Pension members believe that they will at least receive the full amount they have contributed towards pension upon withdrawal. But that is often not the case. We see many members who get substantially less pension withdrawal than what they had originally thought it to be. This is because pension calculation works in a different and convoluted way. This article emphasizes on the important pension withdrawal rules and calculations, some common mistakes which HRs may make leading you to get less pension and steps to get your actual pension amount from the PF department.

Table of Contents

EPS Eligibility

Employee Pension Scheme (EPS) is one of the three schemes under the PF Act. The other two being Employee Provident Fund (EPF) and EDLI. Under EPS if a member contributes for more than 10 years (or 9 year 6 months) then he is eligible for a monthly pension. Moreover, Pension is also provided to members in case of disablement due to work related injury. Dependent pension is also given to widow/children or nominee of the member or pensioner.

A PF passbook generally shows three columns of contributions – PF employee share, PF employer share and Pension contribution. PF members who are eligible for pension get 8.33% of their PF contribution sent to Pension. If a member’s total pensionable service is of 10 years minimum then he is eligible for a monthly pension after he turns 58 years of age. Alternatively, he can also opt for reduced early pension at the age of 50 years. But he cannot opt for pension withdrawal.

However, if a member’s total pensionable service is less than 10 years then he can close his pension account two months after retirement or on leaving the job and withdraw his pension amount altogether. This is also called Return of Contribution since a member gets almost the amount that he has contributed towards pension during service. But the pension amount a member receives upon withdrawal is never the number given in the PF passbook.

Pension withdrawal amount depends on the following factors

Cap on EPS contribution

Since 1st September 2014, the government has put a cap on the EPS contribution of members. Members cannot contribute more than 8.33% of Rs 15,000 which is Rs 1,250 towards their pension fund. Hence, unless a member explicitly informed the PF Department that they want to contribute on their full wages before this law came into place, they cannot pay pension on their full wages. They have to contribute no higher than Rs 1250. If your PF passbook shows more than Rs 1250 being contributed towards pension then that is incorrect and you should get it rectified.

Wages above Rs 15,000

Members joining PF after September 2014 with more than Rs 15,000 monthly wages are not eligible for pension contribution. Only members with less than Rs 15,000 monthly wages can have a pension fund. Hence, if you earn more than that check your passbook to see if you are wrongly paying towards pension.

No interest on pension contribution

Unlike PF contribution which gives a monthly interest, pension contribution does not receive any interest. Thus, the PF interest rate does not apply on the pension contribution.

No advance pension withdrawal

There is no scope to take an advance withdrawal from your pension amount. Whenever a member does take an advance withdrawal, the money comes from their PF funds and not their pension funds.

No TDS deduction on pension

Pension final withdrawal does not incur any TDS deduction. TDS is only deducted on PF withdrawal which can also be avoided by certain methods. But it is not possible to get any TDS deducted on pension amount. To learn how to save TDS on PF withdrawal read Save TDS On PF Withdrawal | Deduction Rules & Refund Process.

Pension transfer

When members change their PF accounts and transfer their PF details from an old account to a new one, then only the pensionable service history is transferred. No actual pension contribution amount gets transferred from one account to another. Hence, there is no problem if your PF passbook shows your pension contribution as zero.

