Are you tired of the relentless insurance sales pitches and empty promises? Do you feel like insurance agents are always after your hard-earned money, leaving you skeptical about the entire industry? Well, you’re not alone in your doubts and concerns. We’re about to embark on a journey into the complex and often mysterious world of insurance. This blog is dedicated to unraveling the truth behind the curtain of the insurance industry, and in the process, we’ll debunk some common misconceptions that have given insurance a less-than-stellar reputation. We will journey through the nuances of a system that touches us all and uncovers the realities of financial profit, deception, and their impact on those who have dreamt of retiring with dignity and security. This blog aims to shed light on exploring some tax-free mutual funds with capital guarantees in ULIPs.

Table of Contents

What are the Sneaky Tactics Lurking in Finance?

The financial world is often depicted as a realm of trust and responsibility, where individuals entrust their hard-earned money to institutions and professionals with the expectation that their financial interests will be protected. Unfortunately, this idealized image is not always reflective of reality, as tales of deceptive practices continue to emerge. One such story revolves around the mis-selling of insurance plans, highlighting the vulnerability of unsuspecting customers and the consequences of misplaced trust in financial institutions.

- The Old Man’s Tale:

Imagine the story of an elderly man, who, after years of diligent work and tireless effort, decides to secure his savings by creating a Fixed Deposit (FD) at his local bank. He walks into the bank with dreams of financial stability during his retirement years. However, what unfolds is a case of gross misrepresentation and financial deceit, as the banker entrusted with his financial well-being diverts his hard-earned money into an insurance plan with a 5-10-year lock-in period.

- Deception and Misrepresentation:

Rather than fulfilling his fiduciary duty to the old man, the banker persuades him to invest in an insurance plan with the promise of guaranteed interest income. The salesman’s pitch is enticing – deposit just once, and you will receive a steady stream of income, with the added benefit of flexible access to your funds whenever you desire. It sounds like an ideal scenario, particularly for an individual in their retirement years, seeking financial security and peace of mind.

Yet, beneath this façade of financial security lurks a troubling reality. The elderly man, unaware of the consequences of his decision, is led to believe that he has made a wise and conservative investment choice. In truth, his money is now locked away for a substantial duration, while the insurance plan he has been sold might not align with his financial needs or objectives.

- The Irony of ‘Guaranteed’ Income

The concept of ‘guaranteed’ interest income can be misleading, as it often hinges on the performance of underlying assets within the insurance plan. These underlying assets may be subject to market fluctuations and other factors that can influence the actual returns received. What is marketed as a guarantee can often be less secure than expected.

- Lack of Accessibility

Another concerning aspect is the claim of access to funds ‘whenever you wish.’ In practice, this access can be severely restricted by the lock-in period, and any premature withdrawals may result in penalties, reduction in returns, or even a complete forfeiture of the invested funds. This contradicts the initial promise of accessibility and leaves the elderly man in a precarious position.

The miss-selling of insurance plans, such as the one encountered by the old man in this story, is a poignant example of the deceptive practices that can occur within the financial sector. It underscores the importance of vigilance and understanding when navigating the complex world of financial products and services. Consumer education, regulatory oversight, and ethical conduct within the financial industry are essential elements in protecting the interests of individuals like the old man who seek financial security and trust that their investments will be handled with integrity. It is a reminder that in the financial world, trust should be met with responsibility, and guarantees should be met with transparency.

What are the Risks of Mis-Sold ULIPs and How Can Financial Education Empower You?

In a world rife with financial complexities and jargon, unsuspecting individuals often find themselves at the mercy of unscrupulous practices. It’s a story that happens all too frequently, where well-intentioned people walk into a bank, hoping to secure their financial future, only to be deceived into investing in something entirely different from what they had in mind. Such instances of deception, like the one involving the mis-sold Unit Linked Insurance Plans (ULIPs), serve as a stark reminder of the dire need for financial education and consumer awareness in the world of personal finance.

- The Shocking Reality

Picture the elderly man who had visited the bank with dreams of financial security during his retirement. He thought he was investing in a Fixed Deposit (FD), but when he returned to withdraw his funds, he received a shocking revelation. The FD he thought he had created had turned into a 5-year locked-in investment scheme, requiring annual premium payments, a far cry from the one-time deposit he had initially agreed to.

- The Deceptive Game

The banker’s sales pitch had promised guaranteed returns and easy access to funds, but the actual reality was quite the opposite. What transpired was a blatant misrepresentation of the investment product and a cruel twist of events that left the elderly man in a precarious financial situation.

- The True Face of ULIPs

ULIPs, or Unit Linked Insurance Plans, are complex financial products that combine insurance and investment elements. They are typically marketed as a one-stop solution for financial security and growth. However, the devil lies in the details. ULIPs often involve long lock-in periods, annual premiums, and underlying investments that can be subject to market risks. The old man had unknowingly fallen victim to a mis-sold ULIP, an unfortunate reality for many who find themselves ensnared by the false promises of such schemes.

- The Need for Financial Education

This story serves as a poignant reminder of the dire need for financial literacy and consumer awareness. In a world where financial products can be overwhelmingly complex, individuals must equip themselves with the knowledge to make informed decisions. It’s crucial to understand what you’re investing in, the terms and conditions, and the potential risks and rewards.

- Empowerment through Knowledge

The power of financial education is undeniable. By educating oneself about the intricacies of financial products, individuals can make informed choices and protect themselves from deceptive practices. The old man’s tale is a testament to the immense consequences of financial illiteracy and the importance of ensuring that financial institutions operate ethically and transparently.

The mis-selling of ULIPs to the elderly man in this story underscores the urgency of consumer education and the need for regulatory vigilance in the financial sector. The loss suffered by the deceived individual serves as a stark reminder of the consequences of unchecked deception in finance. By arming ourselves with financial knowledge and demanding transparency and ethics from financial institutions, we can take a stand against deceptive practices, ensuring that no one’s life is unnecessarily destroyed by financial schemes. Knowledge is the most potent weapon we possess in this realm, and it is our collective responsibility to ensure that no citizen falls victim to such deceitful financial practices.

How can you achieve financial flexibility and security for you and your family?

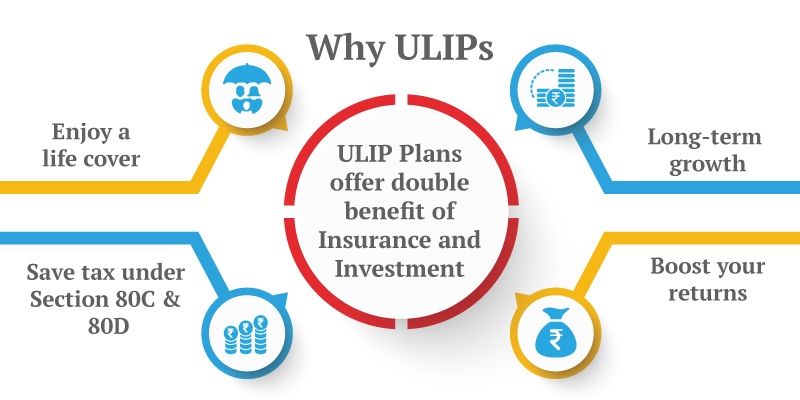

The world of finance is complex and ever-evolving, often leaving individuals searching for financial instruments that provide both growth and security. Concept of accessibility in your investments and the unique advantages offered by Unit Linked Insurance Plans (ULIPs). ULIPs, when used wisely, have the potential to empower individuals and their families, making them a valuable addition to your financial portfolio.

- The Importance of Accessibility

In the realm of personal finance, accessibility is a fundamental requirement. You work diligently to build a secure financial future for yourself and your family. However, life is unpredictable, and unforeseen expenses can arise at any moment. Whether it’s a medical emergency, educational needs, or any other financial requirement, the ability to access your funds when needed is paramount.

