There is one plan which is common in all insurance companies but it goes by different names. Guaranteed maturity, guaranteed lifelong income, double income, money back plan, Sanchay plus, assured wealth plan – are all one and the same, endowment plan. The different names are there just to confuse and manipulate the customers when selling them these plans. There are two major causes why these plans are still being sold even though they are not helping the customers much. Firstly, they get their agents’ high commissions in returns for sale, and the inability to sell them makes the agents and bank relationship managers susceptible to ill-treatment at their offices. Secondly, due to lack of awareness, people just buy anything on the word of the agents.

Table of Contents

What is an Endowment Plan?

Endowment plan is given by an insurance company. These have a life insurance component along with an insurance component attached. Together, they form a hard-to-resist combination which people happily lap up. While ULIP plan is market-linked and the returns on it depend on how the stock market performs, the return on endowment plan is pre-defined and one knows the amount they will receive upon maturity of the plan from the first day itself. Additionally, this plan is tax-free and the investment part yields an annual bonus from the companies which is supposedly “much higher” than the guaranteed return.

Life insurance cover component in endowment plan

A simple question to ask oneself when opting for any life insurance cover plan is how much money will one’s family need to maintain their normal lifestyle even after their member passes away. The answer is generally 10x the annual income of the member after taxes. Minimum required life insurance cover can be Rs 1 crore while the maximum cover cannot exceed Rs 2.5 crore. This will enable the family to live their life comfortably atleast for the next 10 years.

To check the life insurance cover given in these endowment plans we take a look at an example of HDFC Life Sanchay Plus plan. The minimum annual premium for this plan is Rs 30,000 but one can enter any premium amount to check the resulting life insurance cover it will provide. For an annual premium of Rs 50,000, one will get an assured sum of Rs 6.7 lakh only. This is nowhere close enough of an insurance cover a person earning Rs 10 lakh annual income will need. The insurance cover is too low to be of any sufficient help. Secondly, compared to a term insurance plan where an insurance cover of Rs 1 crore for a person of 25 years of age has an annual premium of Rs 10,000-12,000, this insurance premium is 5x more expensive.

Moreover, the later one person expires under the HDFC Life Sanchay Plus plan, the higher the cover they receive. While the earlier a person expires, the lesser the cover they receive. The reason why the maturity amount increases with age is because of the investment component, where the more number of years the plan is active, the more money the plan can amass.

As per the IRDAI guidelines, an insurance company must pay a minimum insurance cover of 10x the annual premium. Hence companies are paying the minimum insurance cover according to the rules while keeping the premium cover high to make the most profit. Also, since there is no maximum cover guideline the companies can get away with paying one just the bare minimum cover. Learn more on Term Insurance and Health Insurance.

Investment component in endowment plan

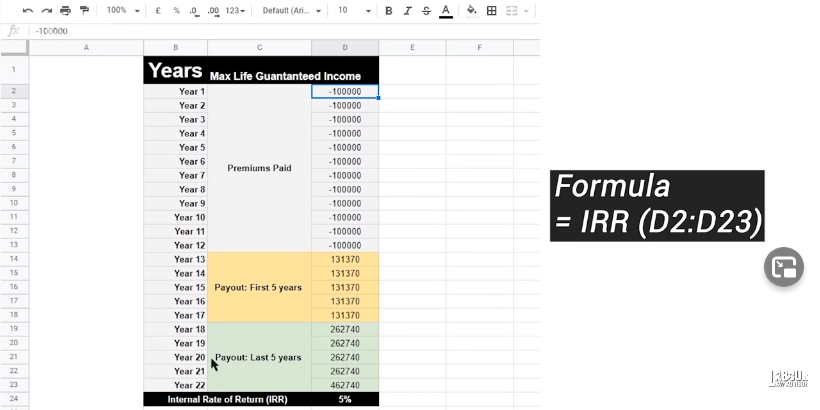

To understand the investment component of an endowment plan, we take a look at Max Life Guaranteed Income Plan. In this plan, when one pays a premium of Rs 1 lakh for 12 years, then they will receive Rs 1.3 lakh from the 13th year, Rs 2.6 lakh after 18th year, and Rs 2 lakh additional income on the 22nd year. Thus, an investment of Rs 12 lakh yields a return of Rs 21 lakh approx upon maturity. This may look enticing given that the investment almost doubles and the guaranteed income is fixed but in actuality, the rate of return for this plan is just 5%.

