EPF (Employee Provident Fund) is a monthly savings scheme for an employee to provide financial stability during his retirement. Both employee and employer contribute towards this scheme. EPF is also mandatory for all companies having above 20 employees. PF members have common knowledge of PF contribution and monthly interest rate. But some of the major details remain unknown to them. Details such as if PF is received on employee or employer’s share? Is the PF amount given in your passbook correct or not? Will late challan payment by employer default your PF monthly contribution? These and some more PF interest rate, rules and misconceptions will be discussed in below.

Table of Contents

PF passbook new format

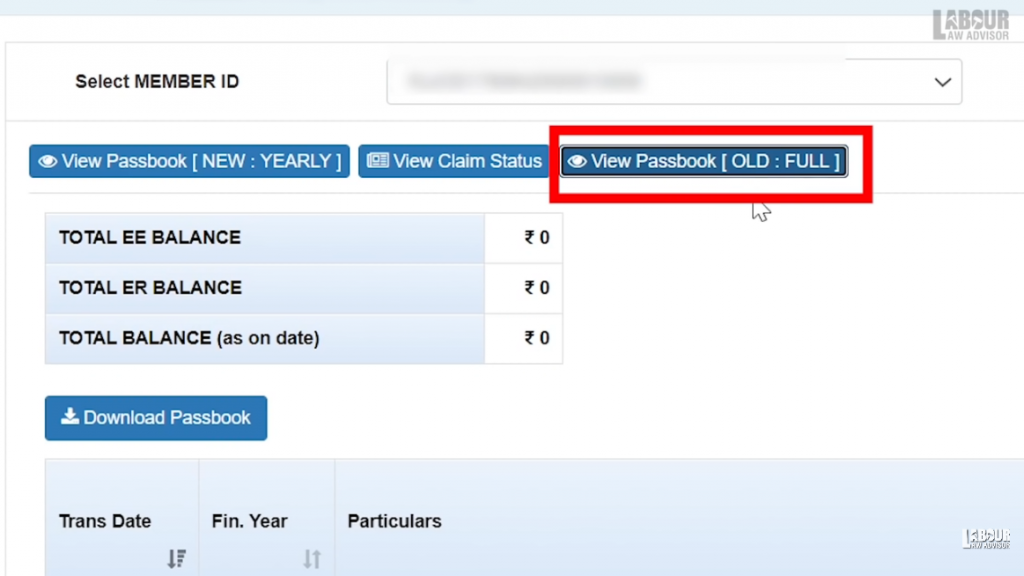

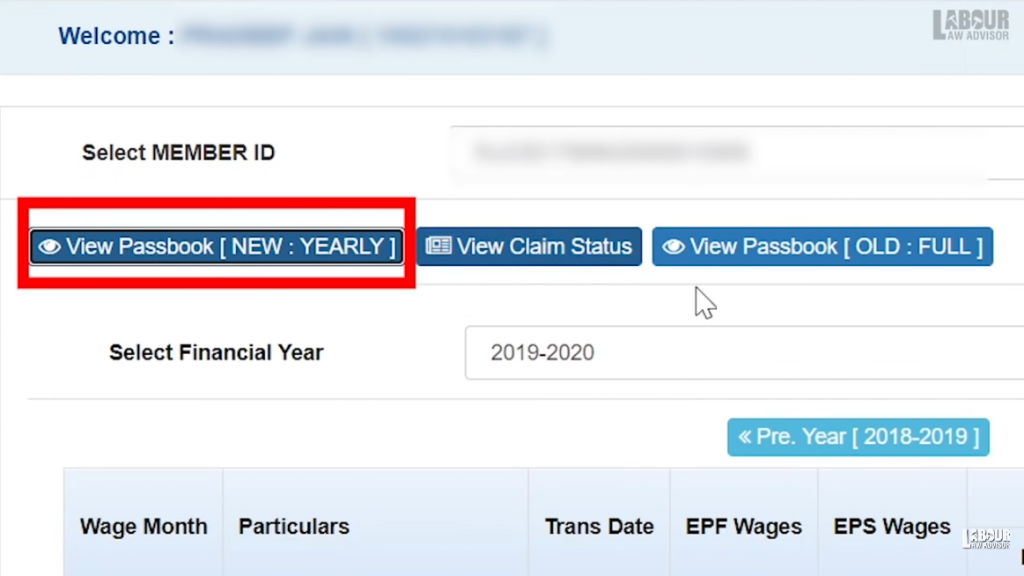

PF now has a new format for its passbook. To check your PF passbook follow the below steps:

