An essential part of earning money is to save some of it for future rainy days. While most of one’s monthly income may go in the daily expenditures of paying bills and buying ration, some of it needs to go in one’s savings too. Having a budgeting tool helps a lot in this scenario.

Table of Contents

What is budgeting?

A budget is a financial plan of one’s income and expenditures for a definite period. Budgeting is the process of creating a budget. Having a budgeting tool helps one to determine if they will have enough money to spend on the things that are important to them. Hence, budgeting helps in balancing out one’s income with their expense.

Why is budgeting important?

Having a budgeting tool in place helps one in the following ways:

- Contrary to the belief that budgeting actually restricts one from spending, budgeting actually helps one to spend money more freely. When one knows all the expenditures they are going to make in advance, then they can fix an amount for it. It may so happen, that they end up spending less than the amount they intended to spend. In this case, they actually save money from the allotted budget. Hence, budgeting gives one the freedom to spend more without any guilt because they have already allotted an amount for all their activities.

- Secondly, a budgeting tool is necessary to help stop one from overspending. When one has a plan in advance of all their spending limits in writing then it is easier to stick to it. If one does overspend with a budget then it is easy to identify the area and help in improving it. If there was no budget in the first place, then one would never know where and how much extra money was going.

- Thirdly, budgeting is a very helpful tool in getting a reality check. One can analyze their savings and expenditures to see if they will be sufficient to fulfil their short and long term goals. If not, then one has to change their spending habits accordingly. It also helps one to know if they need to shift their priority from investing to saving.

- Fourthly, having a budget makes one aware of their spending habits and helps them identify multiple opportunities of saving more money. One can check their spending over a period of time to see if there are ways to cut it down. Thus, budgeting is great to help one save money in the long run.

- Lastly, budgeting gives one control over their funds. Each country or even business have their set budget for a term. This is because it helps them to spend their funds efficiently by allocating more funds where necessary and saving where possible. Budgeting helps in the ultimate aim of growing one’s funds and creating wealth.

What is Envelope Budgeting System?

While there are many budgeting tools available, the envelope budgeting system is an easy one to follow. The method for this system is exactly in the name itself. One has to take physical envelopes and label them for each spending category such as rent, telephone bill, food, electricity bill, etc. Now, when the time for payment comes, one simply opens the envelope assigned for it and makes that payment.

At the end of the month, one can check all envelopes to see if it was all spent or something got saved and accordingly make the envelopes again for the next month. Nowadays, there are many apps available to download on the phone or computer and help keep track of one’s budgeting in exactly the same way without creating physical envelopes for the same.

Prerequisites to budgeting tool

To prepare a budget, one must follow the 50-30-20 rule. This rule entails that 50% of one’s monthly income must go towards their needs. Needs include anything which is a necessity such as rent, electricity bill, medicine, food, etc. The next 30% of monthly income must go towards one’s wants. Wants are not a necessity but a luxury. This could be watching a movie, eating at a restaurant, buying a new dress. The remaining 20% must go towards one’s savings or investments or debt payment. While this is not a set rule, it does help in keeping things in line.

Next, one must follow this 50-30-20 rule at three levels.

- At a monthly level, one must identify their needs, wants and savings/debt payment. Monthly needs can be any bill payment, wants can be shopping and debt can be credit card bill payment.

- Then, one must follow the same at an annual level. Annually, one must identify their wants, needs and savings/debt. However, annual needs and wants may be different from monthly ones. Here, needs can be a lump sum insurance premium payment, while wants can be a vacation.

- Lastly, this must be done at a goal level. This will entail one’s emergency funds, and short term and long term goals.

Watch the video on learning budgeting tool below.

Learn more, budget 2021 for investors.

Step by step process for using budgeting tool

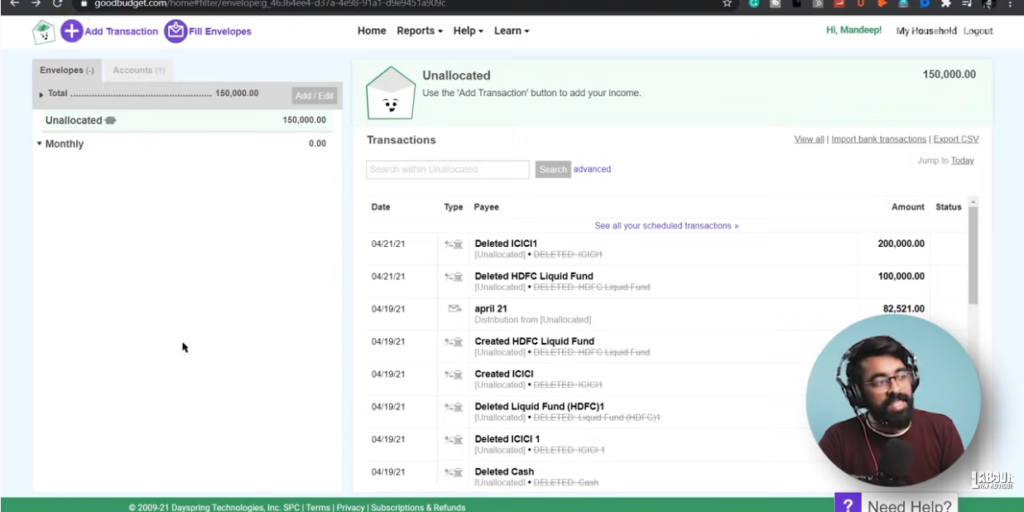

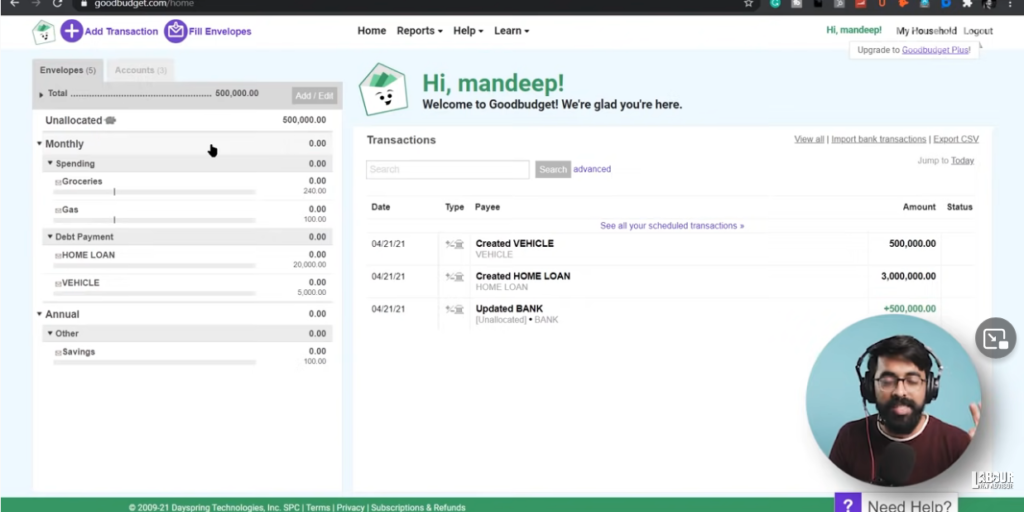

To make the process of budgeting easy we use a tool called GoodBudget, which has both web and app versions. The app has both free and paid versions as well. The free version has limited number of envelopes while the paid version has unlimited. The following process is however done on the paid version of the app.

