CIBIL stands for Credit Information Bureau (India) Limited. CIBIL is the first-ever credit information company of India which began in August of 2000. CIBIL score calculation is a 3-digit number to represent one’s credit history. In a previous video, we explained in details why the CIBIL score is so important and the factors which affect it. In this article, we help you to check your CIBIL score and also suggest ways of improving your CIBIL score.

Table of Contents

Steps to check your CIBIL score:

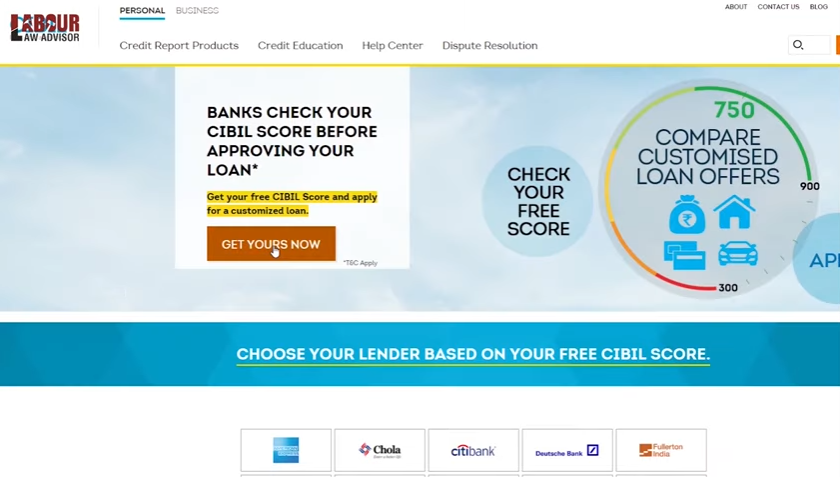

- Open the Google browser and search for “check your CIBIL score”.

- From the search results, go to the website – Free CIBIL Score and Report.

- Once the page opens, click on Get Yours Now.

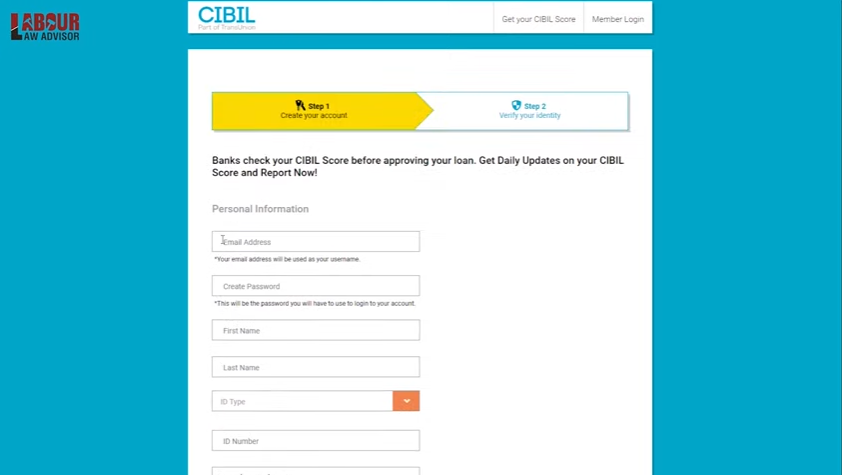

- The website will ask you to form an account, so fill in your details and verify your identity. Thus, your account will be ready in two steps.

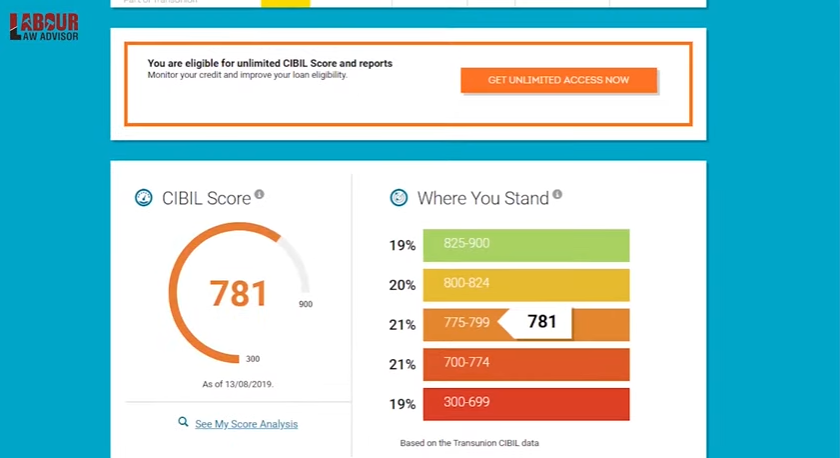

- As soon as your account is done, you can go to the dashboard and check your CIBIL score.

- The score appears automatically and reveals your standing as well. A score of above 750 is good while below 750 will result in higher interest rates for loans and difficult loan approvals.