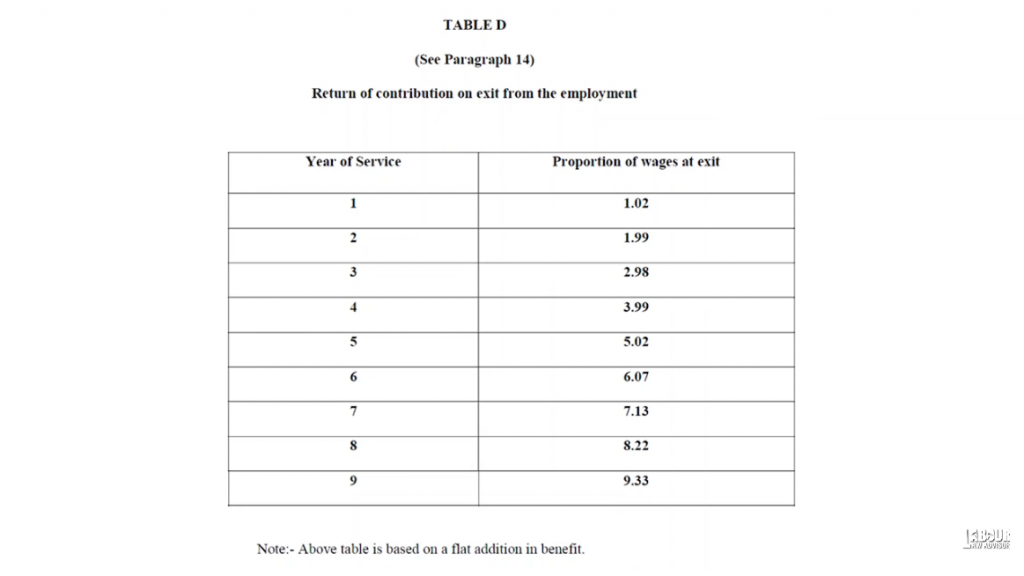

Pension withdrawal as per EPS 1995, Table D

Pension withdrawal calculation amount is never the same as the amount given in the PF passbook. The pension is received according to EPS Act 1995, Table D. This is calculated as follows.

Pension withdrawal calculation

If a member’s overall pensionable service is under 10 years then he can close his pension account and take full withdrawal two months after leaving the job or retirement. Additionally, if a member’s age is 58 years and has less than 10 years pensionable service then although he is not eligible for a monthly pension, he can opt for full pension corpus withdrawal and have his pension contribution post 58 years transferred to his PF account. The pension account though will be closed after 58 years of age.

For pension withdrawal, the officials follow the EPS Act 1995, Table D figures. According to this table given below, a member’s number of pensionable service years are equal to a factor. To calculate the pension withdrawal amount the factor proportionate to the serviceable years is taken and that certain proportion of wages is paid as pension withdrawal amount at exit.

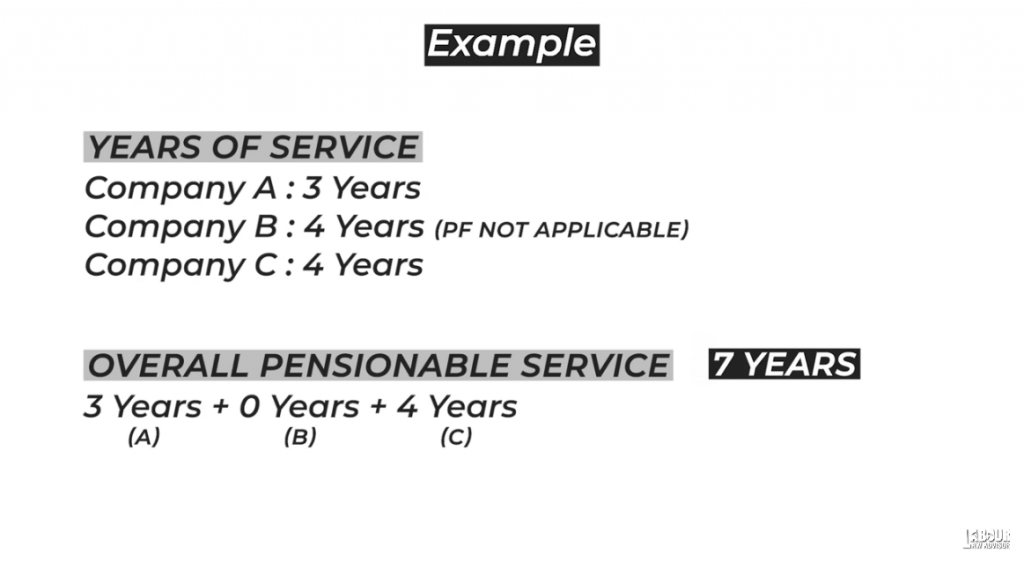

As for counting the number of pensionable service years, you can only count the service years in any company where your PF/pension contribution was done. If any company did not have PF and pension contribution then those service years are not counted for pension serviceable years. Also, if after any individual service member took his pension withdrawal then those service years are not counted as well.

