In our ongoing series of Smart Stock Tips, we share all the necessary information regarding mutual funds investment. Unlike buying shares, when you buy mutual funds, you do not require a demat account or need a brokerage fee. All one needs is a phone number and a valid app and you can learn How To Invest In Mutual Funds online. So, in this blog, we will discuss how you can invest in mutual funds online with the Kuvera app.

Table of Contents

Learn How to Invest In Mutual Funds Online By Following These Easy Steps:

How to open your account?

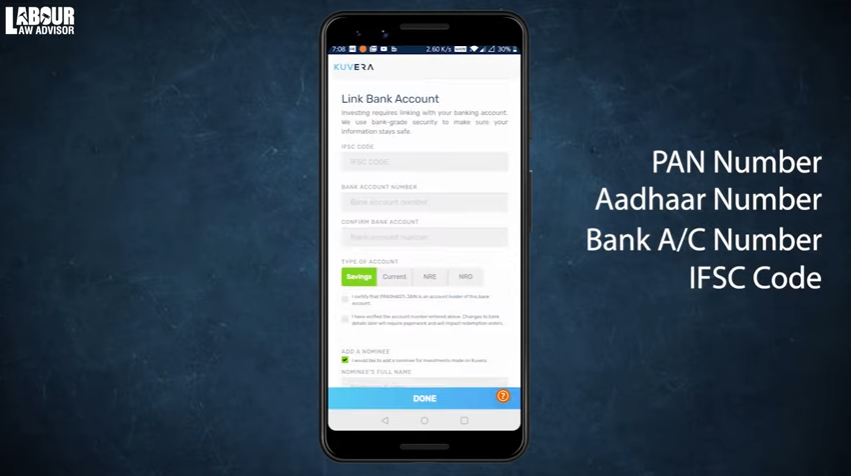

- Download the Kuvera, the mutual funds app.

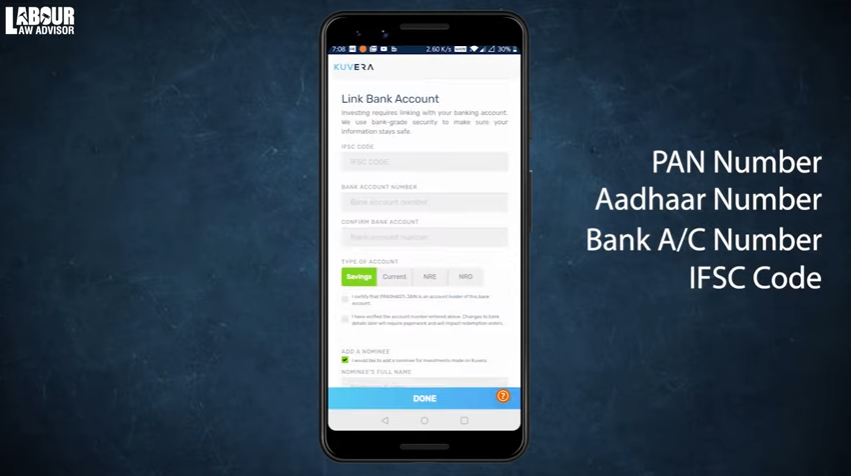

- Create your profile and add your bank details by filling in your PAN details, Aadhaar details, Bank account number, and IFSC code.

- Your account will be set up once all required details are submitted in the app.

How to set your investment goals?

- Go to Dashboard then scroll down to Goals. This sets your near and future goals to attain via your investments, which makes this app even more encouraging to use.

- Click on Add A Goal. You can choose from one of the predetermined goals or create your own goal.