- The Promise of ULIPs

Unit Linked Insurance Plans, or ULIPs, have gained popularity in recent years for their unique combination of investment and insurance components. They not only offer a means of wealth creation but also provide a safety net for your family in case of unforeseen events. ULIPs stand out as a flexible financial instrument that allows you to partially withdraw funds when required, making them a valuable resource during times of need.

- The Power of Partial Withdrawals

One of the most advantageous features of ULIPs is the flexibility they offer through partial withdrawals. This means that policyholders can access a portion of their invested funds whenever the need arises, without surrendering the entire policy. This financial flexibility can prove to be a lifesaver when faced with unexpected situations that demand immediate financial attention.

- Why Some Praise ULIPs?

Across the country, some individuals have recognized the potential of ULIPs as a smart financial strategy. These individuals have leveraged ULIPs to achieve their financial goals while simultaneously ensuring the security of their families. When used correctly, ULIPs can provide several benefits, including:

- Wealth Creation: ULIPs enable long-term wealth accumulation by investing in a range of equity and debt funds, aligning with various risk appetites.

- Life Insurance Coverage: The life insurance component of ULIPs ensures that your loved ones are financially protected, even in your absence.

- Partial Withdrawals: The ability to make partial withdrawals allows you to access your funds during emergencies, ensuring that your financial goals are not compromised.

- Tax Benefits: ULIPs offer tax benefits under Section 80C of the Income Tax Act, further enhancing their appeal.

- Empowering You and Your Families

Financial empowerment and security for your family are achievable through informed and strategic financial planning. Accessibility to your investments is vital, and ULIPs offer an effective solution to this challenge. By understanding the advantages and drawbacks of ULIPs, you can harness their power to empower yourself and ensure financial stability for your family. Remember, financial security is within your reach, and ULIPs are just one tool that can help you achieve it.

What is ULIP?

A Unit Linked Insurance Plan (ULIP) is a financial product that combines elements of both life insurance and investment. It is a popular choice for individuals looking to achieve long-term financial goals while also securing their lives and the financial future of their loved ones. Here’s an explanation of how ULIPs work and the tax benefits associated with them:

- Combination of Life Insurance and Investment:

- ULIPs offer policyholders both life insurance coverage and an investment component. When you invest in a ULIP, a portion of your premium goes towards providing a life insurance cover for you. The remaining portion is invested in various funds, which you can choose based on your risk appetite and financial goals.

- Tax Deduction Under Section 80C:

- One of the significant advantages of investing in a ULIP is the tax benefit it provides. The premiums you pay for your ULIP are eligible for tax deductions under Section 80C of the Income Tax Act, subject to certain limits. As of my knowledge cutoff date is September 2021, and the maximum tax deduction allowed under Section 80C was Rs. 1.5 lakh per financial year.

- Tax-Free Profits Under Section 10(10D):

- The returns and profits generated from your ULIP investment are typically tax-free under Section 10(10D) of the Income Tax Act. This means that any money received as a maturity benefit, including the sum assured and any additional fund value, is exempt from income tax. This tax benefit extends to both the investment gains and the insurance payout, ensuring that you can enjoy the full benefits of your investment.

It’s important to note that while ULIPs offer tax benefits, they are long-term investment and insurance products. Therefore, they may have lock-in periods and charges associated with them. Policyholders should carefully review the terms and conditions of the ULIP, understand the charges, and consider their investment goals and risk tolerance before investing in a ULIP.

Additionally, tax laws and regulations can change over time, so it’s essential to stay updated with the latest tax rules and consult a financial advisor or tax professional to ensure that you are making the most of the tax benefits associated with your ULIP investment. However, it is important to conduct thorough research, assess your financial needs, and consult with experts to determine if ULIPs are the right choice for your unique circumstances.

For those considering mutual funds as part of their investment portfolio, ‘How to Invest in Mutual Funds Online‘ provides a comprehensive guide to initiating investments with ease online. This resource is invaluable for beginners and seasoned investors alike, offering clear steps to diversify your investments effectively.

What factors should I consider to determine the right life insurance coverage?

- Income Replacement: The primary purpose of life insurance is to replace your income when you are no longer there to provide for your family. Calculate your annual income and consider how many years your family will need this support. A common approach is to aim for coverage that can replace your income for 10-15 years.

- Outstanding Debts: Take into account any outstanding debts such as mortgages, loans, or credit card balances. Life insurance can help settle these debts, preventing them from becoming a burden on your family.

- Education Expenses: If you have children, factor in the cost of their education. Determine the estimated expenses for their schooling, college, or any other educational pursuits.

- Day-to-Day Expenses: Consider the daily living expenses of your family, including utilities, groceries, healthcare, and transportation. Ensure that your life insurance can cover these ongoing costs.

- Special Needs or Goals: If you have specific financial goals for your family, such as buying a home, starting a business, or supporting a charitable cause, factor in the funds required to achieve these objectives.

- Funeral and Estate Costs: Account for funeral and estate settlement costs, which can be substantial. Having life insurance can alleviate the financial burden on your family during this emotionally challenging time.

- Inflation: As time passes, the cost of living rises due to inflation. Consider this when calculating your life insurance needs. What may be sufficient today may not provide the same level of financial security in the future.

- Existing Savings and Investments: Deduct your existing savings, investments, and any other financial assets from the total life insurance coverage needed. This will help you determine the gap that needs to be covered by your life insurance policy.

It’s important to remember that there is no one-size-fits-all answer to life insurance coverage. Your circumstances, including your age, family size, financial goals, and existing resources, will influence the appropriate amount of coverage. Regularly reviewing and adjusting your life insurance as your circumstances change is also essential.

Ultimately, life insurance is about providing peace of mind and security to your loved ones. By assessing your financial responsibilities and needs, you can make an informed decision on the amount of coverage that will ensure your family’s well-being and financial stability in the event of your passing.

Before finalizing your investment choices, familiarize yourself with common mistakes through ‘Investing in Mutual Funds – Avoid These 5 Blunders.‘ This insight will help safeguard your investments from typical errors, ensuring a smoother path to achieving your financial objectives.

How Can You Achieve Financial Peace of Mind?

Life insurance is a powerful financial tool that can provide significant benefits for your family, especially in ensuring that their lifestyle remains uninterrupted even in your absence. Let’s delve into some of the critical aspects of how life insurance helps in maintaining your family’s financial well-being:

1. Loan Repayment: Any existing loans, be it a mortgage, car loan, or personal loan, can create a substantial financial burden on your family after your passing. Life insurance can provide the necessary funds to repay these loans, ensuring that your loved ones are not encumbered with debt.

2. Income Replacement: As you mentioned, the primary objective of life insurance is to replace your income. By calculating the appropriate coverage, your family can receive regular income or a lump sum payout to maintain their standard of living. This means your children can continue their education in good schools, and the family’s lifestyle can be preserved.

3. Ensuring Daily Expenses: Life insurance can cover daily living expenses such as groceries, utilities, healthcare, and transportation. This financial support ensures that your family can continue with their daily routines and maintain their quality of life.

4. Special Goals and Aspirations: Life insurance can be tailored to meet specific financial goals or aspirations you have for your family. Whether it’s buying a home, starting a business, or contributing to a charitable cause, the payout from the policy can provide the necessary funds to realize these objectives.

5. Long-Term Financial Security: Life insurance can offer long-term financial security, typically spanning 15 to 20 years or more. This extended coverage period provides your family with a stable financial foundation, allowing them to plan for their future with confidence.

6. Educational Expenses: For parents, ensuring that their children receive a quality education is a top priority. Life insurance can cover the costs of tuition, books, and other educational expenses, ensuring that your children’s education remains uninterrupted.