Round-off rule

For calculation of pensionable service years, the round-off rule is applied. Hence, if the actual service period is 9 years and 5 or under months then it is calculated as 9 years only. But if the actual service period is 9 years and 7 or more months then it is calculated as 10 years.

Moreover, if the total service period for any member is below 6 months, then as per the round-off rule this is calculated as 0 years and the member is not eligible for any pension withdrawal amount.

Similarly, using the same rule, for service period of 9 years and 6 or more months but under exact 10 years, it is rounded off to 10 full years. Hence, the member becomes eligible for monthly pension and will not be allowed any pension withdrawal.

Example 1:

Pensionable wage = Rs 15,000

Serviceable years = 5 years, 7 months

Rounded off years = 6 years

Factor of 6 years = 6.07

10C Withdrawal = 6.07 X 15000 = Rs 91,050

But the pensionable wage here is the wage at job exit.

Pro-rata rule

PF members who joined before September 2014 and have less than 10 years of service period will need to use the weighted average method to calculate their PF withdrawal amount. As per the pro-rata rule, whenever ceiling wage is changed, members need to take the weighted average until then.

Example 2

Initial joining – 2012

Year of exit – 2020

Total service period = 8 years

Ceiling wage for first 2 years – Rs 6,500

Ceiling wage for next 6 years – Rs 15,000

Weighted average = {(2 X 6500) + (6 X 15000)} / 8 = 12875

Multiply weighted average with factor of 8 = 8.22

10C Withdrawal = 12875 X 8.22 = Rs 1,05,832

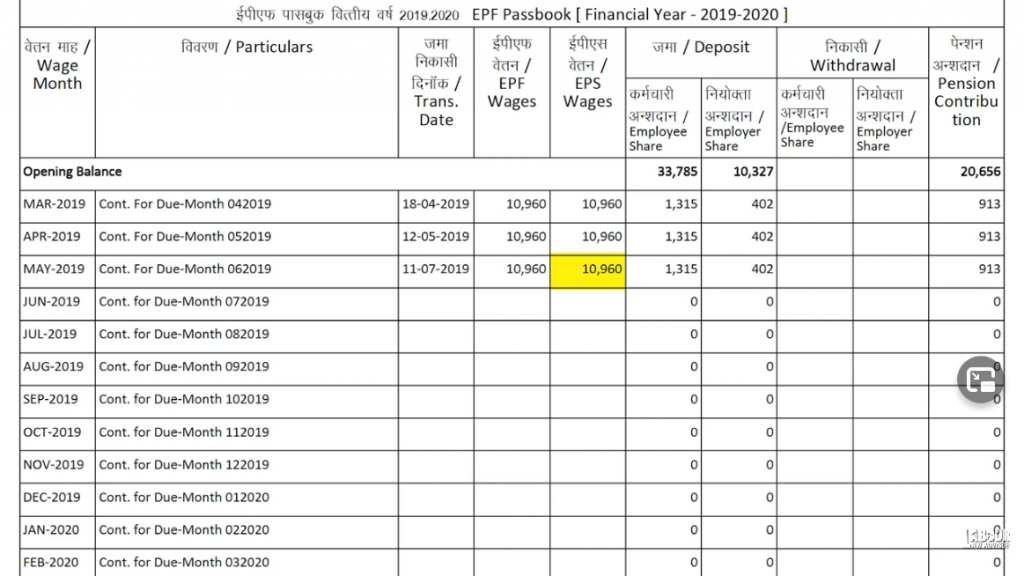

PF Passbook example

Check EPS Wages as per last contribution – here it is Rs 10,960

Number of service years = 4

4 years service factor = 3.99

10C withdrawal = 10960 X 3.99 = Rs 43,730

Actual contributed amount in PF passbook = Rs 23,395

But amount settled = Rs 11,737

Which is definitely wrong, as per earlier rules given.

