While we often discuss investment plans which are great options for the future, there are also some investment plans which are terrible. In this article, we go in-depth into one such investment plan which one should refrain from, ULIP.

Table of Contents

What is ULIP?

ULIP stands for Unit Linked Insurance Plan. The first part of this term “Unit Linked” means that one’s funds in ULIP are invested in the stock market or debt market which is why they will be linked to the stock market. Each insurance company has a variety of ULIP available such as – large-cap, small-cap, debt fund, etc. and one gets the option to select which fund they want to invest in according to the risk management. Similar to mutual funds where one gets units of investment called NAV, one also gets units of investment in ULIP called NAV. The second part of the name, “Insurance Plan” means that in the case of untimely death, one’s family gets an insurance cover. This entire thing combined is ULIP.

What is the Life Insurance component of ULIP?

When getting a life insurance policy, one needs to ask themselves one question – how much money is needed for my family to sustain for the next ten years, in today’s age? This is answered by one’s annual income, annual expenses, and the number of people dependent on them. After considering all these factors, it is said that one should have an insurance policy cover of minimum 10 times their annual income after tax deduction. Theoretically, if one’s annual income is Rs 10 lakh, then their minimum insurance cover should be Rs 1 crore and it should not exceed Rs 2.5 crore. This is because, in the case of one’s untimely death, their dependents have at least 10 years’ worth of funds saved to continue their lifestyle.

Now, in the case of ULIP, for an insurance cover of Rs 1 crore, one will have to pay an annual premium of Rs. 10 lakh. Similarly, for an insurance cover of Rs 5 lakh under ULIP, one will have to pay an annual premium of Rs 50,000 which is quite expensive when you compare it to the premium of term insurance plans. A term insurance cover of Rs 1 crore for someone of 25 years of age will cost them an annual premium of Rs 10,000-12,000.

Why is ULIP so expensive?

The reason behind ULIP plans to be so expensive lies in the IRDAI guidelines. As per IRDAI guidelines, an insurance company has to give its customers a minimum insurance cover of 10x their annual premium. For example, if one’s annual premium is Rs 50,000 then their minimum insurance cover must be Rs 5 lakh. But the catch is that there is no maximum insurance cover limit given under IRDAI guidelines. Hence, the company is not going to give a customer extra cash when they can save it because after all it is a business and they need to make a profit.

What is the investment component of ULIP?

Mutual funds charges

If one was to compare investment in mutual funds vs investment in ULIP, then one can look at the expenses in both cases. Under mutual funds, one has to pay an expense ratio that is higher in regular mutual funds compared to direct mutual funds. It is as low as 0.1% for index funds and between 1-1.5% for direct mutual funds. The second expense is an exit load that one has to pay if they withdraw their investment within the first 1-2 years. Apart from these two, there are no other expenses for mutual funds, hence they are comparatively cheaper.

ULIP charges

Under ULIP charges, premium allocation expense and policy administration expense were recently removed. Next, there is a fund management charge, similar to the mutual fund’s expense ratio, and this is capped at a maximum of 1.35% by IRDAI guidelines. Third is fund switching charges which one has to pay to shift from one ULIP fund option to another. This is usually free for the first 1-2 switches in some companies and then chargeable. There are also other expenses such as premium redirection charges, policy surrender charges, and discontinuance charges. But the most ridiculous and difficult is the mortality charge.

What is the mortality charge?

