Imagine a future where your wallet is completely digital, and you can make transactions with just a few clicks on your phone. Sounds intriguing, right? Welcome to the world of e-Rupee, India’s official digital currency! Let’s explore what it means for us, the common people, and how it stands to revolutionize our financial transactions.

In the age of digital transformation, India has introduced its official digital currency, the e-Rupee, a sovereign-backed currency issued by the Reserve Bank of India (RBI).

But what does this mean for the average employee and the common man? Is it a step towards a more inclusive financial ecosystem, or is it just another form of currency with its own set of challenges? Let’s delve into the world of e-Rupee and understand its implications, benefits, and challenges.

Watch our detailed video below to get a comprehensive understanding of e-Rupee and its functionalities. Dive into the world of digital currency with us!

Embracing the future of digital currency with e-Rupee opens new avenues for financial management and investments. However, navigating the investment landscape, especially in the stock market, can be daunting for beginners. Avoid common pitfalls with our guide on 7 Big Mistakes by Beginner Investors in the Stock Market, which offers valuable insights to help you make informed decisions and optimize your investment strategy. Whether you’re considering traditional investment vehicles or exploring digital currencies, understanding these fundamental mistakes is crucial. Learn how to steer clear of these errors!

Table of Contents

What is e-Rupee?

e-Rupee is India’s official digital currency, akin to a digital version of the traditional banknote. It’s a centralized currency, reflecting as a liability on the RBI’s balance sheet. It is designed to be a legal tender, meaning it’s accepted as a form of payment throughout the country.

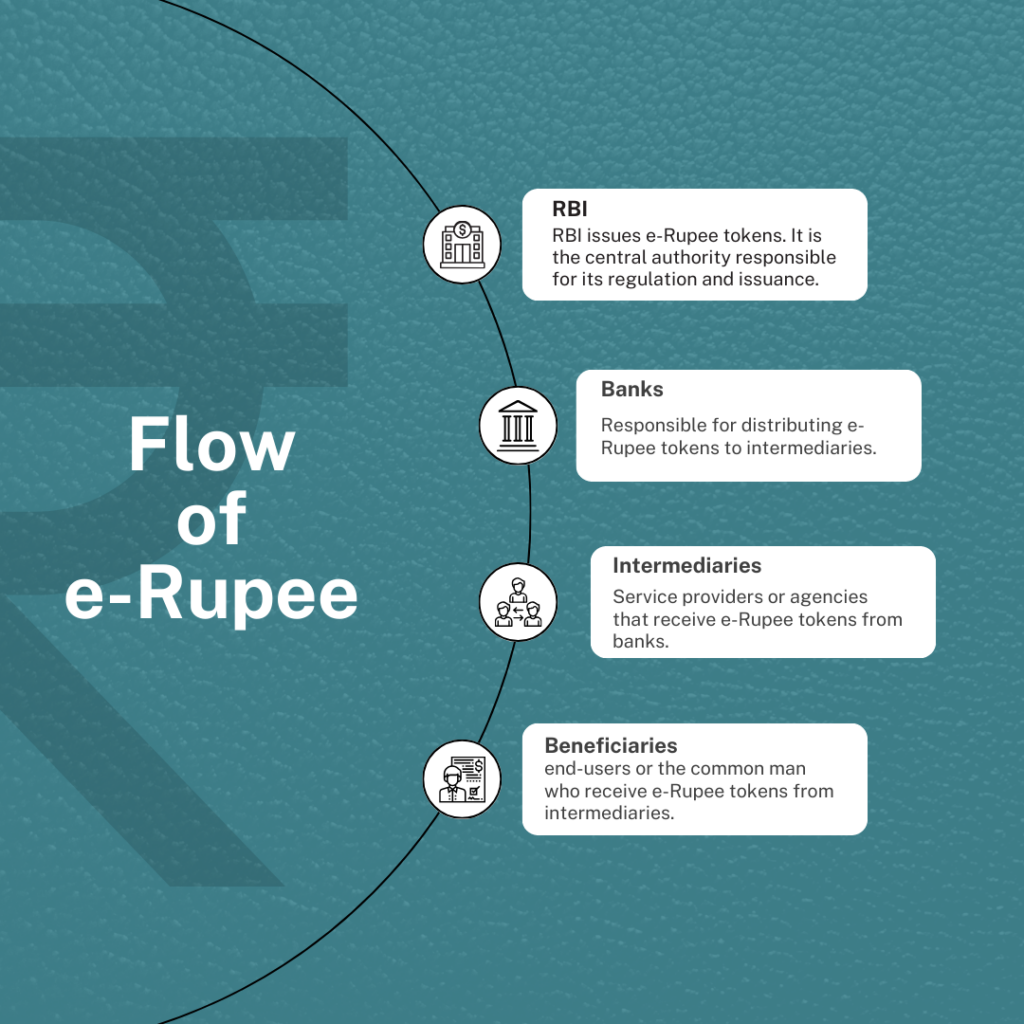

How does e-Rupee work?

