National Pension Scheme or NPS is a voluntary long-term investment plan in India. It is supposed to help individuals after their retirement. A major benefit is that it is exempt from all taxes. This article takes you through all important aspects, pros and cons of National Pension Scheme.

Table of Contents

What is National Pension Scheme?

The National Pension Scheme was launched by the Central Government in 2004. It was primarily a pension program open to all government employees of the country. Exception being the armed forces. The members have to pay investments at regular intervals during their employment years. Once they retire, they get access to a monthly pension. The format was similar to PPF and EPF. In 2009, the Pension Fund Regulatory and Development Authority

(PFRDA) took charge of it. Thereafter, the National Pension Scheme became open to everyone on a voluntary basis. This scheme is specifically beneficial to private-sector employees as they can arrange for pension post-retirement.

Who should invest in NPS?

Anyone between the ages of 18 to 65 years who is specifically in private employment. Since private employment does not provide a retirement pension plan, National Pension Scheme can serve as a good substitution. Individuals who do not want to go ahead with high-risk investments such as stock market trading are also good candidates for this scheme. Furthermore, salaried employees who want to take advantage of tax deductions can go for this.

How is NPS different from PPF and EPF?

The interest rate for PPF/EPF is decided beforehand. But for National Pension Scheme the return is variable since some of the money is invested in the stock market. Although low-risk, the National Pension Scheme returns differ slightly according to this performance. Furthermore, in the last ten years, NPS annual returns have ranged between 8-10%. Sometimes, the National Pension Scheme returns have been even higher than the PPF/EPF returns.

What is the minimum investment in NPS?

To open the National Pension Scheme account, one needs to make a payment of Rs 500. The minimum transaction requirement is also Rs 500. And, the minimum contribution requirement for a given year is also Rs 500. If individual forgets to make a contribution for a year then the account becomes inactive. To reactivate the account Rs 500 has to be paid for each year of being inactive.

Who manages NPS funds?

The Indian Government has given the responsibility of managing National Pension Scheme funds to seven fund managers as follows:

- Life Insurance Corporation

- HDFC Pension Fund

- UTI Mutual Fund

- SBI Pension Funds

- ICICI Prudential Mutual Fund

- Aditya Birla Capital

- Kotak Mahindra Bank

As an NPS account holder, you get to decide which of these seven fund managers will manage your account fund. Additionally, you can also change your fund manager in the future.

Where is the NPS money invested?

The National Pension Scheme funds are invested as per the following 4 categories:

- Low risk – These assets are G Class, Government bonds.

- Moderate risk – These assets are C Class, Corporate bonds

- High risk – These are E Class, Equity or stock market investments. One can allocate a maximum of 50% of funds to this.

- Very high risk – These are A Class, Alternative investments. Since this is very high risk, one can only allocate up to 5% of their total fund in this. These include Real Estate Investment Trusts, Infrastructure Investment Trusts, Alternative Investment Funds, Cat I and II, etc.

How is the asset allocated?

The National Pension Scheme account holder gets complete authority to decide what percentage of his bonds go in which class of investments. Thus, there are two choices of investment modes available:

1. Active choice

Active choice allows the National Pension Scheme account holder to decide the splitting of his investments in different schemes. There is a catch here though. You are allowed a maximum equity allocation of 75% of your funds, up to 50 years of age. You cannot give 100% allocation to equity funds. Moreover, once you attain 50 years of age, your equity allocation starts falling by 2.5% every succeeding year of investment. Finally, when you reach 60 years, your equity allocation settles down at 50%. Funds will be shifted from equity bonds to government or corporate bonds. Reason being that equity bonds are high risk, and the scheme aims at reducing your exposure to risky investments as your age grows. Furthermore, the division of other investments can be changed up to twice a year.

2. Auto choice

The auto choice option is for people who are overwhelmed with the division of investments. Auto choice decides the risk profile of your investments as per your age. The older you are, the more stable and less risky your investments. Auto choice gives you three investment options:

- Aggressive life cycle fund – This is for high risk-takers. It allows maximum equity allocation of 75% if you are 35 years or below. Henceforth, equity allocation falls by 4% every succeeding year. Once you attain 55 years, equity allocation is fixed at 15%.