- Visit the PF member portal

- Go to the passbook tab

- Click on View Passbook (Old: Full)

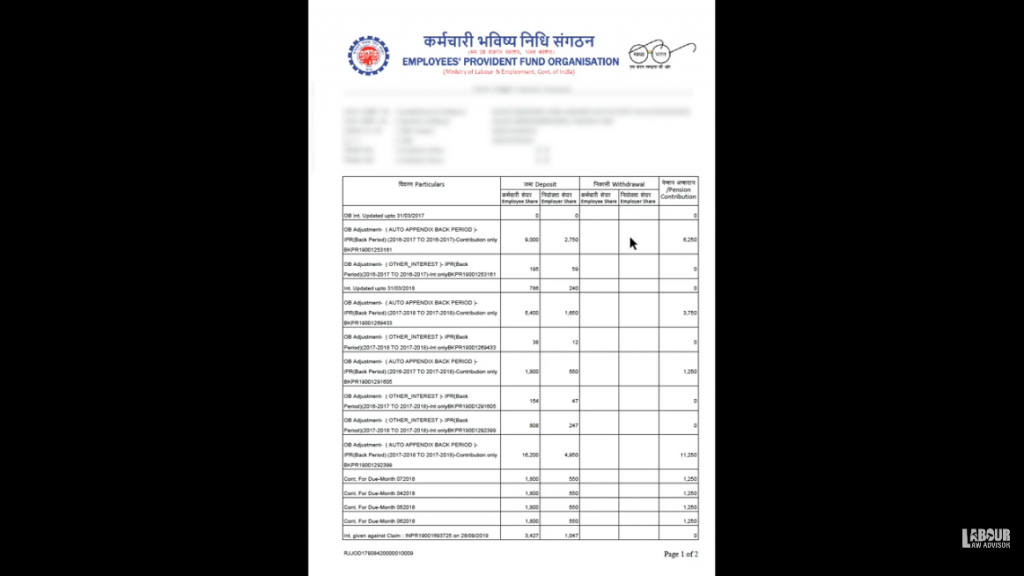

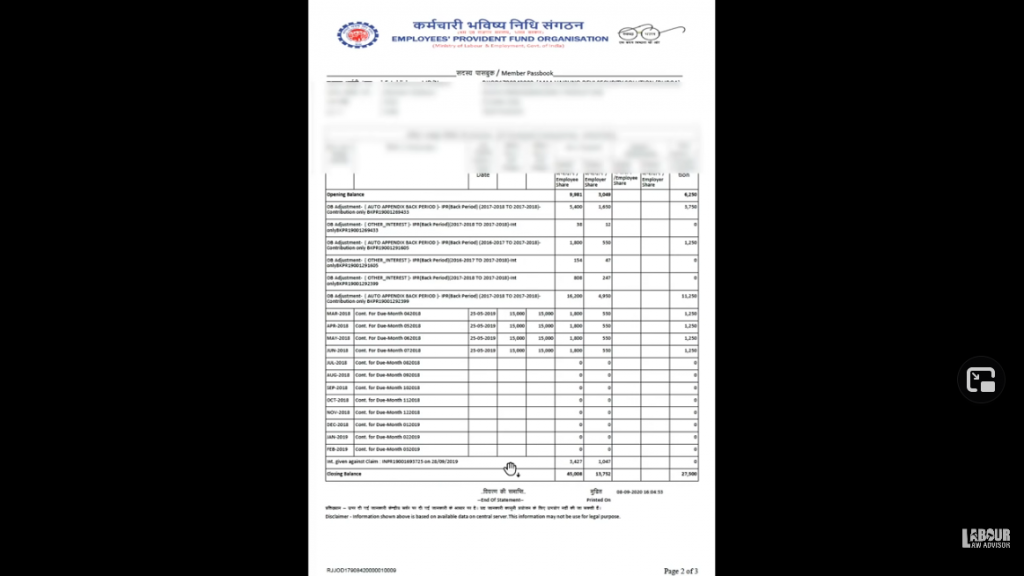

- Download Passbook to view the earlier PF passbook format with all your contributions on a single sheet.

- Click on View Passbook (New:Yearly) to see the new PF passbook format with your year-wise PF contribution and interest earned.

- Download the New Yearly PF Passbook for easier usage.

Important PF interest rules

PF interest rules are mentioned in the EPF Act 1952, under paragraph 6D. These are as follows:

- The PF interest rate is decided by the PF Board. Once decided, it is sent to the Finance Ministry and after their approval, the interest rate is notified and credited in the members’ accounts.