To use e-Rupee, users need to download a digital rupee app from the Play Store or App Store. After verifying the SIM and setting up security pins, users can link their bank accounts and load e-Rupees into their digital wallets. The e-Rupee can be sent to anyone, even those without a bank account, making it a versatile and inclusive form of currency.

Example: Two individuals, were able to transact using e-Rupee, with one person receiving the exact serial number note that the other person sent, maintaining the integrity and uniqueness of each digital note.

Why is the government introducing e-Rupee?

The introduction of e-Rupee aims to reduce the costs associated with money printing and transaction verification. It’s a step towards bringing individuals without a bank account into the mainstream banking ecosystem, allowing them to transact online and store value digitally.

How is e-Rupee Different from Bitcoin?

While Bitcoin is a decentralized currency using a public blockchain, e-Rupee is centralized and uses a private blockchain. Bitcoin is not backed by any government and has no intrinsic value, whereas e-Rupee is backed by RBI, making it a legal tender in India.

Can e-Rupee and UPI Coexist?

Currently, e-Rupee and UPI are not linked, but the government plans to make them interchangeable soon, allowing payments from digital rupee to UPI QR codes.

What are the Benefits of Using e-Rupee?

- Inclusivity: It brings people without a bank account into the mainstream banking ecosystem.

- Cost-Efficiency: It reduces the costs associated with cash management and printing.

- Energy Efficiency: It requires less energy to verify transactions compared to other payment systems.

- Cross-Border Transactions: It simplifies cross-border transactions between central banks.

- Anonymity: It offers a degree of anonymity for lower-value transactions.

Are There Any Concerns with e-Rupee?

While e-Rupee offers a degree of anonymity, it’s not absolute. RBI has the ability to track all transactions and can trace the route of any particular e-Rupee note through its blockchain, raising concerns about privacy and data security.

Understanding the intricacies of government spending is crucial as it significantly impacts the economic fabric of a country. Our insightful piece on Government Spending Explained: The Good, Bad, & Ugly, dives into how strategic investments in infrastructure and other areas drive transformative changes, boosting efficiency and economic growth. It also sheds light on the potential pitfalls of mismanagement, such as wastage and corruption, offering a balanced view on this complex subject.

Conclusion

Is e-Rupee a revolutionary step towards India’s more inclusive and efficient financial ecosystem?

It certainly seems so. It not only reduces costs and energy consumption but also brings the unbanked population into the financial mainstream. However, the concerns regarding privacy and the centralized nature of e-Rupee are valid and need addressing. As employees and responsible citizens, it’s crucial to stay informed and make the most out of the advancements in digital currency while being aware of its implications.

As we embrace digital currencies like e-Rupee, understanding the existing digital payment ecosystems becomes increasingly important. Our detailed analysis of the differences between NEFT, IMPS, UPI, USSD, RTGS provides a clear understanding of each payment system’s unique features, advantages, and limitations. Grasping these concepts will enhance your comprehension of how e-Rupee fits into the broader digital payment landscape, preparing you for a future dominated by electronic transactions.

FAQs

- Question: What is the value of e-Rupee?

Answer: The conversation rate is 1 e-Rupee = 1 Rupee - Question: What is the difference between e-Rupee and UPI?

Answer: Unlike e-Rupee, which is a currency, UPI is only a payment system that allows the transfer of money from one bank account to another through an intermediary. - Question: Is e-Rupee anonymous?

Answer: e-Rupee offers a degree of anonymity for lower-value transactions, but the RBI has the ability to track all transactions if needed. - Question: Can e-Rupee be used by individuals without a bank account?

Answer: Yes, e-Rupee is designed to be inclusive, allowing even those without a bank account to transact and store value digitally. - Question: Is e-Rupee legal tender in India?

Answer: Yes, e-Rupee is a legal tender in India, backed by the Reserve Bank of India.

Comment below if you think e-Rupee will replace traditional cash transactions in the future.

Stay tuned for more insights on digital advancements and subscribe to our newsletter, “The Success Circle” to stay informed about the latest trends and tips. It’s free, informative, and invaluable!

Don’t forget to share this blog with your network and let’s embrace the future, together!