- Moderate life cycle fund – This allows maximum equity allocation of 50% if you are 35 years or below. Thereafter equity allocation will fall by 2% every succeeding year, finally resting at 10% when you are 55 years.

- Conservative life cycle fund – This allows maximum equity allocation of 25% if you are 35 years or below. Thereafter equity allocation will fall by 1% every succeeding year, finally resting at 5% when you are 55 years.

What are the withdrawal rules?

The lock-in period for this investment is 60 years of age. It does not allow early withdrawal before the account holder turns 60. Thereafter, account holder has the option to either continue or defer the account till 70 years. After 60 years of age, you are allowed maximum of 60% fund withdrawal. For the remaining 40%, you need to buy an annuity plan mandatorily. You will receive a regular pension from a PFRDA-registered insurance firm on this 40%. You also have the option to withdraw the 60% in ten instalments until you turn 70 years of age. Alternatively, if your National Pension Scheme account holds less then Rs 2 lakh, then you can get full withdrawal.

For premature withdrawal, you must have 3 consecutive years of contributions. Then you are allowed up to 25% withdrawal of your own contribution. This is allowed a maximum of three times, with a gap of five years between each withdrawal. Furthermore, it is only allowed for special reasons such as serious illness, children’s education or wedding, building or buying a house, medical treatment for self or family, skill development or business.

What is premature exit?

If you want to take early retirement and start your National Pension Scheme pension before 60 years then you can apply for a premature exit. To avail this your account should have ten years of contributions. Then you can withdraw a maximum of 20% and keep 80% as an annuity plan. Moreover, if the total fund is below Rs 1 lakh then full withdrawal is allowed. In premature exit, your National Pension Scheme account is closed.

What are the tax benefits?

National Pension Scheme falls under the exempt exempt exempt category. Therefore, the contribution, return and withdrawal under this scheme are all exempt from taxation. A deduction of up to Rs 1.5 lakh can be claimed for NPS – for your contribution as well as for the employer’s contribution.

- 80CCD(1) covers the self-contribution, which is anyway a part of Section 80C. The maximum deduction one can claim under 80CCD(1) is 10% of the salary, but no more than the said limit. For the self-employed taxpayer, this limit is 20% of the gross income.

- You can claim an additional self contribution of up to Rs 50,000 under section 80CCD(1B) as NPS tax benefit. The scheme, therefore, allows a tax deduction of up to Rs 2 lakh in total.

- 80CCD(2) covers the employer’s NPS contribution, which will not form a part of Section 80C. This benefit is not available for self-employed taxpayers. The maximum amount eligible for deduction will be the lowest of the following: a. Actual NPS contribution by employer, or b. 10% of Basic + DA, or c. Gross total income.

However, the monthly pension you receive from the annuity plan post-retirement is taxable.

Types of NPS accounts

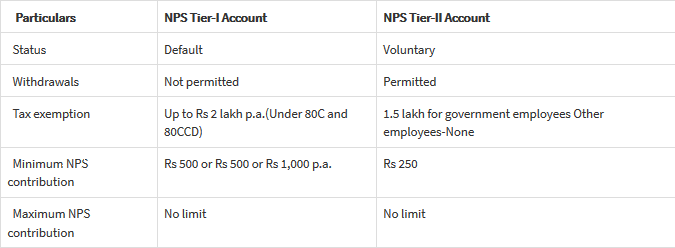

There are two types of NPS accounts as given below – Tier-I and Tier-II.

How to open a National Pension Scheme account?

Offline process

- To open an NPS account manually, you will have to a bank.

- Collect a subscriber form and submit it along with the KYC papers. Ignore if you are already KYC-compliant with that bank.

- Once you make the initial investment of not less than Rs. 500 the bank will send you a PRAN – Permanent Retirement Account Number. This number and the password in your sealed welcome kit will help you operate your account.

- There is a one-time registration fee of Rs125 for this process.

Online process

- It is also possible to open an NPS account digitally.