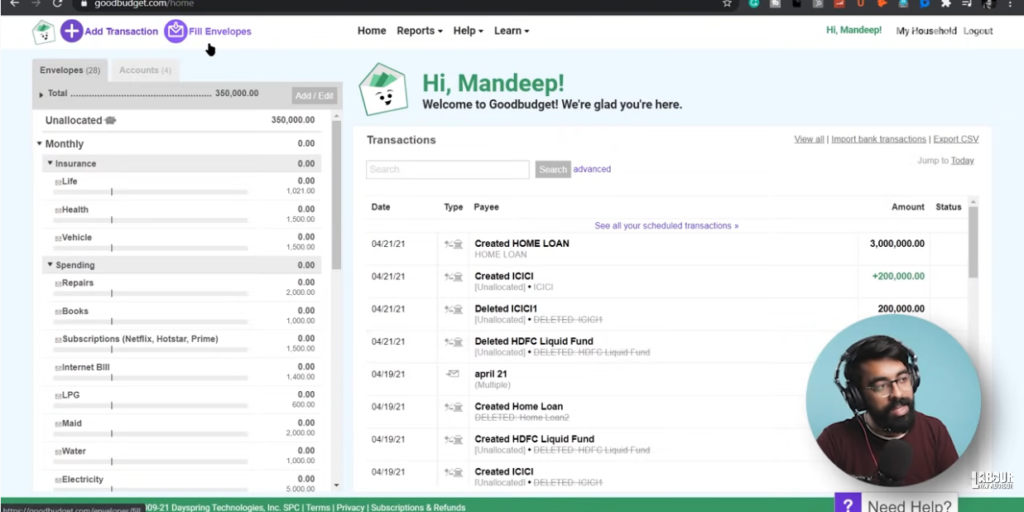

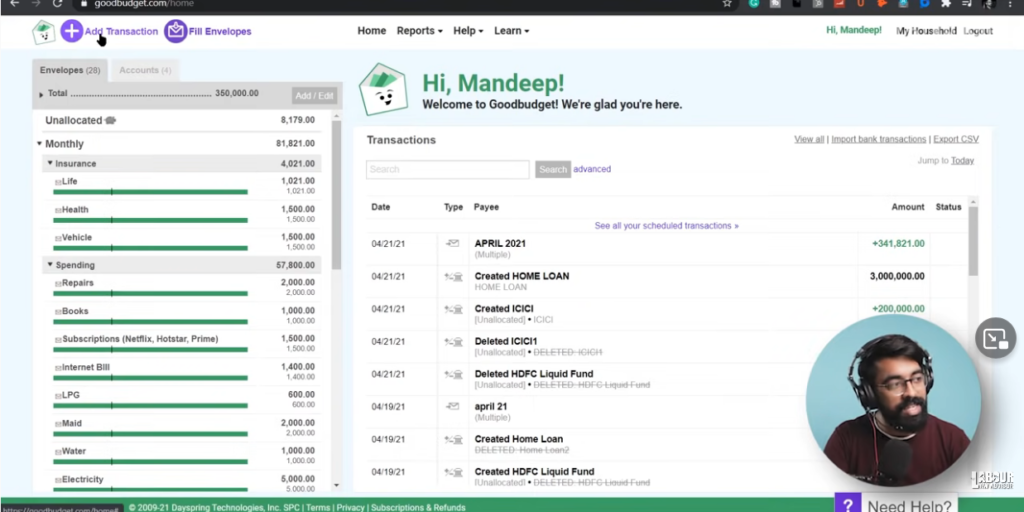

Dashboard

- Login to the GoodBudget website and click on Sign Up to create an account.

- The top-left corner of the dashboard has Add Transaction button. This can be used to add daily transaction details.

- Next to it is the Fill envelopes button.

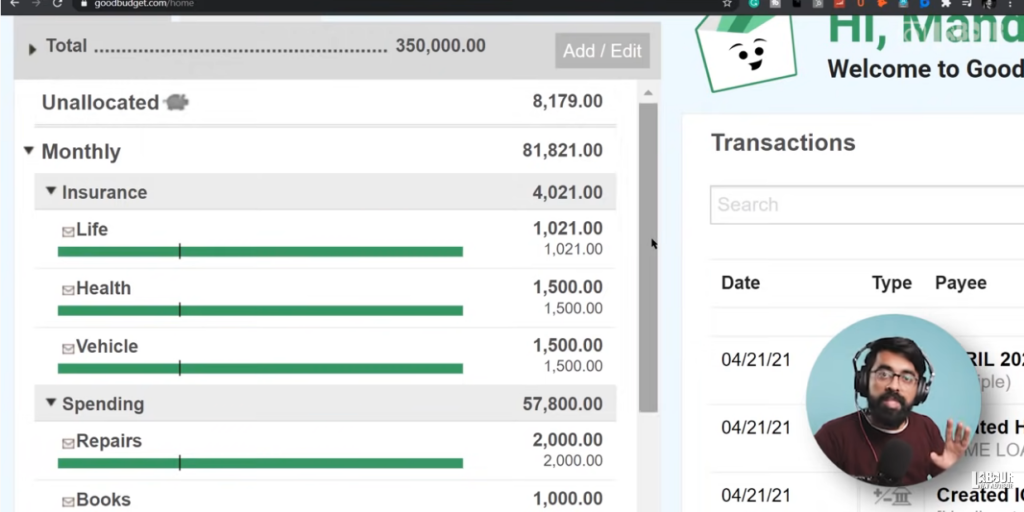

- All the envelopes will create a real-time statement on the right-hand side of the screen for any transaction that occurs.

