Dividend is basically the portion of profit after tax, which the company distributes to its shareholders. In this blog, we shall discuss the taxability of dividends before, and majorly after F.Y. 2020-2021. We shall see to the basics of dividend taxability, applicable rates of tax, idea behind such change and its effects.

Table of Contents

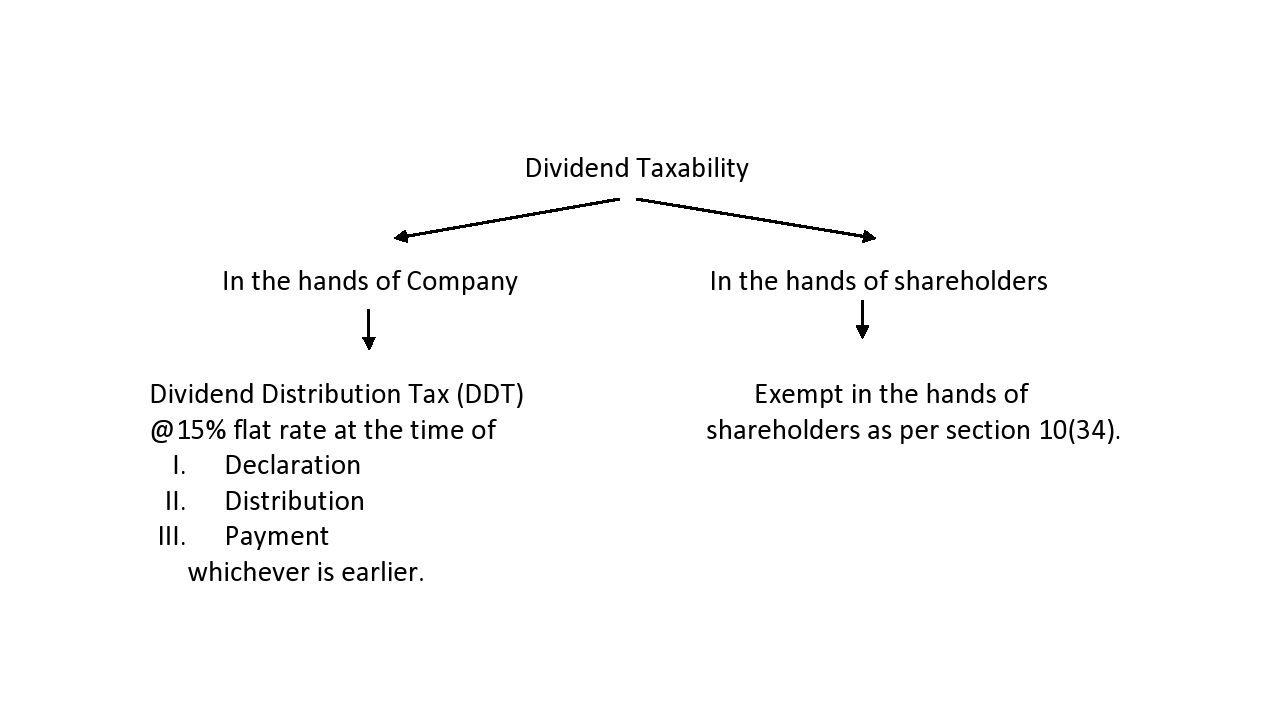

Before F.Y.2020-2021

It can be easily understood through the following flowchart:

After F.Y. 2020-2021

Basics of the dividend

As per the budget 2021, the concept of DDT and Section 10(34) has been abolished. This means that the dividend which was earlier exempt in the hands of shareholders now becomes taxable. Secondly, the question is in which head shall it be taxable? Dividend shall be taxable in the head “Profits and Gains from Business & Profession” or “Other Sources” depending on the purpose for which shares are held.

Let us better understand through the table.

| Particulars | Profits and Gains from Business & Profession | Other Sources |

| Purpose of holding shares | Shares held for trading purpose | Shares held for investment purpose |

| Deduction of Expense | Can claim deduction of all the expenses to earn such dividend | Deduction of Interest expense only |

| Nature of Expense | Interest on loan, collection charges etc | Interest |

| Limit of expense deduction | No limit | Upto maximum of 20% of total dividend income |

Rates of Tax on Dividend – Shareholder point of view

Dividend shall be taxable at normal slab rates as applicable to the shareholder. However, there are few exceptions. In such cases, it is taxable at a flat rate of 10% without allowing any deduction of expense from the dividend income.