7. Ongoing Maintenance: Life insurance can also cover the maintenance of assets like cars. The payout can be used to cover costs like car insurance, fuel, and maintenance, ensuring that your family can continue to use and enjoy their assets without financial worries.

In essence, life insurance acts as a safety net, preserving the financial well-being and lifestyle of your loved ones in the event of your demise. It provides a sense of security and peace of mind, knowing that your family will be taken care of, and their future will remain secure. Life insurance isn’t just a financial product; it’s a means of ensuring that your legacy and the well-being of your family endure, even in your absence.

What’s the Golden Rule of Personal Finance, and Why Should You Never Forget It?

In the complex world of personal finance, there are countless strategies and tools available to help you build wealth, secure your future, and achieve your financial goals. But before you dive into investments, savings accounts, and retirement plans, there’s one essential step that you must take—securing your family’s financial well-being with life insurance.

- The First Rule: Prioritize Life Insurance

Imagine your life as a complex financial puzzle, with many pieces that need to fit together perfectly. Among these pieces, life insurance is the cornerstone. It’s the first rule of personal finance because it ensures that your family’s financial future is protected, no matter what life throws your way.

- Calculating the Ideal Life Insurance Coverage

Determining the right amount of life insurance coverage can seem like a daunting task, but it’s crucial for achieving peace of mind. A general rule of thumb is to aim for life insurance coverage that’s 15 to 20 times your annual income. For example, if you earn 12 lakh rupees per year, you should ideally seek life insurance coverage between 1.8 crore and 2.4 crore rupees.

Why is this calculation significant? It’s because this level of coverage ensures that, in your absence, your family can maintain their current lifestyle, fulfill financial obligations, and achieve their long-term financial goals. Whether it’s paying off debts, funding your children’s education, or simply covering daily expenses, the life insurance payout provides the necessary financial foundation.

Is Life Insurance the Ultimate Pillar of Financial Security?

- Protecting Against Debt: If you have outstanding loans, such as a home loan or other financial obligations, life insurance can provide the funds needed to settle these debts, ensuring that your family doesn’t bear the financial burden.

- Income Replacement: The primary purpose of life insurance is to replace your income. If you’re the primary breadwinner, your family can receive a regular income or a lump sum payout to cover daily expenses and long-term financial needs.

- Maintaining the Family Lifestyle: With adequate life insurance coverage, your family can continue to live the life they’re accustomed to. This means they can pursue their goals, maintain their standard of living, and even enjoy life’s little pleasures.

- Planning for Special Goals: Life insurance can be tailored to help your family achieve specific financial objectives, whether it’s buying a home, starting a business, or supporting a charitable cause.

What’s the Immediate Action Required for your finances?

The essence of the first rule of personal finance is that life insurance should be a top priority. It’s an investment in your family’s future, ensuring that they remain financially secure, even in the face of life’s uncertainties. While you may consider various investment options and savings plans for the future, life insurance is the foundation that secures your family’s tomorrow.

Don’t wait for a better time; don’t put it off for another day. Purchase your life insurance policy today. It’s a tangible expression of your love and responsibility towards your family, ensuring that they can look forward to a secure and prosperous future, no matter what life may bring. In the world of personal finance, the first step is often the most crucial, and when it comes to your family’s financial well-being, there’s no time like the present to take that step.

Are ULIPs Worth It?

In the vast landscape of financial products, Unit Linked Insurance Plans (ULIPs) often pique the interest of individuals seeking a combination of investment and insurance. While ULIPs offer a range of features, one crucial aspect that deserves careful consideration is the life insurance coverage they provide. Critical exercise of assessing ULIP life insurance covers, comparing them with term insurance, and unraveling the complexities of premium payments.

- The Quest for Adequate Life Insurance

Life insurance isn’t just a financial product; it’s a promise of financial security for your loved ones. One fundamental principle of life insurance is that the coverage should be substantial enough to protect your family’s future, no matter when the unexpected may occur. A general rule of thumb suggests aiming for life insurance coverage between 15 to 20 times your annual income.

Term insurance is a straightforward and cost-effective way to achieve this level of coverage. For instance, with an annual premium of just Rs 20,000, you can secure a substantial life insurance cover of 2 crore rupees. The core benefit of term insurance lies in its ability to provide a high coverage amount at a relatively low cost.

- ULIPs: A Closer Look

Now, let’s focus on ULIPs. These financial instruments offer not only life insurance coverage but also the opportunity to invest in various funds. However, it’s essential to critically assess the life insurance component of ULIPs to understand the value they offer.

- The Case of an Exceptional ULIP

One particular ULIP with a monthly premium of Rs 2,40,000 provides a life insurance cover of 99.8 lakh rupees. This stands out, considering that many other ULIPs in the same category offer life insurance covers worth a fraction of that amount, typically around 25 to 26 lakh rupees.

- Comparing Premiums and Coverage

There’s a significant discrepancy in the life insurance coverage offered by this ULIP when compared to term insurance. With an annual premium of Rs 20,000, you can secure a term insurance policy with a coverage of 2 crore rupees. In contrast, the monthly premium of Rs 2,40,000 for a ULIP provides a substantially lower life insurance cover of 99.8 lakh rupees.

- The Decision-Making Process

When evaluating ULIPs for their life insurance component, it’s crucial to consider your individual financial goals and needs. While ULIPs offer the combined advantage of investment and insurance, the trade-off may involve a lower life insurance coverage compared to term insurance.

A prudent approach involves conducting a thorough assessment of your financial situation, considering your existing investments, your risk appetite, and your need for life insurance. In many cases, term insurance may offer a more cost-effective way to secure the necessary coverage, leaving you with additional funds to invest in other financial instruments that align with your goals.

The decision between ULIPs and term insurance should be based on a holistic evaluation of your financial objectives. While ULIPs offer a unique blend of investment and insurance, it’s crucial to scrutinize the life insurance component, ensuring that it aligns with your need for adequate coverage. Ultimately, the primary goal is to secure your family’s financial future, and the choice of the right financial tool can make all the difference in achieving that objective.

How Can Common Sense Revolutionize Insurance Premiums?

The world of insurance can often seem complex, with a myriad of factors influencing premium rates. However, at its core, insurance is about securing your financial future, and there’s a degree of common sense that can help guide your choices. How common sense can be applied when considering life insurance premiums, specifically focusing on the ballpark figure for securing substantial coverage and understanding the long-term commitment involved.

- The Common-Sense Ballpark Figure

When it comes to life insurance, a ballpark figure can provide a practical starting point for many individuals. For those in the age range of 28 to 33, a premium ranging from 20,000 to 30,000 rupees annually can secure a life insurance coverage of 2 crore rupees. This ballpark figure represents a common-sense approach to obtaining significant coverage without overextending your financial resources.

- Factors Influencing Premiums

It’s important to acknowledge that insurance premiums can vary based on a range of factors. These factors include your age, health condition, lifestyle choices, and habits such as smoking. Premiums are typically higher for older individuals and those with adverse health conditions, as the risk to the insurer is greater.

- Understanding the Long-Term Commitment

While the idea of paying a premium for life insurance might seem daunting, it’s essential to recognize that this commitment serves a crucial purpose. By making annual premium payments, you ensure that your family is financially secure, even in your absence. Life insurance is about planning for the long term, providing a safety net for your loved ones, and taking responsibility for their financial well-being.

- The Significance of Early Action

The common-sense notion that a person capable of paying 2 lakh rupees for one year can continue to pay premiums for the next 10 years underscores the importance of early action. The sooner you secure a life insurance policy, the more cost-effective it can be. Your age and health play a significant role in determining your premium rates. By obtaining life insurance in your late twenties or early thirties, you can secure substantial coverage at a relatively low cost.