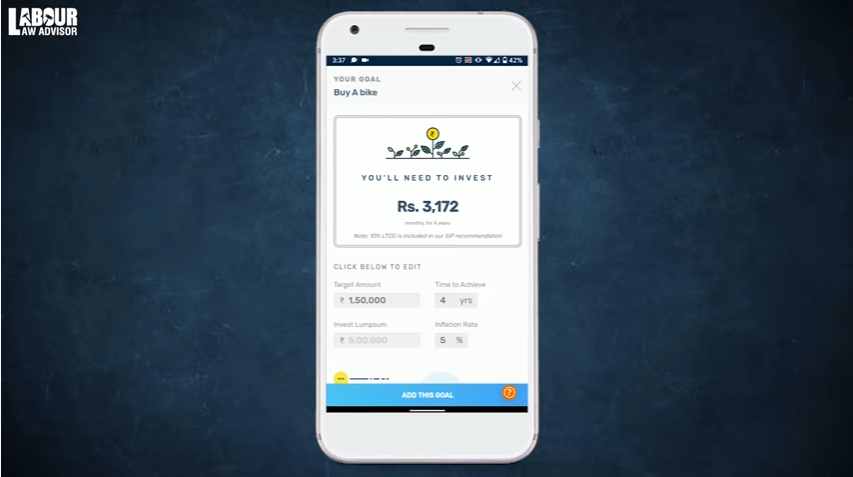

- Next, you will have to put in the amount you want to save and the duration for this goal achievement. You may choose not to invest anything upfront.

- Upon filling in these parameters, the app displays the monthly invest you need to do to achieve your goal.

- This monthly invest keeps the inflation rate in mind while procuring the amount.

- You can adjust the other parameters to get a lower monthly investment as well.

- When satisfied with the goal, click on Add This Goal.

How to buy mutual funds?

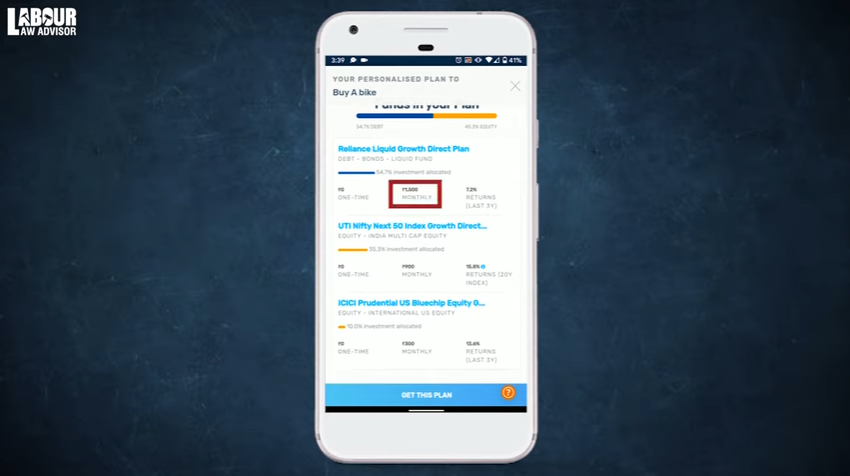

- According to the goals you set previously, the Kuvera app suggests certain mutual funds which you can invest online.

- You can click on each of the suggested funds to study them in-depth. This will give you details of the fund’s past performance, their objective, expense ratio, exit load, fund manager details, minimum SIP, top 10 holdings, and their returns.

- Then, click on Invest In This Fund to buy that mutual funds.

- Enter your monthly SIP amount, as suggested by the Kuvera app and leave the lumpsum amount blank. Click on Invest Now.

- You can select a specific date when the SIP amount is deducted from your bank. Then click on Place Order.