Add accounts

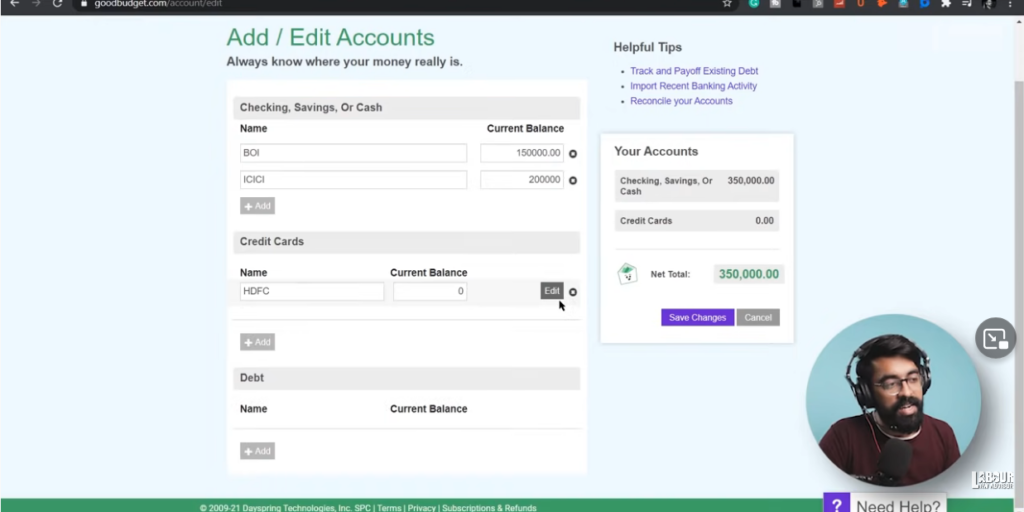

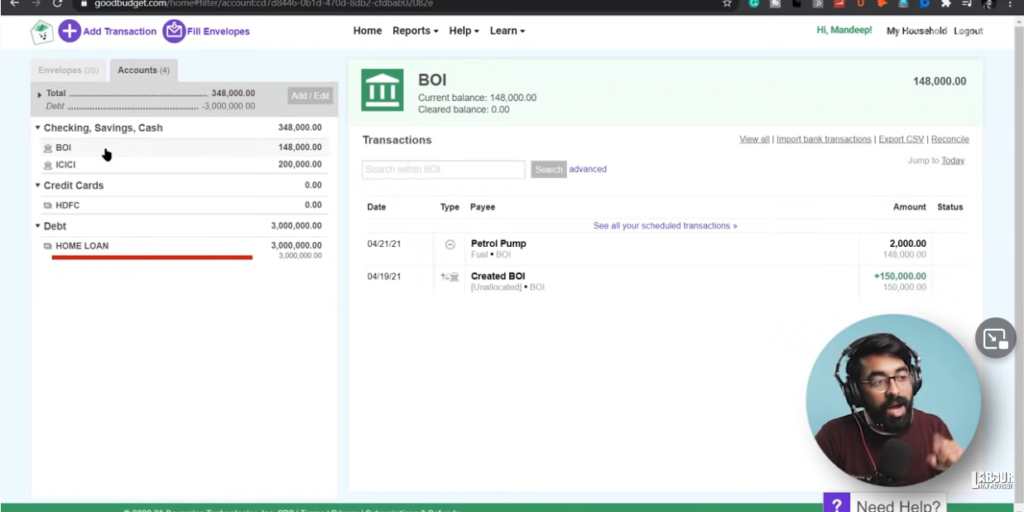

- On the left-hand side of the screen, click on Accounts tab.

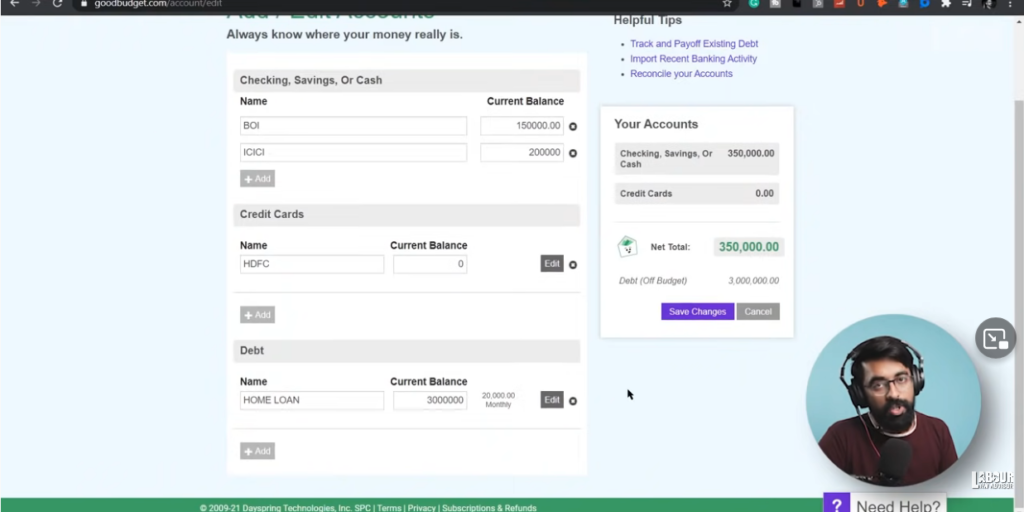

- Click on Add/Edit to add all bank account names with their current balance, credit card name with current outstanding balance and any outstanding loans under debts.

- Finally, click on Save Changes to save all the information added.

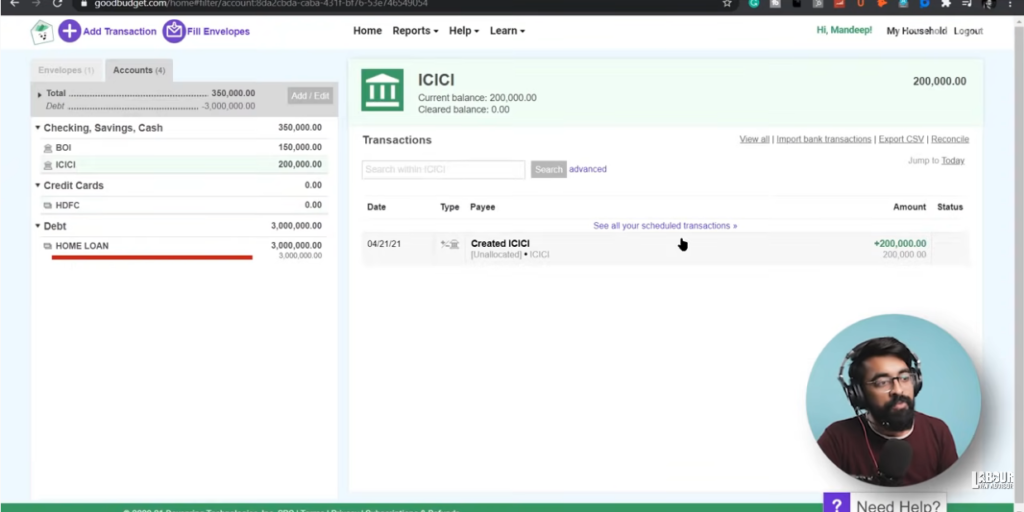

- Now, the Accounts tab will display the Checking/Savings/Cash, Credit Card and Debt details.

