The stock market seems a very practical and lucrative space for the normal people to invest their money in. When income is limited and property or other asset purchase is not a viable option, then buying shares is one of the few sources for wealth creation. Many people jump into the stock market craze without realizing how to navigate this world correctly and end up making mistakes which can lead to monetary loss. Thus, this article outlines some basic mistakes by beginner investors to avoid in the stock market which will help your money to grow rather than fall.

In the following part, we sit down with Pranjal Kamra, a very successful content creator and entrepreneur, to discuss his mistakes and lessons learned in his financial investment journey.

Table of Contents

In conversation with Pranjal Kamra

Should you always ignore high value shares and buy affordable units instead?

As a beginner in the stock market, people tend to ignore high value shares and go for more affordable ones instead. But this thinking is incorrect. People might ignore high value share thinking that it has already reached its peak in terms of value and it cannot go any further. So now it will only go down from here. Secondly, people find it more convincing to buy multiple shares of lower value rather than a single share of high value.

But one must understand that you are not making money on the number of shares you buy. Rather you make money on the percentage growth of shares. No matter the number of shares you own, the growth percentage will remain the same for both multiple shares and a single one. Hence, when buying shares look at the possibility of growth percentage and not the number of units.

Also, there is no guarantee that the lower value share will grow more in the future. Since growth of the share depends on the company’s performance. So buying a lower value share with the thought that it has more scope for growth rather than a share which has already reached an all-time high is not a valid reason. Moreover, question why a share is valued so low before buying it, as is it not a good thing that the share value is low. It means that the management is doing something wrong there. This is the first mistake made by beginner investors.

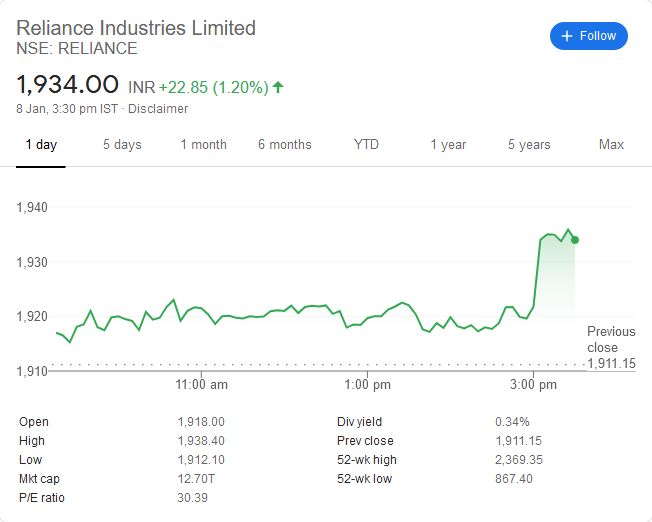

Reliance is a bigger company but it’s share price is low. Whereas MRF is a smaller company but has a very high share price?

Another one of the mistakes by beginner investors is that they fail to understand that the price of a share depends on the percentage of the company’s stake behind it. In this case, Reliance has broken down their share value worth Rs 1000 into many smaller parts to make each share attainable for the common man. But when you bring all those smaller parts together, the value of Reliance as a company is high. On the other hand, MRF has kept their share numbers low since it doesn’t care about making shares attainable for every person. As the share units are less, the amount per share is high. But when you bring all shares together, the total value is less than the value of Reliance as a company.

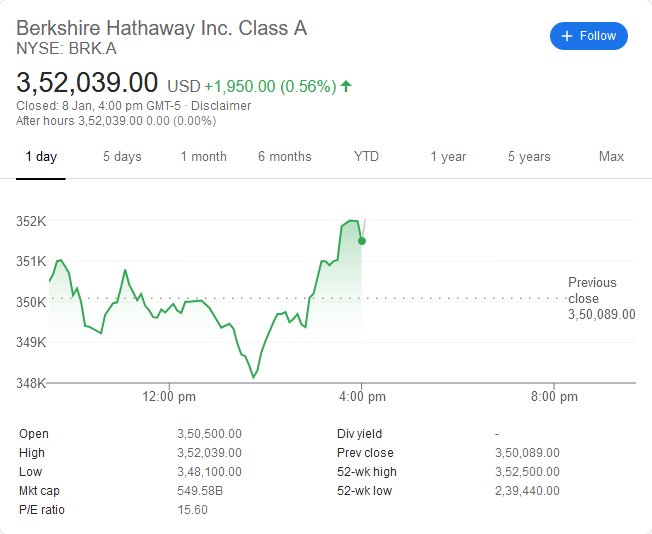

For some companies, it is important to make their shares easily accessible to people of different economic backgrounds, which is why they split their shares to make per share value low. For example, the per share value of Berkshire Hathaway Inc. which is a Class A share is close to Rs 2 crores. Reliance Industries Limited is as big a company as Berkshire Hathaway, but since they want more and more people to have a share of their company and split their bonuses among their shareholders, hence their per share value has been kept low. If they didn’t do that, Reliance too would have per share value of close to Rs 2 crores.

