A partnership is a relation between two or more people who agree to share profits of the business carried on by all or anyone acting for all. This article explains the provisions of the Partnership Firm including LLP (Limited Liability Partnership) from the viewpoint of taxation. The article deals with the basics of Partnership Firm/LLP, slab rates, treatment of interest, remuneration, profits and losses for the firm and its implication on the partners, and various tax planning schemes for the partnership firm.

Table of Contents

Definition

It is very important to understand the difference between a Partnership Firm and an LLP. However, from the point of view of tax, it is very much similar. Hence, they are covered under the same sections.

| Partnership Firm | LLP |

| Unlimited liability | Limited liability |

| No legal status | Separate legal entity |

| Governed by Partnership Act, 1932 | Governed by Companies Act |

| Maximum 100 partners | No limit on maximum partners |

| Name as decided by partners | Must suffix LLP after the name |

Income tax slab rate

| Tax rate on Profit from business and profession | Flat 30% + 12% surcharge if Net Taxable income>1Cr + 4% Health and Education Cess |

| Long term capital gain | 20% |

| Short Term Capital Gain 111A | 15% |

| Long Term Capital Gain 112A | Refer link |

Provisions of taxation for Partnership Firm/LLP and its implications in the hands of Partners

This can be better understood through the following table:

| Particulars | Partnership Firm/LLP | Partners |

| Interest on capital | Allowed as per Section 40(b) | Exempt to the extent allowed u/s 40(b) |

| Remuneration | Allowed as per Section 40(b) | Exempt to the extent allowed u/s 40(b) |

| Share of Profits | Taxable | Exempt u/s 10(2A) |

| Share of Loss | Carried forward by the firm | Not allocated to the partners |

| Bonus | Allowed as deduction | Exempt |

| Commission | Allowed as deduction | Exempt |

Important point to be cautious:

In case of death or retirement of a partner, the firm will be eligible to carry forward the share of losses of the existing partners only and not of the deceased/retiring partner. However, it can claim a share of unabsorbed depreciation of the deceased/retiring partner also.

Tax Planning

Interest on Capital – Section 40(b)

Interest on partner’s capital and the loan is allowed at a maximum of 12% per annum simple interest as per Section 40(b) if the following conditions are satisfied:

- It should not be retrospective. That is, it should be of the period falling after the date of the partnership deed.

- It should be authorized by the deed.

Remuneration to partners – Section 40(b)

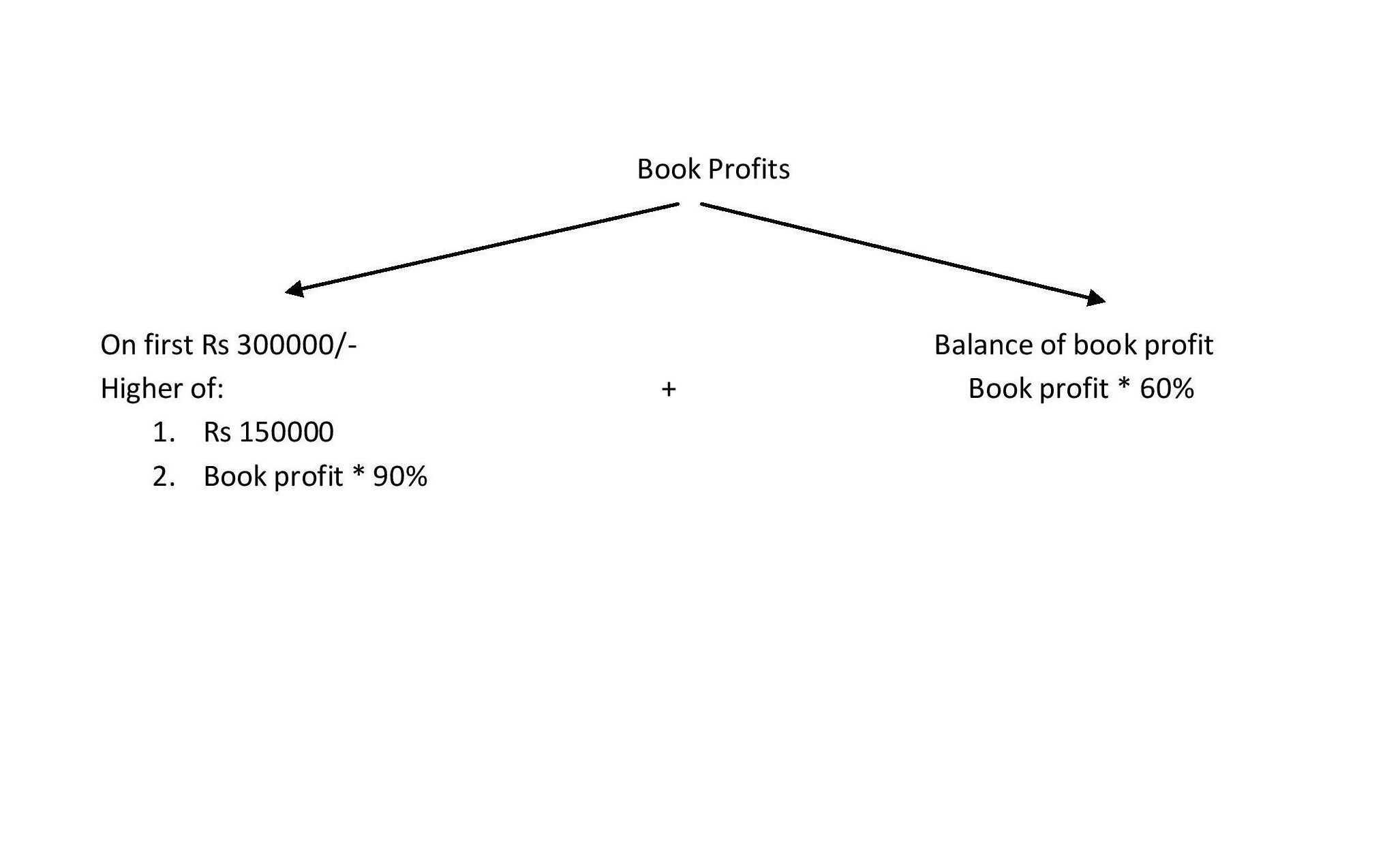

Remuneration is allowed on a Book Profit basis.