- Visit the National Pension System Trust website.

- Fill the required form with all your details.

- Link your account to your Aadhaar your mobile number so you can validate the registration using the OTP sent to your registered mobile.

- You will receive your PRAN (Permanent Retirement Account Number) via courier which you can use for NPS login.

Watch the below video if you still have any doubts.

PPF Vs NPS – Which is the better option?

PPF and NPS, both are lucrative saving schemes. To know a parameter wise comparison between both schemes, view the table below. To know about PPF in detail, read PPF Scheme | Details, Benefits, Loopholes Explained.

| CRITERIA | PPF | NPS |

| Eligibility | All Indian citizens can open a PPF account regardless of age. One can even open PPF account on behalf of a minor. | All Indian citizens, as well as NRIs, can open an NPS account, but they must be between 18 to 65 years of age. |

| Minimum Investment | A minimum contribution of Rs 500 per year is mandatory. | Here also a minimum contribution of Rs 500 per year is mandatory. |

| Maximum Investment | A maximum contribution of Rs 1.5 lakh per year is allowed. | There is no limitation to the maximum contribution in a year. |

| Returns | The returns received under PPF is the interest which is revised every quarter. Current quarterly interest rate is 7.1%. Historically, interest rate has also sometimes been above 8%. Currently, it is low due to the economic crisis because of COVID-19 lockdown. | The returns are relatively higher but also riskier since the investment happens in stock market partially. Historically, interest rate has been between 8-10%. |

| Lock-in period | 15 years mandatory. | Until the account holder attains 60 years of age. |

| Fund Management | PPF account holder cannot manage his own fund. The PPF authorities do the investment on their terms and give you the interest as decided. | NPS account holder has full autonomy to decide what percentage of his fund goes into which investment category. |

| Tax Benefit | Comes under exempt exempt exempt. All the contributions made, interest received and withdrawal amount are deductible under taxation. | Comes under exempt exempt and almost exempt. All contribution, interest and withdrawal amount are deductible under taxation. But the monthly pension received after retirement is taxable. |

| Extension | Extension of 5 years at a time is possible for as many times as you want. | Extension is possible only once for 10 additional years. You can also choose to defer your extension wherein you don’t have to pay anymore contribution. |

| Premature Withdrawal | Allowed after 6 years of regular contribution and up to 50% of your fund. | Allowed after 3 years of regular contribution and up to 25% of your own contribution in the fund. For Tier-I account holders only 3 withdrawals are allowed. For Tier-II account holders unlimited withdrawals are allowed. But Tier-II account does not get any tax benefits. |

| Maturity Withdrawal | Can withdraw the full amount on maturity. | Can only withdraw maximum 60% of fund. Remaining 40% of fund will fall under an annuity plan to pay for your monthly pension post-retirement. |

| Expense Ratio | 0%. No charges are applicable for fund management. | 0.01% fund management fee is applicable. |

| Security | Most secure option out of all saving schemes in the country. | Not as secure as PPF. |

| Risk | No risk. | Low risk. |

| Account Opening | Can open PPF account through banks or post office. | Can open NPS account through banks, POP or even online on the nEPS website. |

| Employer Contribution | No option for employer contribution. | Employer contribution is possible. Percentage of contribution is up to the employer. |

For more knowledge on PPF Vs NPS comparison along with an example, watch the video below.

EPF Vs NPS – Which is the better option?

EPF is contributed upon by both employer and employee at a fixed rate. The EPF contribution is further segregated towards EPF, EPS, EDLI and admin charges. On the other hand, NPS is a voluntary contribution made only by the employee in most cases. Employer contribution is not mandatory. For comparison between the two schemes, we will look at the four divisions of EPF individually Vs NPS as follows.

