Due to the coronavirus pandemic lockdown, Nirmala Sitaraman had announced the Pradhan Mantri Garib Kalyan Yojana on 26th March 2020. This scheme plans to help the poor since lockdown has made life difficult for the working class. The Central Government plans to pay the full 24% EPF contribution for the next 3 months for workers who earn below Rs 15,000/month. This Pradhan Mantri Garib Kalyan Yojana is eligible for companies who have up to 100 employees and 90% of their employees earn less than Rs 15,000/month. The government plans to spend around Rs 1.70 lakh crore under this relief package. To implement this relief package, the Ministry of Labour, notified a scheme guideline on 10th April 2020.

Table of Contents

What is the scheme benefit?

The Pradhan Mantri Garib Kalyan Yojana aims to prevent any disruption in the livelihood of low wage-earning employees. It also aims at helping smaller establishments in this difficult time. Since they may already be going through a loss due to lockdown. Thus, the scheme will have the Central Government pay the employees’ EPF contribution of 12% of their wages as well as the employers’ EPF and EPS contribution of 12% of the wages. Hence, a total of 24% of the monthly wages will come directly from the Central Government. This is applicable for the next three months. The 24% contribution payment will directly happen in the EPF accounts of the employees, who are already members of the EPF Scheme 1952. The employers of these employees must be members under the EPF & MP Act 1952 as well.

What is the validity of the scheme?

The Pradhan Mantri Garib Kalyan Yojana is applicable for the wages of March, April and May 2020. Thus, this scheme benefit will appear for April, May and June 2020 challan filing.

What is the eligibility criteria for Pradhan Mantri Garib Kalyan Yojana?

For Employers/Establishment

To be eligible for the Pradhan Mantri Garib Kalyan Yojana benefits, the employer/establishment must fulfil the following criteria:

- The employer’s establishment or factory should already be covered and registered under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952.

- The establishment must employ under 100 employees or workers.

- 90% of the total number of employees must earn less than Rs 15,000 per month.

For Employees

To be eligible for the Pradhan Mantri Garib Kalyan Yojana benefits, the employee or worker must fulfil the following criteria:

- The employee must have employment in an eligible establishment and earn less than Rs 15,000 per month.

- The UAN of the employee must be seeded with his or her Aadhaar.

- Said employee must also be a member of the Employees’ Provident Fund Scheme, 1952 and the Employees’ Pension Scheme, 1995.

- At least one contribution must be received by the employee in the last six month period. This period lies between September 2019 to February 2020. This must happen in the ECR filed by any eligible establishment against his/her UAN.

- Such contributions in ECR must be received on monthly wages of less than Rs 15,000.

- If any employee is already a registered beneficiary and his/her employer is availing benefits of employer’s share by the Central Government under the PMRPY/PMPRPY 2016, then no such benefit will be available under Pradhan Mantri Garib Kalyan Yojana.

How to avail Pradhan Mantri Garib Kalyan Yojana benefits?

- The employer in relation to any eligible establishment, shall disburse wages for the month to all employees of the establishment and file the Electronic Challan cum Return (ECR) online.

- Since the Central Government is paying the employee’s share of EPF contributions for employees eligible under this scheme, for the months of March 2020, April 2020, and May 2020, the employer shall not make any deduction of employee’s share of EPF contributions from the monthly wages of any eligible employee drawn for the wage months – March 2020, April 2020 and May 2020.

- The employer of establishment claiming benefits under this scheme have to file only one valid ECR for each of the months – March 2020, April 2020 and May 2020.

- Form 5A (Ownership Return) filed electronically should contain the details of all branches/departments and EPF code numbers, if any, allotted separately to such branches/departments.