Undermining stock advisors because they do not commit to multi-bagger returns

People may fail to listen to fund managers who promise a return of 15-20% on stocks and look at the returns of big companies with 60-100% annual returns thinking they can achieve the same on their own. In this case, people often see the past history of stocks and think they can get those returns. But it is usually a portfolio of stocks out of which one may get a very high return and be a multi-bagger while some may tank. Hence, it doesn’t matter how many multi-bagger shares you have in your portfolio. What matters is how many poor performing shares one has. Since ultimately the total portfolio return is going to be the net of the high performing stocks minus low performing stocks. So, it is not much value if one share rises 10x but the other nine shares in your portfolio tank.

The mistake made by beginners investors is that the first priority in investing is to preserve your capital. If you preserve your capital, your index automatically grows. But viewing the graphs of blue chip stocks and buying penny stocks instead thinking that they will perform similarly is not the way to go ahead. This is a high risk step which will lose your capital. While we need to preserve our capital. Rather go for blue chip stocks because they can also give extraordinary returns in due time.

On the other hand, it is also not true when fund managers say that they can give you a high return of 15-20% which is as much as Warren Buffett makes. Since Warren Buffett’s holding is worth multi-billions, he can only invest in the most mature companies which give moderate returns. So his returns are moderate but comparing the funds worth few crores being managed by fund managers versus few lakh crores being managed by Warren Buffett is not one and the same.

Is comparing a graph of one stock with another stock and expecting similar results a good thing?

If we take the example of Ruchi Soya Industries Ltd. share, it grew about 8000% in a couple of months. If seasoned retail investors wanted to buy this share they could not do it, because by the time they got news of the share doing well, it was already getting upper circuits and entry was difficult. But since its peak, the share has continued to fall.

So how this works is that for the first one-two months, some investors continue to buy a particular share and increase its price. Next, they tell other investors to invest in the same, saying that the share will continue to grow and increasing the share price even further. When new investors check the share graph, they can actually see the graph growing higher since the initial investors had been increasing its price for the last two months. Hence, the new investors go ahead and purchase it, what they don’t realize is that the initial investors have been dumping their shares of the company on them.

For the next few months, the share price continues to fall, and only the initial retail investors who had purchased them and increased the share price have now gotten a profit on it while the others are left sitting with penny stocks. This is generally true for new and unknown company shares. Thus, it is not advisable to look at a particular stock graph and compare it with another before investing, especially if you are comparing a penny stock against a blue chip stock. It is also not advisable to listen to “insider news” of stocks growing and then purchasing them because it most certainly is going to be a case of share dumping wherein you will be left with penny stock in lower circuits. A common mistake made by beginner investors.

My money has doubled from share A, so let’s sell it now because it will only go down from here.

A common mistake made by beginner investors is that they often feel that if a particular share has done well and doubled their cost in a year then they should sell it off, as it will only go down from here. When buying shares, 40-50% of the time you may pick a wrong one which does not give great returns. Thus, it is important to figure out which of the shares are not growing at all and sell them off at the minimum profit to recover your loss. On the other hand, hold on to the shares that are multiplying their price since they have the potential to become multi-bagger stocks and yield big results. If the company itself is not dependable then it is fine to sell the shares but do not sell with the thinking that it has already made 100% profit and won’t grow further.

Selling half of the shares to recover the cost.

Another case that happens is that if a particular share price has doubled pretty soon then mistakes made by beginner investors is to sell off half of them to recover the cost. Again, the reason for selling shares should not be that you have made enough profit. Rather it must be that the company is not stable and their financial future does not look secure. If the company has a good reputation and is projected to do well then by all means you should stay with their stocks and let the price keep growing. That is how you get a multi-bagger stock.

It is important to have patience with the stock market. Treat it as a long-term investment of 10-15 years and only then will you be able to get 10x to 100x returns. Since shares will only increase that much when the company business will increase that much and it takes 10-20 years for a company to grow and become a big corporation. That is not possible over a couple of years.

Should you make stock buying decisions based on the news and incoming data?

Often you may get news of a stock going to do well based on industry sources and the news, and you think of buying it since there is most probably going to be a rise on that stock price. But most often than not you end up buying the stock right at its peak and after buying it the price continues to fall. This is because similar to you, a hundred other investors also have the same news. So thinking that you are the only one with this insider news is a common mistake made by beginner investors and buying stocks on the basis of news is wrong.

