Suppose you bought a share in 2015 for Rs 900. That share grew to Rs 1300 in 2016. However, in 2017 it decreased to Rs 1000. Now, if anyone asked you the return you earned on your Rs 900 investment and your answer was an absolute return of 11.10% then you must read this blog to get a better understanding of CAGR. Because in actuality your CAGR is 5.41%. Thus, this blog details the meaning of CAGR, its importance and how you can calculate it.

Table of Contents

What is Absolute Returns?

In the above example, when you took the difference between Rs 900 investment of 2015 and final value of Rs 1000 at 2017 to be Rs 100, as 11.10% then that is called the absolute returns. Absolute returns look at the percentage difference between the initial value and the final value of an asset. However, it does not consider the time lapsed for the percentage difference, which is a very important aspect.

Hence, whenever you look at an investment opportunity, the right question to ask is how much annual returns can you expect from it. Or in the past few years, what has been the annual returns of that investment asset.

What is CAGR?

Compound Annual Growth Rate (CAGR) is the rate of return that an investment requires to grow from its starting balance to its ending balance. Wherein we assume that the profits were reinvested at the end of each year of the investment’s total duration.

CAGR is one of the best and most accurate ways to calculate and determine returns for any investment whose value has the tendency to fluctuate over a period of time. However, CAGR does not reflect investment risk.

Example

Suppose investment A had following share values:

| YEAR | SHARE VALUE (in Rs) | ANNUAL RETURN | AVERAGE ANNUAL RETURN |

| 2015 | 900 | ||

| 2016 | 1300 | + 44.4% | |

| 2017 | 1000 | – 23% | |

| 2018 | 1200 | + 20% | 14.23% |

| 2019 | 1600 | + 33.3% | |

| 2020 | 1500 | – 6.25% | |

| 2021 | 2000 | + 33.33% |

As seen in the table above, the annual return shows that sometimes the investment returns are increasing to 44.4% but other times it has also decreased by 23%. Hence, we need to figure out the average annual return for this investment in the last six years. This average annual return is the CAGR.

CAGR Calculation Formula

Final Value = Previous Value X (1 + (r/100))^n

Thus, 2000=900 X (1+(r/100))^6

Therefore, r = 14.23%

where, r is CAGR and n is number of years.

Here, it is important to exclude the initial year in counting since the investment will take the first complete year to give the initial return. So even though the count of years in the table is seven, we will only consider only six.

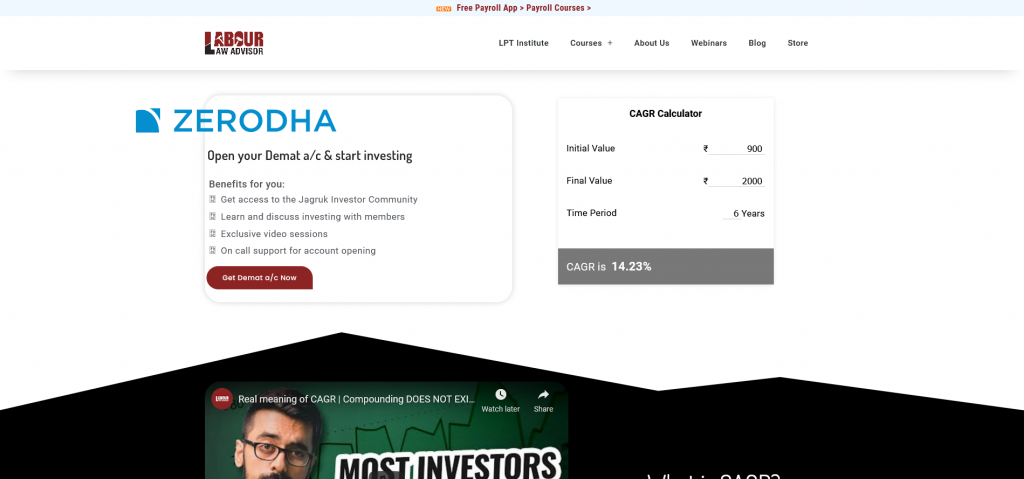

But the easiest way to solve for r is to visit the CAGR Calculator and input the initial value, final value, and time period. It will give the CAGR value automatically within seconds.

Pros of CAGR

- This CAGR value can help you decide whether this investment is a good option for you or not.

- You can use this value to compare different investment instruments.

- You can compare the best mutual fund option out of 5 mutual funds from their CAGR.

- It can also help you evaluate the growth of an organization over a period of time.

- Moreover, it can also help you understand the average growth rate of an insurance policy you are looking to buy.

Cons of CAGR

| YEAR | SHARE VALUE (in Rs) |

| 2015 | 900 |

| 2016 | 1 |

| 2017 | 1000 |

| 2018 | 10000 |

| 2019 | 2 |

| 2020 | 50000 |

| 2021 | 2000 |

Suppose there is a highly volatile share, as shown in table above, whose price fluctuates from Rs 900 to sometimes Rs 1 and sometimes Rs 50000. At the end of six years, if the price is Rs 2000, then it will still give a CAGR of +14.23%.

Now, if we don’t consider the values for 2020 and 2021, then the initial share price is Rs 900 and final share price is Rs 2. Here, the CAGR for four years is -78.29%.

- Thus, CAGR will never tell you the volatility and risk involved in an investment. So you will never understand the fluctuations involved in the investment pricing and how risky that may be for you.

- The CAGR value can change drastically with change in time duration, as seen in the table above. Hence, it is said that compounding does not in stock market. Since, compound interest is important for compounding, where the investment will keep growing at a fixed interest rate annually. And you will receive interest on both your principal value and interest every year. But that is not how stock market and mutual duns work.

- Although CAGR does not work where SIP is concerned. That is because SIP consists of multiple investments over multiple time duration. Hence, CAGR will not give you the correct value for the full time period of total investment.

Watch the video below, for any further clarifications.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!