The Employee State Insurance Corporation Scheme (ESIC) was created by the Government of India, as a means of providing financial protection to members in case of an untimely health-related incident. Every company with 10 or more employees with an individual salary of less than or equal to Rs. 15,000 per month, should have mandatory ESIC registration. Every ESIC member has access to multiple benefits, ranging from sickness, maternity, disablement, and more. This article covers ESIC member benefits in detail.

Table of Contents

ESIC Member Benefits

- Medical ESIC Benefits – Full medical expense cover for members and five other family members in case of any disease or accident.

- Sickness ESIC Benefits – Receive free treatment as well as 70% of salary during sick leave, for a maximum duration of 91 days. This is eligible for employees who worked for 78 days under 6 months. For special diseases such as TB, Code, etc., you can get 80% of your salary during your sick leave, for a maximum duration of up to 2 years.

- Maternity ESIC Benefits – Pregnant women receive all maternity facilities for free along with 26 weeks of fully paid leave. This is eligible for employees who worked for 70 days in the previous year.

- Disablement ESIC Benefits – In the case of disablement, the employee receives his monthly salary for the duration of their injury if it is a temporary state. If it is a permanent state, then the payment continues for life.

- Dependent ESIC Benefits – If the employee expires, then their dependent receive 90% of their monthly salary.

- Funeral ESIC Benefits – Rs. 10,000 is given to the dependent or to the person who performed the last rites of the employee.

- Unemployment ESIC Benefits – If an employee becomes unemployed due to factory closure, retrenchment or permanent disability, and they have been disabled for three years or more, then they can receive this benefit.

ESIC Registration Procedure and Requirements

- The employer can apply for ESIC registration by filling and submitting the Employer’s Registration Form (Form-1).

- The employee can also access the PDF format of the form that is available on the website. Then fill it up and submit it to ESIC on the official website.

- Once the application and documents have been verified, the company receives a 17 digit registration number. Then they can file their ESIC filings.

- Employees are sent an ESIC card once their registration is complete and they have submitted a form with their photograph and details about their family members.

- Any new changes like the additions of employees, etc., must be informed to the ESIC.

In general, the employer needs to submit the following documents to the concerned ESIC Office:

- Certified copies of various documents related to company incorporation and business/profession of the company.

- Address Proof, PAN Card, Company Bank Account, and all Tax-related certificates and documents applicable.

- Documents submitted by the employees to the employer.

- Registers containing information about the employment, salaries, attendance, etc. of concerned employees.

- Copy of the updated Bank Statement of the company’s account.

- Other documents which may be demanded by the ESI Office.

Get more details on ESIC registration in ESI new employee registration process. Other details in ESI Act 1948 | Calculation, Late Payment, All Details.

Do’s and Don’ts of ESIC Scheme

Some of the things to keep in mind are:

- If an employee with an ESIC Registration Number changes jobs, they should inform the new employer of the same.

- There are certain benefits that are provided based on the length of their contribution. If the employee is changing his job then he should register with the same ESIC number, to reap the maximum benefits.

- Always take referral procedures seriously.

- Follow the doctor’s instructions carefully.

- If the employee wants to go travelling for an outstation trip then he should get his Form 105 signed by his employer. This helps in case the employee needs to avail ESIC facilities in another region.

Following video summarizes the above article:

Maternity Benefits – Details

The Maternity Benefits Act of 1961 states that a women employee is entitled to maternity benefits at the rate of her average daily wage for the period of her absence, for a maximum duration of 26 weeks (since 29th March 2017) or as per the company’s HR policy. ESIC maternity benefit is available to all insured women under the scheme, who take a break from their employment during pregnancy. ESIC will pay the woman 100% of her salary for the full term of her maternity leave. Furthermore, we explain who is eligible for ESIC maternity benefit, for what duration and how to avail it.

