Table of Contents

What is the Tarrakki App?

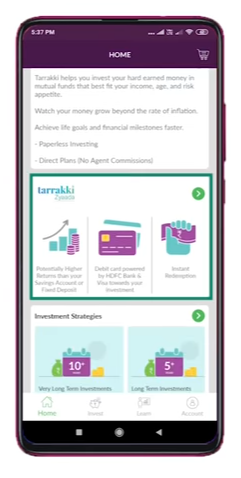

Tarrakki app is the brainchild of Ahmedabad’s fintech start-up Plutonomic Savtech Pvt Ltd. The company is further working towards building a strong artificial intelligence-based wealth management app. The Tarrakki app is currently focussing towards mutual fund investment. But it plans to branch out into other assets as well, such as equity advisory, insurance, P2P lending and loan management. Tarrakki app in association with Reliance Nippon Life Asset Management allows investors to invest their wealth in the Reliance Liquid Mutual Fund. Thus, Tarrakki app mutual fund helps investors to save, invest and spend their money at the same time. All while offering a higher rate of return than a normal bank.

Features of Tarrakki App

- Investors can earn returns of up to 7.2% p.a.

- The expense ratio for Tarrakki App Mutual Fund is 0.18% which is highly attractive.

- It invests your money in an ultra-short-term liquid debt fund, which has minimal risks.

- You also receive an HDFC bank VISA Debit cum ATM card by applying for it for Rs 100.

- It is a lifetime free debit card.

- The card can be used to shop, travel, purchase movie tickets, etc. as a usual VISA card.

- You can even swipe the VISA card at an ATM for instant cash withdrawal, an unlimited number of times.

- You also get instant withdrawal facility of money just like a bank.

- The annual maintenance fee for this VISA card is nil.

- It is not mandatory to maintain any minimum balance in your account.

How to apply for Tarrakki App Mutual Fund account?

- Visit the given link and download the Tarrakki app mutual fund investment.

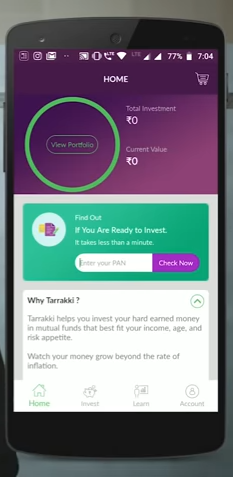

- Once the home page opens, input your PAN number in the green box and click on Check Now.

- This will open a pre-filled registration form. Check your details given in the form and input your Nominee details.

- Input your country, place of birth, income source and annual income slab.

- Toggle Yes for certifying that you are a resident of Indian and click on Next.

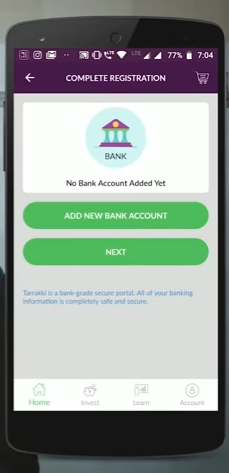

- On the next screen, input the bank account details from where you want to transfer funds to Tarrakki App.

- Give your bank name, account number, account type and IFSC code and confirm.

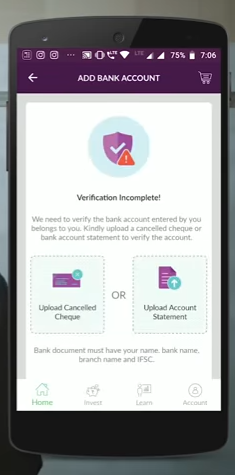

- Upload a cancelled cheque or your account statement as the last step of registration and verification. Your name and account number should be clearly visible in either.

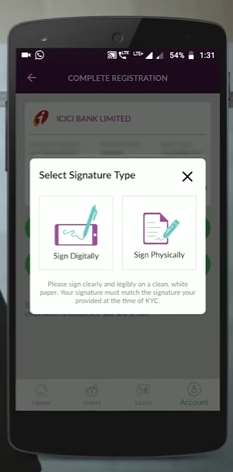

- Select to either sign physically or digitally.

- For physical sign option, write your signature on a paper, click its picture and upload on the app.

- For digital sign option, write your signature on the app screen via your phone.

- It will take another 2-3 working days for your account to be completed and linked.

- Once registration and bank linking are complete, open the Tarrakki app to find the option of Tarrakki Zyaada on your homepage.

- Click on this option to find details regarding the Nippon mutual fund.

- Continue to scroll down and click on Invest and Save Now.

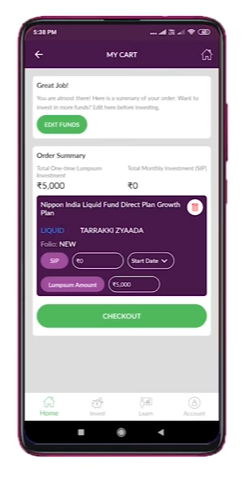

- Enter either a lump-sum or monthly SIP amount. Further, click on Invest Now.

- This amount will get added to your card. Verify the amount and click on Checkout.

- Click on Place Order and complete the payment via either NEFT or NetBanking.

- Once payment is successful, your allotment of units of the mutual fund will happen in 1-2 days.

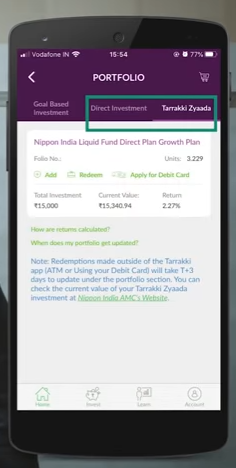

- Once mutual fund investment is live, go to your Portfolio and Direct Investment option.

- Click on Apply for Debit Card and continue to click on Next. Thus, your application for a VISA card is complete and your card will be delivered free of charge.

Watch our detail video on Tarrakki App Mutual Fund below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!