CIBIL stands for Credit Information Bureau (India) Limited. CIBIL is the first-ever credit information company of India which began in August of 2000. The main work of this organization is to collect and maintain the credit records of all individuals as well as commercial firms. All credit related to borrowing and repayments of any loan, such as car loan, home loan, education loan or credit card loan, is included in this. On the basis of these, the CIBIL score’s calculation is made which is a 3-digit number to represent one’s credit history. More important than what is CIBIL score, is the question: Why should you care about yours?

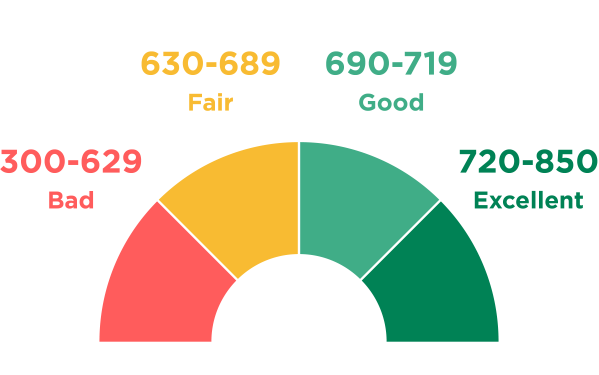

CIBIL score’s calculation appears on the basis of one’s credit report with all of their credit history. The CIBIL scores lie between the range of 300 to 900. The higher the score, the better. Hence, the closer the score to 900, the higher the chances of one’s loan getting approved. Similarly, the closer the score to 300, the higher the chances of the loan getting rejected. Having a CIBIL score above 750 is usually good.

Table of Contents

Why are CIBIL Scores important?

A good CIBIL score’s calculation has the following benefits:

- Upon applying for any loan, the lending institution checks one’s credit history to check their creditworthiness. This is done via the CIBIL score. A high CIBIL score calculation means lending money to that person will be a safe bet and the loan gets approved easily. However, a low CIBIL score calculation means the person is not reliable and the loan will get disapproved.

- A high CIBIL score calculation also helps in getting loans at a lower interest rate.

- A high CIBIL score means getting loan approval faster and hence loan money faster.

Factors affecting Cibil Score’s calculation:

- CIBIL gives 30% weight to one’s payment history for CIBIL score calculation. Delays in repayment of previous loans have a negative impact. Hence, try to repay any outstanding payments on time.

- Secondly, 25% weight is given to one’s credit exposure. Credit exposure means the ratio of your credit utilization. Thus, if your credit limit is Rs 1 lakh and you’re utilizing Rs 80,000, it means your credit exposure is 80% which is high. A high credit exposure negatively impacts the CIBIL score because it means you are credit hungry. Approx 30% usage of one’s credit limit is considered to be a safe zone.

- Thirdly, credit type and duration gets 25% weightage. This explains your previous types of loans taken, how they were utilized and how they were repaid. Having a higher percentage of secured loans, such as a home loan or car loan, is better than having unsecured loans, like credit card load.

- Lastly, multiple enquiries and other small factors get 20% weightage. Putting in a larger number of loan enquiries at the bank lowers the CIBIL score.

Watch our video on this topic below, and stay put for Part 2 of this blog, where we discuss how to check and improve your CIBIL score.

Also read: Open Demat Account With Zero Brokerage Fee

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!