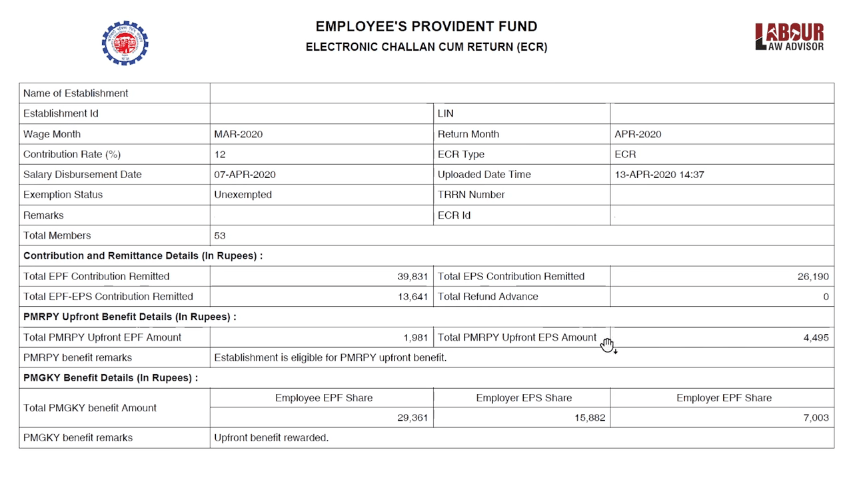

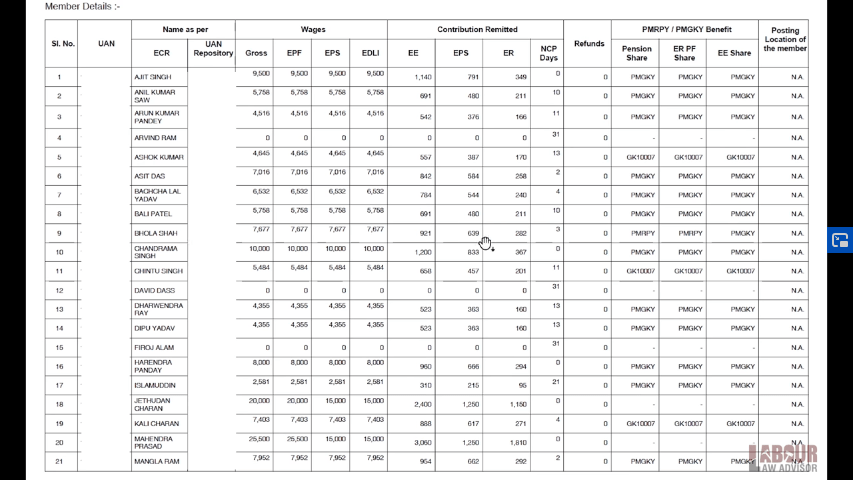

- Once ECR is uploaded by an eligible employer, then the challan will separately show such amounts of employees’ and employers’ contributions, as Central Government relief, due under this scheme in respect of eligible employees. It will also show the remaining amount payable by the employer-contributions towards EDLI Scheme, 1976 and EPF administrative charges in respect of all employees as well as EPF & EPS contributions due in respect of ineligible employees.

- After the employer remits the payment due from him as reflected in challan as noted above, the EPF & EPS contributions in respect of eligible employees will be credited directly in their respective UAN by the Central Government. There is no additional need to seek reimbursement for relief.

- At the time of submission of the ECR, the employer shall be required to certify the correctness of information furnished electronically in ECR and in Form 5A with an undertaking that the employer is liable for a penal and coercive consequence for submitting any incorrect or false information/declaration to avail the relief. The form of certificate/declaration of the employer is appended below:

CERTIFICATE/ DECLARATION OF EMPLOYER

“I hereby certify that the information relating to the names of employees who are members of the EPF Scheme, 1952 and/or EPS 1995, UANs seeded with Aadhaar of employees, EPF/EPS wages already disbursed to employees, number of excluded employees in the ECR for wage month of March/April/May, 2020 are true and correct.

