Do you know about the new EPF rules by the Department that have been in action from September 2014? Well unlike you, there are many other employees who fall under the PF category and do not have any idea, why their claims are getting rejected. Presently, anyone whose salary is more than Rs 15000, will not be entitled to get any pension. Without the proper knowledge, you might lose your PF amount, and your transfer and claims too might get rejected.

We will first introduce the PF Transfer – Form 13, that says some claims are getting denied. Apparently, this is because the employee whose salary is more than Rs 15000, is not eligible for PF even if at the time of joining, the salary was Rs 15000 or more, and the pension was being collected. On this note, the PF department is seeking clarification as to why was the pension being deducted.

From 1st September 2014 onwards, there was a huge change brought by the PF department. This was a rise in the deduction limit to 15000, meaning it will increase membership base and quantum of contributions. Employees whose salary is up to Rs 15000 will receive PF and pension deduction both. Now, employees who have a monthly salary between Rs 6500 to Rs 15000, will be covered under the three schemes. Other than the PF and insurance scheme, voluntary membership will not be available under the pension scheme for employees with a monthly

New EPF rules by the Department are that, if an employee joins on or after 1st September 2014 with a salary above Rs 15000, then his pension contribution will not be collected, and all the contribution will go to the PF share.

Table of Contents

PF Procedures:

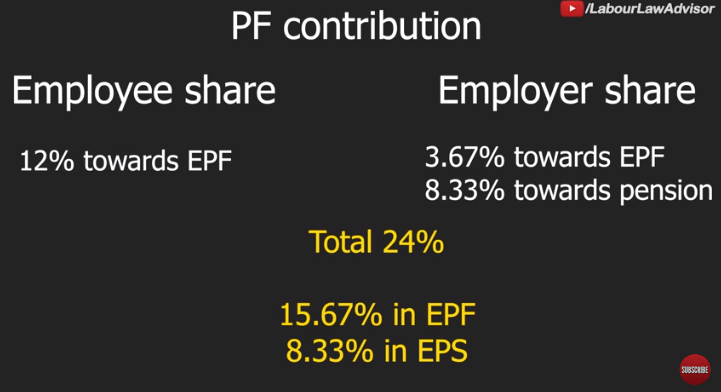

For people who are still confused about the PF procedures, let us brief you in short. There are two contributions involved, employee share and employer share. The employee share comes to 12% towards EPF and the employer share is 3.67% towards EPF and 8.33% towards Pension. The total contribution of 24% goes for PF and Pension. However, after the 1st September 2014, the entire 24% will be going under the EPF.

PF Calculation Example:

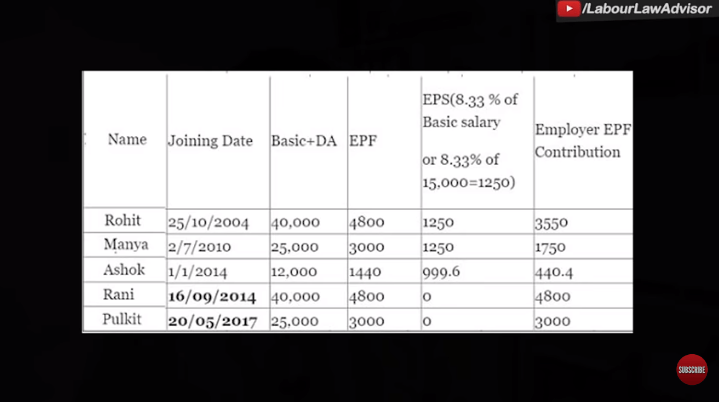

Further, let us go ahead and check a few examples of employee details and understand how the new rule has affected PF.

From the above Table 1, you can understand that all employees who joined before September 1st 2014, get a PF deduction. The employees who have joined after September 1st 2014, do not get any pension contribution and all their income share goes to the EPF.

This news did not have much wide publicity. Therefore, employers, employees and the internal PF department also had a lot of confusion regarding this new plan. Moreover, the confusing aspect highly reflects in the rejection list of many employees when they claimed for their EPF.

How To Correct The Error And Follow EPF Rules?

As you have seen, many employers and employees are clueless about the new PF rules, so let us see what can be done so that these mistakes are not repeated again. First and foremost the PF department has to clear the following two

- If the salary is more than Rs 15000, then what

is the criteria? Does this amount include DA or is this just gross wage amount? Without any clarity, there is no point in debating on this topic and it will be difficult to understand the issue. - If any employee has been rejected PF due to the reasons not justified, what are the redressal measures? What are the procedures and do the employees have to submit any form?

It is requested that the PF department provide clear information on what are the right policies regarding the new PF rules set by the department. Moreover, whether the amount that was transferred in the pension contribution will be transferred in the PF? The Department must provide clear cut information on the interest on the PF.

Meanwhile, if you are facing any issue like this, you can download your EPF rules and passbook and check them. Employees whose salary is more than Rs 15000 but your pension contribution is on-going, should go for immediate redressal measures.

Our video below provides more information on this topic:

Further, if you want to know more about new rules and amendments in EPF, you can check it here.

You can also view our EPF calculation video for further clarification.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!