Stocks should be bought on the basis of your interpretation of the data. Rather than focus on the numbers, focus on the company history and their future prospects. Even companies themselves are focussing on gathering more and more data and strengthening the core, rather than going after profits. Hence, you as an investor should also not look at the company only in terms of their profits.

Look at a company on the basis of their management analysis, vision and business analysis. Be more forward-looking rather than backward. One advice is never to remove your investment from the stock market. If you feel the market is going to crash then don’t put in new money but don’t pull out the already invested money as well. Since there is the possibility that your hunch may be wrong and the stock market may not fall at all. Secondly, once the money is retracted from the stock market and transferred to your bank account, then it is a waste.

How much should I invest and decide that amount is enough?

The amount of investment should be such that it makes a difference to your net worth. Especially when you are young and can take the risk, it is advisable to put a major portion of your savings into equity investment. If you can afford to take loans which are double the value of your net worth then you can afford to make equity investments which are a significant portion of your net worth. But never take a loan for stock market investment, as that would be highly risky and undesirable and a big mistake by any beginner investors.

Watch the video below for our chat with Mr. Pranjal Kamra.

In the following part, we sit down with Ankur Warikoo, a renowned mentor, angel investor, entrepreneur, public speaker and content creator, to discuss his mistakes and lessons learned in his financial investment journey. Ankur Warikoo is the founder of Groupon which is now known as Nearbuy. He started his content creation journey on LinkedIn, which blew up, and he now makes content on YouTube as well.

In conversation with Ankur Warikoo

What was your thought process which lead to your financial mistakes?

There are generally two kinds of financial awareness. First, where we are earning X amount but we will never reach the level of financial liberation, or where we don’t know how much our money can do for us and how long it will take to reach the stage of financial liberation. Second is the obnoxious irrational optimism kind where we know that we are born with all the luxuries of life, and we have a security blanket to fall on, so how far up can we go from here onward.

So I was the second kind and had an unexplainable level of confidence that I will get there. Hence, I was just playing with my money because I didn’t think there would be a point where I would have no money. People with experience in money-making will always say that one part of the game is making money while the second part is holding on to that money. But I faltered at holding on to the money and making it grow further.

Did an MBA in Finance make you overconfident?

MBA in Finance had nothing to do with it. Since it deals mostly with corporate finance and not personal finances. I fell into the startup cocoon and thought that this was the only world, there was nothing beyond that. But I felt that fixed deposits were boring and for old people. I didn’t believe in debt instruments, still don’t to a great degree. Even equity instruments felt boring to me. Meanwhile, when you put your money into startups it would grow 10x-20x within 3-4 years, which excited me immensely. Also, being from that world, I had more information coming in on new startups. Likewise, real estate also seemed like great investment. But it just ended up being a cluster of mistakes.

How old were you when you made your first investment?

I started investing at around 22-23 years when I opened my first demat account. I was a student and earning some surplus while in the West. So I converted them into INR and invested in the Indian stock market. I started buying some stocks and investing in the wrong way, trying to make some quick bucks. Once I got a tip and invested in some cheap stocks which did get me a profit upon selling in the short-term. So I bought them again when their price fell but then they only ran at a loss.

Due to similar stories, people face losses and blame the stock market as being risky. Hence, the dismal percentage of retail investors in the country. The problem is with the approach of entering the stock market. People should invest in stock market as a commitment to a company that they will feel has a good future and will grow further. One has to do an analysis of the company before investing in its share, otherwise, it is a gamble. If you look at the fundamental sectors and its products which are obviously going to stay relevant for a long time, then that’s a good stock to invest in.

Did you stop investing after your losses?

After the dips, I didn’t stop investing. Rather started purchasing better stocks which got some appreciation. Around 2006-2007 when I went to pursue my MBA, I took a break from investing. Then in 2009, I got some liquidity and made my second mistake of buying real estate using a loan. I paid 20% down payment and took loan for remaining 80%, thinking that its price would definitely increment.

The house was bought purely as an investment at around Rs 16 lakh. After 5 years, the house was sold for Rs 33 lakh. With the Rs 13 lakh loan and interest and registry charges, I ended up making only Rs 40,000 profit. After paying capital gain tax, my actual profit was negative.

Why did you disagree with your wife even after making mistakes?

In my head, those mistakes were in different categories. First it was an error of the stock market, then real estate market then startups. However, my wife always put her surplus money in mutual funds SIP. She has always been very disciplined about it. She never looked at stock market or real estate investments, but focussed on mutual funds only. After 2009, when the startup bug hit me I made the mistake to put all my money into liquid assets. Meanwhile, my wife continued with mutual funds. And every time we were in a financial soup, she dipped into her mutual funds investment to help us out.

