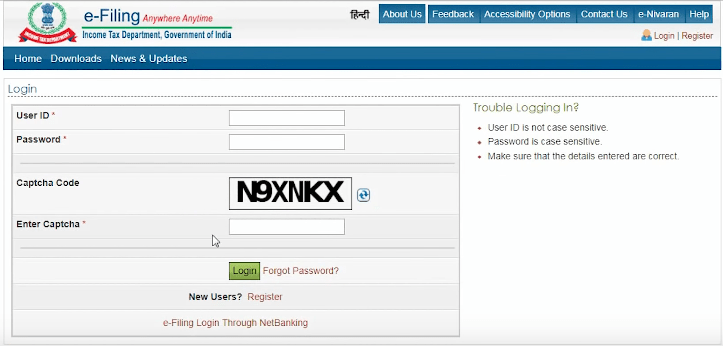

- Log on to the income tax portal.

- Click on Login Here. Put your PAN for User ID, password and Captcha. Click on Login.

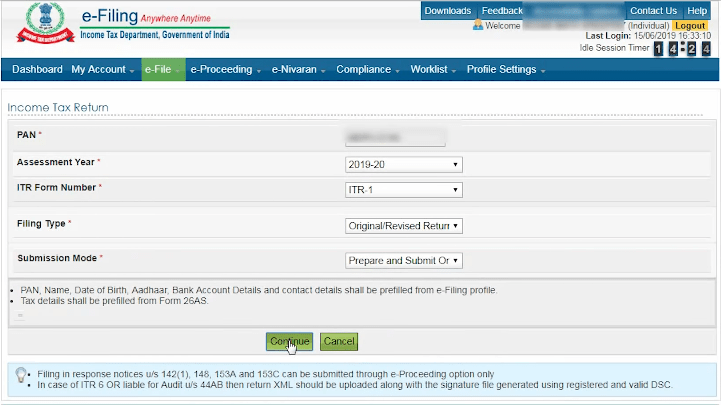

- On the new page, go the third option E-File on the menu bar and click on Income Tax Return from the drop-down list

- Now, choose the Assessment Year as 2019-20, to show the income of the financial year 2018-19. ITR Form Number would be ITR-1 because you are filing for a salaried income. Filing Type will be chosen as Original/Revised Return. Submission Mode to be chosen as Prepare And Submit Online. Then click on Continue.

File your income details as follows:

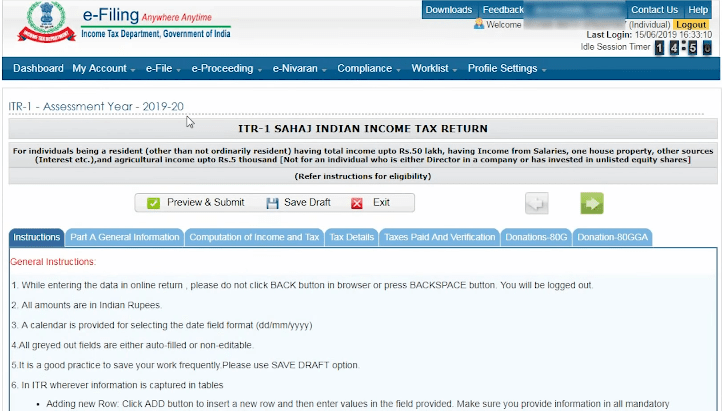

The next page has many tabs which we go through one by one.

- The first tab has general instructions.

- The second tab has Part A General Information.

- This is usually already filled up. You only need to select the Nature Of Employment parameter, which will be Others for a private company employee or as applicable. For Filled Under section, choose 139(1)-On Or Before Due Date. Click on the right arrow to open the third tab.

