Mutual Fund houses such as Reliance Mutual Fund, ICICI Prudential AMC and Birla Sun Life Mutual Fund, have recently come up with an additional feature for their investors. This add-on feature is a free life insurance policy for mutual fund SIP investors. This life insurance policy free if only eligible for select scheme investors of these mutual fund houses and is also directly proportional to the SIP investments by the investor on a monthly basis. Hence, this add-on not only gives life coverage but also gives the chance of gathering wealth.

Table of Contents

Age Eligibility For Free Life Insurance Cover:

The minimum age of the investor has to be 18 years old while the maximum age can be 51 years old, during the first investment for eligibility for the free insurance cover. Furthermore, the free life insurance cover will cease when the investor goes over the maximum age limit as described by the individual fund houses. The investor also has to have opted for a SIP of a minimum of 3 years. The investor may be an Indian citizen or an NRI as well.

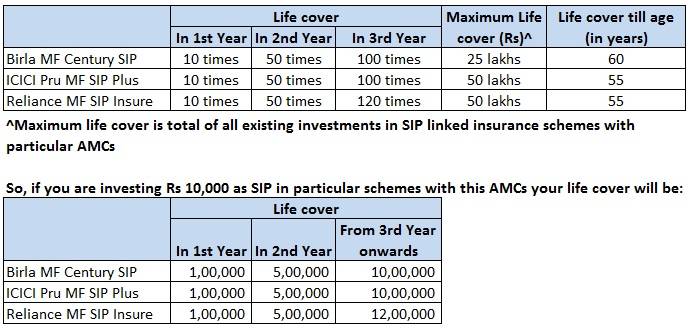

Cover for Free Life Insurance Cover:

The investor will receive a free life insurance cover of 10 times the monthly SIP instalment in the first year. This increases to 50 times the monthly SIP instalment in the second year and then to 100 times from the third year onwards. But there is an upper limit to the maximum cover one can get. This can be Rs 50 lakh in some cases and Rs 25 lakh in others.

When Does the Free Life Insurance Cover Begin?

Does the free life insurance cover begin on the same date as the SIP starts? No. One has to wait for a period of 45 days. The life insurance cover will activate on the 46th day. But in the case of accidental death, this 45 days waiting period is ignored, and the life insurance policy cover is paid to the beneficiary.

Multiple SIP Holders?

In case of multiple SIP holders, the life insurance cover will be eligible for the first holder only.

Expiration Date of Life Insurance:

The life insurance cover will expire once the person attains the age of 55 or 60 years. This depends on the SIP one has taken up. As it varies from one brand to another.

Early Withdrawal:

If the investor withdraws before 3 years of completion of his SIP, then his life insurance policy will lapse. He will also be liable for a penalty of 2% Net Asset Value if there is partial or full withdrawal within one year. And a penalty of 1% of Net Asset Value if there is partial or full withdrawal between the second or third year.

The life insurance policy cover will also lapse if the investor is late in paying his monthly instalments or does not pay a few consecutive instalments at all. This varies from company to company. But if you are able to hold your money for 3 years then the life insurance cover will not lapse. The cover might get reduced if you make a partial withdrawal later, but that also depends on the company you opt for.

An important point to note is that this life insurance free cover is not provided by the mutual fund house itself. Instead, it is a tie-up with a life insurance corporation. Hence it is not the mutual fund house’ responsibility if your claim is delayed or gets rejected. The nominee has to apply to the life insurance corporation for these claims and not the mutual fund house.

Advantages:

- Free life insurance cover without any extra cost

- The insurance cover continues to pay the SIP amount to the nominee in case of the early death of the investor

- A bigger SIP investment plan means a bigger life insurance coverage

Disadvantages:

- This add-on free insurance is not available under all schemes, hence giving limited choices to investors in terms of selecting funds

- Insurance is not given to the first holder, if there are multiple SIP holders

- The mutual fund house is not liable for any insurance claims, since it has to be dealt with the insurance company directly

- Buying this cover as the only source of protection is not advisable since it is only a multiple of your SIP. Ideally, life insurance should taken on a multiple of the annual income.

- Any insurance cover ending before 60 years of age is not good, since people mostly retire at 60. So the cover should exist until 60 atleast.

Our Take:

Opting for a mutual fund only for the free life insurance cover is not a good decision. When choosing a mutual fund, look for their past fund records, fund manager’s consistency and risk-adjusted return strategy. Only go ahead with the mutual fund if satisfied with these, and not just for their life insurance cover.

Ideally, an investor should have at least 10 to 20 times his annual income as life cover. If the total life insurance sum assured across different schemes do not get the same, you are under-insured. The best bet for this would be term insurance. Check out all the details on it here.

Here’s a quick video on the topic below:

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!