There have been new suggestions and changes recommended for the EPF Act. This has now taken the form of the EPF Amendments Bill, 2019 and been introduced to the public domain for a month for discussion. We have already witnessed the Labour Code on Wages become an Act and are now awaiting the remaining labour codes to become Acts. These Labour Codes though do not currently include the EPF Act, ESI Act and Shop & Establishment Act. In this article, we will discuss the proposed amendments in the EPF Amendments Bill.

Table of Contents

Overview

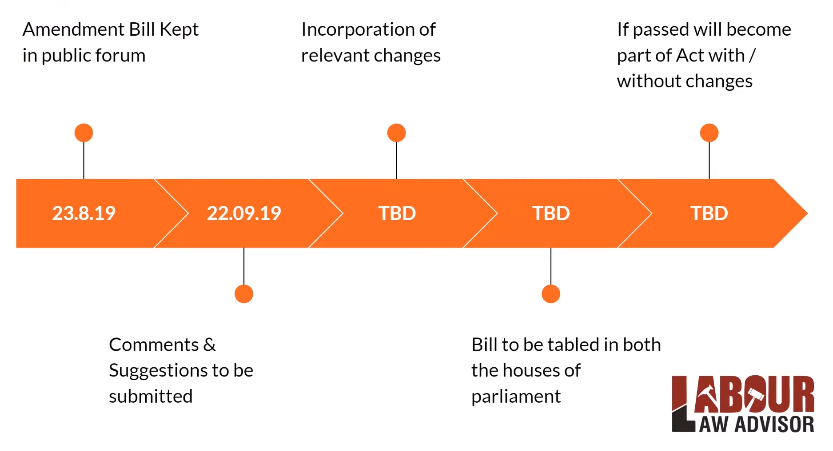

This proposed EPF Amendments Bill was brought forth on 23rd August 2019. It is open to the public for discussion and suggestions until 22nd September 2019. The original document can be found below.

Proposed changes in the EPF Amendments Bill, 2019:

1. Definition of Wage

The definition of Wages has been borrowed from the recently passed Code on Wages Bill. This states that basic, dearness and retaining allowances will be counted as Wages. Meanwhile, bonus, the value of house accommodation and similar allowances, conveyance allowance, TA, HRA, OT, commission, retrenchment, special expenses, will not come under Wages. Thus, no PF would be applicable to them. The sum of allowances cannot exceed 50% of the wages. Else the excessive amount will be counted under wages. Since the Wages definition is being taken from the Code on Wages, the bifurcation of Minimum Wages will not be possible and the reduction of PF liability cannot happen.

Any production bonus being paid on the bilateral or unilateral act in the establishment would have to be under PF liability. Since, among exclusions, only the bonus payable under any law has been kept outside the ambit of wages. These changes will increase the PF contribution liability for both employee and employer. Thus, it will reduce the takeaway salary of the employee.

2. Different contribution rates for employees

A new provision in Section 6 gives the Central Government the chance to change the PF contribution rates of employees. This change in rate can happen for any class of employees for a certain period of time. This change of rates would also depend on age, income, gender, etc. of the employees. Meanwhile, the employer PF contribution rates will remain constant. This change will be flexible for the employees, wherein they can still can more than the reduced rate of PF contribution.

3. Period of limitation for 7A and enquiry

Similar to the ESI Act which has a limitation period of 5 years and the Income Tax Act with limitation period of 7 years, the EPF Act will now have a limitation period of 5 years. Thus, the PF department cannot make an enquiry on an employer for any records above 5 years. Furthermore, all ongoing enquiries by PF department need to be conducted and concluded within 2 years. Otherwise, the central commissioner will have to

4. Other amendments

- In case of a company going bankrupt or insolvency, the company has to prioritize the PF payments over any other debt. So, if the company’s assets were to be sold, the first payment from that money would go towards their pending PF contribution.

- Most penalties proposed earlier have been increased ten times.

- Now, there is also the provision of employees to opt-out of EPS and enrol into the NPS (National Pension Scheme). A detailed guideline for this transition is awaited.

What comes next for the EPF Amendments Bill?

- The EPF Amendments Bill entered the public forum on 23rd August 2019.

- The EPF Amendments Bill is open to public suggestions until September 22nd 2019.

- Once all the suggestions are in, a few of the good suggestions will get incorporated into this bill.

- Next, this bill will be tabled in both the Lower and Upper Houses of Parliament.

- Once the bill is passed, it will become an official Act.

Impact of the EPF Amendments Bill?

- The PF contributions by employers and employees will increase.

- Employer harassment by PF authorities will decline. Since the

definition of wages and limitation period are now clearly given. - The flexibility of employee contribution rates will help employees comply with PF rules.

How to send your suggestions?

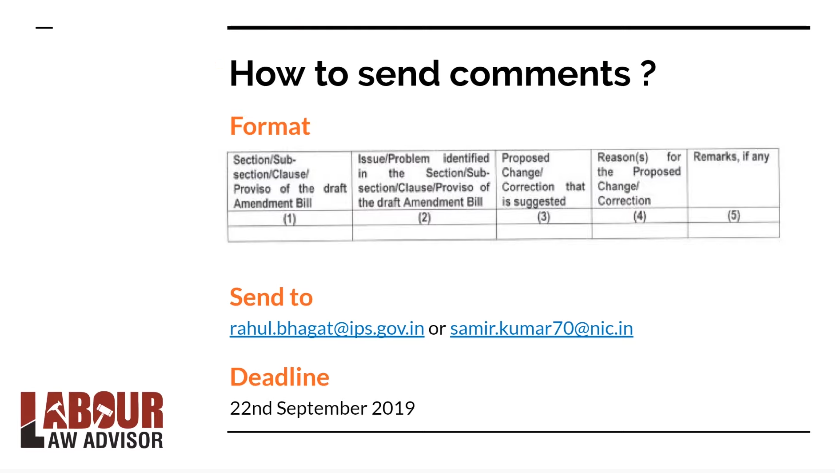

Create a format as given below and write down your suggestions in it. Then mail it to either rahul.bhagat@ips.gov.in or samir.kumar70@nic.in. Deadline for this is 22nd September 2019.

Watch our detailed video on this below.

Also read: 5 PF Decisions From The Central Board Of Trustees Meeting

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!