- Upon clicking on any account, its statement will open on the right hand side of the screen.

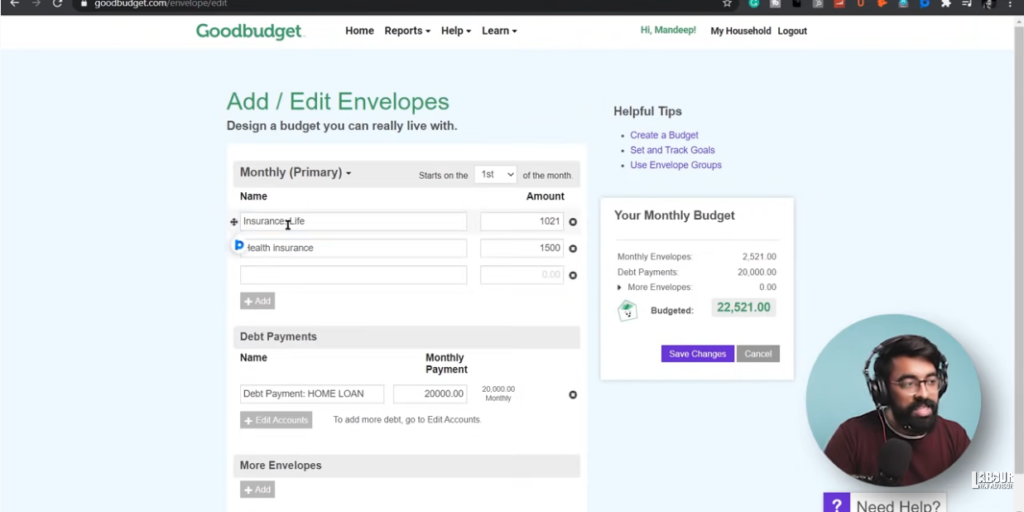

Adding envelopes

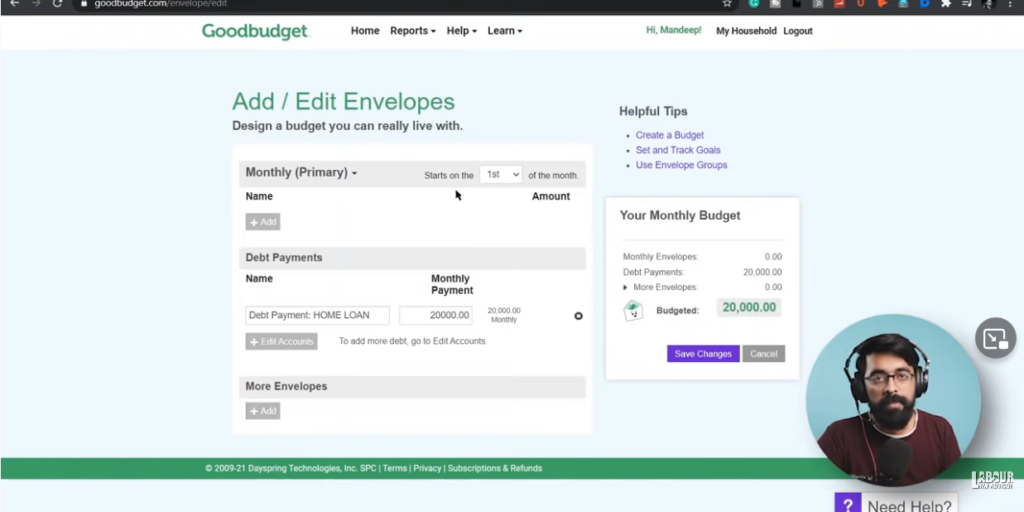

- On left-hand side of screen, click on Envelopes tab.

- Click on Add/Edit.

- Select the starting date for the budget.

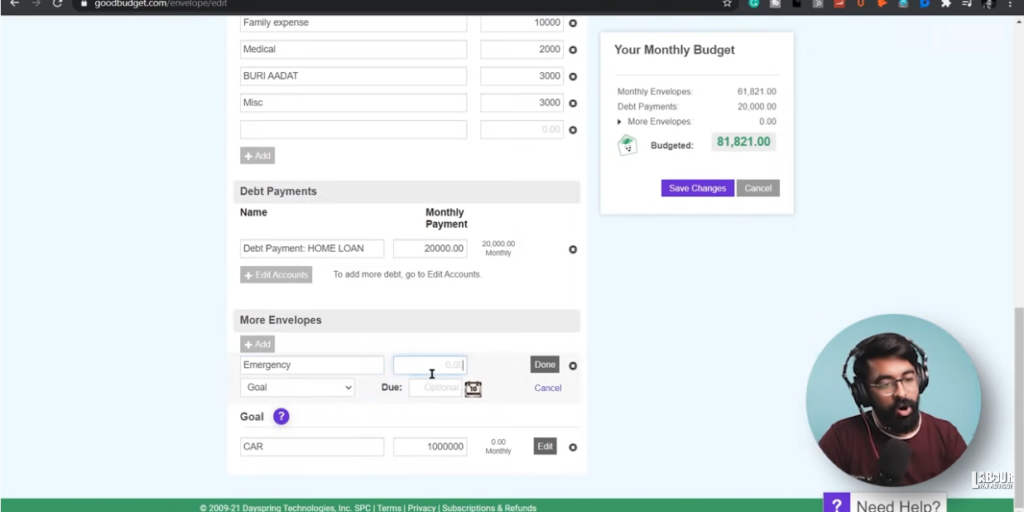

- Next, click on Add to add the name and budget allocation for each envelope. The budget will be an estimated one as per one’s general spending for it in the last few months. The budget allocations can also be edited later if needed.

- It is also possible to group the envelopes by putting a common name followed by a colon and sub-name for the envelope. It is recommended to group all fixed spendings such as bill payments, insurance payments, etc. While variable spendings can be added without grouping.

- It is possible to rearrange the order of envelopes by dragging them up or down.

- At the bottom, there will be another section for More Envelopes. This can be used to create envelopes for goals or annual spendings or quarterly spendings.