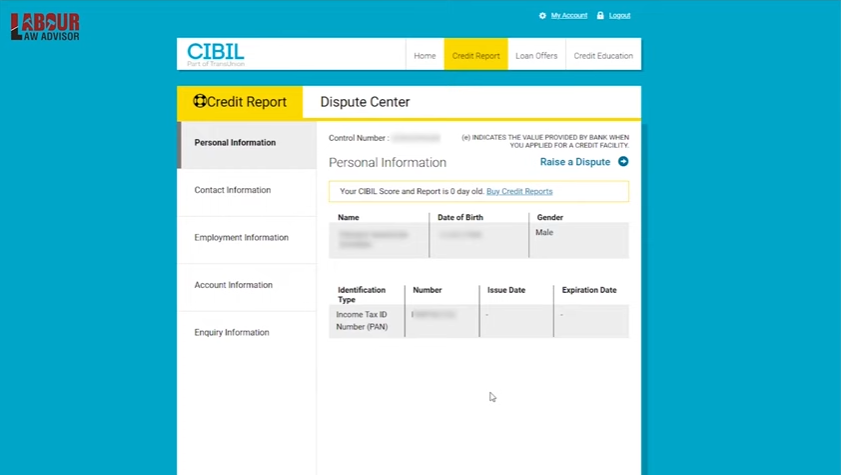

- To check your Credit Report, click on Credit Report on the toolbar. This will show your personal, contact, employment, account and enquiry information.

- Contact Information will showcase all the addresses submitted to all banks ever, by you.

- Account Information will showcase all the loans you have ever taken.

- Enquiry Information will reveal all the loan enquiries you have ever made in any bank.

- If your CIBIL score appears as NA or NH, then it means that either you have never taken out a loan or CIBIL has insufficient data about the loans you have taken to determine to CIBIL score.

How to improve your CIBIL score?

1. Repayment history

CIBIL looks into your past loan repayment history while calculating your CIBIL score. If this history for records shows that there was a

2. Credit exposure

Credit exposure is also known as credit utilization. This means that if you use your credit limitation completely or to a maximum, then your CIBIL score goes down because it reflects you as being credit hungry. Thus, it is always better to maintain a safe credit utilization of 30%. For instance, if your credit limit is Rs 1 lakh, then you do not use over Rs 30,000. Additionally, all your EMI payments and credit card payments should not be more than 40% of your income. Hence, you always want to show yourself as not craving for credit.

3. Credit mix

Credit mix means the types of unsecured loans and secured loans which you have. Having more unsecured loans than secured loans will lower your CIBIL score. Unsecured loans are credit card usage or personal loans while secured loans are car loans or home loans. It is advisable to limit your unsecured loans to 20% of your credit limit. Your monthly credit limit is half of your monthly income. For instance, if your monthly income is Rs 50,000 then your monthly credit limit is half of 50,000, i.e. Rs 25000. Hence, your repayment for unsecured loans like credit card and EMI should not exceed 20% of this 25,000, which is Rs 5000.

Similarly, if you take frequent loans over a short period of time then it reflects you as a person who is always on the lookout for taking more credit. Hence, try not taking multiple loans over a few months. Even if you require multiple loans, try keeping a gap of at least 6 months to a year between them.

4. Multiple enquiries

Even if you are no actively taking loans but enquiring about them in different places, then also CIBIL gets this information. Having multiple numbers of enquiries again reflects you as being credit hungry and thus, your CIBIL score gets a

5. Your name in documents

Having your name on the loan document for another person, where the other person delays repayments, will affect your CIBIL score. Having an add on credit card for which another person delays payment will also impact your score. Also, if you are someone’s loan guaranter and they default in the payment then your score goes down. Even having your name as a partner on a company which default any loan payment will affect your score. Thus, it is always better to be extremely sure before putting down your name as the guaranter for someone else’s loan.

6. Inaccuracies

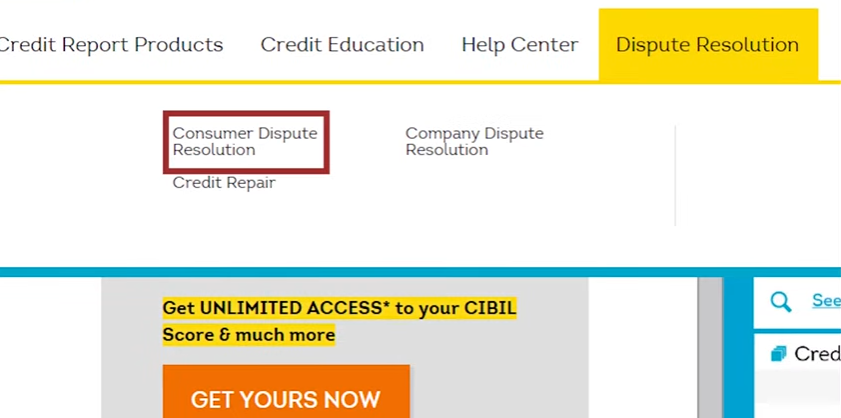

There is always a possibility of an inaccuracy on the bank or CIBIL’s end about your loan repayment status. You may have already cleared all loan repayments but CIBIL might think that you have some outstanding payments. In such a case you need to raise a dispute. For this, go to CIBIL’s website and click on Consumer Dispute Resolution under Dispute Resolution. After filing the dispute it will go to your bank for confirmation. If the bank accepts its mistake and rectifies it then CIBIL will restore your correct score.

7. Keep old credit cards

You must not close your old credit cards, especially where you have been doing all repayments on time. This is because all credit card history always impacts your CIBIL score and strong repayment history will help increase your CIBIL score.

8. Take loans

Another way to keep a check on your CIBIL score is to firstly take out loans which do not need CIBIL score approval and then repay them before the due date. This will make your repayment history better and keep a check on your CIBIL score. Such easy loans can be taken again your fixed deposit, shares, gold or assets.

Here’s a detailed video of this topic below.

Also read: What is CIBIL score and how it can get your LOAN rejected?

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!