Genuine reasons for pension calculation mistakes

- Applying for pension withdrawal before completing account transfer.

- Calculation error in round-off rule for service period.

- Pension contribution still continuing after 58 years of age, which will go to waste.

- The pension contribution is on even when monthly wages is over Rs 15,000.

- Pension and PF contribution on over Rs 15,000 of wages; unless specially opted for earlier maximum pension contribution cannot exceed Rs 1250.

- Worked fewer days on the last day of month, hence salary calculation was less than usual and PF department calculated pension on that.

How to get the difference in pension amount?

- Applying for pension withdrawal before completing account transfer – first transfer your pension amount and then apply for withdrawal.

- Pension contribution still continuing after 58 years of age/Pension contribution even when monthly wages is over Rs 15,000 – Submit Revised Form 3A to the PF Department to correct any wrong contribution.

- For any other reason – File a complaint on PF Grievance Platform mentioning the difference in your contributed amount and your settled amount.

Watch further details in the video below.

EPS Pension Calculation

Calculation of pension for all members joining after 1995 is on the basis of Paragraph 12 of the EPS Scheme. This paragraph states that, in the case of a new entrant, the amount of monthly superannuation pension or early pension, as the case maybe, shall be computed in accordance with the following factors, namely:

Monthly member’s pension = (Pensionable salary X Pensionable service) / 70

But this formula is applicable on the following conditions given in Paragraph 12:

Provided that the member’s monthly pension shall be determined on a pro-rata basis for the pensionable service upto the 1st day of September, 2014 at the maximum pensionable salary of six thousand and five hundred rupees per month and for the period thereafter at the maximum pensionable salary of fifteen thousand rupees per month.

How is pensionable salary determined?

To calculate the pensionable salary you take the average pensionable salary by taking the sum of the salary of last 60 months and dividing it by 60.

Average pensionable salary = Sum of last 60 months salary / 60

But if the member has taken too many leaves then this average pensionable salary is calculated slightly differently. In this case, the pensionable salary is calculated keeping in mind the non-contributory days.

Thus, average pensionable salary = (Sum of EPS wages X 30) / (365 X 5 – Non-Contributory Days)

How is pensionable service determined?

The pensionable service of a member is determined by the number of years they have contributed to the EPF. In case the member’s pensionable service is over 20 years then his pensionable service is increased by 2 additional years.

However, if the member has opted for early pension then he does not get the bonus 2 years added to his pensionable service automatically after 20 years. He can get the bonus 2 years only after completing 20 years and attaining the age of 58 years.

Pension calculation example

Employee’s Date Of Joining – 1st September 2000

Employee’s Date Of Exit – 1st September 2020

Total service = 20 years

Average pensionable salary = Sum of last 60 months salary/60 = Rs 15,000

Pensionable service = 20 + 2 bonus years = 22

Therefore,

Pension amount for 20 years without Pro-Rata = (22 X 15000) / 70 = Rs. 4714

But, this will not be the actual pension amount because of the pro-rata rules.

What is the pro-rata rule?

The pro-rata rule states that upto 1st September 2014, pension calculation will be done at the maximum pensionable salary of six thousand and five hundred rupees per month and for the period thereafter at the maximum pensionable salary of fifteen thousand rupees per month.

Therefore, using the previous example,

Pension amount for 20 years with Pro-Rata = [{(14+2) X 6500} + (6 X 15000)] / 70 = Rs 2771

Here, 14 years from 2000 to 2014 plus 2 bonus years will be multiplied by maximum pensionable salary of 6500 and remaining 6 years from total pensionable service will be multiplied by maximum pensionable salary of 15000.