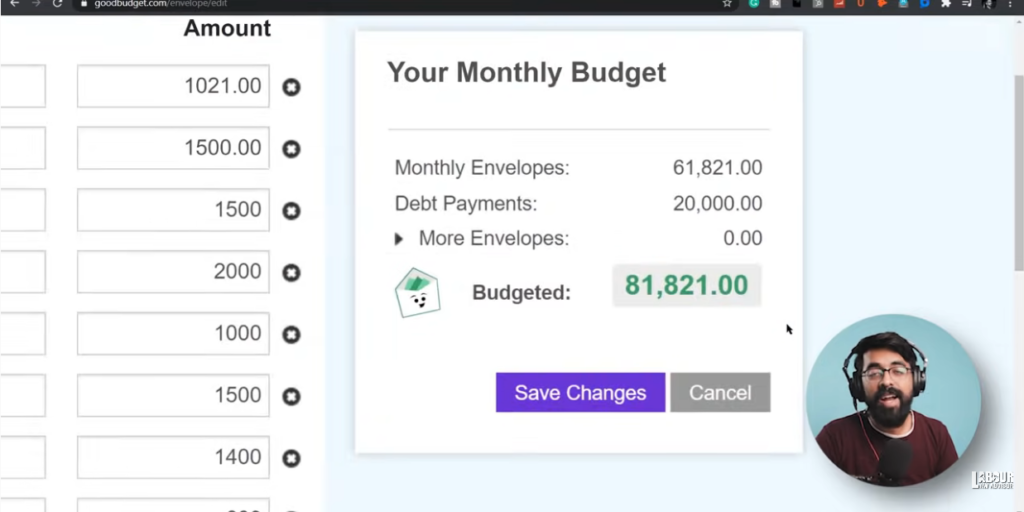

- Once all envelopes are added, the right side of the screen will display the monthly budget of incomes and expenses combined. Click on Save Changes.

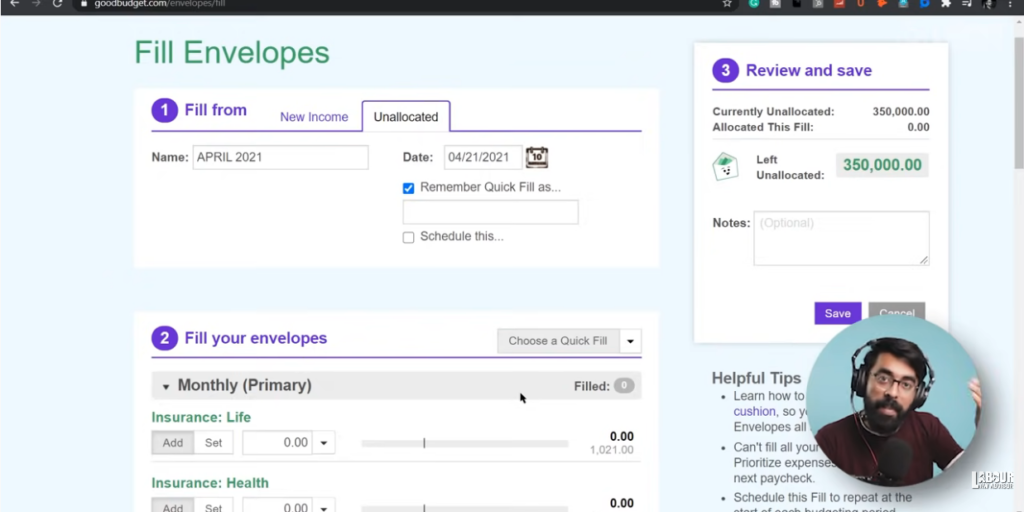

Filling envelopes

For every envelope that is added, the amount allocated represents the amount one wants to spends for it, but one has to add money to each envelope for actual spending. To do this one has to fill each envelope via the following process:

- Click on Fill Envelope on top-left side of screen.

- On the new window which opens, select Unallocated tab.

- Add a Name to the envelope.

- Select checkbox for Remember Quick Fill As Payment and input Name of Current Envelope, thus it automatically duplicates all envelopes to the next month. Hence, saves time from creating new envelopes from scratch every month.