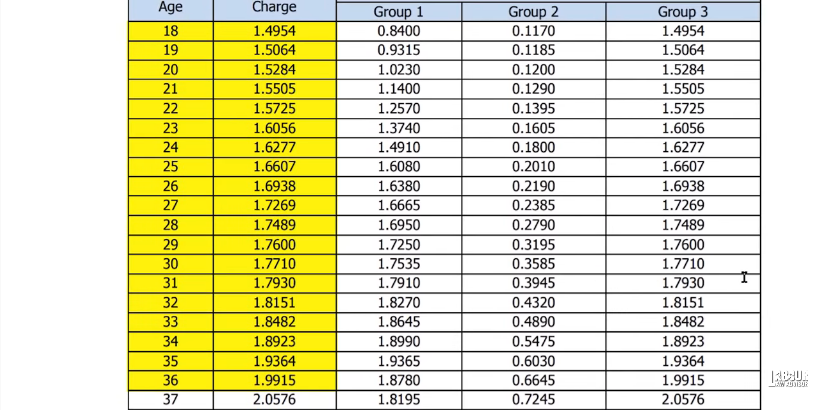

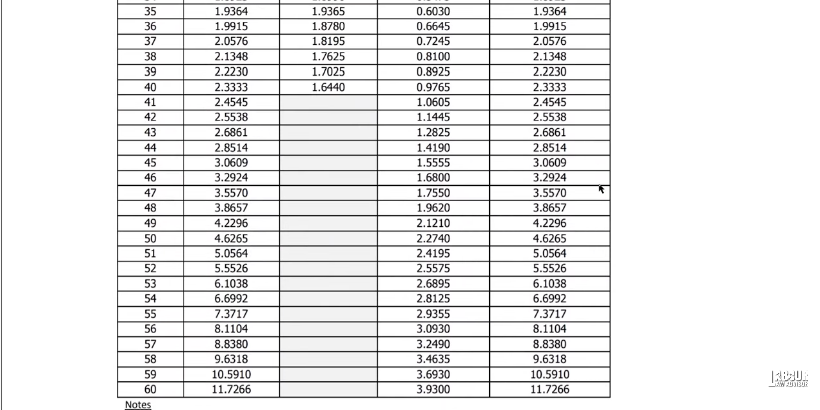

Mortality charge is calculated as = Charge Rate (attained age) X (Sum at Risk/1000) X (1/12)

Here,

Charge rate (attained age) is the charge rate applicable for the month depending on the attained age of the life insured on the day of calculation of the charge amount. The charge rate begins at 1.5 when a person is 18 years of age and grows exponentially till one reaches 60 years of age. The higher the age, the higher the charge rate.

Sum at risk is the value of the part of risk-benefit that the company is liable to pay if the claim is reported.

Hence, one may think that they are investing a large sum of amount every year in ULIP but in actuality, the charges get deducted first from the premium payment and then the remaining amount is invested. Moreover, the charges increase as one ages so they invest less and less amount each year. So unlike term insurance where the premium remains fixed throughout the duration, the premium for ULIP increases with age.

Lock in period

All investments in ULIP have a five-year lock-in period. If one requires to withdraw their ULIP funds before five years then their fund is put under Discontinued Fund and all the returns on that amount are penalized. The person gets returns only equivalent to a savings bank account, approximately 4%. This is the penalty for breaking one’s ULIP fund before the lock-in period.

Lock-in period policies deliver their agents a commission of 25-30%. It is a chain of commissions starting from the agent, moving upward to his target area manager, and more. Hence, approx 30% of the first premium goes into maintaining these extra charges even before they go into investing. Moreover, investments are done on the basis of certain factors such as risk involved, duration of investment, goals for the investment, flexibility of investment terms, lock-in period, etc. But these factors are generally ignored under ULIP investment and all funds are invested in a single scheme without any proper goal for it. This results in lower returns than expected over a period of time where people lose out on the power of compounding. Even if they want to shift to term insurance by then, that becomes more expensive with age.

Is ULIP really tax-free?

ULIPs may appear to be tax-free under Section 80C as an exempt category but with already higher charges and lower returns, it is quite unthinkable to get more deductions with taxes. Rather than earning 8% returns tax-free, it is better to earn 15% returns with tax. Learn more about investments without tax in Section 80C Income Tax Deductions.

Are there tax exemptions for high-premium ULIPs?

The Ministry of Finance said clearly in the 2021-22 union budget that the tax regime for high-premium ULIPs and low-premium ULIPs must be distinct. The fourth and fifth provisos were added to Section 10(10D) by the Finance Act 2021.

The fourth proviso indicates that no tax exemption is available for ULIP plans issued on or after 01-02-2021 if the total annual premium paid in any year throughout the tenor of the ULIP exceeds 2.5 lakhs. This provision specifically mentions a single policy. So, if the premium paid for your single coverage in any year exceeds 2.5 lakhs, you will not be entitled to the tax deduction under Section 10(10D).

The fifth proviso specifies the exemption rule in the event of numerous policies. If multiple ULIPs are issued on or after 01-02-2021, the aggregate amount of all premiums paid for all plans must not exceed the 2.5 lakhs level to qualify for the tax exemption under section 10(10D). In addition, if you have four plans, only two of which are qualified for tax exemption, you can choose which ones to claim tax exemption on.

If not ULIP, then what?

If you do not go for ULIP then you should go for the following:

- Opt for term insurance as the first priority which gives an insurance cover of Rs 1 crore for an annual premium of Rs 10,000.

- Second, you must look at wealth creation. This is best done by investing your money in the stock market or mutual funds.

- If you want to save tax then opt for PPF, EPF, NPS, SSY, ELSS, etc.

What to do with an existing ULIP?

If it has only been under a month or 15 days then you can close your ULIP immediately. Each policy gives the customer a free look period of 15-30 days generally wherein you can cancel it and withdraw all your money without any penalty. If the ULIP is less than five years old, you can still withdraw from it, because time is money, and keeping your money in ULIP for longer is wasting your money longer.

Watch the video on ULIP below.

Busting the ULIP Scam

We recently came across this chart which shows the savings one can make from ULIP Vs Mutual Funds and found it to be quite misleading. Hence, here we break down this chart to see why and how this is not the ideal investment scheme for anyone.

Analyzing the chart

- There is no mention of the company name, plan, or logo on the chart. It only mentions that this is a Platinum Wealth Plan.