- The Role of Financial Responsibility

Life insurance is an embodiment of financial responsibility. It’s a proactive measure to ensure that your family’s financial future remains secure. By committing to regular premium payments, you’re making a conscious choice to protect your loved ones, safeguarding their standard of living, and enabling them to pursue their goals, even in your absence.

The practicality of a ballpark figure for life insurance premiums, coupled with an understanding of the long-term commitment involved, underscores the significance of insurance in your financial planning. It’s a common-sense approach to securing your family’s future, ensuring that they have the resources needed to continue their lives without financial hardship. Life insurance isn’t just an investment; it’s a testament to your care and responsibility for those you love and a testament to your understanding of the importance of financial security.

Are High Premiums Hiding Deceptive Appeals?

In the world of personal finance, discussions about life insurance often revolve around premium payments and coverage. It’s a critical aspect of financial planning that warrants careful consideration. Delves into the intriguing idea of securing substantial life insurance coverage with relatively low premiums, emphasizing the importance of financial flexibility and long-term sustainability.

- A Common-Sense Ballpark Figure

Let’s begin with a concept that’s rooted in common sense: for individuals between the ages of 28 and 33, paying an annual premium ranging from 20,000 to 30,000 rupees can secure a substantial life insurance coverage of 2 crore rupees. It seems straightforward, but it’s a concept that demands closer examination.

- A Dilemma of High Premiums

Imagine you’re in your early thirties, earning a healthy income in the range of 12 to 15 lakh rupees per year. The thought of securing an 80 lakh rupees insurance cover might seem somewhat peculiar, even inadequate. After all, why would you need a coverage amount that’s not proportionate to your income and financial standing? It’s a valid question, but the path to securing the right life insurance isn’t always about the coverage amount alone.

- ULIPs: The Temptation of High Coverage

Unit Linked Insurance Plans (ULIPs) can be enticing, especially when they promise impressive coverage amounts, ranging from 1 crore to 2 crore rupees. But there’s a catch, and it’s a significant one: the premium payments. While the prospect of having a life insurance cover worth 2 crore rupees while paying only 1-2 lakh rupees annually is alluring, it’s important to consider the long-term implications.

- The Peril of High Premiums

Consider this scenario: you purchase a ULIP at the age of 30, during a period of financial stability and high earnings. You’re confident that paying premiums of 1-2 lakh rupees annually for the next ten years won’t be an issue. But life is unpredictable, and rough patches can come unannounced. It could be a job loss, a business slowdown, new financial responsibilities, or even a lack of the income growth you anticipated.

- The Struggle for Sustaining High Premiums

If your financial situation takes a downturn, sustaining high premiums becomes an immense challenge. The burden of paying 1-2 lakh rupees annually can quickly turn into a source of stress. Unforeseen emergencies or dilemmas may further exacerbate the situation, leaving you grappling with a cash crunch that makes premium payments increasingly burdensome.

- The Prudent Choice: Term Insurance and Separate Investments

In the quest for life insurance coverage, it’s essential to strike a balance between adequate coverage and manageable premiums. High-coverage ULIPs may offer an appealing proposition, but the ability to sustain premium payments through life’s ups and downs is equally significant. Your life insurance should not become a financial burden, but rather a source of security and peace of mind for you and your family regardless of the uncertainties life may bring.

Can Term Insurance Be Enhanced with Separate Investments?

When it comes to life insurance, choosing the right path can significantly impact your financial security. One of the choices you face is between bundled products like Unit Linked Insurance Plans (ULIPs) and the more straightforward approach of term insurance with separate investments. The compelling reasons why many individuals favor term insurance and distinct investment strategies over the complexity and risk associated with ULIPs.

- Simplifying the Premium Puzzle

The concept of life insurance premiums can be perplexing, especially when you’re torn between securing substantial coverage and maintaining financial flexibility. Let’s explore the scenario where common sense prevails, and you choose a more straightforward path to securing your family’s future.

- Term Insurance and Separate Investments: The Essence of Common SenseInstead of embarking on the complex journey of ULIPs, you opt for term insurance with separate investments. This choice aligns with the idea that a person who can comfortably pay 2 lakh rupees as a premium for one year can continue to allocate this sum for the next ten years. However, life can be unpredictable. A sudden downturn in your financial situation could make premium payments exceeding 20,000 rupees unmanageable.

- The Risk of High Premiums in ULIPs: ULIPs offer the combined benefits of insurance and investment. While they may seem appealing with their high coverage promises, they come with the burden of steep premiums. Committing to premium payments of 1 lakh rupees or more annually may become challenging during rough patches in life. This difficulty can be compounded if you face a job loss, business slowdown, new financial responsibilities, or insufficient income growth.

- The Role of Term Insurance: Term insurance offers a straightforward and cost-effective solution. When you purchase a term insurance policy at a young age, your premium is determined based on age, health, and the coverage amount. Importantly, it remains fixed for the entire term of the policy. This stability ensures that your life insurance commitment does not become a source of financial stress during challenging times.

- Financial Flexibility and Risk Mitigation: By choosing term insurance and separate investments, you retain financial flexibility. The premium for term insurance can be significantly lower compared to high-coverage ULIPs, leaving you with extra funds to invest in various financial instruments of your choice. This approach minimizes the risk associated with high premiums, ensuring that you can maintain your life insurance coverage, even during economic downturns.

In the realm of life insurance, it’s prudent to prioritize simplicity, flexibility, and risk mitigation. Term insurance and separate investments represent a common-sense approach that enables you to secure your family’s future without the complexity and potential financial strain of high-premium ULIPs. By making this choice, you ensure that your life insurance remains a source of security and peace of mind, regardless of life’s uncertainties. Remember, life insurance should be a safeguard, not a gamble, and term insurance is a popular and beneficial choice that aligns with this philosophy. It allows you to secure the coverage you need without the burden of high premiums, all while maintaining financial flexibility and control over your investments.

In the realm of personal finance, the choices you make regarding life insurance can significantly impact your financial well-being and that of your family. It’s a decision that calls for careful consideration. This blog explores the common pitfalls of mixing insurance and investment and emphasizes the importance of opting for the purest form of term insurance.

Can Term Insurance Be Enhanced with Separate Investments?

The world of insurance and investment products can be complex, and when the two are intertwined, as is the case with Unit Linked Insurance Plans (ULIPs), it can create a labyrinth of financial choices. The idea behind these bundled products is to offer the dual benefits of insurance coverage and investment growth. However, there’s a catch—this combination often leads to confusion and can prove costly in the long run.

- Avoiding the Common Mistake: One common mistake that many individuals make is adding unnecessary complexities to their financial portfolios by combining insurance and investment. This not only increases the overall premium but can also defeat the primary purpose of life insurance, which is to secure the financial future of your loved ones.

- The Cost of Mistakes: These mistakes can cost you dearly, potentially amounting to lakhs of rupees. As long as the policy is active, it continues to affect your financial situation, often leading to financial strain during challenging times.

- Embracing the Purest Form of Term Insurance: To protect yourself from these pitfalls, it’s essential to opt for the purest form of term insurance. This straightforward approach involves securing a life insurance policy that offers only protection, without any investment component. It’s the most effective way to ensure that your family’s financial future remains secure in case of unexpected events.

- The Clarity of Term Insurance: While term insurance is a simpler choice, it’s not entirely devoid of complexity. It’s important to understand the terms and conditions of the policy and avoid unnecessary complications.

- The Support of Comparison Tools: To make an informed decision, you can use comparison tools provided by platforms like Policy Bazaar. These tools allow you to compare term plans from various insurance companies, helping you choose the one that best suits your needs.

- The Link to Support Our Work: If you decide to purchase term insurance and want to support our work, you can use the provided link to visit Policy Bazaar. By doing so, you won’t incur any additional costs, and you might even receive discounts from time to time.