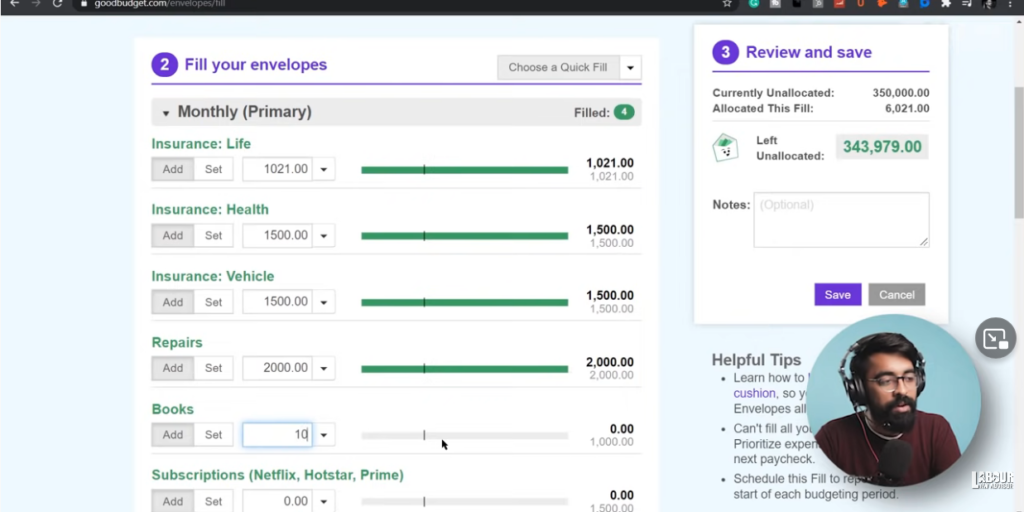

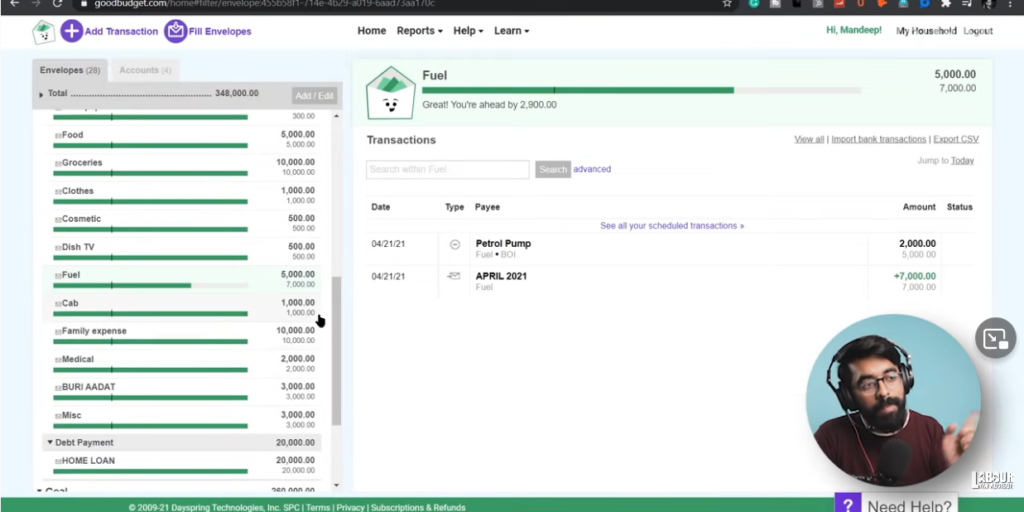

- In the next section, input the amount for each envelope created manually. The green bar for each envelope represents the amount remaining in it and gradually decreases as amount is spent from it.

- If any bar turns red then it means that there is overspending in that.

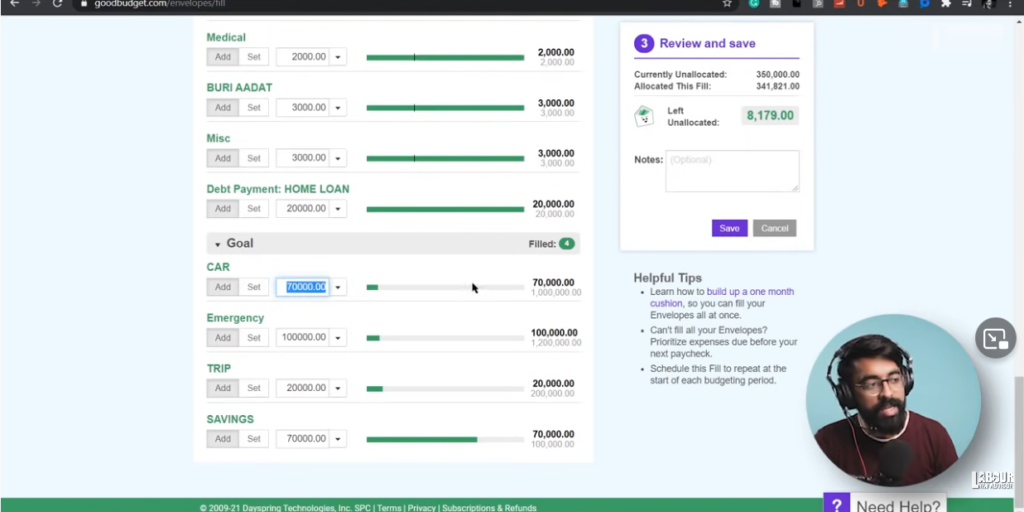

- Similarly, under the Goals section, manually input amount to be spent for each goal.

- After all the envelopes are filled, if any amount is shown as Unallocated Cash then it means that that particular amount has not been allocated anywhere for spending and may convert into savings if not ultimately spend.

Adding transactions

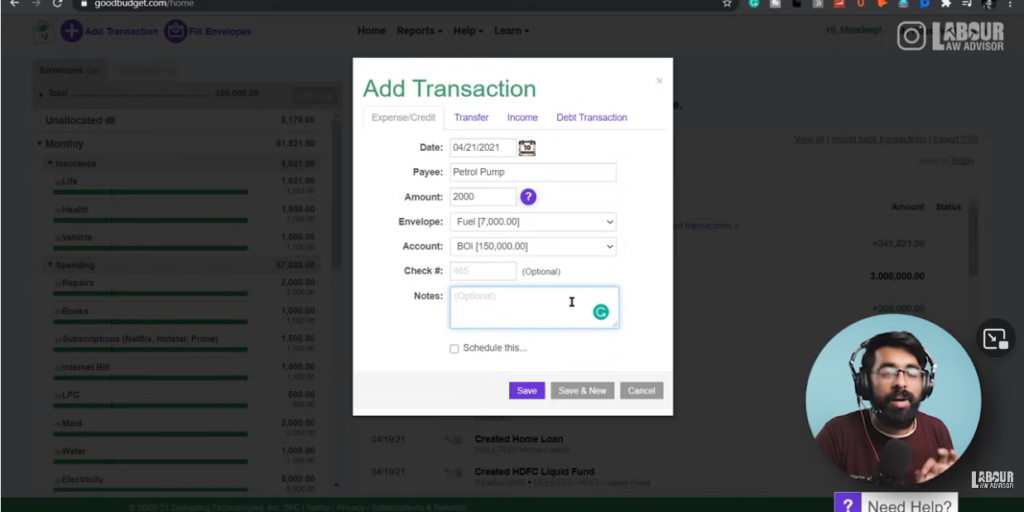

- To add daily transactions made to the app, click on Add Transaction on top left of the screen.

- A new window will open with four options – Expense/Credit, Transfer, Income, Debt Transaction.

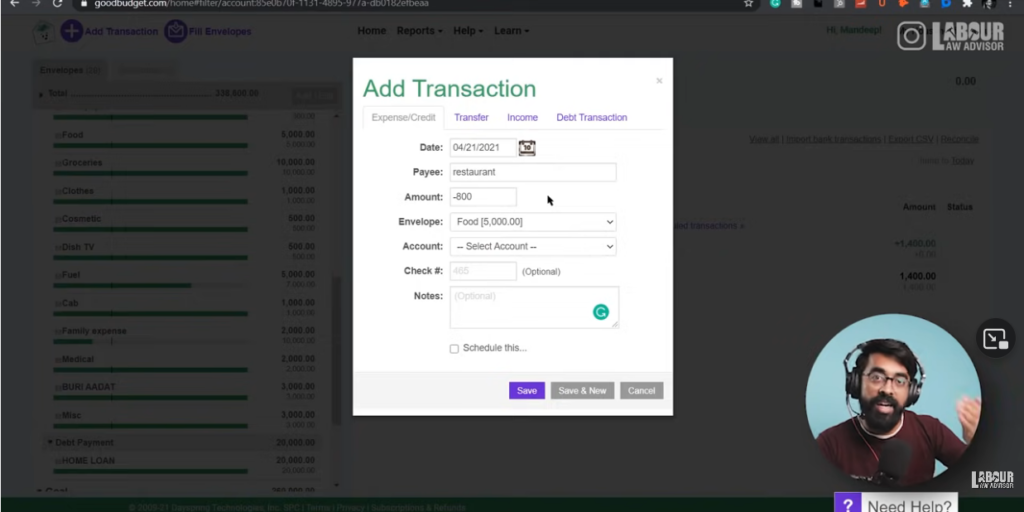

Expense/Credit

- Expense/Credit is a record of any money that one spends.