Exception:

Resident Individual who is an employee of an Indian company or its subsidiary engaged in the business of:

- Information Technology(IT)

- Pharmaceutical

- Entertainment industry

- Biological technology

and receives a dividend in respect of GDRs issued by such company under Employee Stock Option Scheme. More importantly, the GDRs should be purchased by the employee in foreign currency only.

Implication on the Indian Company

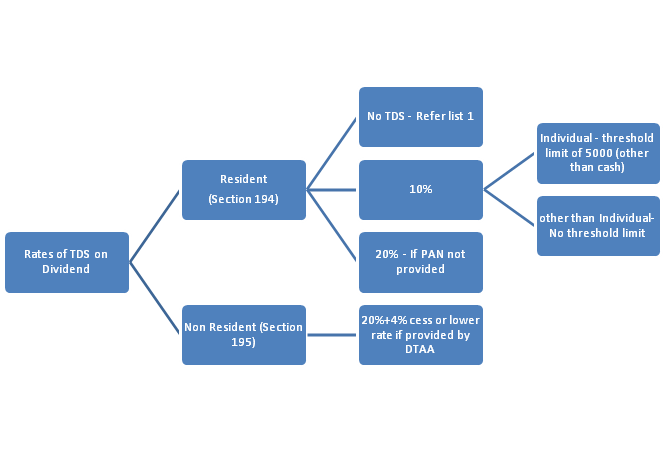

The company is liable to deduct TDS as per Section 194/195 as the case may be.

TDS on the Dividend

In the case of Residents, the company shall deduct TDS @ 10% (7.5% up to 31.03.2021 due to Covid – 19) as per Section 194. However, if the resident is an individual, then there is a threshold limit of 5000 only if the dividend is paid in a mode other than cash. However, in the case of the assessee being other than an individual, there is no threshold limit. Moreover, there are a few exceptions where TDS is not required to be deducted.

These are (List 1):

- LIC/GIC/any other insurer.

- In respect of shares owned by it.

- If Form 15G/15H is filed to the company paying the dividend.

- If lower/NIL TDS certificate is furnished under section 197.

- The dividend is paid to Mutual Funds.

In the case of Non – Residents, company is liable to deduct TDS at the rate of 20% as increased by 4% health and education cess + surcharge if applicable. However, if DTAA between the countries provides for a lower rate then tax can be deducted at such rate.

Also in the case of Foreign Institutional Investors or Foreign Portfolio Investors, TDS is to be deducted at the rate of 20% as per section 196C/196D.

The concept of TDS deduction can be better understood through the following flowchart.

The concept of TDS deduction can be better understood through the following flowchart.

Idea behind such change

Before F.Y. 2020-2021, it was considered that instead of thousands of shareholders paying tax separately, it is better that the company pays the DDT at the time of declaration, distribution, or payment. However, it was felt that investors were shifting to growth schemes from dividend payout schemes as the dividend payout was very low. Also, shareholders with the higher slab rate would pay more tax on such dividends.

Effects of such change

- Higher tax on Dividends – Investors who are covered under a higher tax bracket pay a higher tax on dividend income. For instance, an investor earning a salary of 20lakhs receives a dividend amounting to Rs. 10000. Then the government would receive a tax of Rs.3120 on such an amount as compared to Rs.1500 in the earlier scenario.

- Shares Buyback – Many companies are now opting for a share buyback scheme as it is more beneficial from the investor’s point of view.

- Beneficial for assessee with lower income – To illustrate, suppose a person with the salary of Rs.4,50,000 receives a dividend amount of Rs.5000, then he shall not be liable to pay any tax on that. However, as per the previous scenario, he would have received only Rs 4250 after deduction of DDT.

Conclusion

Adoption of the older system and abolishment of DDT comes with various effects, some positive and some negative. Moreover, it is at par with the global scenario and hence should be positively welcomed. Also, it is always advised to seek a professional opinion if necessary.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!