That I have disclosed names & UANs seeded with Aadhaar of every employee employed in all units/branches/departments as well as number of excluded employees of my establishment in the ECR for wage month of March/April/May 2020, the total number of employees being ____ (EPF members and excluded employees), out of which _____employees earned EPF/EPS wages less than Rs.15000/- qualifying for Central Govt. relief. I further certify that the Form 5A contains the details of all branches/departments and EPF Code numbers allotted separately to these.

I also certify that monthly wages due to all employees for the month of March/April/May 2020 has been disbursed and also certify that no deductions towards either employees’ EPF contributions or employers’ EPF/EPS contributions have been made from wages of eligible employees for the month of March/April/May 2020.

That I have neither suppressed any material information nor omitted any particulars and submitted correct information to avail the relief of employer’s and employees’ share of contributions in r/o eligible employees from the Central Govt. for the month of March/April/May 2020.

I understand that the employer is liable to refund the relief amount and is also liable for any penal and coercive consequence for submitting any incorrect or false information/declaration to avail the Central Govt. relief.”

__________________________________

- The employer and establishment, seeking benefits of this scheme, shall be fully responsible for the information furnished electronically in ECR or Form 5A or otherwise. If it is found that employer or any person has filed false information or statement or made a false declaration, the employer shall be treated as a defaulter and be liable for penal consequences for such contravention as per the provisions of the EPF & MP Act, 1952 and EPF Scheme, 1952 and the relief paid by the Central Govt. shall be liable for recovery along with interest and penalty.

Modalities for implementation of the scheme

- EPFO shall develop a software for implementing this scheme. It will also develop a procedure which is transparent and accountable at their own end.

- EPFO shall credit the funds in the Aadhaar seeded accounts of members of EPF in an electronic manner.

Monitoring mechanism

- EPFO shall put in place a robust mechanism to monitor the implementation of the scheme on a daily basis.

- EPFO shall provide weekly reports to the Ministry of Labour & Employment (Directorate General of Employment), Govt. of India, for effective monitoring of the scheme.

Third-party evaluation

- EPFO shall undertake a third-party evaluation of the scheme. This will happen within a period of three months from the closure of the scheme. It will then send a report to the Ministry of Labour & Employment, Govt. of India.

- The expenditure incurred towards the evaluation of the scheme shall be borne by the EPFO out of its own resources.

Important FAQs

For important FAQs regarding Pradhan Mantri Garib Kalyan Yojana please see the document below.

Watch the video below for more details on Pradhan Mantri Garib Kalyan Yojana 2020.

EPFO extends date of return

After repeated requests from the people, the EPFO finally extended the date of return for filing the EPF challan. The filing for March 2020 has gotten an extension till May 15th 2020. March 2020 challan filing and payment must be complete within 15th May 2020.

PMRPY Benefit

In the case of PMRPY benefit, where 12% of employer’s share for EPF is given by the government, the PMRPY benefit for March 2020 will lapse if the challan payment is not complete within 15th April 2020. If a new challan is made post the 15th of the next month, then it will not have PMRPY benefit. All rules regarding PMRPY remain the same as February 2020, even with the deadline extension. If the challan is already made but not paid yet, then it will display a message as follows. “This ECR is containing PMRPY benefit and you are making payment after 15th. Please cancel this ECR and re-upload it again.”

Pradhan Mantri Garib Kalyan Yojana (PMGKY) benefit

The Pradhan Mantri Garib Kalyan Yojana benefits as per our AB testing is as follows. The benefit for 12% employer’s share and 12% employee’s share contributions will continue till April 15th 2020. Not sure till when the benefit is valid though. The benefit will be available for new challans as well. But this benefit is not available on the employer’s share for the employees registered under PMRPY.

Employers need to note that they do not deduct employee’s share of EPF contributions from wages of eligible employers from March to April 2020. But if the EPF deduction is already done then it has to be reimbursed to the employees. For reimbursement, check the employee’s name, UAN, employee’s share contribution amount and if the benefit for it says “PMGKY”. If it does, then that contribution amount needs to be refunded to the said employee.

For more queries on this update, watch the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!