Eligibility for ESIC maternity benefits

To be eligible for ESIC maternity benefit, firstly, the woman must have a minimum service period of 9 months during which she has paid her ESIC contribution. Secondly, from April to September and October to March, the woman should have made a total of 70 days of ESIC contribution. These two points make a woman eligible for ESIC maternity benefit. You can also check this eligibility online via the following process:

ESIC maternity benefit eligibility, online checking procedure:

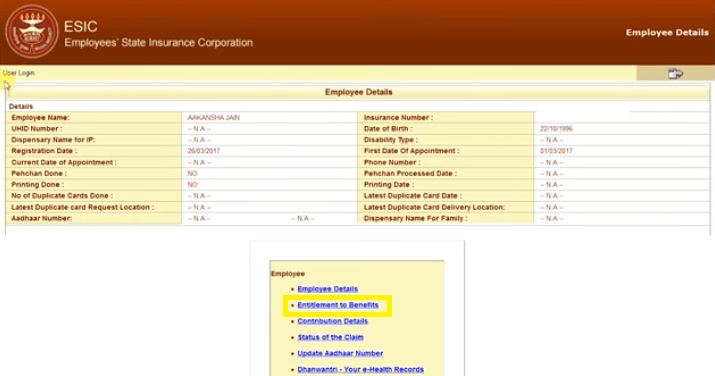

- Log in to the ESIC website.

- Under User Login, put your Username and Captcha. Then click on Login.

- This will open a new window where you can check your common details. Next click on Entitlement To Benefits.

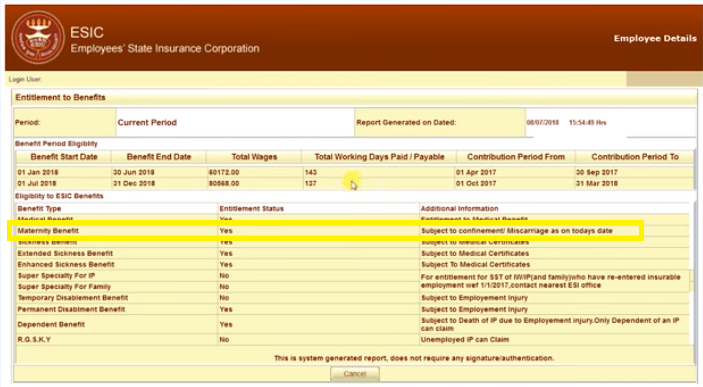

- This will open a new window showing all the benefits you can receive, depending on your contribution history.

- You can also update your Aadhaar number on this platform since it is important to avail ESI hospital benefits.

How much maternity benefit is received?

- How much ESIC maternity benefit is received depends on the confinement. Confinement can stand for either a normal delivery resulting in the birth of a living child, before or after 26 weeks of pregnancy. Or confinement can also stand for a miscarriage after 26 weeks of pregnancy. This benefit can also be availed 8 weeks before delivery of the child. But the total duration of maternity leave cannot exceed 26 weeks. This 26 weeks benefit is only applicable for up to 2 surviving children. From the third delivery onwards, the woman can only get 12 weeks of benefit. This is only considering surviving children and does not count miscarriages.

- In case of the adoption of a child, maternity benefits can be availed if the adoption was legal and the child was under 3 months. This makes the woman eligible for 12 weeks of maternity benefit.

- If the woman has a miscarriage before 26 weeks of pregnancy, then she gets 6 weeks of maternity benefit.

- In case of sickness due to pregnancy, the woman can receive 4 weeks of benefit.

- In case of death due to pregnancy, the nominee shall receive the insured person’s entitled benefit.

- The insured woman can also receive a lump-sum amount of Rs 5000, known as confinement expenses if the delivery occurs in a place which lacks proper arrangements under ESIC. This can also be given to insured husbands whose wives have undergone delivery under such conditions. Furthermore, this is only applicable for two deliveries. A third delivery will not be eligible for this confinement benefit.

How to claim maternity benefit?

ESIC member needs to visit the nearest ESIC dispensary and get a health checkup. Then they need to duly fill and submit Form 19 to the ESIC office. In case of death of the pregnant woman, the nominee has to fill and submit Form 20 to the ESIC office to avail the benefits.