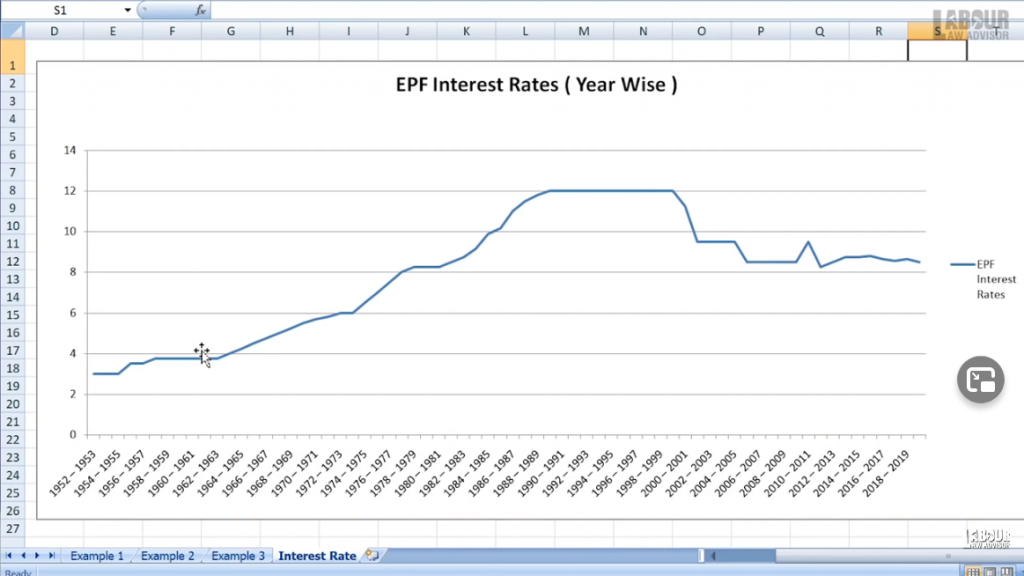

- PF interest is credited on a monthly running balance basis. As a general pattern, it is seen that the PF interest rate used to be around 3-4% in the 50s and 60s but in the last decade, it hovered between 8-10%.