- Input the date of transaction, the person or organization name paid to, the amount paid, the envelope payment was done from, the account payment was done from and note.

- Click on Save.

- Clicking on any particular envelope on the left hand of the screen will open its transaction details on right side of the screen.

- Similarly, clicking on any account under Accounts tab will display the transactions made from that account on the right side.

- Likewise, an expense or credit transaction can be added from the phone app as well by clicking on the + sign at the bottom of the screen.

Transfer

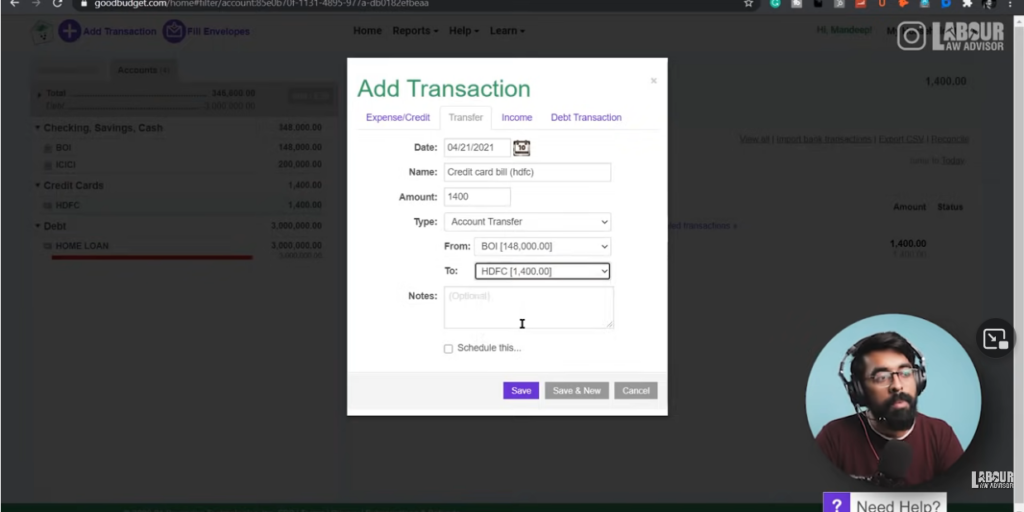

- To input any credit card payment, go to Add Transaction and select the Transfer tab.

- Then input the date of transaction, name of credit card company, amount to transfer.

- Select type as Account Transfer and select the two accounts of banks where amount is being transferred from and to. Click on Save.

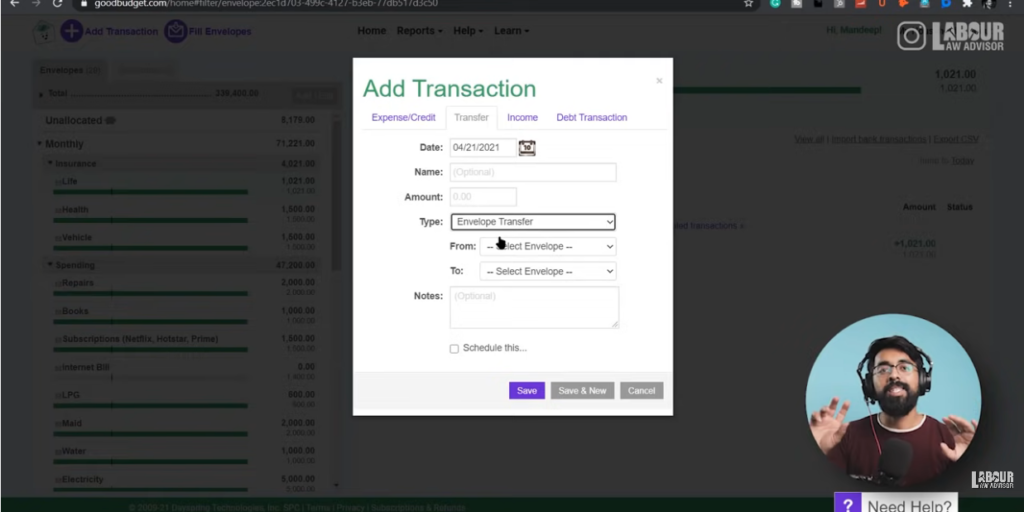

- Similarly, transfer tab can be used to transfer funds between bank accounts or even between envelopes.

- To transfer funds between envelopes, select Envelope Transfer instead of Account Transfer. However, it is suggested to not transfer funds between envelopes as it will not help in identifying actual spending capacity.

- Adding a Note to each transaction helps in identifying a pattern of spending at the month-end report.

Cashback/Credit

- Under the Expense/Credit tab, if one wants to input some money earned, then that can be done with a minus sign before the amount.

- This will add the amount back to the envelope selected.

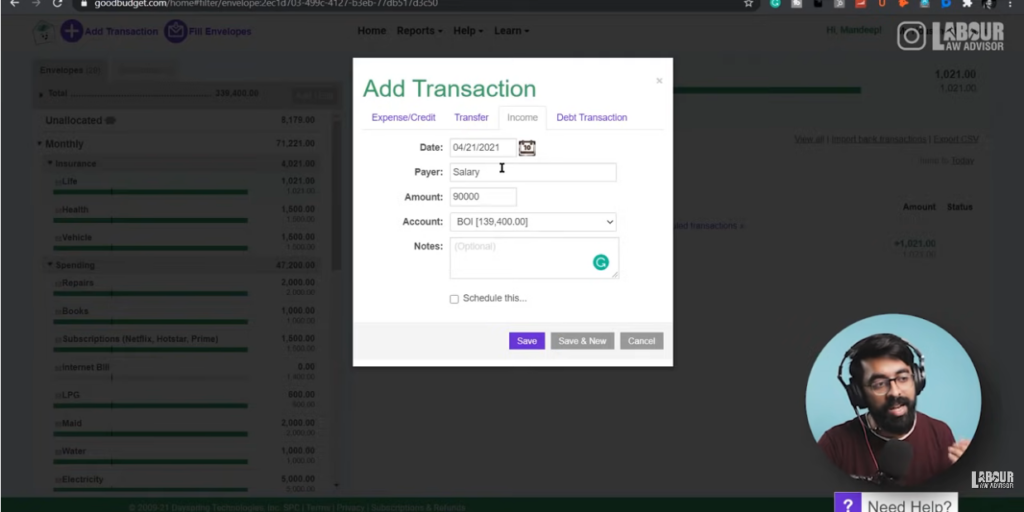

Income

- To add any income select the Income tab.