You can watch our video below to clear all doubts on this topic:

Sickness Benefits – Details

Under ESIC, members get sickness benefit which allows them to continue receiving part of their salary even when they are on sick leave. Under ESIC, “sickness benefit” definition is the “periodical cash payments made to an Insured Person (IP) during the period of certified sickness occurring in a benefit period when IP requires medical treatment and attendance with abstention from work on medical grounds. Prescribed certificates are Forms 8, 9, 10, 11 and ESIC Med 13. Sickness benefit is 70% of the average daily wages and is payable for 91 days during 2 consecutive benefit periods.”

Therefore, ESIC member can get sickness benefits in cash when they produce certification of their sickness from an ESI hospital or dispensary. This is only applicable during the benefit period. For example, ESI contribution from April to September provides benefit coverage until March of next year. ESIC member must also be absent from work to avail sickness benefit. The employer’s attendance register must record an “S” in place of “L” as well. Furthermore, the “2 consecutive periods” accounts for April to September and October to March. ESIC members can get maximum of 91 days of sickness benefits during this period.

Eligibility for sickness benefits

- To become eligible for sickness benefit, an IP should have paid contribution for not less than 78 days during the corresponding contribution period. Therefore, ESIC member must be present for atleast 78 days between April to September and October to March, to avail ESIC sickness benefits.

- A person who has entered into insurable employment for the first time has to wait for nearly 9 months before becoming eligible to sickness benefit because his corresponding benefit period starts only after that interval. Therefore, ESIC member cannot avail sickness benefit upon the first day of joining itself. They will have to make contributions for minimum 9 months to start getting sickness benefits.

- Sickness benefit is not payable for the first two days of a spell of sickness except in case of a spell commencing within 15 days of closure of earlier spell for which sickness benefit was last paid. This period of two days is called the “waiting period”. The provision should be clearly understood by IMOs/IMPs as actual experience shows that such of IPs who want to avail medical leave on flimsy grounds generally come for First Certificate/First & Final Certificate within 15 days of the earlier spell, usually on unpaid holidays and/or on each weekly off, etc., to avoid loss of benefit for 2 days due to fresh waiting period.

How to claim sickness benefit?

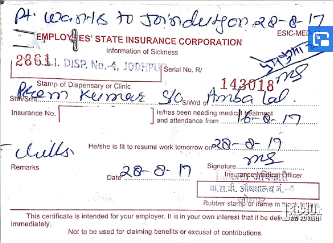

Upon falling ill, ESIC members must visit their nearest ESI dispensary/hospital and get a checkup. If the doctor feels you are unwell to attend work then they will provide you with Form 11. Form 11 will have your name, IP number, duration of sickness and medical officer’s signature. This is commonly known as Sick Form. Members needs to submit to to their employer. Employer will then mark member as “S” on attendance register. Thus, member will receive his salary from ESIC and not from employer.

Secondly member will get Form 7. This is known as Fit Form. This form acknowledges that the ESIC member is now healthy and fit to rejoin work. It contains the member’s name, IP number and medical officer’s signature.

Members have to submit both Form 11 and 7 at their nearest ESIC office. They will reconfirm the leave period, cause and other details. Once confirmed, ESIC office will release member’s sickness benefit as a cheque or demand draft. Some cases can even receive sickness benefit in the form of cash.

Steps to check sickness benefit eligibility

- Visit the ESIC employee portal.

- Login with your Username and Captcha.

- Important to check that your Dispensary Name For IP is updated here. If not, then bring it to your employer notice for immediate updation.

- Now click on Entitlement To Benefits option from below.

- The next page will specify your benefit period. This is usually from January to June and from July to December. Depending on your total working days, you can view which ESI benefits are available to you in the list below. View the Entitlement Status against the Benefit Type. Yes means available and No means not available.

- Next go to the previous page and click on Update Aadhaar Number. This is necessary to avail ESIC benefits.

- In the next page enter your Name, IP Number and Aadhaar Number. Click on Save to complete the process.