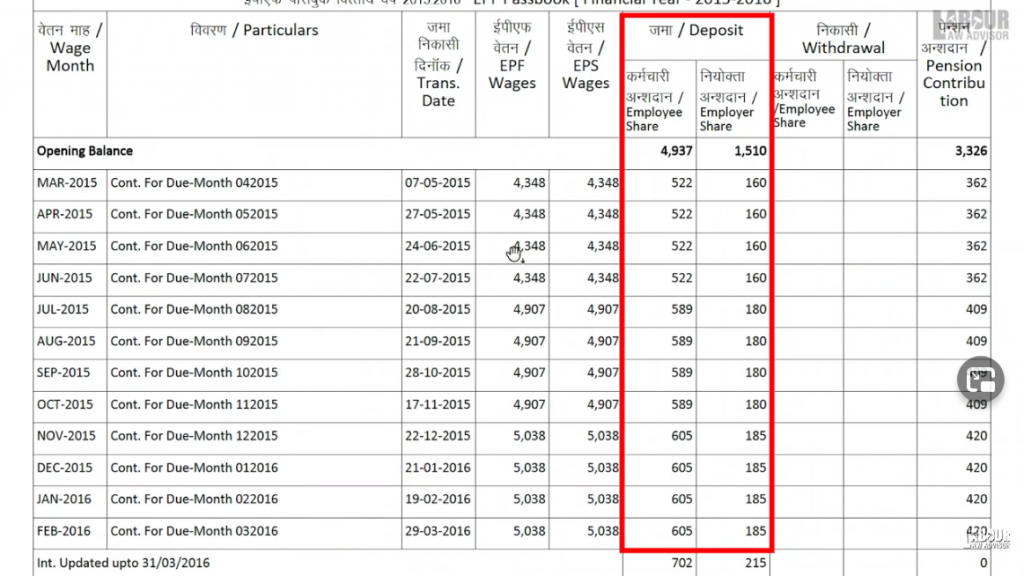

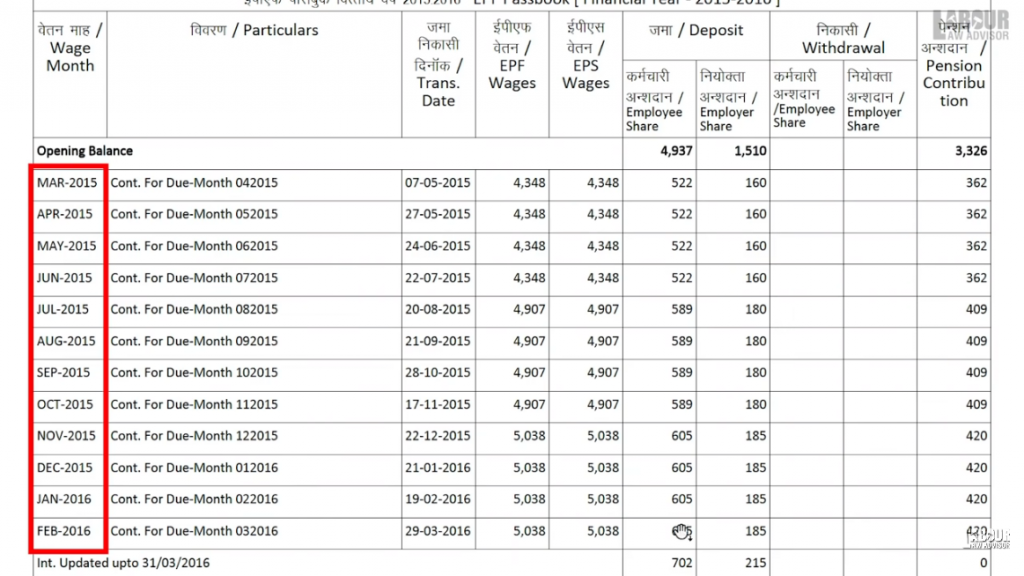

- Members get PF interest only on the PF contribution of 12% by the member himself and the 3.67% contribution of the employer. Hence, PF interest is only calculated on the Deposit columns of Employee’s Share and Employer’s Share in the PF passbook. It is never calculated on the Pension Contribution amount, given on the PF passbook.

- In our country, the financial year is considered as April to March. But for PF the interest is calculated on the wage months from March to February. Hence, your PF interest will be given for March to February only.

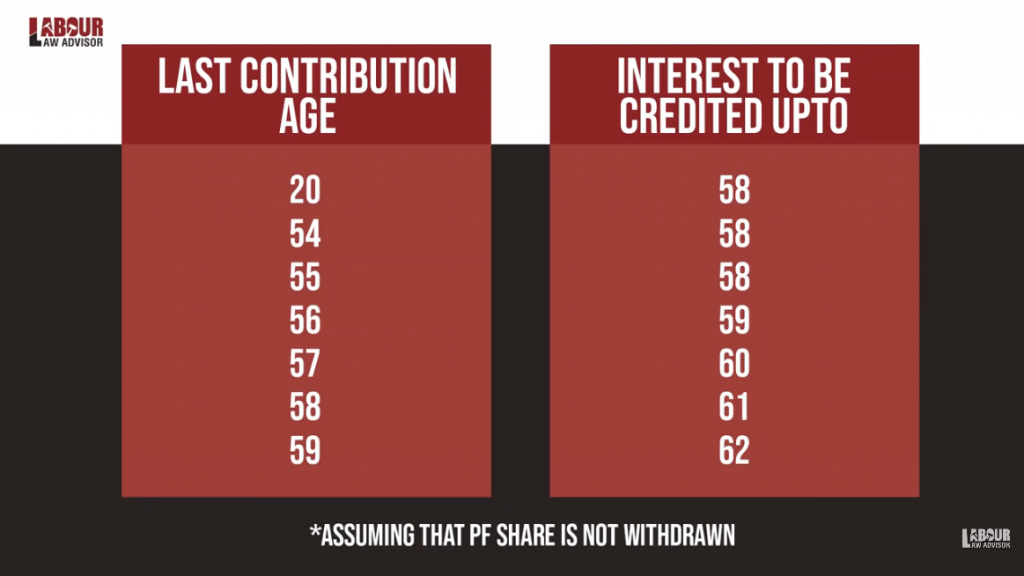

- The PF interest is credited in all member accounts which are active. This excludes all “inoperative” PF accounts. As per EPF Act, paragraph 72, a PF account is deemed inoperative if the member has retired on completion of 55 years of age or has migrated abroad permanently or the member has died and no claim has been received for settlement for 36 months from the date when the amount became payable. Once the PF account becomes inoperative, it will not get any PF interest credit.

Case studies

Example 1

What happens to the pending interest credit if a member opts for a full and final settlement withdrawal of their PF account, or transfers the amount to another PF account, in between a financial year?

