EPF provides free life insurance of up to Rs 7 lakh to all its members. This is known as EDLI. This article lists PF EDLI benefit – its eligibility, the premium involved, and the process of claim.

Table of Contents

What is the PF EDLI Scheme?

EDLI stands for Employee Deposit Linked Insurance. Thus, it links one’s PF deposit to their life insurance. It is one of the three schemes under EPFO, the other two being EPF and EPS. The EDLI scheme link to the EPF and EPS saving schemes as it provides life insurance to all employees who subscribe to EPF by their employers. The EDLI scheme was launched in 1976. However, it underwent major amendments in 2016, 2018, and 2020. The notification for the last amendment being released in April 2021 only. PF EDLI benefits all the members subscribed to EPFO, thus being a group insurance scheme.

PF EDLI Contributions

Who pays the premium?

The employee does not contribute a single penny to PF EDLI. Meanwhile, it is the employer’s responsibility to contribute the PF EDLI premium on behalf of the employee monthly.

How much is the premium?

The employer is entitled to pay 0.50% of employee PF wage (i.e., DA and basic salary of employee). For example, if an employee’s wage is Rs 10,000 then their employer will contribute 0.50% of 10,000 which is Rs 50 towards their EDLI account. EDLI benefit has a cap at Rs 75, that is maximum contribution can be Rs 75 in a month. Generally, companies do not calculate EDLI contributions individually for employees. Rather they calculate an amount basis of all employees in the firm.

To learn PF EDLI calculation from the employer’s point of view, visit our LPTI Courses on Android App and iOS App.

Eligibility and Coverage

EDLI scheme eligibility

As long as one is a member of EPF, one is eligible for EDLI benefits. The PF member will receive insurance coverage for their full employment duration as well. However, some establishments may have a separate group insurance for their employees, which provides better benefits than EDLI. Such establishments will be exempt from EDLI. But these are very few.

EDLI benefit common misconception

There is a misconception that an employee needs to have minimum 12 months of continuous service to claim EDLI benefit. However, that is not true. While the EDLI benefit may reduce drastically if an employee’s service is less than 12 months, it won’t be completely nil. An employee can receive some EDLI benefits even before completing 12 months of service. EDLI also provides complete coverage for employees be it accidental death, work-related, non-work related, etc.

EDLI Scheme Benefits

- Claim amount under this scheme is 30 times the employee’s salary (i.e. DA + Basic Salary)

- A bonus of Rs. 1,50,000 is also payable at the time of claim.

- The quantum of coverage under this scheme directly links to the employee’s salary.

- The premium payable for this scheme is the same for all the employees.

- Neither age nor any other factors affect the eligibility of the employee for this scheme.

- If an employer finds a better insurance policy for his employees, then he can opt out of this scheme under Section 17(2A).

How To Calculate PF EDLI benefit?

Important points regarding calculation

Before calculating PF EDLI benefit, one needs to check if employee’s service duration is more or less than 12 months. Along with if employee’s date of expiration is before or after 15th February 2020. Depending on these two factors, the EDLI benefit calculation will occur.

Calculation for service > 12 months

If the employee’s service duration is over 12 months then EDLI benefit calculation is as per Section 2, Paragraph 3 of the PF EDLI scheme.

| Before 15th February, 2020 | After 15th February, 2020 | |

| EDLI Amount Calculation | 30 x average monthly PF wages (restricted to PF ceiling wages) + 50% of average EPF balance in the deceased employee’s account (subject to the ceiling of Rs.1.5 lakh) | 35 x average monthly PF wages (restricted to PF ceiling wages) + 50% of average EPF balance in the deceased employee’s account (subject to the ceiling of Rs.1.75 lakh) |

| Maximum Possible EDLI Amount | 4,50,000 (say, 30 times of monthly wage of 15,000) + 1,50,000 (say, 50% of average EPF balance at limit) = Rs 6,00,000 (i.e. maximum allowable amount) | 5,25,000 (say, 35 times of monthly wage of 15,000) +1,75,000 (say, 50% of avearge EPF balance at limit) = Rs 7,00,000 (i.e. maximum allowable amount) |

| Continuous Service | Subject to continuous 12 months of service in a single establishment | Subject to continuous 12 months of service in multiple establishments |

| Example | Employee’s Average Salary is Rs 10,000 and Average EPF Balance is Rs 1 lakh | Employee’s Average Salary is Rs 10,000 and Average EPF Balance is Rs 1 lakh |

| EDLI Calculation | = 30*10,000 + 50%*1,00,000 = Rs 3,50,000 | = 35*10,000 + 50%*1,00,000 = Rs 4,00,000 |