Watch the tutorial in the video below:

ESIC Covid-19 Benefits – Details

ESIC released a press release explaining the various benefits available to IPs and their dependents regarding Covid-19. We discuss these points in detail in the following section of the blog.

Medical Benefits for Covid-19

- ESIC has declared some of its hospitals as Covid-19 dedicated hospitals. Any IP and their family member can avail free medical care if diagnosed with Covid-19 in these hospitals. Currently, there are 21 ESIC hospitals directly run by ESIC which have 3676 Covid isolation beds, 229 ICU beds and 163 ventilator beds. Along with that, there are 26 ESI Scheme Hospitals that are run by State Government and these have 2023 beds dedicated for Covid-19. One can get daily updated bed availability in all these ESIC hospitals here.

- Apart from the above, all ESIC hospitals have been instructed to keep a minimum of 20% bed capacity as Covid-19 dedicated beds for all ESI IPs and their beneficiaries. One can find all ESIC hospitals in this link and all state-run government hospitals providing ESI facilities in this link.

- ESIC Medical College and Hospital, Faridabad (Haryana) and ESIC Medical College and Hospital, Sanath Nagar (Telangana) are also providing plasma therapy for Covid patients.

- Since many ESIC hospitals have become Covid dedicated, their regular non-Covid patients can seek emergency and non-emergency medical treatments in ESIC tie-up hospitals without any referral letter, as per their entitlement. If any of our readers have had the experience of using an ESIC hospital then please fill out this form with your feedback, which would help out other members too.

- If an IP or beneficiary takes Covid-19 treatment in any private institution, then they can claim a certain part of the expenses as reimbursement.

Cash Benefits for Covid-19

- If an IP is absent from work due to Covid-19 infection, then he can claim Sickness Benefit for his period of absence as per his entitlement. The sickness benefit will be paid at 70% of the IP’s average daily wage for 91 days. This period of absence will not include the first two days of absence. The payment of the rest of the absence period will be paid by the ESIC department. To get this cash benefit, IP has to submit a sick and fitness form, the procedure for which is given above.

- For IPs who have lost their job due to Covid, they can avail cash relief under Atal Beemit Vyakti Kalyan Yojana (ABVKY). This provides up to 50% of the IP’s average daily earning for a maximum of 90 days. This scheme has now been extended till June 2021.

- If any IP loses their job due to closure of workspace or forceful retrenchment then as per ID Act, 1947, they can claim unemployment allowance for 2 years under Rajiv Gandhi Shramik Kalyan Yojana (RGSKY), if eligible.

- In the unfortunate event of the demise of any IP, their eldest surviving family member will receive Rs 15,000 as funeral expenses.

Covid-19 update for lifetime pension

As per previous rules, a deceased IP’s family can only receive pension when the IP expiry was due to a work-related injury or accident. This would leave the families of all those multiple workers who passed away due to Covid-19 at a loss. Since they would not be able to receive any pension benefit. This pension would be equal to 90% of the IP’s average daily wage. For example, if the IP’s contribution was around Rs 20,000 on average then his family would receive Rs 18,000 as pension for lifetime.

But as per the latest ESI update, all workers who expire due to Covid-19 will be considered as work-related death and their families will get the pension benefits under ESI. The Labour Ministry and Prime Minister’s Office made a recent press release regarding this. It stated that workers who passed away due to Covid-19 will also have their families eligible for 90% of their daily average wage as lifetime pension. Although this comes with certain terms and conditions.

ESIC Complaint Redressal

If any IP/beneficiary is facing issues regarding any settlement of benefit then they can visit the Centralized Public Grievance Redress And Monitoring System (CPGRAMS). It is an online site handled by the Directorate of Public Grievances (DPG) and the Department of Administrative Reforms and Public Grievances (DARPG). It aims to enable submission of grievances by the aggrieved members from anywhere and anytime basis to Ministries/Departments/Organisations who scrutinize and take action for speedy and favorable redress of these grievances. Tracking grievances is also facilitated on this portal through the system generated unique registration number.

Watch full video on this ESIC Covid benefit below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!