It is always important to know the IRR (Internal Rate of Return) for any investment one does. In this case, the IRR will be the sum of payouts at the end of each year minus the Rs 12 lakh premium one pays. This comes to only 5% which is negligible.

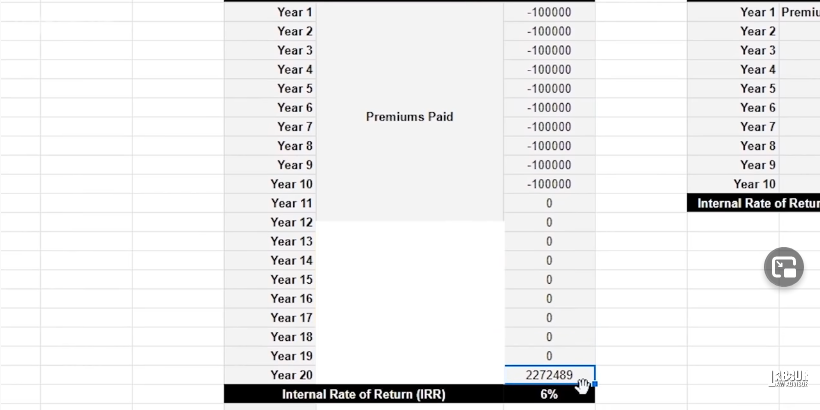

Similarly, in another endowment plan called HDFC Sanchay Plus Guaranteed Maturity, one has to pay Rs 1 lakh premium for first 10 years. It does not yield any payout between the 11th and 19th year of the plan. In the 20th year of the plan, upon maturity, one will get approx Rs 22 lakh. Thus the IRR for the plan is a meagre 6%.

So overall, one can see that this is not a great investment plan either since the returns on it are so low.

Tax free investment

Some might argue that the endowment plan is tax-free for their investment and returns under Section 80C. But firstly, a plan which already has such low margins of returns would not sell if there were additional taxes to be paid on it. Secondly, this investment comes under debt funds category wherein one receives indexation benefits for holding their investment for 3 years atleast. Hence, after putting indexation benefit on this plan, one’s payable tax anyway comes to zero because the return rate is so low. Overall, this plan being a tax-free investment is not justifiable and one could rather opt for one of these options instead. Learn about other tax-free investment options in Tax on stock market & mutual funds.

Surrender charge

On the other hand, the surrender charge for such endowment plans is enormous and leads to major loss if one opts out of the plan before maturity. Sometimes even losing more than half of the premium payments made. Again making this plan unjustifiable for an investment plan.

Bonus

If one does get a bonus amount through the investment component, which is anyways not going to be a large sum, it is not possible to access that amount before the maturity period of the plan is over. Also, that amount is not reinvested to grow anywhere, it just stays put in the plan and its value decreases with rising inflation.

So while one may feel that they have done a great job by taking an endowment plan with both investment and life insurance cover components, in actuality it is not going to be of much help in the future because one’s money will not be growing but rather falling as we have seen from the examples above.

What should one do instead of taking an endowment plan?

If one is not taking an endowment plan then they should follow the below

- The first priority must be a term insurance plan to ensure the safety of one’s family in case of their untimely passing. Term insurance is one of the best life insurance coverage plans.

Learn more on Term Insurance and Health Insurance. - Next, one must take a health insurance policy because health is the ultimate wealth and diseases do not come knocking on the door. Thus it is better to take the precaution and stay safe for any rainy days ahead.

- An emergency fund with one’s six months worth of salary must always be there incase of sudden job loss or no income. This money must not be invested anywhere but just kept for any emergency days. At the most, one can put this in a fixed deposit or liquid fund.

- For wealth creation, one must look into diversified investing with one’s money in different investment plans such as NPS, debt funds, mutual funds, stocks, etc to fulfil one’s goals and future plans. Some funds must always go in stocks and mutual funds, to ensure some of them may give a high return. Also, with diversified investing, all the money is not going into one plan which balances the risk level overall.

Watch the video on endowment plans below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!