The Intersection of Insurance and Investment:

A critical aspect to understand in the context of ULIPs is the separation of insurance and investment components. While you pay a premium, it’s essential to recognize that only a small portion of this amount goes toward your actual life insurance coverage. The rest is invested.

- The Fate of Investment in Case of Lapsed Coverage

If you fail to pay your premium, your life insurance coverage may lapse, leaving your investment component in jeopardy. When the premium goes unpaid, the insurance aspect is affected, potentially leading to lapses in coverage. However, what becomes of your investment?

The answer to this question is both yes and no. The premium you pay represents only a fraction of your overall premium. The remainder is allocated for investments. So, if your insurance coverage lapses due to unpaid premiums, the investment component typically continues. However, it’s important to recognize that these investments are subject to market fluctuations, which can impact their growth.

The complexities of combining insurance and investment are best avoided. Opting for pure-term insurance ensures that your family’s financial security remains intact, even during unexpected events. Term insurance, when chosen wisely, provides the clarity and simplicity needed to secure your loved ones’ future without undue financial burdens. Using comparison tools like those offered by Policy Bazaar can help you make an informed choice and protect your family’s financial well-being.

Are ULIPs the Ultimate Investment Choice?

Unit Linked Insurance Plans (ULIPs) are financial products that offer a unique combination of insurance coverage and investment opportunities. One of the key aspects of ULIPs is the allocation of funds into various ULIP Funds, which resemble mutual funds. Structure of ULIP Funds, their resemblance to mutual funds, and how they operate within the framework of an insurance policy.

- The Landscape of ULIP Funds

ULIPs are provided by insurance companies, and each insurer offers a range of ULIP Funds, similar to the diverse mutual funds available in the market. These ULIP Funds encompass a variety of asset classes and investment strategies to cater to the varying risk appetites and financial goals of policyholders.

- Diversity of ULIP Funds: Within a single insurance company, you’ll typically find an array of ULIP Funds, each designed to suit different investment preferences. These may include equity funds, debt funds, hybrid funds, large-cap funds, small-cap funds, and mid-cap funds.

- Unit Allocation and Net Asset Value (NAV): When you invest in a ULIP, you are allotted units in the chosen ULIP Fund. The value of each unit is referred to as the Net Asset Value (NAV). NAV is a crucial metric, as it represents the current market value of the assets held within the fund. Similar to mutual funds, ULIP NAVs fluctuate based on the performance of the underlying assets.

Are Investments That Resemble Mutual Funds Catching Your Eye?

ULIP Funds closely resemble mutual funds in many ways, which can make them more familiar to investors.

- Portfolio Diversification: Both ULIP Funds and mutual funds offer diversification benefits. They pool money from multiple investors and spread it across a portfolio of assets. This diversification reduces the risk associated with investing in individual securities.

- Professional Management: ULIP Funds, like mutual funds, are managed by professional fund managers who make investment decisions based on the fund’s objectives and the prevailing market conditions. These experts aim to maximize returns while managing risk.

- Liquidity and Flexibility: ULIPs and mutual funds provide liquidity and flexibility. Investors can buy and sell units at NAV-based prices, allowing them to adjust their portfolios in response to changing financial goals or market conditions.

- Tax Benefits: ULIPs and certain mutual fund investments offer tax benefits. Under Section 80C of the Income Tax Act, the premiums paid for ULIPs are eligible for tax deductions. Additionally, returns from ULIPs are tax-free under Section 10(10D).

The structure of ULIP Funds mirrors that of mutual funds, providing a diverse array of investment options within an insurance framework. Understanding ULIP Funds and how they operate is crucial for policyholders seeking to align their investments with their financial objectives and risk tolerance. Whether you opt for ULIPs or mutual funds, these investment vehicles offer the opportunity to diversify your portfolio, access professional management, and work towards achieving your financial goals.

What Are the Hidden Costs Behind ULIPs?

ULIPs come with a specific fee structure that distinguishes them from mutual funds. In this essay, we will explore the charges associated with ULIPs, with a focus on premium allocation charges, policy admin charges, and how they’ve evolved over the years.

- Charges in ULIPs

ULIPs are known for their unique charge structure, which differs from the expense ratios typically associated with mutual funds. These charges play a vital role in determining the effectiveness of your investment and insurance plan.

- Premium Allocation Charge: In the early days of ULIPs, premium allocation charges were significant and could absorb a substantial portion of the premium paid by policyholders. For instance, these charges could amount to 10%, 20%, 30%, or even 50% of the premium. To put it in perspective, if you paid a premium of Rs 1 lakh, a 30% premium allocation charge would mean that only Rs 70,000 would be invested on day one. Fortunately, newer-generation ULIPs tend to have significantly lower premium allocation charges.

- Policy Admin Charges: Policy admin charges are incurred to manage the administrative aspects of your policy. These charges cover the basic office work required to keep your policy up and running. In the past, companies levied these charges without a fixed structure, and they are typically deducted every month. If your premium is paid annually, these charges are adjusted by redeeming units from your invested corpus.

- Evolution of Charges: In contrast to the earlier ULIPs, modern online ULIPs tend to have more transparent and reasonable charge structures. The premium allocation charges have been reduced substantially, making a more significant portion of your premium available for investment. Additionally, policy admin charges are now structured and disclosed, ensuring that policyholders have a clearer understanding of the deductions.

Understanding the charge structure of ULIPs is vital when evaluating these products for your investment and insurance needs. While older ULIPs had high premium allocation charges and less transparency regarding policy admin charges, the landscape has evolved. New-age online ULIPs tend to offer lower premium allocation charges and a structured policy admin charge, ensuring a more significant portion of your premium is invested. This evolution has made ULIPs a more attractive option for individuals looking to align their insurance needs with investment objectives while minimizing the impact of charges on their returns. However, it’s crucial to thoroughly examine the charge structure of any ULIP to make an informed decision about your financial future.

What Are the Hidden Charges in ULIPs and How Can You Decode Them for Financial Success?

- The Landscape of ULIP Charges

ULIPs are distinct for their charge structure, which sets them apart from traditional mutual funds. These charges have evolved over the years and play a pivotal role in determining the effectiveness of your investment and insurance plan.

- Premium Allocation Charge: In the early days of ULIPs, premium allocation charges were hefty and had the potential to significantly reduce the premium invested. For instance, a 30% premium allocation charge meant that only 70% of the premium was invested on day one. Fortunately, contemporary online ULIPs typically feature considerably lower premium allocation charges, making a more significant portion of your premium available for investment.

- Policy Admin Charges: Policy admin charges are levied to cover the administrative tasks associated with maintaining your policy. While these charges used to be unstructured in the past, they are now typically fixed and deducted every month. If your premium is paid annually, these charges are adjusted by redeeming units from your invested corpus.

- Fund Switching Charge: ULIPs offer a variety of funds, such as equity, debt, hybrid, large-cap, and small-cap. If you decide to switch from one fund to another, you may be subject to a fund-switching charge. However, most companies now allow at least one free fund switch per year.

- Premium Redirection Charge: This charge applies when you wish to redirect future premiums to different funds without changing your current investment mix. It used to be applicable in older ULIPs but is generally not present in modern online ULIPs.

- Current ULIP Charges

Today, the charge structure of ULIPs is far more transparent and investor-friendly. In modern ULIPs, three primary charges typically exist:

- Discontinuance Charge: If you decide to cancel your policy prematurely, you may incur a discontinuance charge. This charge is essential to consider before deciding to terminate your ULIP.

- Fund Management Fee: Similar to mutual funds’ expense ratio, ULIPs feature a fund management fee. IRDAI has capped this fee at 1.35%, ensuring that the charges remain within reasonable limits.