Why did you break the power of compounding?

That was just the need of the hour since we needed liquidity. However, every time you break compounding, it will take similar duration to bring it up again. That is something I do regret though. If it was possible to get cash from somewhere else then that compounding wouldn’t have been affected. At the same time, however, if one needs money urgently then it is ok to break the compounding. Since one cannot be a slave to money, rather make money your slave.

What is the biggest mistake you’ve made?

I invested in many ill-liquid assets. For investments in real estate, startups – it is difficult to get buyers easily who will pay the asking price. All of these create massive pressure. As an entrepreneur, your earnings are unpredictable. So it was the perfect example of the urban poor concept, where my liabilities were high and everything was depending on future earnings. Having investments that don’t help out in actual time of need is irrelevant.

I also didn’t invest in any traditional instruments like gold. Which would have actually been great now but did not seem cool then. At the end of day, money is very static in its operation.

The urban poor concept is hitting many hard

People take wrong decisions and buy things out of their financial capability only to keep up an image. Since access to credit is so easy nowadays, people don’t realize the high interest they are actually paying. Everything is on EMI and savings are virtually none. People may be living in a great house, but it’s on loan. They may have the latest iPhone but it’s on EMI. Or they may have a big branded car but it’s on loan. So just showing the image of urban perfection but having virtually no savings or liquidity is a problem in today’s society.

What’s the mindset between a user Vs an investor?

As an investor, you believe that the users of the brand will continue using it for a long time. Even if the product or service is good or not. So while taking credit via EMI from Bajaj Finserv is not recommended, being an investor in Bajaj Finserv is recommended because its users will keep using it and its demand will always be high thus equating to great share value.

Have you explored cryptocurrency?

Yes, I bought my first Bitcoin around 2015-2016 when it was at a high of around $9000. Although I wasn’t sure of it and bought only a few, it is now worth $24,000! That was all the crypto investment I’ve ever done. When its price fell, I did not buy anymore. I’ve only ever bought Reliance and Tesla shares when their prices fell. I feel that these companies will stay and create the future for a long time and I’ve never regretted my decision.

How did you end up taking term insurance plan?

I took my term insurance when I was 31 years old. The insurance cover was quite big, worth Rs 10 crore with an annual premium of Rs 1.5 lakh for 20 years. I gave a lot of thought before going for term insurance instead of a traditional life insurance policy or insurance with an investment policy.

However, people thought it was an incorrect decision but I stayed with my thought process behind picking this. Firstly, the total cover of Rs 30 lakh was spread over 20 years, which amounted to not that much when you take inflation into consideration. Secondly, I was getting Rs 10 crore insurance cover for Rs 30 lakh, which no other option would provide. Hence, the trade-off is great.

Why did you not take an endowment plan instead?

The endowment plans were offering a return of 10-12%. Meanwhile, I believed that I could get 20% and more with my startup investments. With my confidence in achieving more returns, I did not opt for endowment plans. However, now endowment plans give 5-6% returns which is even less than fixed deposit returns. Yet, people are still investing in fixed deposits knowing that tax-adjusted inflation returns will be negative. Hence, I still continue with my earlier term insurance plan. Additionally, I have disability and critical illness add-ons with it. Since it is a more likely scenario in today’s age.

How important are taxes?

Taxes are a necessary evil. It is something which everyone has to pay but hardly anyone takes into account while planning investments. There are a lot of mechanisms to save taxes, which people don’t make use of. In my own experience as the CEO of Nearbuy, we had an extensive tax savings system where people had to submit bills for rebates. But hardly anyone did that and I would call up my employees and ask them to do it personally.

I was the only one who would extensively send the bills for tax rebates at the end of each month. Even when we save taxes and use that money, we still pay taxes indirectly. Thus, one has to be disciplined around tax savings as well. The government has actually provided so many tax benefits which people are not making use of. With so many online platforms and ease of access, one should not have any excuse for not filing taxes anymore.

What’s your current asset allocation?

My current portfolio has around 40% investment in large-cap stocks which are market leaders. Another 30% investment is in Zerodha smallcase where I invest in momentum strategy. About 20% of investment is in USA-based stocks in four market leaders. The last 10% is invested in startups through syndicates. I don’t have any traditional investments. However, I am planning to take up some debt instruments, high dividend stocks and gold. The investment strategy for 2021 is to get in more commodities, more ETFs in USA stocks and more debt assets.

My emergency fund is parked in a mutual funds which has 2-3 days of redemption. It’s not in any bank account. Additionally, I have good limits on my credit cards so emergency money won’t be an issue.

Watch the complete conversation with Ankur Warikoo below.

Interested in stock market? Learn more in Smart Stock Tips Series.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!