| CRITERIA | NPS | EPF | EPS | EDLI | ADMIN CHARGES |

| Eligibility | All Indian citizens, as well as NRIs between the ages of 18 to 65 years, are eligible. | If the employee’s establishment hires more than 20 employees then the establishment has to have EPF mandatorily. All employees earning less than Rs 15,000/month are eligible. Others earning more are given voluntary EPF. | If the employee’s establishment hires more than 20 employees then the establishment has to have EPF mandatorily. All employees earning less than Rs 15,000/month are eligible. Others earning more cannot opt for EPS. Hence, the remaining EPS contribution goes to EPF. | If the employee’s establishment hires more than 20 employees then the establishment has to have EPF mandatorily. All employees earning less than Rs 15,000/month are eligible. Others earning more are given voluntary EPF. | If the employee’s establishment hires more than 20 employees then the establishment has to have EPF mandatorily. All employees earning less than Rs 15,000/month are eligible. Others earning more are given voluntary EPF. |

| Contribution | Primary contribution is by the account holder. Minimum contribution is Rs 500/year and no cap on maximum contribution. | Both employee and employer contribute. Employee contributes 12% of their monthly salary. Whereas, employer contributes 3.67% of employee’s salary from his finances. | Employee does not contribute anything. But the employer contributes 8.33% of employee salary from his finances. | Employee does not contribute. But employer contributes 0.5% of employee salary from his own finances. | Employee does not contribute. But employer contributes 0.5% of employee salary from his own finances. |

| Returns | The average return in the last 10 years has been 8-10%. Investment occurs in stock market, corporate bonds, government bonds and alternative investments. Slightly risky due to stock market instability. | The return is not market dependent. There is a fixed interest rate decided by the EPFO for every financial year. The interest rate for 2019-20 was 8.5%. | No interest received. | ||

| Lock-in Period and Extension | Lock-in period till the retirement age of 60 years. This can be extended till age of 70 years. | Lock-in period till the retirement age of 58 years. Can be extended for another 2 years by deferring. | Lock-in period till age of 58 years. Can access early pension as well at age 50 years with lesser pension. Or can opt for extension for 2 more years and start pension at 60 years at a higher pension. | ||

| Fund Management | Account holder can manage his fund investment as per each category. | EPFO manages the investments and account holder has no say. | EPFO manages the investments and account holder has no say. | ||

| Tax Benefit | Comes under exempt exempt exemot, but monthly pension is taxable. | Comes under exempt exempt exempt completely. | Comes under exempt exempt exempt completely. | ||

| Premature Withdrawal | Allowed after 3 years of regular contribution and up to 25% of your own contribution in the fund. For Tier-I account holders only 3 withdrawals are allowed. For Tier-II account holders unlimited withdrawals are allowed. But Tier-II account does not get any tax benefits. | Primarily allowed after employee has been unemployed for some time. If employee wants to withdraw while on the job then he has to fill Form 31 and can only withdraw either 6 months basic salary or employee’s share + basic (whichever is lower). | Allowed only after employee’s service period is 9 years 6 months. Before that can withdraw is employee is unemployed. Need to fill Form 31C. | ||

| Maturity Withdrawal | Can only withdraw maximum 60% of fund. Remaining 40% of fund will fall under an annuity plan to pay for your monthly pension post-retirement. | Can withdraw full PF fund 2 months after leaving the job. | Can only get monthly pension after service period of 9 years 6 months. No option for full fund withdrawal. | ||

| Expense Ratio | 0.01% fund management fee is applicable. | No expense ratio. | No expense ratio. | ||

| Risk | Low risk because it is market dependent. | No risk. | No risk. | ||

| Account Opening | Can open NPS account through banks, POP or even online on the nEPS website. | Account registration process is completely done by the employer. | Account registration process is completely done by the employer. | ||

| Death Cases | If account holder expires before retirement, then his legal heir or nominee receives the full fund tax free. If death occurs post retirement then pension goes to spouse. | Legal heir or nominee receives the full fund. Nominee details need to be filed beforehand for this. | Spouse received equal pension while 25% pension goes up to 2 children. If no spouse, then children receive 75% pension. | ||

| Pension Calculation | Use calculator. | Use calculator. | Highest pension = (Average salary of last 5 years x number of service years) / 70 = Max Rs 7500. Lowest pension = Rs 1000. |

For more details plus calculation example, watch the video below.

What is Annuity?