- This chart appears to be at least four years old since it mentions service tax in place of GST. As we know, the service tax was replaced by GST in 2017 in India. The service tax column can be changed to 18% GST and presented as a new ULIP plan, which would be wrong.

- The expense ratio given for mutual funds is 2.5% which was SEBI’s highest prescribed expense ratio two years ago. It has since then been revised to a 2.25% maximum. However, the expense ratio can be calculated as 2.25% and represented to mislead people.

Why is this chart misleading?

Incorrect expense ratio

The expense ratio is always calculated slab-wise. As a mutual fund’s value increases, its expense ratio slab decreases. The final expense ratio is the weighted average of all the slabs. However, here it is given as one fixed value for all amounts which is incorrect. Additionally, due to high competition, mutual funds generally don’t charge expense ratios at the highest value. Moreover, it does not say whether the mutual fund is a regular plan or a direct plan. Direct plan mutual funds are generally slightly cheaper than regular plans.

For ULIP, the expense ratio is given as Fund Management Charge but it does not mention the percentage deduction happening. As per IRDAI, the ULIP expense ratio charge is capped at 1.35%.

Additional charges

Even with the addition of allocation charge, mortality charge, admin charge, service tax, and fund management charge, the table shows better savings with ULIP rather than mutual funds, which seems dicey.

Premium payment terms

The ULIP chart shows an annual investment of Rs 2 lakh for the first five years only. After that, there is no investment required. Similarly, the allocation charge is not applicable after the 5th year, the mortality charge is not applicable after the 9th year and the admin charge is not applicable after the 5th year. This serves the psychological purpose of making one feel happy and better about not paying from their end.

However, the representation of mutual funds is incorrect. Under mutual funds, there is no investment after 5th year as well, but that has not been clearly shown as zero.

Mortality charge

The chart shows a decreasing pattern of mortality charge payments with no charges applicable after the 9th year. But the mortality charge generally increases with passing age as the risk of mortality increases. However, the exact opposite is given in the chart. This is because this ULIP is another kind of fund where the company puts a condition of giving an X amount of insurance, which ceases once the person’s investment plus returns exceed the X insurance amount. Hence, as time duration increases, the mortality charge decreases.

Return of mortality charge

It is generally said that upon maturity the company returns the mortality charges deducted. However, the problem here is that due to inflation, the X amount invested today will be degraded in value after a number of years. Instead, if that X amount was invested for the number of years that passed, then it would have yielded a good return with the power of compounding.

How to correctly compare ULIP with Mutual Funds?

To accurately compare ULIP Vs mutual funds in today’s day, we only need to take the following charges into account:

- For ULIP – mortality charge + GST at 18%, and fund management charge which is generally at 1.35% approx

- For mutual funds – the expense ratio is at 1% average for direct plans

Moreover, we calculate the expense ratio on daily value. The CAGR given on mutual fund apps also displays the value after the expense ratio deduction. So no extra charges are applicable beyond that.

For easier calculation we can take the following values:

| ULIP | Mutual Fund | |

| Returns | 12% | 12% |

| Expense ratio | 1.35% | 1% |

| XIRR | 10.35% | 11% |

Thus, instead of calculating annual values and then deducting the expense ratio from it, we directly deduct it from returns and take the XIRR for actual return calculations.

Now in the above example,

- For ULIP, investment is Rs 2 lakh for the first five years.

- In the second column, we deduct mortality and GST charges to find the actual invested amount.

- After 5 years, at 12% returns, the total return value will equal Rs 14,09,625.

- Similarly, in mutual funds full Rs 2 lakh is invested every year to yield Rs 14,23,037 as total returns at 12%.

- Here, we consider both return % after charges deduction.

- After compounding both return values for 15 years, we get final fund values of Rs 77,15,675 for ULIP and Rs 77,84,012 for mutual funds.

- Therefore, there is a difference of Rs 68,337 between both.

Benefit

- All the profit from ULIP is tax-free. However, if the ULIP has multiple charges then this is redundant because even after paying taxes from mutual funds profit taxes, the value will be more than ULIP profits.

- But if the ULIP has only 1-2 charges and no commission payment then the tax-free benefit will be worth it. However, ULIP returns are usually so low compared to mutual funds that there are no tax-free benefits to claim.

- ULIPs give fund-switching options for no extra charge at least 4-5 times in a year. This is better than mutual funds, where fund switching leads to payment of capital gain tax. However, the options for ULIPs are limited whereas mutual funds have unlimited options to pick from.

Disadvantages

- Insurance requires a premium payment which is compulsory and regular, unlike SIPs. Failure to make premium payments will result in penalty and loss. This may not be possible for every individual in the social strata.

- Never mix insurance with investment. Rather take term insurance separately and investment separately. When the going gets tough it is easier to stop recurring SIP payments for mutual funds; rather than not make ULIP premium payments.

- In mutual funds, one can stop investment or withdraw at any time without penalty. However, ULIP has a compulsory five-year lock-in period.

Watch more details on this below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!