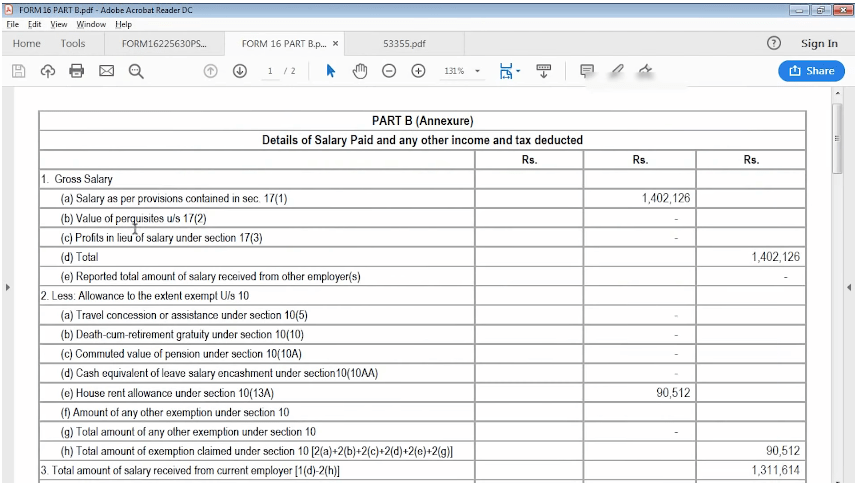

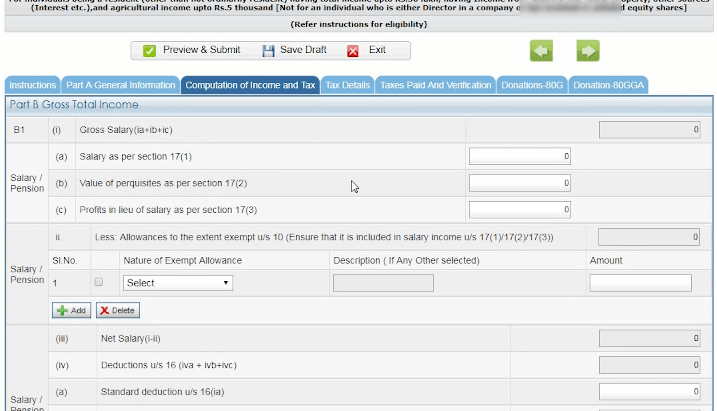

- Part B – Computation Of Income And Tax. This is the most important tab. You need to have your Form 16 Part B to fill these details. Fill the details equivalent to each as follows:

- Salary as per section 17(1) = Salary as per provisions contained in sec. 17(1) in Form 16

- Value of perquisites as per section 17(2) = Value of perquisites u/s 17(2) in Form 16

- Profits in lieu of salary under section 17(3) – same as Form 16

- Less allowances to the extent exempt u/s 10 – given in Form 16. Add each exempt allowance as a separate row.

- Net salary – automatically calculated from the above parameters

- Deductions u/s 16 – this has 3 variants which are all given in Form 16, so add them accordingly

- Income chargeable under the head “Salaries: – automatically filled

- Type of house property – fill your housing loan, rental or other details. Get all details from the Interest Certificate.

- Income from other sources – select as applicable

- Gross total income – automatically calculated

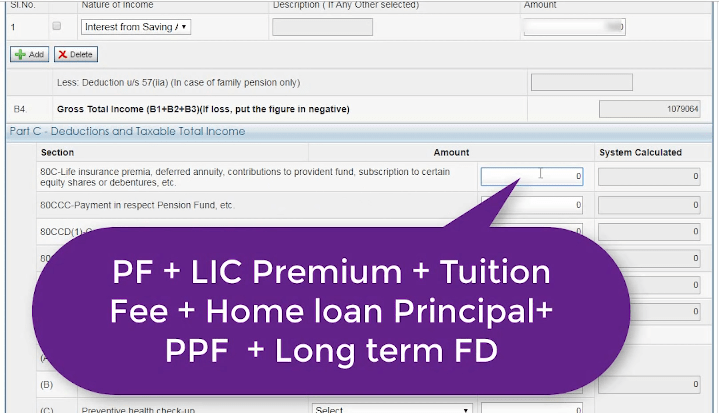

- Part C – Deductions And Taxable Total Income

- 80C – PF, Life insurance premium, Tuition fee, Home loan principal, PPF, Long term FD