When you opt for NPS, you can withdraw maximum 60% of your investment upon maturity. For the remaining 40% fund, you need to buy a mandatory annuity plan from one of the following insurance companies – Star Union Dai-ichi Life Insurance, SBI Life Insurance, LIC, Kotak Life, India First Life Insurance, ICICI Prudential Life Insurance or HDFC Life Insurance. For example, if your investment is worth Rs 1 crore in NPS, then you can withdraw Rs 60 lakh, while you have to buy annuity worth Rs 40 lakh.

Annuity percentages varies from 5%-8% among different plans. If we assume the annuity percentage to be 6% then you will receive 6% of 40 lakh, which is Rs 2.4 lakh. Thus, a monthly pension of Rs 20,000.

This is quite similar to getting interest on your savings bank account. Exceptions being firstly, the higher interest rate compared to savings interest rate. Secondly, you do not own the fund in your annuity account and cannot withdraw it all together. In case of death, the annuity can be given to your nominee but at a lower annuity percentage.

Types of NPS Annuity Plans

The different type of Annuity options under NPS are as follows:

- Annuity/ pension payable for life at a uniform rate.

- Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

- An annuity for life with return of purchase price on death of the annuitant.

- Annuity payable for life increasing at a simple rate of 3% p.a.

- Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- An annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her lifetime on death of annuitant. The purchase price will be returned on the death of the last survivor.

ELSS Vs NPS – Which is the better option?

| CRITERIA | Equity-Linked Savings Scheme (ELSS) | National Pension Scheme (NPS) |

| Lock-in period | ELSS has a lock-in period of 3 years. | NPS has a lock-in period of up to retirement. |

| Minimum annual investment | You can invest Rs 500 either as a lump sum or as a SIP investment. | You can invest Rs 500 as an initial contribution in a year. |

| Tax benefits | You can claim a tax deduction of up to Rs 1.5 lakh p.a. under Section 80C of the Income Tax Act. | You can claim a tax deduction of up to Rs 1.5 lakh p.a. under Section 80C and an additional Rs 50,000 under Section 80CCD (1B) of the Income Tax Act. |

| Where is the money invested? | The entire amount is invested in equity in a diversified manner and is monitored regularly. | A maximum of 50% is invested in equity. The rest is distributed in government bonds, treasury, etc. |

| Returns | These are pure equity schemes maintaining a very high exposure, 90%-95% to equity schemes throughout the tenure. But in short-term , ELSS funds have barely risen 4% in the past year. | These cannot invest more than 75% in equity schemes, which also declines as the person grows older. But in short-term, NPs funds have shown double digit growth. |

| Flexibility | Allows person to spread investment over multiple ELSS funds. | Person can opt for only one pension fund for handling his entire corpus. |

| Premature withdrawal | Funds invested in ELSS cannot be prematurely withdrawn. | You can withdraw prematurely within certain limits and under the condition of purchasing an annuity. |

| Are the returns taxable? | LTCG over Rs 1 lakh is taxable at 10%. | The maturity amount is partially taxable. |

For further clarity, you can input your investment amount to check the pension from your annuity plans under both ELSS and NPS. For NPS, we have given two annuity providers for further comparison, HDFC and SBI.

Better options for pension generation

If the whole idea is to generate a monthly income after retirement, then there are other options to go for apart from annuity plans. You have the option to opt for a Liquid Mutual Fund. These are short-term debt-based funds with minimal risk. This also gives you the freedom to withdraw your money whenever you wish to.

For further comparison between ELSS and NPS, check out the video below to see examples with actual calculations.

What is Atal Pension Yojana (APY)?

The Government of India announced the Atal Pension Yojana Benefits scheme during the 2015-2016 budget. It focuses on providing financial security at old age to the working class individuals as well as to help them voluntarily save for life after retirement. The Pension Fund Regulatory and Development Authority (PFRDA) through the National Pension Scheme structure, together administer the Atal Pension Yojana scheme.