It is calculated as follows:

Gross Receipts from the business or profession

- (-) All other expenses

- (- ) Interest on Loan/Capital

- (-) Depreciation current year/brought forward

- (+) Remuneration if any debited to P&L

In simpler terms, it is Profit before remuneration.

Following conditions must be satisfied to claim the deduction:

- Remuneration is allowed to working partners only.

- It should not be retrospective. That is, it should be of the period falling after the date of the partnership deed.

- It should be authorized by the deed.

To illustrate,

A, B, and C partners sharing profits in the ratio of 4:3:3 having the capital of Rs 4 lakh, 3 lakh, and 3 lakh respectively. The firm earned profit before interest and remuneration of:

Case I – Rs 2,70,000

Case II – Rs 10,00,000

Hence, the remuneration is calculated as follows:

| Particulars | Case I | Case II | |

| Net Profit | 270000 | 1000000 | |

| (-) | Interest on Capital @12% | 120000 | 120000 |

| Book Profit | 150000 | 880000 | |

| Remuneration allowed | Higher of i)150000 ii) 90%*150000=135000 that is 150000/- | Higher of i)150000 ii) 90%*300000=270000 + 60%*580000= 348000 That is 618000/- |

Deductions allowed to a Partnership Firm/LLP

Section 80G – Donations

Kindly note that donations under this section are not allowed if the donation made in the cash is more than Rs 2000.

Section 80GGA – Donations in respect of scientific research and rural development

100% of the donation is allowed for deduction. If the amount > 10000, then the mode of payment should be other than cash. Since Section 35 allows the deduction relating to scientific research under the head of business and profession; they cannot claim deduction under section 80GGA.

Section 80GGC – Donation to Political Parties or Electoral Trusts

Any person other than the Indian Company can claim a 100% deduction of the donation made to a political party or electoral trust if it is made in a mode other than cash.

Section 80JJAA – Deduction in respect of employment of new employees

Any assessee having turnover > 1 Cr can claim a deduction of 30% of the additional employee cost paid for three consecutive years. Additional employee cost means the total emoluments paid to the additional employees employed during the previous year. Therefore, in the case of an existing business, if there is no increase in the total number of employees, then additional employee cost shall be NIL.

Points to be cautious:

- Emoluments to be paid other than by cash.

- An additional employee does not include

- An employee whose emoluments > 25000 per month

- Employment days is < 240 days in the year (in case of manufacture of footwear, apparel, or leather products – 150 days)

- The employee does not participate in RPF.

- Employee’s entire contribution to EPS is paid by the government.

Section 80JJA – Deduction for income from collecting biodegradable waste

Assessee can claim 100% deduction of income for 5 consecutive years from the year in which the business is commenced if the profits are derived from the business of processing and collecting biodegradable waste for:

- Power generation

- Produce biofertilizer or biopesticides or biogas

- Making pallets or briquettes for fuel

- Organic manure

Section 80IAC – Deduction for new start-ups – only for LLP and not partnership firms

- Assessee is a company or LLP engaged in the business

- Of innovation, development & improvement of product, process or service

- Has the high potential to generate employment or wealth

- Holds certificate from Inter-Ministerial Board of Certification

Can claim a deduction of 100% of profit derived from the startup for any 3 consecutive years out of 10 years from the year in which the startup was incorporated.

Points to be cautious:

- The Year of Incorporation should be after 01/04/2016.

- Turnover should be up to 100Cr in the previous year in which deduction is claimed.

- It should be a new business and not split or reconstitution of existing business.

- At least 80% of the plant and machine should either be new or imported.

- Mandatory Audit by a Chartered Accountant.

Presumptive tax scheme – only for partnership firms, not LLP

- Every Resident Individual, Resident HUF and Resident Firm

- Whose turnover does not exceed Rs 2 Crore

- Can offer tax on presumptive basis i.e Gross Receipts/Turnover * 8%

- If Gross Receipts/Turnover is routed directly through the bank then T/O * 6%.

- No requirement to maintaining books of accounts and audit.

Points to be cautious:

- Not applicable on 44AE Business, Agency business, Commission & Brokerage business.

- The assessee cannot claim a deduction of expenses separately.

- If the assessee does not claim the benefit of Section 44AD in one A.Y. and gets his books of accounts audited then he is not eligible to opt presumptive tax scheme for the next 5 consecutive assessment years.

- If the firm opts for 44AD, then it cannot claim a deduction of interest and remuneration separately.

Conclusion

To sum up, a Partnership Firm/LLP can conveniently adopt the basic points and appropriate deductions wherever applicable. Tax planning is an important concern for partnership and proper planning of tax should be the cardinal point of all partnership firms to avoid government interventions. However, it is always advisable to seek professional advice wherever necessary.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!