SBI Cards is India’s second-largest credit card issuer. SBI Cards will be starting an initial public offering (IPO) between March 2nd to 5th. With this IPO, SBICards aims to raise Rs 10,289 crores at the lower end of the price band (Rs 750 per share) and Rs 10,355 crore at the upper end (Rs 755 per share). This latest offering is the talk of the town, which is why we made this detailed article to help you understand if you should invest in this IPO.

Table of Contents

About the company

SBI Cards was established in 1998, as a joint venture between State Bank of India and GE Capital. As the name suggests, the company is involved in dealing out credit cards. Since its establishment, the company was able to make a milestone of 1 lakh customers within 10 months. It hit 10 lakh customers in 2002, 20 lakh customers in 2006 and 90 lakh customers in 2019. SBI Cards is the second-largest credit card issuer in India, only after HDFC. It has a market share of 18% in terms of outstanding credit cards and 17% of credit card transactions at the end of FY 2019. Just short of the market leader, HDFC, with a share of 26%.

Revenue model of SBI Cards

SBI Cards earns its revenue via two sources of income – interest income and service fee. These are explained as follows:

- Interest income – The major revenue source for SBI Cards is income from interest. Whenever you make a transaction using your credit card, you are given time duration to repay the amount. If you fail to complete the payment within the time given, then you are charged interest on the payment. This payment is usually quite high, lying between 2.5% to 3.5% a month. This is known as interest income.

- Service fee – There are 3 types of service fees as follows:

- Spend based fees – Whenever you make a transaction with your SBI credit card, the major part of it goes to the merchant or the shopkeeper. But out of the remaining amount, some part goes to the company whose swiping machine was used, known as the Acquirer; some part goes to the Payment Network such as VISA, MasterCard, RuPay; and some goes to the company whose credit card was used, known as the Issuer. This whole concept is known as Spend based fees.

- Instance based fees – When you do certain activities like late payment then you are charged late payment fees; for cash withdrawal using a credit card you are charged cash withdrawal fees; for statement retrieval also you are charged a fee. These are known as instance based fees.

- Subscription based fees – Even if you do not use your credit card, you will be charged a monthly or yearly maintenance fee. This is known as subscription based fees.

About SBI Cards IPO

The SBI Cards IPO will be open for bookings between March 2-5, 2020. If you are lucky to get any shares then they will be credited to your demat account by March 13th 2020. By March 16 2020, SBI Cards will be listed on BSE and NSE in India for stock trading. The SBI Cards IPO is a combination of Fresh Issue and Offer For Sale (OFS). Therefore, the existing investors of the company are selling only some of the shares to the public. Currently, 74% of the shares are held by SBI itself, while 26% is held by US-based firm CA Rover Holdings. Hence, these two firms are the current investors of SBI Cards, who will be selling some of their existing shares to the public, along with SBI Cards also issuing some new shares.

SBI Cards will utilize the income from the sale of these new shares in the growth of the company. The price band of each share is expected to lie between Rs 750-755. Thus, at the higher end of the price band. The company expects to raise approx Rs 9000 crore from the IPO. If that happens, then it will be the 5th biggest IPO ever.

To know the full process of opening a demat account, view Open Demat Account With Zero Brokerage Fee with Zerodha or 100% FREE Demat Account with Upstox.

To learn the full process of applying for an IPO, view How To Apply For IPO With Zerodha & Upstox?

About the credit card industry in India

In terms of numbers, India had 19 million credit card issued in 2014. This rose to 47 million credit cards issued in 2019. Thus, within 5 years, this industry saw a compounded annual growth of 20%. Meanwhile, in terms of credit card transactions, the amount summed to Rs 1.5 lakh crore in 2014. This amount rose to Rs 6 lakh crore in 2019. Hence, it saw a CAGR of 32% in the last 5 years. Seeing this, it is expected that the transactions will increase 2.5 times by 2024.

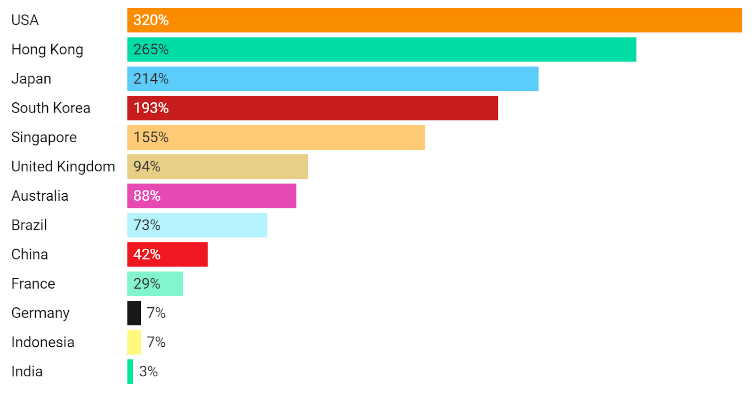

Further, if we compare the penetration of credit cards in India, we see that the average number of credit cards per 100 people in very low at 3%. Meanwhile, bigger economies like the USA have 320% and growing economies like Brazil have 73%. Thus, there is still a lot of scope for growth in this industry in India. More growth means more opportunities too. Additionally, the growth of e-commerce websites had led to an influx in EMI buying, which encourages usage of credit cards for transactions. Lastly, the improvement in terms of POS machines and digital payment gateways with better infrastructure is also paving the way for more cashless transactions. All these reasons are only going to fuel the growth of credit card usage in India.

