With the exponential rise in COVID-19 cases, the chances of attracting the virus also increase. Keeping this in mind, the Insurance Regulatory and Development Authority of India (IRDAI) has launched two COVID insurance policies – Corona Rakshak and Corona Kavach. Regardless of which company you pick a COVID insurance policy from, its terms and conditions will remain the same, only premium amounts will change. This article gives a detailed analysis of both these insurance policies.

Table of Contents

Corona Kavach Vs Corona Rakshak – Comparative Analysis

| CRITERIA | CORONA KAVACH POLICY | CORONA RAKSHAK POLICY |

| Plan | This is an indemnity-based plan where only your hospital bills will get reimbursement. | This is a benefit-based plan where 100% of the sum insured is paid to the policy holder. |

| Eligibility | 18-65 years. But cover for dependent children below 25 years (who are financially dependent on parent), parents, parents-in-laws, etc. is available via a family floater plan. | Similarly, eligibility age is 18-65 years. |

| Waiting Period | You can only get the insurance 15 days after you have applied for it. | Similarly, the waiting period is 15 days. |

| Policy Period | Three periods are available – 3.5 Months, 6.5 Months and 9.5 Months. Susceptibility to COVID-19 during these periods is covered by the insurance policy. | Similarly, three periods are available – 3.5 Months, 6.5 Months and 9.5 Months. Susceptibility to COVID-19 during these periods is covered by the insurance policy. |

| Coverage Amount | Minimum sum insured – Rs 50,000. Maximum sum insured – Rs 5 lakh. | Minimum sum insured – Rs 50,000. Maximum sum insured – Rs 2.5 lakh. |

| Special Discount | 5% Discount in Premium is available to Healthcare Workers. | 5% Discount in Premium is available to Healthcare Workers. |

| Types of Plan | 1. Individual 2. Family Floater (Tip – Individual will be more beneficial as the SI in Family Floater plan may not be enough to cover a family). | Only Individual. |

| Conditions of Claim | Either through a positive diagnosis of COVID-19 from a Government authorised laboratory or a minimum 24 hrs of continuous hospitalization. | Either through a positive diagnosis of COVID-19 from a Government authorised laboratory or a minimum 72 hrs of continuous hospitalization. |

| Availability | One may approach insurers but life insurance companies cannot offer them. | One may approach any insurer including the life insurance companies |

| Tax Benefit | Under Section 80D. | Under Section 80D. |

| Premium | Premium will depend on Pan India basis and will be a one time payment. There is no one-specific premium plan being followed by all insurance companies. | Similarly, Premium will depend on Pan India basis and will be a one time payment. There is no one-specific premium plan being followed by all insurance companies. |

| Coverage Terms | 1. Pre Hospitalization – 15 days. 2. Post Hospitalization – 30 days. 3. Comorbid conditions (new/pre-existing) along with COVID-19. 4. Road ambulance (Rs. 2000 per hospitalization), Room rent (no-sublimit), boarding, nursing, specialist charges, ICU, Surgeon, Consultant, Anesthetist, Blood Oxygen, OT, Ventilator, Medicine, Different Test Charges, Oximeter. 5. PPE, Gloves, Mask and other consumables. 6. Home Care Treatment Expenses (Maximum up to – 14 days per incident). 7. Covers Ayush Treatment also (from Government approved centres). | NA |

| Exclusions from policy | 1. Day Care treatment and OPD treatment. 2. Diagnosis/Treatment outside the geographical limits of India. 3. All covers under this Policy shall cease if the Insured Person travels to any country placed under travel restriction by the Government of India. | NA |

| Optional Cover | You can get daily hospital cash for the number of days you are hospitalized. For example, if SI isRs 4 lakh, daily cash will be Rs 2000. Cashless – Network Hospital. Reimbursement – Non-Network Hospital. | NA |

Premium Comparison

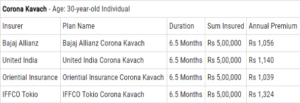

Premium plans for Corona Kavach are as given below.

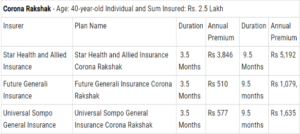

The premium plans for Corona Rakshak are as given below.

Comparing the two COVID insurance policy, premium for Rakshak is always a little higher than premium for Kavach.

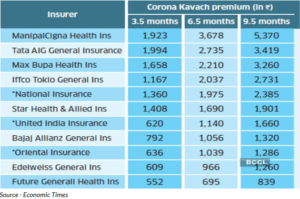

Premium plans also differ majorly for different insurance companies. For instance, as you can see in the image below, TATA AIG General Insurance charges Rs 1994 per month for 3.5 month premium plan. Whereas, Bajaj Allianz General Insurance charges Rs 792 for the same plan. The overall terms and conditions remain the same, the quality of service may differ though.

Why should you opt for Corona Kavach?

- Corona Kavach is not only standardised but is also a more comprehensive version of the existing COVID plans since it also covers home care, PPE and treatment of co-morbidities when hospitalised. Since these are not covered by basic health plans, you may end up paying from your own pocket for these additionals. The plan also covers ventilator and ICU charges, as well as the cost of oximeter and oxygen cylinder.

- Since everyone may not have a high and a comprehensive cover, or may not be able to afford the high premium, or may have no health insurance at all, Kavach may be a good option to cover the enhanced risk in the current circumstances.

- It can be used in combination with basic plans to increase the overall cover size. For instance, if you have a Rs 5 lakh basic plan that covers COVID, you can take a Rs 5 lakh Kavach plan to enhance your cover size to Rs 10 lakh.

Why should you opt for Corona Rakshak?

- Corona Rakshak could suit you if you already have a health insurance policy but feel that a positive diagnosis for COVID-19 could result in loss of income.

- Also, any deduction that happens on the health insurance claim can be supplemented with this benefit-based policy. In regular health policies, sometimes PPEs and other consumables may not be covered.

Important links

IRDAI Guidelines on COVID Standard benefit based health policy (for all Insurers).

Watch the video below for further information on COVID insurance policy.

Also read, National Pension Scheme | Better Than PPF/EPF/ELSS/APY?

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!