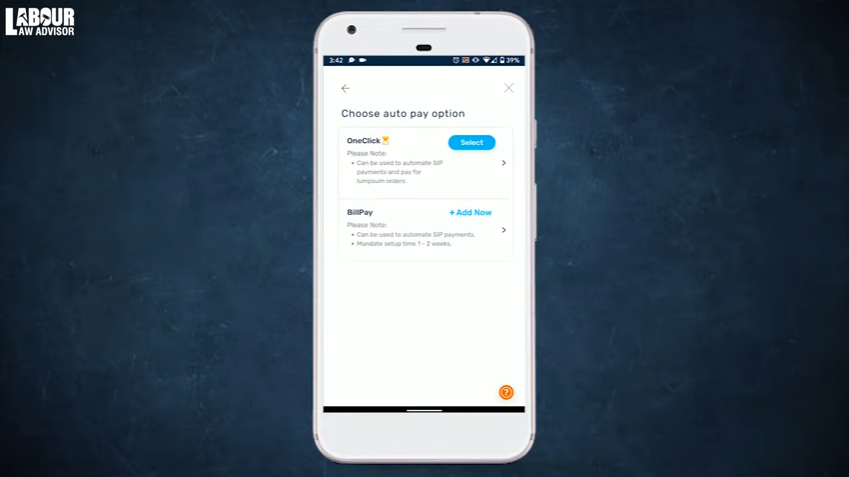

- Next, you need to select the bank for payment. You can choose the OneClick option to make your SIP payments automatic.

- Click on Place Order.

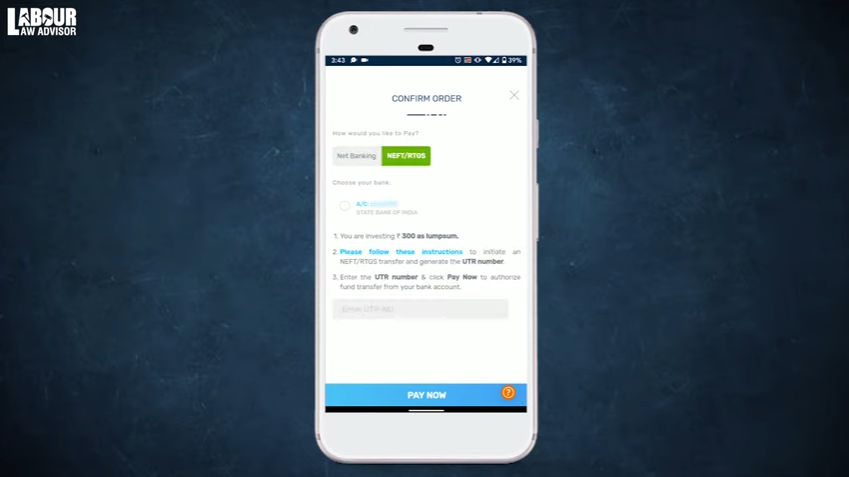

- Under Confirm Order, check your details and click on Continue Payment. You can choose between Net Banking or NEFT/RTGS for payment.

- For NEFT/RTGS payment option, choose your bank account again. This will send an Account Number to your email id, where you need to submit the SIP payment.

- This payment will generate a UTR number.

- Enter that UTR number on this page and click on Pay Now, to finally buy your mutual funds.

- If you choose the option for Netbanking payment, then also select your given bank account and click on Pay Now.

- Complete the payment on the net banking portal by submitting your id and password. Click on Confirm.

- Do not close this window since it will automatically redirect to the Kuvera app and your order is complete.

Track your goals:

- Once you invest in the mutual funds online, you get a message saying that it will take 2 days for your investment to begin.

- But the NAV (Net Asset Value) assigned to your funds will be of the day you buy the mutual funds only.

- You can click on Goals from the dashboard to see your investment progress.

- You can also Update Your Goal with a new amount or time period, which will reflect the new monthly investment and mutual funds options.

- Additionally, you can add multiple such goals.

- You also have the option to invest without setting any goals, by going to Explore Funds from the Menu.

- Click on the mutual

funds options available online and choose to invest in any.

By the way, did you know you could make a whole lot more if you knew the difference between regular and direct mutual funds?

Watch a detailed tutorial for this process below.

Also read: How to Open Demat Account With Zero Brokerage Fee.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!