Additionally, if the Date of Joining for an employee is before 16th November 1995, then some contribution from the Family Pension Scheme is also added to the pension calculation. This is calculated on the basis of Table 12 (3)(B) and Table B from the EPS. This value is generally Rs 500.

Real life pension calculation example

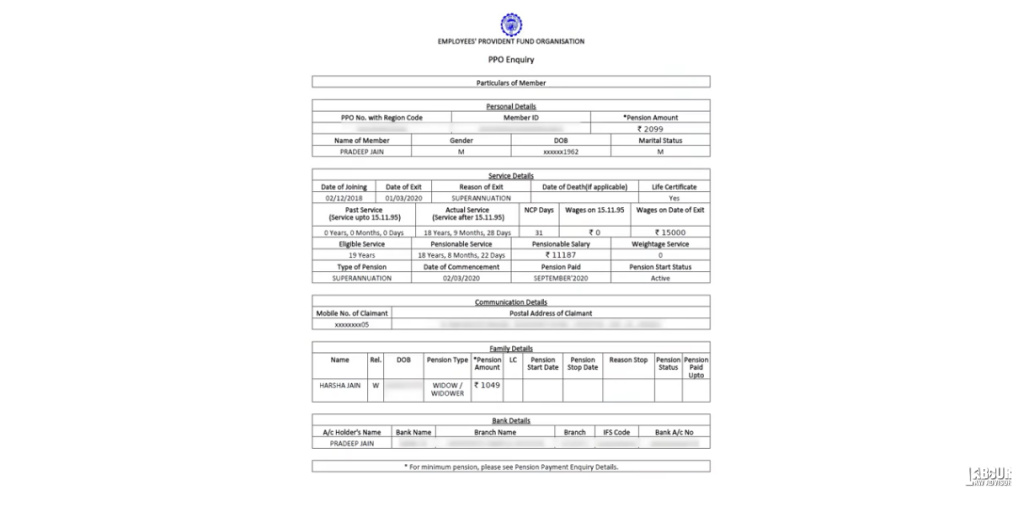

PPO enquiry form

Members need to obtain their PPO form by visiting the Pensioner’s portal and inputting their details. Then they can download their PPO Form.

Members need to check the following on the PPO enquiry form:

Pension amount = Rs 2099

Actual service = 18 years, 9 months, 28 days

NCP days = 31 days

Pensionable service = 18 years, 8 months, 22 days

Pensionable salary = Rs 11187

Actual calculation

Pensionable salary (60 months average) = Rs 11187

Pensionable service = 18 years, 8 months, 22 days = 6832 days

Service between 16 November 1995 and 31 August 2014 = 4856 days

Service after 1 September 2014 = 1974 days

Therefore, Pro-Rata pension calculation = [(4856 X 6500) + (1974 X 11187)] / (365 X 70) = Rs 2099

Actual pension calculation = Rs 2099

Important points to note

- Monthly members pension including any relief payable to any existing or future member cannot be less than Rs 1000.

- Provided that on and from the first day of September 2014 the minimum pension of one thousand rupees payable under this subparagraph be subject to

- Deductions on accounts of benefits of commutation and return of capital taken by members under the extant provisions of this scheme prior to 26th September 2008 and

- Deductions on account of early pension under subparagraph (7).

Delay in pension

Payment of pension

The claims complete in all respects submitted along with the requisite documents shall be settled and the benefit amount paid to the beneficiaries within 20 days from the date of its receipt by the PF Commissioner. If there is any deficiency in the claim, the same shall be recorded in writing and communicated to the applicant within 20 days from the date of receipt of such application. In case the Commissioner fails without sufficient cause to settle a claim complete in all respects within 20 days, the Commissioner shall be liable for the delay beyond the said period and penal interest at the rate of 12% p.a. may be charged on the benefit amount and the same may be deducted from the salary of the Commissioner.

Guarantee of pensionary benefits

None of the pensionary benefits under the Scheme shall be denied to any member or beneficiary for want of compliance of the requirement by the employer under subparagraph (1) of paragraph 3 provided however that the employer shall not be absolved of his liabilities under the Scheme.