- Mediclaim for yourself or any family member

- Interest on saving bank account

- Total Income – automatically calculated

- Part D – Computation Of Tax Payable

- All payable tax is automatically filled

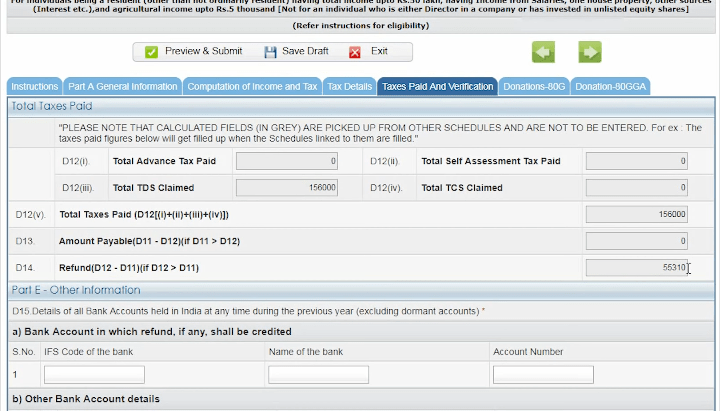

- Tax Details – this is the next tab. All your TDS, advance tax, and other tax details appear here automatically.

- Taxes Paid And Verification – this will show how much tax you have paid and how much refund you are eligible for, only if you are eligible for any refund.

- Part E – Other Information. Put in your bank details where you want to transfer your refund.

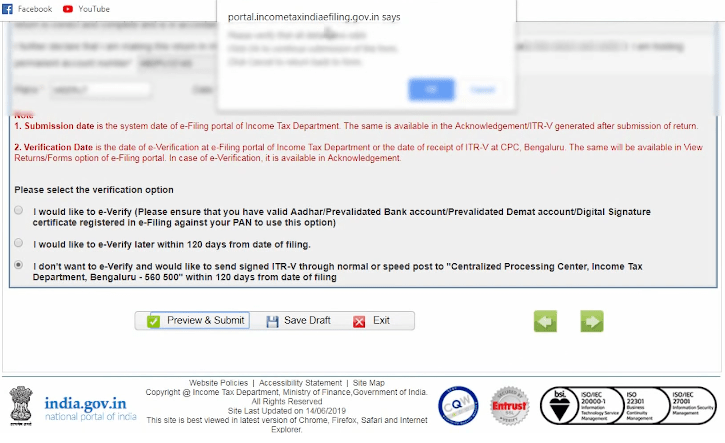

- Part F – Verification. Fill in your details for required verification. Choose the third option for e-verification.

- Click on Save Draft

- Last two tabs are related to Donations. Fill them if applicable to you.

- Click on Preview And Submit.

- A pop-up window will open to verify. Click on OK to preview your full form, and click on Submit

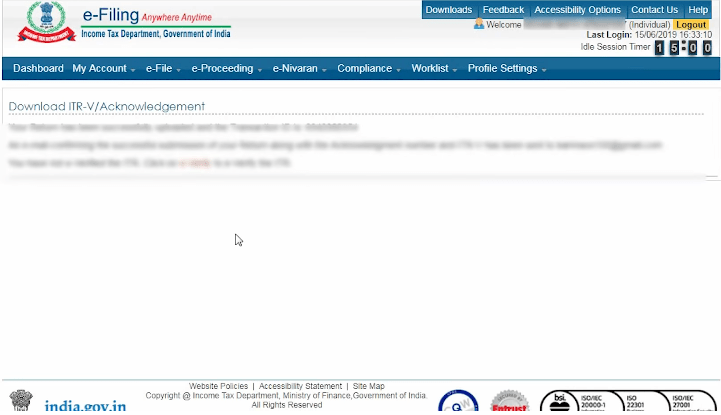

- You will see an acknowledgment message saying that your return has been successfully uploaded.

Watch the detailed tutorial in our video below:

Learn some more financial tips through our following blogs:

Franchise Business | Low Investment High-Profit Business Idea

Income Sources | Financial Advice To Earn More Money

EasyPlan – Investment Solutions

Meesho App – Earn Money Online Without Any Investment

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!