Calculation for service < 12 months

If employee’s service duration is less than 12 months then EDLI benefit calculation is as per Section 22, Paragraph 1 and 4 of the PF EDLI scheme.

| EDLI Amount Calculation | 1.2 X (Average balance in account of deceased during the period of membership (Maximum 50,000) + 40% of amount in excess of 50,000 (Subject to ceiling of 1 lakh )) |

| Maximum Possible EDLI Amount | Rs 1.8 lakh, theoretically |

| Example | Employee’s closing balance is Rs 23,837 and Average EPF Balance is Rs 15,000 |

| EDLI Calculation | = 1.2*15000 = Rs 18,000 |

PF EDLI Benefit Claim Process

Who can claim?

- The EDLI benefit can only be claimed if the deceased employee was actively employed at their time of death.

- The EDLI amount can be claimed by the employee’s nominee, no questions asked, if the employee has filed a nominee. Learn how to file PF nomination in Nomination Form of PF – Offline & Online Nominee Update Process.

- If there is no nominee or eligible family member, then the legal heir can take the claim. This also requires some hassle like court certification to prove their claim. If the legal heir is minor then the claim can go to their guardian.

- If the nominee has expired or has not been named, the employee’s next of kin can claim the amount.

- Claims cannot be made by the eldest son or married daughters with living husbands.

How to claim the EDLI benefit amount online?

- To claim PF EDLI benefits, the nomination form has to be completed.

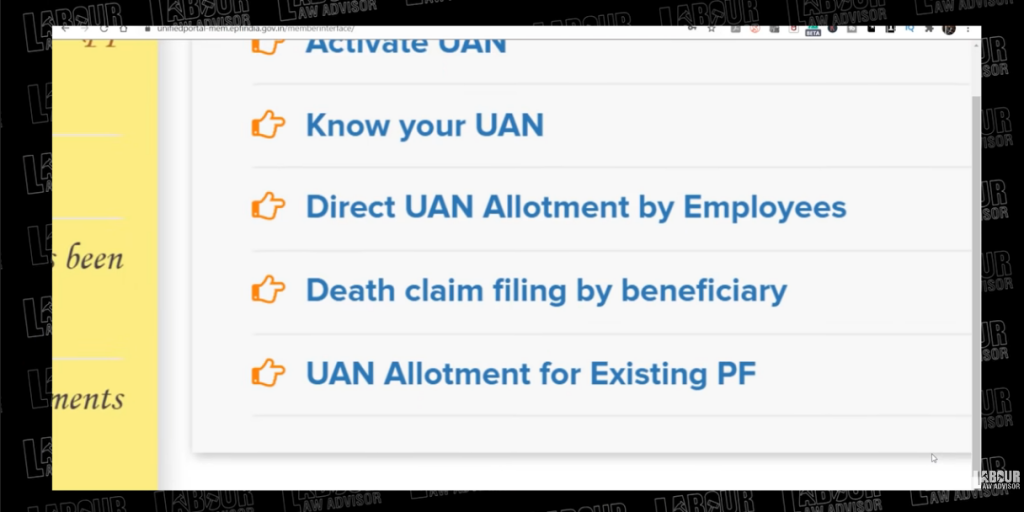

- Next, nominee has to visit the EPF employers’ portal and click on Death Claim Filing By Beneficiary on the bottom right of the homepage.