Bonus tip

Deferred pension

A member who has attained the age of 58 years and is otherwise eligible for pension under clause (a) of sub-paragraph (1), if he so desires may be allowed to defer the age of drawing pension later than 58 years but not beyond 60 years of age.

In such cases as is referred to in clause (a) – the amount of pension shall be increased at the rate of 4% for every completed year after the age of 58 years which shall be restricted to the wage ceiling given under the proviso to subparagraph (2) of paragraph (3).

However, it takes upto 25 years to break even the 2 years of pension foregone when a member actually starts getting pension. Hence, this option is not advisable.

Early pension

A member if he so desires may be allowed to draw an early pension from a date earlier than 58 years of age but not earlier than 50 years of age. In such cases, the amount of pension shall be reduced at the rate of 4% for every year the age falls short of 58 years.

But early pension is always a better option then deferred pension, since in this case you get the pension for 8 years whereas you don’t get anything in the latter option.

Watch further details in the video below.

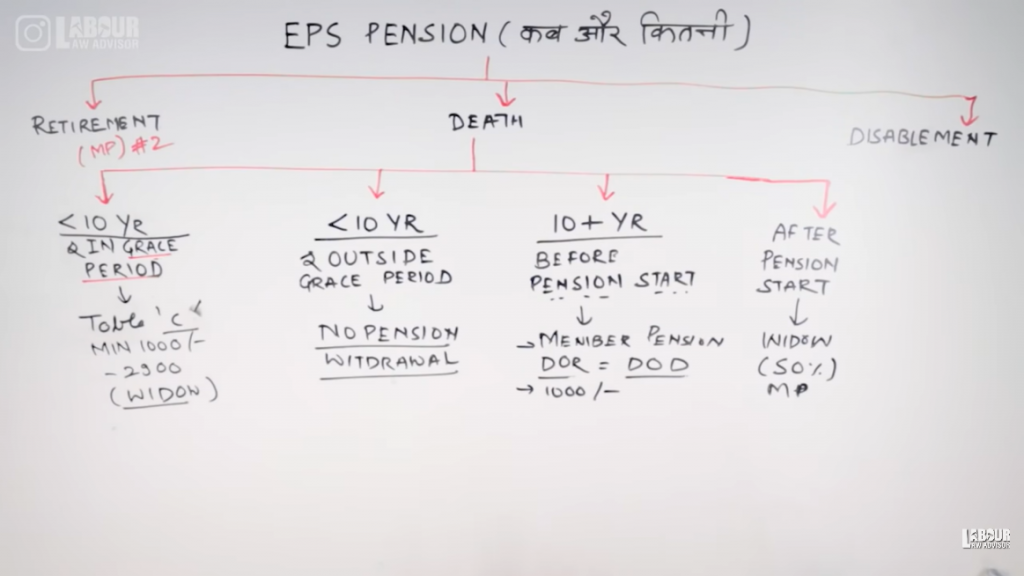

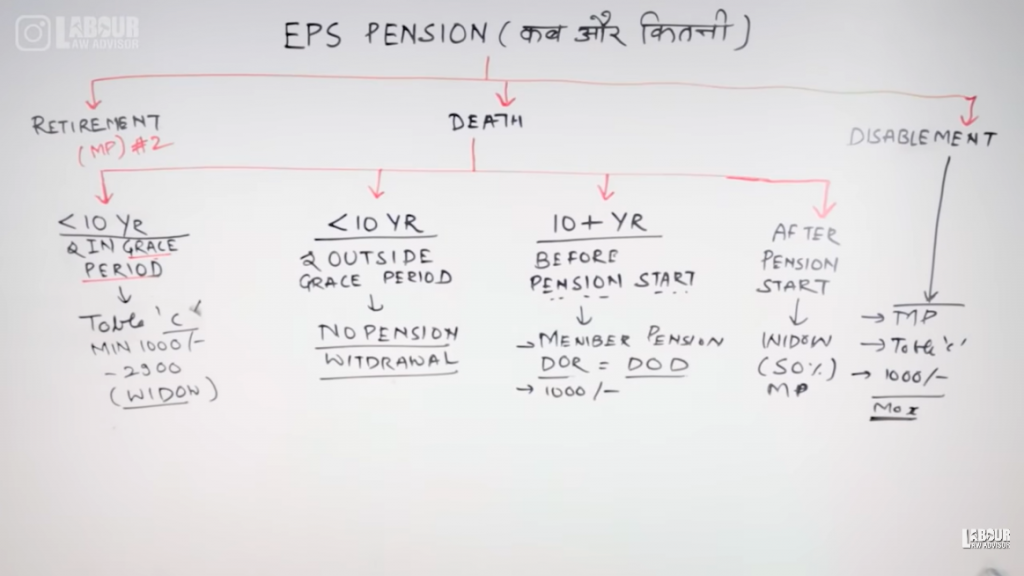

Pension in case of death

In the case of the death of the member, four scenarios may occur as follows:

1. Member’s death before 10 years service period & within grace period

If a member passes away before completion of 10 years of service period, then technically he does not qualify for pension. But if member’s service falls under Grace Period, which means that member does not withdraw pension fund after leaving job and passes away within 36 months after leaving job, then he is considered as an active pension member. Hence member death while in service or within 36 months after job exit is called the grace period.

For pension in this situation, one will refer to Table C and find pension equivalent to member’s last wages. Here, minimum pension can be Rs 1000 per month while maximum pension can be Rs 2901 per month. This will be called Widow Pension.

2. Member’s death before 10 years service period & outside grace period

If a member passes away before 10 year service period completion and 36 months after leaving job, then he does not get any pension. Member will only be able to withdraw EPF funds.

3. Member’s death after 10 years service period & before starting pension