What’s the Real Deal with Mortality Charges?

ULIPs combine insurance coverage with investment opportunities, and at the heart of your insurance component lies the mortality charge. This charge is intrinsically linked to the core purpose of life insurance – to provide financial security in case of an unfortunate event.

- Calculation of Mortality Charges: The mortality charge is derived through a specific formula: Mortality rate x Sum at risk / 1000, further divided by 1/12. The reason for dividing by 1/12 is that these charges are deducted monthly.

- Understanding Mortality Rate: The mortality rate, which is an essential component of the formula, is determined based on the IRDAI-prescribed table. In simple terms, the more advanced an individual’s age, the higher their mortality charge will be. Similarly, a higher sum assured (the coverage amount) will result in higher mortality charges. This is logical, as the primary purpose of life insurance is to provide a financial safety net to the family of the policyholder in case of their untimely demise.

- Integration with Premium: It’s important to note that mortality charges are not separate fees that you need to pay. Instead, they are integrated into the premium you pay for your ULIP. When you pay your premium, it is invested in your chosen ULIP funds, and you are allotted units from these funds. From these allocated units, a proportionate number is deducted to cover your mortality charges. In essence, your insurance premium caters to both your investment and insurance needs.

Understanding the charge structure of ULIPs is crucial for making an informed choice about your financial future. The landscape of ULIP charges has evolved over the years, becoming more transparent and investor-friendly. Modern online ULIPs typically feature lower premium allocation charges and offer clear structures for policy admin charges. While older ULIPs were characterized by a range of charges, contemporary ULIPs have simplified the fee structure. Ultimately, by examining the charges associated with your ULIP, you can make informed decisions about your investments and insurance needs, ensuring that your financial future remains secure.

A critical aspect of investment assessment revolves around the tax implications and performance evaluation of mutual funds and ULIP funds.

- Tax Implications: The text suggests there is a loophole related to tax-free mutual funds and capital guarantees. This likely pertains to a scenario where certain mutual funds may provide tax benefits, such as tax-free dividends or long-term capital gains tax exemptions. However, it’s essential to understand that these tax benefits come with specific conditions and holding periods. If investors don’t meet these conditions, they might not enjoy the expected tax benefits.

- Performance Based on NAV Returns: The text mentions that the returns of both mutual funds and ULIP funds are based on NAV returns. Net Asset Value (NAV) represents the value of the assets within the fund, and the returns are calculated based on changes in NAV over time. This means that the returns are derived from the fund’s performance, and investors receive returns based on the change in NAV over specific timeframes, such as 1-year, 3-year, and 5-year periods.

- Caution in Performance Assessment: The text hints at the need for caution when assessing the performance of these funds. Here, it’s highlighting the importance of considering the tax implications while evaluating the returns of these funds. While a fund might appear to have attractive returns, investors should keep in mind that the tax treatment of these returns could affect the actual gains they receive.

- Impact on Capital Guarantees:

The deduction of mortality charges from the allotted units has a direct impact on the capital guarantees in ULIPs. Capital guarantees, if they exist in a ULIP, typically assure policyholders that they will receive at least the total premiums paid (minus any charges and deductions) upon maturity or in the event of the policyholder’s demise.

However, since mortality charges reduce the number of units held by the policyholder, this directly affects the overall value of the policy. In other words, the deduction of mortality charges can erode the capital guarantees because the policyholder might receive fewer units, and consequently, lower returns compared to what they might have expected based on the NAV alone.

For instance, if a policyholder paid a premium of Rs 1 Lakh and received 5,000 units with an NAV of Rs 20, a mortality charge of Rs 2,000 (deducted from the units) means that they effectively have fewer units in their account. This reduction in units could potentially lead to a lower payout upon maturity or in case of an unfortunate event.

How Do I Calculate Returns in a Mutual Fund?

With a Net Asset Value (NAV) of Rs 20 per unit, resulting in a deduction of Rs 2000 from 100 units, leaving the investor with 4900 units. It highlights that the per-unit price does not change, and returns are shown to investors based on this price, which is advertised. However, it suggests that this doesn’t reveal the actual NAV returns. Let’s break down the scenario to calculate the implications for investors:

Initial Investment:

- The investor’s initial investment is Rs 1,00,000.

- The NAV at the time of investment is Rs 20 per unit.

- Therefore, the investor initially purchases 1,00,000 / 20 = 5,000 units.

Mortality Charge Deduction:

- A mortality charge of Rs 2,000 is deducted from the investment.

- As a result, the investor loses 100 units from their investment (Rs 2,000 / Rs 20 per unit = 100 units).

- The remaining units after the deduction are 5,000 units – 100 units = 4,900 units.

Actual Investment Value After Deduction:

- The remaining investment value, after the deduction of the mortality charge, is Rs 1,00,000 – Rs 2,000 = Rs 98,000.

Implications:

- The per-unit price (NAV) remains at Rs 20 throughout the transaction.

- From the investor’s perspective, the per-unit price seems constant, and the advertised NAV doesn’t change.

- However, the investor ends up with fewer units (4,900) than they initially purchased (5,000) due to the deduction of the mortality charge.

Transparency Implication:

- The text suggests that this lack of apparent change in the NAV per unit may not reveal the actual NAV returns. In this case, the investor might believe that their investment value remains unaffected by charges, while, in reality, they have fewer units representing their investment.

This scenario highlights that the way returns are presented to investors in mutual funds, particularly in the context of NAV, may not always transparently reflect the deductions and charges that impact their actual investment. Investors should be cautious and thoroughly examine the details of their investment statements to understand the actual returns they are receiving after deductions and charges.

concerns regarding the expectations and reality associated with Unit Linked Insurance Plans (ULIPs) in the context of providing tax-free mutual fund investments with a capital guarantee. It emphasizes that these plans often appear as a combination of insurance and investment but may not deliver as promised. Let’s elaborate on this with an example:

Example Scenario:

Imagine an individual who invests in a ULIP, intending to secure both a life insurance cover and investment benefits. They pay a premium of Rs 1,00,000 per year for their ULIP plan. The plan is structured in a way that provides a life insurance cover of Rs 15,00,000, while the remaining Rs 85,000 is invested in various fund options within the ULIP.

Expectations:

- Tax-Free Mutual Fund Investment: The individual might expect that their investment component, the Rs 85,000 invested annually, would function as a tax-free mutual fund investment. In traditional mutual funds, long-term capital gains may be tax-free, and the investor anticipates similar benefits.

- Capital Guarantee: ULIPs are sometimes marketed as investment vehicles with a capital guarantee. This implies that the individual assumes their investment amount is safeguarded, and they can expect a return of their principal amount.

Reality and Challenges:

- Mortality Charges: ULIPs, as the text highlights, often come with mortality charges. These charges are deducted from the invested portion of the premium to cover the insurance aspect. This deduction effectively reduces the amount available for investment. In our example, the Rs 85,000 investment is subject to these charges, which can be significant depending on the individual’s age and the sum assured.

- Reducing Insurance Cover: ULIPs frequently have a decreasing insurance cover. In the example, even though the individual initially receives a life insurance cover of Rs 15,00,000, this cover might decrease annually, further affecting the premium allocation toward investment.

Implications:

- The individual may find that the returns on their investment portion, which they expected to be tax-free like mutual funds, are significantly lower than anticipated due to deductions for mortality charges.

- The decreasing insurance cover can result in a shift of premium allocation, affecting the investment component.

ULIPs can appear as a combination of insurance and investment that promises tax-free mutual fund-like returns with a capital guarantee. However, the reality may differ due to undisclosed aspects like mortality charges and decreasing insurance coverage. As a result, the tax-free mutual fund investment with a capital guarantee that ULIPs seem to promise may not be achievable in one’s lifetime. Investors should carefully evaluate the terms and conditions of ULIPs and consider the impact of charges on their actual investment returns.