Competitive analysis

Since there is so much opportunity in the credit card industry in Industry, other companies are aiming to grab a share of it too. Currently, there are 74 players in the country who offer credit cards. Out of these, the top 5 players in India are HDFC Bank, Axis Bank, ICICI Bank, SBI Bank and Citi Bank. The leader is HDFC with 26% market share, and second, comes SBI Cards with 18% market share. The remaining market share is distributed among Axis Bank, ICICI Bank and Citi Bank.

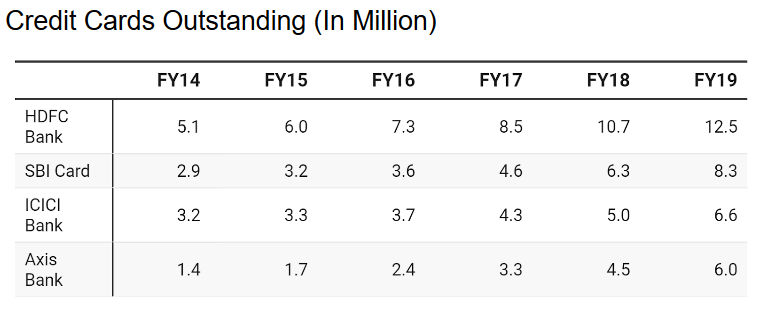

Moreover, in FY 2014, SBI Cards had issued 2.9 million credit cards. This crossed 8.3 million in FY 2019. On the other hand, HDFC Bank increased its credit card issuers from 5.1 million in FY 2014 to 12.5 million in FY 2019. Details for other market players can be seen in the image below.

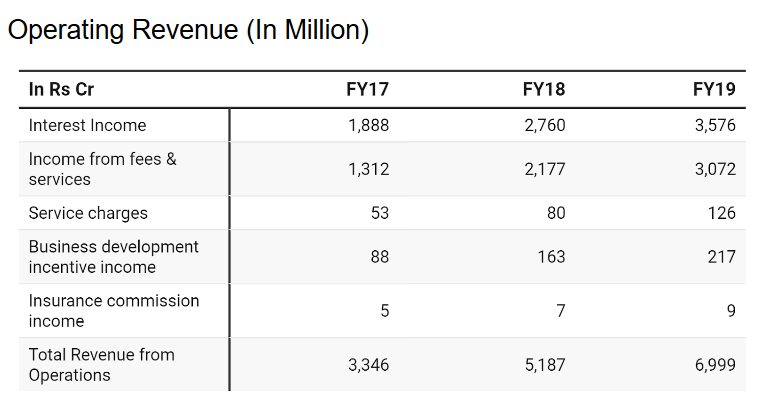

Furthermore, in FY 2017, SBI Cards made a total revenue of Rs 3346 million from operations. This doubled to Rs 6999 million in FY 2019. Therefore, the operating revenues grew by 45% CAGR.

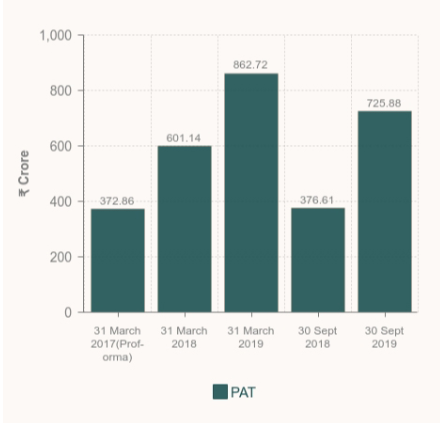

On the profitability front, the company’s net profits grew from Rs 372 crore to Rs 862 crore. Thus, it saw a CAGR of 52% within this period. As of September 2019, the company had collected profits worth Rs 726 crore and was expected to have a 93% growth. The expected profits for FY 2019-2020 is around Rs 1200-1500 crore.

Competitive advantage of SBI Cards

- The brand name and power of the name SBI itself lends a heavyweight to SBI Cards. Everyone in the country is aware of the brand.

- Additionally, it provides access to SBI’s extensive branch network of around 22,007 branches across India. This will help SBI Cards in getting access to their existing 43 crore customer base.

- SBI Cards has partnered with 18 co-branded companies to launch credit cards, such as Apollo Hospitals, Ola, TATA, etc. Even most Big Bazaar outlets in the country house an SBI kiosk.

Watch the below video for more details on SBI Cards IPO.

Apply with ICICI Direct

- Open the ICICI Direct app on your phone.

