There is a high chance that at least once in your lifetime, you will face the situation of a cheque bounce. This means that the cheque given to you by another party will fail for some reason to give you the payment when you submit it in a bank. But how many of us are aware of the legal proceedings which we should take in such situations. Hence, we sat down with Advocate Naman Mohnot. Naman also runs the legal blog AapkaConsultant.com and is an alumnus of NLU, Delhi. Read on for our interview.

Table of Contents

What are the reasons for cheque bounce?

Cheque bounce occurs when you submit a cheque to the bank and the bank refuses to give you the amount written on it. This happens due to the following reasons mainly. First, the account from which money is supposed to be deducted has insufficient funds. Secondly, when the payment is stopped by the account owner due to an ulterior motive, Hence the account holder tells the bank to not do the payment for the cheque. Third, there can be some error in the cheque written such as incorrect spelling or signature. Also, if you are cutting a cheque from the Company account and it does not have the company seal or signature of all authorities as needed.

Hence, it is important while collecting a cheque to see that the date, signature, company seal (as applicable) and amount both in numerical and alphabetical, are all written correctly. Do note that cheques become invalid after three months from the date given on it.

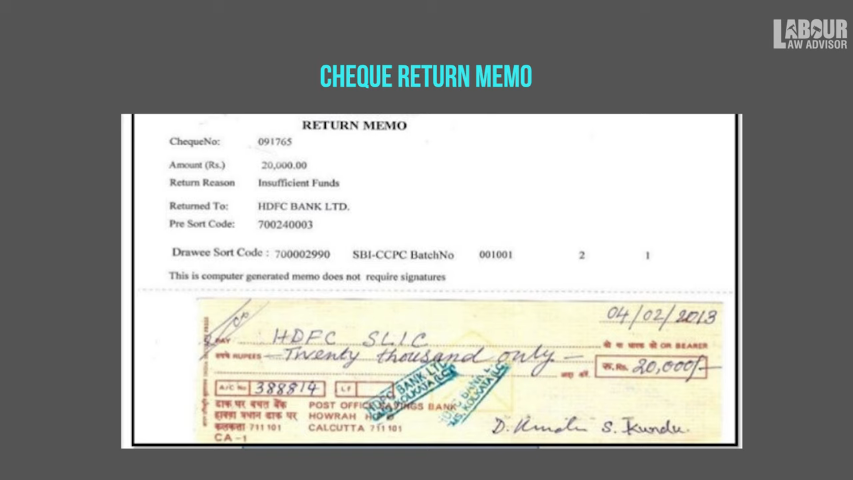

When a cheque bounces, the bank gives a written memo to the customer in return. It tells the reason the cheque has bounced. Additionally, the bank also gives a copy of the bounced cheque.

Legal actions to take when cheque bounce:

- According to the Negotiable Instruments Act under Section 138, there is a limitation period of 30 days to send the accused a legal demand notice.

- It is necessary to mention on the legal demand notice that it falls under Section 138. You also have to give the bounced cheque number, the reason for cheque getting bounced and 15 days time for a reply. This is mandatory as per the law.

- The law presumes that the notice has been served to you even if you refuse to accept the notice. So refusing to take the legal notice will not cause any change.

- You can find the format of legal notice for serving here. Fill this form up and post it via a registered postal service with AD for record purpose. You can also mail it via speed post.

- You do not need a lawyer to send a legal notice and can send it yourself too.

- As soon as the 15 days period after serving the legal notice is over, you have 1 month’s time to file a case.

What are the prerequisites to file a case?

- Before filing a case it is important to have the following things ready with you. The original cheque which got bounced. The return memo for the cheque bounce given by the bank. A photocopy of the legal notice you served the accused. And the receipt of the postal service or speed post sent by you to the accused.

Legal notice sent via email or WhatsApp is still not widely accepted, except for a few courts. So you should refrain from doing this. Rather use a postal service.

Where can the case be filed and what is the process, therefore ?

- The case should be filed from the bank account location of the person filing the case. The jurisdiction of the accuser who has got the bounced cheque is valid for filing the case.

- Once 15 days lapse since serving the legal notice to the accuser and you file the case, the magistrate of the bank’s jurisdiction sends a summon to the accused. The summon states the date and time for appearing before the court.

- If accused does not come even after the summon, he is sent a bailable warrant.

- If accused does not come with bailable warrant also, he is then sent a non-bailable warrant. Herein, a police officer arrests the accused and brings him to the court forcefully.

- Once the accused appears, he gets bail. This is a right for all citizens.

- The accused then has to move an application under Section 145(2) to get a right to defend himself.

- Next, the accuser has to give a statement and witness regarding his complaint. He can either stand and say it himself or ask the complaint filed to be taken into consideration.

- The court listens to both parties and their witnesses and delivers judgement.

- There is also a new amendment called Interim Compensation under Section 143A. Once charges against the accused are prooved, the accuser gets 20% of the bounced cheque amount, even if the judgement is pending. Once the final court judgement is delivered, the accuser can keep the 20% amount if the judgement is in his favour, else he has to pay it back to the accused. This needs to happen within 60 days of the court’s judgement. Even if you appeal to a higher court, the 20% still has to be paid.

What punishment is given to the guilty in case of cheque bounce?

- One penalty is getting imprisonment for 2 years.

- And/or double amount of the bounced cheque has to be given.

When can a case cannot be filed for cheque bounce?

- A check given as a “security” is not valid for a cheque bounce case. For example, when an employer takes a cheque as security for hiring you, and you leave without a notice period, then it is not a cheque bounce case. There should always be a legal debt for it to be valid as a cheque bounce case.

- Cheques used after 3 months are not valid as cheque bounce.

- Not sending the notice within the limitation period, is also not a valid reason.

Points to note:

- In the case of MNCs, the case should be filed for the current active director present at the company at that moment. The case need not be filed against all the authorities and the authorities residing abroad.

- In case of similar default in online payment transaction such as NEFT, the government has come up with the Payment of Settlement Act. Under Section 25 of the Act, you can serve a similar legal notice and file a case for a default online payment.

Watch our full video with Naman below.

Also read: Consumer court complaint filing process.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!