Curious about ULIPs? Discover their key features and benefits.

ULIPs (Unit Linked Insurance Plans) indeed offer a unique combination of insurance coverage and investment benefits, which can be quite appealing to individuals who desire both financial protection and investment opportunities.

1. Insurance Coverage:

ULIPs provide a life insurance component, which ensures that in the event of the policyholder’s demise, a death benefit is paid out to the beneficiaries. This death benefit is a significant feature of ULIPs, and it is determined based on the highest of the following three factors:

a. Basic Sum Assured: This is the guaranteed amount that the policyholder’s beneficiaries will receive in the event of the policyholder’s death. It provides a foundation of financial protection.

b. Fund Value: The fund value represents the total value of the investments made within the ULIP, based on the performance of the chosen funds. This component can fluctuate based on market conditions and investment performance.

c. 105% of Premium: The death benefit can also be a minimum of 105% of the total premiums paid by the policyholder, ensuring a certain level of financial security.

2. Investment Benefits:

In addition to life insurance coverage, ULIPs allow policyholders to invest their premiums in various fund options. These funds can include equity, debt, or a mix of both, providing flexibility and the potential for wealth accumulation over time. The investment component offers the opportunity for growth and wealth creation.

3. Flexibility and Control:

Policyholders have the flexibility to choose how their premiums are invested, enabling them to tailor their investment strategy based on their risk tolerance and financial goals. They can also make fund switches if they wish to change their investment approach.

4. Tax Benefits:

ULIPs often come with tax benefits, including tax deductions on premiums paid and tax-free withdrawals upon maturity. These tax advantages can make them an attractive choice for tax-conscious investors.

5. Transparency and Disclosures:

While the text highlighted concerns related to undisclosed aspects of ULIPs, it’s worth noting that insurance providers are required to provide policyholders with detailed information about charges, deductions, and the terms and conditions of their ULIPs. This transparency allows individuals to make informed decisions regarding their investments.

ULIPs offer a balanced approach to financial planning by combining life insurance coverage with investment opportunities. They provide a death benefit to protect the financial security of the policyholder’s beneficiaries while allowing for investment in various funds to build wealth over time. While ULIPs may not provide the exact tax-free mutual fund investment with a capital guarantee that they may appear to promise, they do offer a comprehensive package for individuals looking to secure their financial future through a combination of insurance and investments. It’s essential for individuals considering ULIPs to carefully read the policy documents and consult with financial advisors to fully understand the terms and benefits.

- Challenging the Capital Guarantee Illusion in Insurance Policies

Scenario 1 – Misconceptions about ULIPs: In the first scenario, the text highlights a common misconception about ULIPs. It outlines a situation where an individual invests in a ULIP, expecting both an investment component and a life insurance cover. However, a crucial point emerges: if the total investment made by the individual is below the life insurance cover (i.e., the sum assured), and the individual passes away, the insurance company will only provide the life insurance amount and not the investment gains. This scenario challenges the belief that ULIPs guarantee a return of the total investment amount along with insurance coverage.

Scenario 2 – Fluctuating Premiums in Life Insurance: The text goes on to describe a different scenario involving a life insurance policy where the premium increases every year, eventually reaching 15 lakh. When the total investment surpasses the 15 lakh mark, the text points out that the life insurance cover ceases. If the policyholder passes away after this point, their family won’t receive a life insurance payout.

Key Takeaways

- Capital Guarantee Myth: The text appears to emphasize a potential issue with certain life insurance policies, specifically the misconception surrounding capital guarantees. Policyholders might assume that these policies guarantee the return of their invested amount, but this might not be the case, especially when insurance coverage and investment components are intricately linked.

- Premium Fluctuations: The second scenario highlights the dynamic nature of some life insurance policies, where premium amounts can fluctuate over time. This unpredictability can affect the expected insurance coverage and impact the policy’s capital guarantee.

- Challenging Expectations: The scenarios presented challenge the expectations individuals may have regarding the security and reliability of insurance policies. It’s crucial for policyholders to thoroughly understand the terms and conditions of their policies and the interaction between their investments and insurance coverage.

The scenario presented raises questions about the treatment of investments and insurance proceeds in the event of the policyholder’s demise. Let’s break it down:

Scenario 3: Total Investment Value and Insurance Payout

Suppose an individual has a total investment value of 50 lakhs in mutual funds. Additionally, they have a separate term insurance policy, which provides a life cover. In the unfortunate event of the individual’s passing, their family is entitled to receive the term insurance cover and the mutual funds that were held in the individual’s name.

Expectations:

- The individual has prudently separated their insurance needs from their investment strategy, understanding the importance of keeping these aspects distinct.

- The family expects to receive the term insurance payout, which is designed to provide financial security to the beneficiaries.

- They also anticipate the mutual funds to be transferred to their name, allowing them to access and manage the investments.

Reality:

- In this scenario, the family is set to receive the term insurance cover, which is a pre-determined amount specified in the insurance policy. This sum is intended to provide financial support to the family after the policyholder’s demise.

- Mutual funds, being an investment, have a different nature. Upon the policyholder’s death, these investments may pass to the beneficiaries or legal heirs, subject to the legal procedures and documentation.

- It’s unlikely that the mutual fund company will say on the day of the policyholder’s demise, “You have received 1 crore.” Instead, the family would need to follow the procedures outlined by the mutual fund company to transfer the investments to their name.

Key Takeaways:

- The scenario demonstrates the value of separating insurance and investments. Each serves a distinct purpose and requires a different approach to ensure financial well-being.

- While the term insurance payout is straightforward, the treatment of investments post-demise depends on legal and procedural considerations, and the family needs to be aware of these processes.

- It’s essential for individuals to have a clear understanding of how their investments and insurance policies work and to communicate their intentions to their beneficiaries to avoid misunderstandings and complications.

This scenario emphasizes the importance of maintaining clarity and separation between insurance and investments and highlights the need for informed decision-making and communication among policyholders and their beneficiaries. It also underscores the differences in the treatment of insurance payouts and investments in the event of the policyholder’s demise.

Are We Witnessing a Remarkable Drop in Mortality Rates?

In the scenario presented, the text highlights an unusual trend—the mortality charges in a popular ULIP decrease every year, contrary to the common expectation that they should increase with age. This raises questions and might appear counterintuitive to many.

The reason for this decrease is attributed to the annual payment of premiums. As you continue to pay your premiums every year, the overall liability the insurance company has toward you is reduced. Mortality charges in ULIPs are typically calculated based on two primary factors: your age and the sum assured (the insurance cover amount).

Let’s say you start with an annual premium of 1 lakh and a sum assured of 15 lakhs. In the initial year, the mortality charge is calculated based on the entire sum assured because, if a policyholder were to pass away on day one, the beneficiaries would receive the full 15 lakh sum assured. However, in the subsequent years, the previous year’s 1 lakh premium payment reduced the overall liability. This reduction in liability is reflected in the decrease in mortality charges.

- Key Takeaways

- Unconventional Mortality Charge Trend: The text unveils a non-standard trend in ULIPs, where mortality charges decrease over time. This defies conventional expectations and highlights the intricacies of insurance calculations.

- Effect of Premium Payments: Annual premium payments gradually reduce the overall liability of the insurance company towards the policyholder, resulting in a diminishing trend in mortality charges.

- Impact on Policyholders: Understanding how mortality charges work in ULIPs can help policyholders make informed decisions about their insurance and investment choices. It’s essential to grasp the underlying mechanics to avoid misconceptions.

The unusual decrease in mortality charges in ULIPs may challenge common perceptions, but it’s a result of the cumulative effect of annual premium payments. This information can empower individuals to make more informed choices regarding their insurance and investment strategies.