The PF Department will credit the member the interest on the account until the date of amount withdrawal or transfer. In case of withdrawal, it will be included in the amount and in case of transfer, it will reflect in the new PF account passbook. The PF interest will be credited on the basis of the rate declared for the immediately preceding year.

If the current year’s interest rate is not yet notified, then the preceding financial year’s interest rate will be used.

Although, if the withdrawal or transfer is done before the 25th of any month, then no interest will be earned on the month’s contribution. If withdrawal/transfer happens after the 25th of the month, then full interest on the month’s contribution will be received. Albeit, in some cases of advance PF withdrawal, no interest is earned even if the withdrawal is made after the 25th of a month.

Example 2

What happens to PF interest if the employer submits the PF contribution very late or not at all?

If the employer does not make the payment, even after challan generation, then no interest is earned. Although, if the employer makes the payment quite late, even after a couple of years, the employee will still receive the full interest for the pending years. The employer will have to submit some penalty for late PF payment separately.

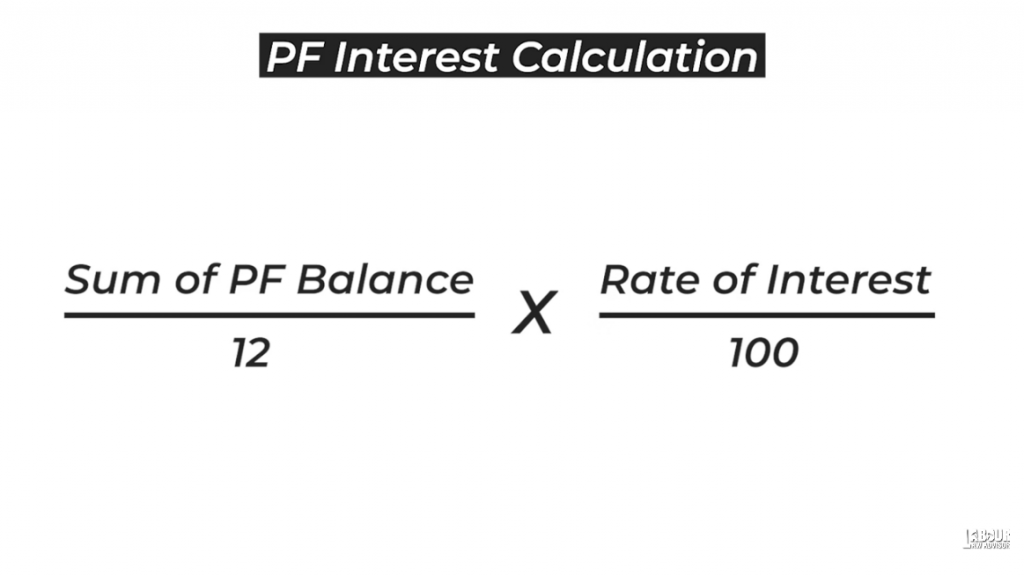

PF Interest calculation formula

The PF interest is credited on a monthly running balance basis depending on the following rules:

- On the closing balance of the amount: Interest will be given as on the late date of the preceding year less any sum withdrawn during the current year, for 12 months.

- For the sums withdrawn during the current year: Interest will be given from the beginning of the year till the last date of the month preceding the month in which withdrawal took place.

- On the amounts of contributions credited during the current year: Interest will be given from the first date of the month succeeding the month of credit till the last date of the current year.

Note: Interest is separately calculated for the employee share and the employer share of the PF account.

Therefore, PF interest calculation formula= (Sum of PF balance/12) X (Rate of interest/100).

Closing balance of a given year = Opening balance of the year + Contributions of the given year – Withdrawal of the given year + Interest of the given year.

PF interest calculation example

- For the year 2014-2015, the PF interest rate is 8.75%.

- The PF interest calculation is done separately on employee and employer share.

- Hence, contributions are calculated individually for each month on a running basis as shown below.

- For April, there is no contribution, which is reflected for May in the table.

- For May Employee’s contribution is 146 and Employer’s contribution is 44. This is reflected in June Interest Calculation.

- In June, Employee’s contribution is 504 and Employer’s contribution is 154. Thus, July interest calculation is a sum of May and June interest, i.e. 650 and 198.

- Similarly, keep adding the average monthly balance of each month.

- Now, use the PF interest calculation formula = (Sum of PF balance/12) X (Rate of interest/100).

- Moreover, Closing Balance = Opening balance of the year + Contributions of the given year – Withdrawal of the given year + Interest of the given year.

Download PF interest rate calculator.

Watch the full detailed explained in the video below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!