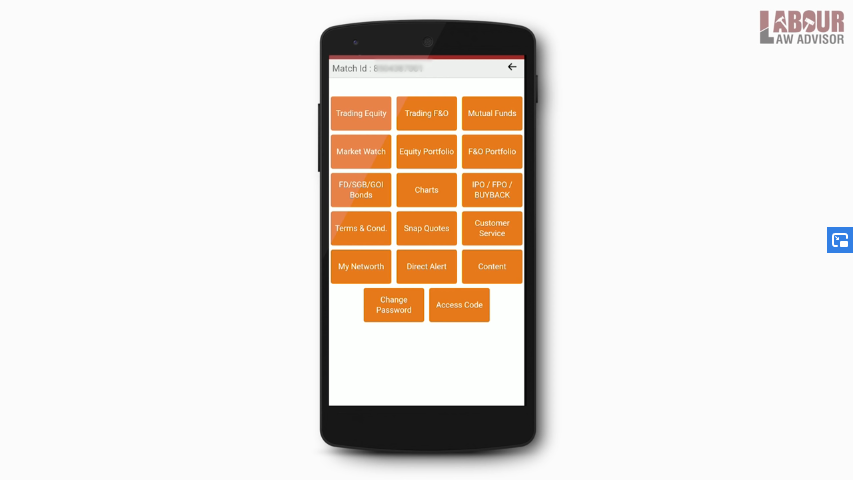

- Click on the option IPO/FPO/BUYBACK.

- Next, proceed to click on PLACE ORDER.

- This will open a new page which will display all the IPOs which are currently on sale. The SBI IPO will be at the top of the listing. Click on APPLY NOW.

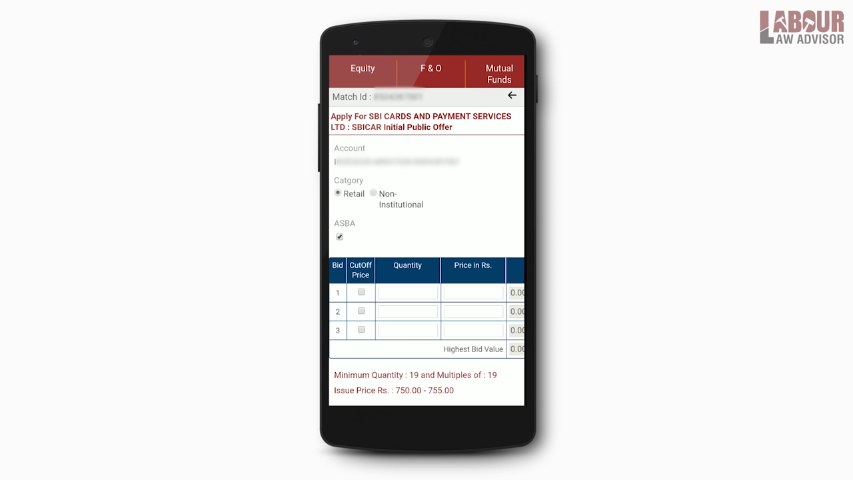

- If you do not want money deducted from your bank account before the IPO allotment, then tick the checkbox for ASBA.

- Now, enter the minimum QUANTITY, which is 19 or its multiples, in this case. Tick the checkbox for CUTOFF PRICE as well, which ensures that your bid will be the same as the opening price of the IPO.

- Scroll down and tick the checkbox for I Accept the Terms & Conditions. Click on CONFIRM.

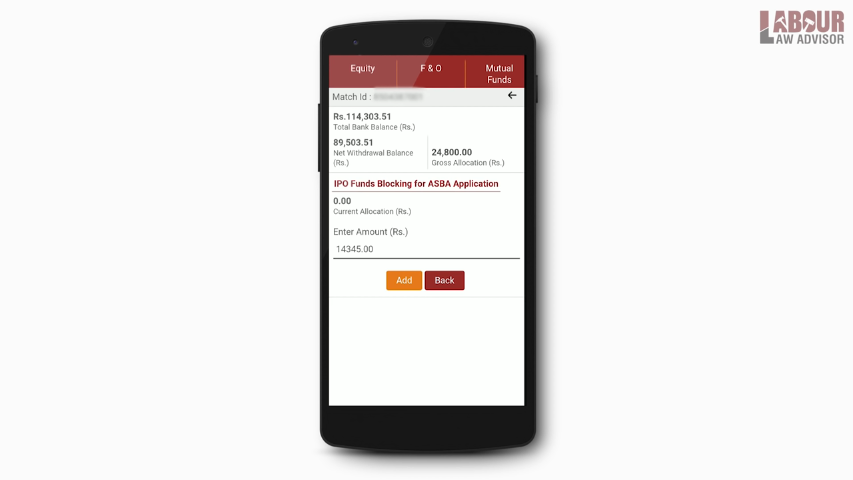

- Review your blocked amount for the IPO and click on ADD.

- Now your IPO is under process and if you click on MORE DETAILS, you will be able to see further information on your IPO.

Additionally, watch the full process for applying for SBI Cards IPO in the video below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!