What’s the Dynamic Link Between Investment Value and Life Insurance Cover?

An intriguing connection between investment value and life insurance cover in ULIPs, shedding light on how this relationship evolves:

- In ULIPs (Unit Linked Insurance Plans), your annual premium payments have a dual role: they contribute to your life insurance cover (Sum Assured) and get invested in various funds.

- The text highlights a scenario where, over time, your investments yield returns, and the cumulative return amount becomes a significant figure, such let’s say, Rs 1,10,000.

- Deduction from Life Insurance Cover

- The deductions from your life insurance cover occur because the insurance company’s primary obligation is to pay the Sum Assured, typically specified in the policy, in the event of the policyholder’s demise.

- In the scenario presented, if the company has already received a return of Rs 1,10,000, it implies that they need to invest Rs 13,90,000 from their own funds to fulfill the total Sum Assured of Rs 15 lakhs in case of the policyholder’s death.

- Consequently, the new mortality charges are calculated based on the revised liability, which is now Rs 13,90,000, reflecting the decreasing risk to the insurance company due to the policyholder’s investments.

2. Mortality Charge Becoming Zero

- The text outlines an intriguing aspect of this process. With the continuing growth of investments and the subsequent deductions from the Sum Assured, there comes a point where the mortality charge reduces to zero.

- When the mortality charge becomes zero, it signifies that the cumulative investment value has exceeded the life insurance cover (Sum Assured). At this stage, your insurance coverage effectively ceases to exist because there is no longer any financial risk for the insurance company.

Implications:

- When the insurance cover effectively ceases to exist, the policyholder is no longer protected by the life insurance component of the ULIP.

- In the event of the policyholder’s demise after this point, the insurance company will pay out an amount equal to the highest of either the initial Sum Assured or the accumulated investment value.

Key Takeaway:

The text highlights the intricacies of ULIPs, where the relationship between investment value and life insurance coverage evolves over time. As investments grow, they reduce the insurance company’s risk and liability, eventually leading to a point where life insurance coverage becomes practically redundant. This dynamic process underlines the importance of understanding how ULIPs function, as well as the implications for policyholders when their investment value surpasses the original life insurance cover. It’s crucial for individuals to comprehend these mechanisms to make informed decisions regarding their insurance and investment strategies.

Curious About ULIP Mortality Charges?

Essential insights into ULIP (Unit Linked Insurance Plan) mortality charges, the promises some ULIP sellers make, and the significance of the time value of money. Here’s a breakdown of these concepts:

- The Decreasing Mortality Charge Misconception

- ULIP sellers sometimes market the decreasing trend in mortality charges as a positive aspect, claiming that eventually, it will reach zero. They suggest that the refunded amount at the end of the policy term is essentially ‘free money.’

2.The Time Value of Money

- The text introduces the concept of the time value of money, which is crucial for understanding the fallacy in the decreasing mortality charge argument. This concept acknowledges that the value of money changes over time due to factors like inflation and investment opportunities.

Why the Decreasing Mortality Charge Argument Falls Short:

- The text emphasizes that merely refunding a deducted charge in the future doesn’t make it ‘free’ or equivalent in value to the money paid initially. It points out that the money’s value diminishes over time, meaning you can buy fewer things with it if it’s returned after a significant delay.

3. The Reality of ULIP Mortality Charges

- The text sheds light on ULIPs where the policyholder receives either the life insurance cover amount or the investment returns upon death, but not both. It’s highlighted that such ULIPs are less common, and many people may not even be aware of their existence.

4. Additional Charges in ULIPs

- The text briefly touches on additional charges in some ULIPs, such as the increasing mortality charge, the impact of GST, and other undisclosed fees that may reduce the policy’s overall benefits.

The key takeaway here is that understanding the time value of money is essential when evaluating financial products like ULIPs. While some aspects of ULIPs may appear favorable on the surface, the actual value of money and the return on investment need to be considered over time. The decreasing mortality charge might not be as beneficial as it initially seems, and additional charges could further erode the policy’s benefits.

This information serves as a valuable reminder to approach financial decisions with a clear understanding of how they will affect your financial well-being over the long term.

What are the Implications of the ULIP Lock-In Period?

The concept of the lock-in period in ULIPs (Unit Linked Insurance Plans), highlights the following key points:

- Lock-In Period in ULIPs

- In ULIPs, policyholders cannot access their invested money for the first five years. This is known as the lock-in period, and it is a mandatory feature of ULIPs.

2. Two Scenarios During the Lock-In Period

- Premium Non-Payment: If a policyholder is unable to pay the premium before the completion of the first five years, their life insurance coverage ceases, as previously mentioned. The invested money is paused, and it is moved to the discontinued fund, where it accrues interest at a rate similar to a savings bank.

- Cancellation Request: If a policyholder wishes to cancel their ULIP policy between the third and fifth year, they will incur a double penalty. They lose their life insurance coverage, and the growth of the investment is intentionally halted. The money is transferred to the discontinued fund.

3. Discontinuance Charge

- After the completion of the lock-in period (i.e., after five years), if a policyholder decides to discontinue their ULIP, they must pay a discontinuance charge. This charge is levied to cover administrative expenses and any losses incurred by the insurance company due to the discontinuation.

4. Implications for Policyholders

- The lock-in period ensures that policyholders commit to their ULIP for at least five years before they can make any withdrawals or cancel the policy without penalties.

- During the lock-in period, policyholders should be aware that their investment growth may be impacted if they cannot continue paying premiums or wish to cancel their policy.

Understanding the lock-in period in ULIPs is crucial for policyholders. It’s a commitment period where policyholders cannot access their funds or cancel the policy without repercussions. Those who fail to pay their premiums or wish to cancel during this period face penalties and a cessation of their life insurance coverage. After the lock-in period ends, a discontinuance charge may be incurred if the policyholder chooses to discontinue the ULIP.

The lock-in period is a significant feature of ULIPs that requires careful consideration by policyholders to ensure they make informed financial decisions that align with their long-term goals and financial stability.

What’s the Real Cost Difference Between Fund Management Charges in ULIPs and Mutual Funds?

Concept of fund management charges in ULIPs (Unit Linked Insurance Plans) and mutual funds, shedding light on the key differences:

- Fund Management Charges – ULIPs

- Fund management charges are fees associated with managing the investments in ULIPs.

- In ULIPs, you entrust professional fund managers with your investment, who allocate your money into various funds, stocks, or bonds to generate returns.

- These charges are essentially the fee for the expertise and experience of fund managers who aim to generate returns on your investment.

2. Fund Management Charges – Mutual Funds

- Mutual funds also charge fund management fees, which are essentially the expense ratio. This is a percentage of the fund’s assets that goes toward covering the costs of managing the fund.

- In mutual funds, experienced fund managers are responsible for selecting and managing the securities within the fund’s portfolio to achieve the fund’s investment objectives.

- The expense ratio in mutual funds covers various expenses, including management fees, administrative costs, marketing, and other operational expenses.

Key Differences

- Purpose of Fund Management Charges:

- In ULIPs, fund management charges are associated with the active management of your investments with the aim of generating returns. This fee compensates professionals for their expertise in managing your investment.

- In mutual funds, the expense ratio covers a broader set of expenses, including the management fee but also other operational costs related to running the mutual fund.

- Rate of Fund Management Charges:

- In ULIPs, the fund management charges can vary but are typically lower compared to mutual funds. The rate is often around 0.5% for the discontinued fund.

- In mutual funds, the expense ratio can vary widely depending on the type of fund and its asset size, but it can be higher than the fund management charges in ULIPs.

- Investment Approach:

- ULIPs often offer a combination of insurance and investment, and the fund management charges reflect the expertise required to manage the investment component.