- Input the date of payment received, the name of Payer, the amount, the account paid to, and any note associated with it.

- One can also select the checkbox for Schedule This if this income is recurring every month.

- Click on Save.

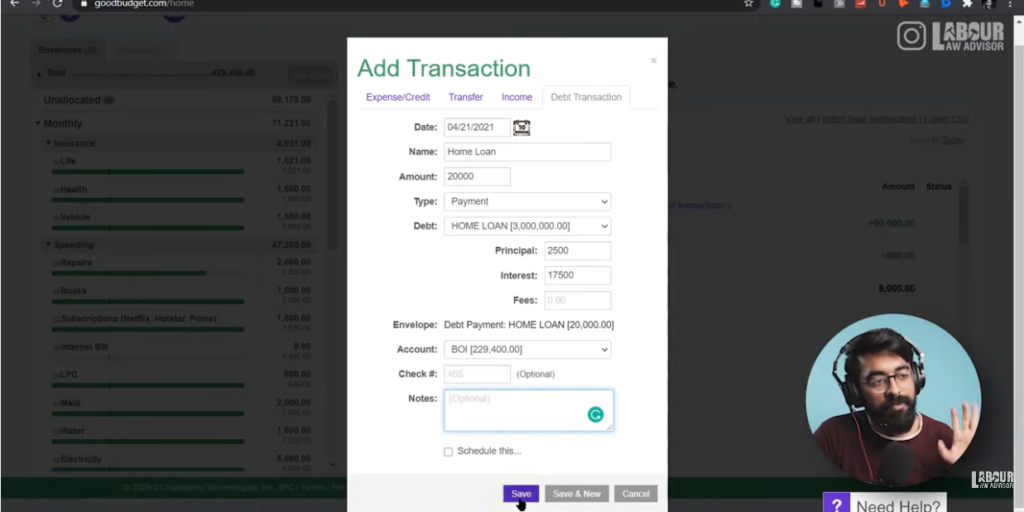

Debt Transaction

- This tab is used for any EMI transactions.

- Input the date of transaction, name of loan, amount, type as Payment.

- Then select the type of debt payment and input amounts for principal and interest payments.

- Then select the bank account and click on Save.

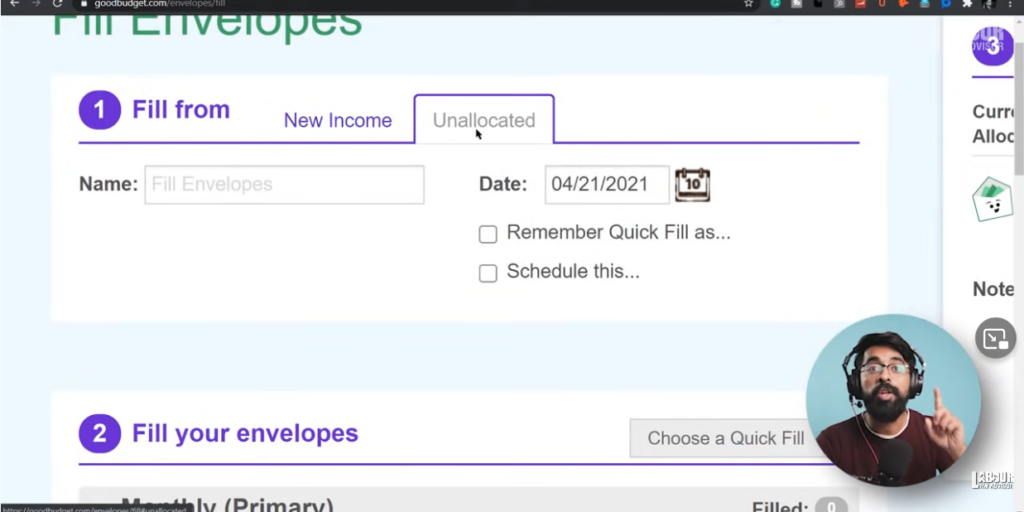

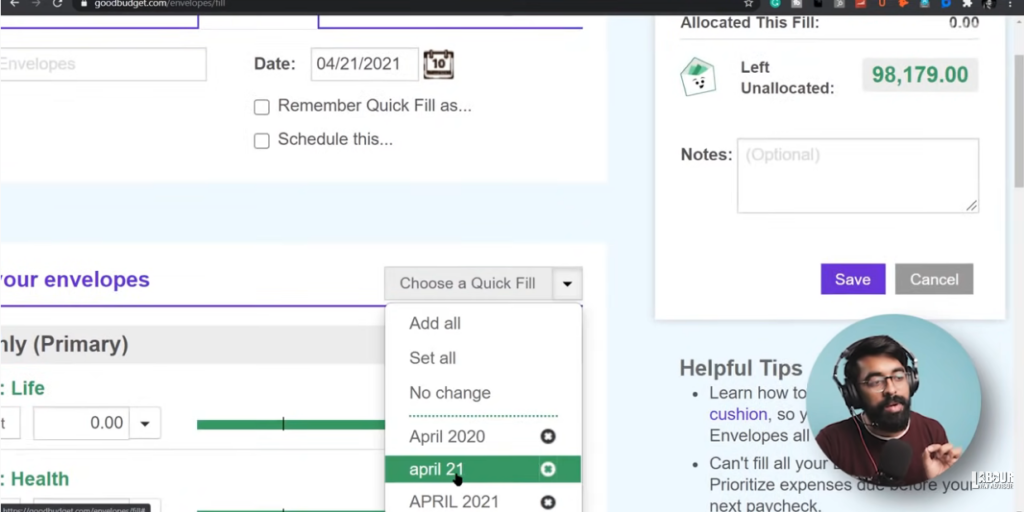

Filling envelopes for the next month

- Instead of manually refilling each envelope for consecutive months, go to Fill Envelopes.

- Select Unallocated tab.

- From the Fill Your Envelopes section below, select option for Choose A Quick Fill and name of the last month’s envelope.

- All envelopes will get automatically filled and can be edited manually if needed.

Using free version of GoodBudget

- In free version, only one account addition is available. So use that to input the total of all your bank accounts at one go.

- Likewise, only 10 envelopes are available. So group the envelopes to use one each to create for all fixed expenses and one for variable expenses.

To get more details on this budgeting tool watch the video below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!