If member passes away after completing 10 years service period and/or after exiting job then he is eligible for member pension. In this case, the date of expiring will be considered as the date of retirement for the member’s pension. Minimum pension can be Rs 1000 per month.

4. Member’s death after pension starts

If member’s pension has begun, be it retirement pension, deferred pension, or early pension, and he passes away then his widow is eligible for 50% of member pension.

Pension in case of disablement

In the case of disablement of the member, three scenarios may occur as follows:

1. Member’s service period is 10 or more years

If member has already completed a service period of 10 years at the time of disablement then he is eligible for member pension.

2. Member’s disablement before 10 years of service period

In this case, check Table C of EPS to find out the amount of monthly pension member is eligible for.

3. Member gets minimum Rs 1000 pension per month

The member can get Rs 1000 per month as pension for disability.

Out of these three scenarios, member will receive whichever option gives the maximum pension return for disablement.

Pension for dependents

Under the pension scheme, in case of a member’s passing, his family continues to get his pension benefits. The “family” for a male member is described as his wife and two children. Similarly, the “family” for a female member is described as her husband and two children. Following scenarios explain which family member gets how much pension in case of member’s death.

- If member was married

- If spouse is alive then

- Then spouse gets 100% widow pension as given above in case of member death scenarios for entire life

- Two children get 25% of widow pension, up to the age of 25 years

- If more than two children, then first two will receive 25% widow pension until first-born turns 25 years, then middle and third child will receive 25% widow pension. Likewise, all children will receive 25% widow pension until they all turn 25 years.

- If spouse has also passed away and the children are orphan

- Then two children will receive 75% of widow pension until they turn 25 years.

- If more than two children then order of oldest to youngest will be followed.

- If spouse is alive then

- But if member was unmarried

- If nomination form is filed

- The Nominee will get a 100% member pension for their entire life.

- If nomination form is not filed

- Then the Father or Mother, whoever is surviving, will get 100% widow pension.

- If nomination form is filed

Hence it is always recommended to file your PF nomination form.

Watch further details in the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!