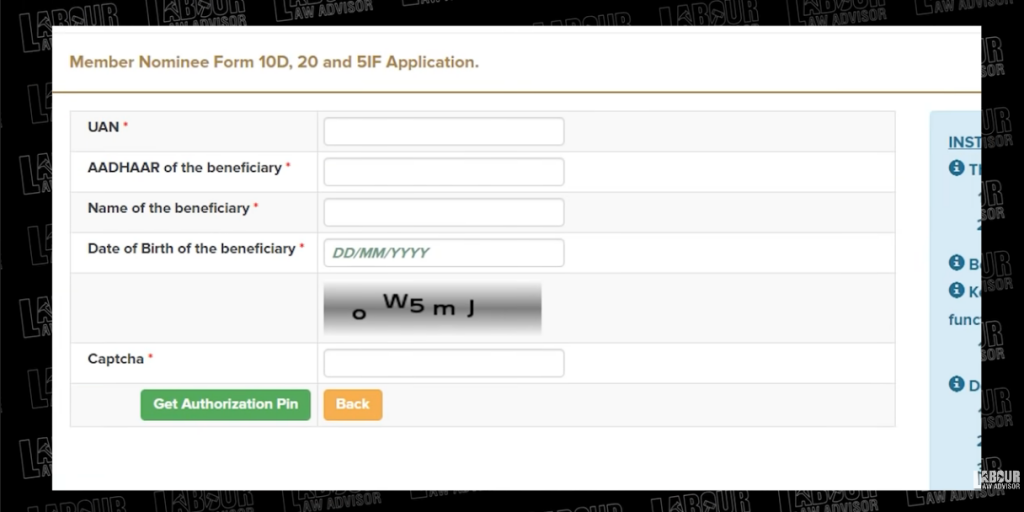

- Login to the next page by entering details of the nominee such as UAN, Aadhaar, name, date of birth and Captcha. This will send an OTP on the Aadhaar registered mobile number to complete the login verification.

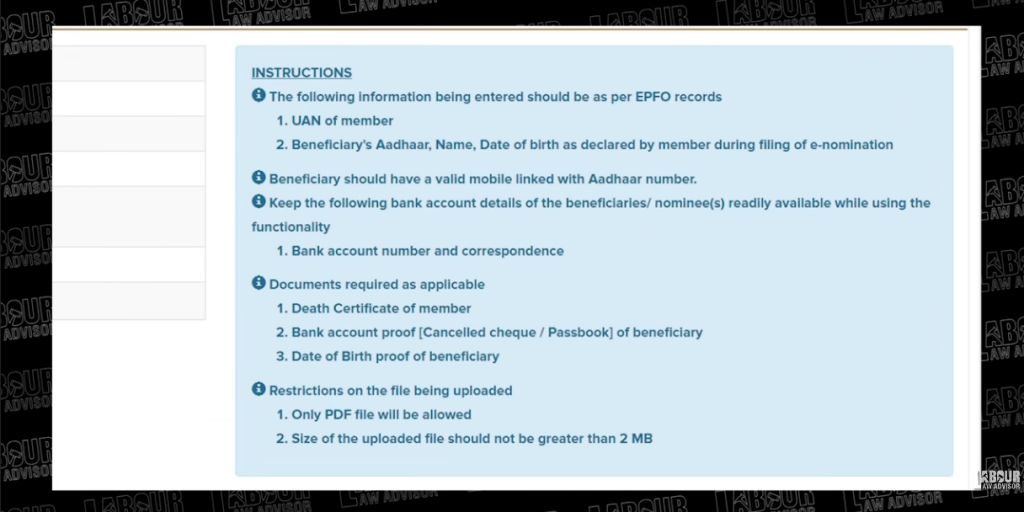

- The following documents appearing on the right side of the page need to be kept ready by the nominee to complete the claim process.

- It is also important here that the employer has to fill the Reason for employee’s service exit as Death In Service or Death Away From Service. Only then can the nominee claim PF EDLI benefits. Death in service is applicable if employee passes while at work and Death away from service otherwise.

- Nominee has to fill out the remaining form details after logging in and click on Submit.

- Then nominee must use his e-Sign to authenticate the claim. Nominee can also check the progress report of the claim. Generally, the claim is settled within 30 days.

How to claim the EDLI benefit amount offline?

- In case the EPF member’s nomination has not been filed then nominee has to apply for claim offline.

- For this, nominee must download the Composite Death Claim Form.

- The following documents need to be attached with the form –

- Employee’s death certificate

- Joint photograph of claimants

- Scheme certificate if applicable

- Copy of cancelled cheque or attested copy of first page of bank passbook, for bank verification

- Next, the form and all documents need to be signed and stamped by the employer and submitted at the local EPFO office. If the establishment has shut down, then signature of a Gazette Officer or Bank Manager can be taken with permission.

- If everything submitted is error-free, then EPFO will settle the claim within 30 days. Else EPFO will have to pay 12% interest.

No response after filing claim form

If nominee has filed the claim form correctly and still not gotten any response then they can

- file a grievance on the EPF Grievance Portal

- else they file an RTI

- or file a complaint on PM Complaint Portal

Important things to do

As an employee

- File your EPF nomination form

- Inform your family or nominee about the EDLI scheme details

- Inform family or nominee about your UAN and other PF account details

As an employer

- If an employee expires at your establishment, then put his reason of exit as Death In Service or Death Away From Service only.

- If an employee is terminally ill or suffers an accident and is unable to attend work then mark him as absent and fill out his PF challan as nil. But do not mark his establishment exit date as the day he stops coming to work due to illness. The exit date should be the employee’s expiration date.

Also, please check out our helpful video guides on this topic below:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!