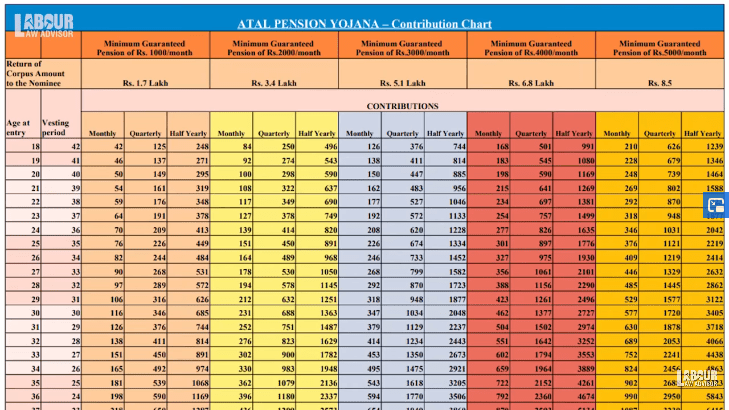

Anyone in the unorganized sector, between the ages of 18 to 40 years can apply for this scheme. The contribution for APY depends on your age and pension plan. Lower your age, lower the contribution. Alternately, higher the pension plan amount, higher the contribution. Moreover, you can select from five different monthly pension plans of Rs 1000, Rs 2000, Rs 3000, Rs 4000 and Rs 5000.

From the chart below, select your age for the row and the corresponding plan for the column. Then look for the monthly contribution payment to know your exact monthly contribution. Furthermore, you can upgrade your pension plan during April only.

For further information on APY view Atal Pension Yojana Benefits.

APY Vs NPS – Which is the better option?

| CRITERIA | ATAL PENSION YOJANA (APY) | NATIONAL PENSION SCHEME (NPS) |

| Eligibility | 18 – 40 years, for Indian citizens of unorganized sector | 18 – 65 years, for Indian citizens as well as NRIs |

| Minimum Investment | Depends on age, minimum transaction can be Rs 42/month | Minimum one transaction per year and Rs 500/year |

| Maximum Investment | Rs 1318/month | Unlimited |

| Returns | Guaranteed pension so not applicable | 8-10% (dependent on market performance) |

| Lock-in Period | Retirement age of 60 years | Retirement age of 60 years |

| Tax Benefit | Exempt, exempt, exempt | Exempt, exempt, exempt |

| Premature Withdrawal | Allowed in case of critical illness or death of member | Allowed after 3 years of regular contribution and up to 25% of your own contribution in the fund. For Tier-I account holders only 3 withdrawals are allowed. For Tier-II account holders unlimited withdrawals are allowed. But Tier-II account does not get any tax benefits. |

| Maturity Withdrawal | Cannot withdraw anything on maturity | Can only withdraw maximum 60% of fund. Remaining 40% of fund will fall under an annuity plan to pay for your monthly pension post-retirement. |

Pension calculation comparison

In the below calculations, we have taken some assumptions to see which pension plan, Atal Pension Yojana or National Pension Scheme, give a better pension in the end. You can use the NPS calculator for this.

| CRITERIA | APY | NPS |

| Date of Birth | 1/7/1995 | 1/7/1995 |

| Monthly Contribution | Rs 376 | Rs 376 |

| Return Rate | 9% | 9% |

| Annuity Percentage | 100% | 100% |

| Annuity Return Rate | 6% | 6% |

| Pension Corpus at Retirement | Rs 8,50,000 | Rs 11,14,407 |

| Expected Monthly Pension at Retirement | Rs 5000 | Rs 5572 |

Should you invest in both APY and NPS?

Thus, from the above calculations, we can see that both Atal Pension Yojana and National Pension Scheme result in quite similar amounts of monthly pension at the end of the day. Since you will be investing a small part of your monthly income, it is not advisable to split it between two scheme. Rather invest in one scheme completely.

Moreover, National Pension Scheme has unlimited investment capacity, option to increase contribution without a cap and complete tax benefits. So overall, it feels like a better investment plan compared to Atal Pension Yojana. APY is rather more suitable for people working in the unorganized sector with lower incomes who cannot afford a higher investment plan.

Watch the video on this comparison below.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!