Earlier opening a demat account would require you to pay some charges. In our case, it cost us Rs 10,000 to open a demat account in 2016. But in today’s time, it is possible to open a demat account under 10 mins and within Rs 300. This is possible via Zerodha! But why should you opt for Zerodha? The two major reasons why you should opt for Zerodha are – firstly, investing in the stock market via Zerodha is free! Trading would incur a flat brokerage fee of Rs 20, otherwise, brokerage for investment is free. Secondly, if you use our code to open demat account in Zerodha, you get 7 investing courses worth Rs 31,500, absolutely free!

Table of Contents

Documents required to open demat account

- Bank account number

- IFSC code and MICR code – This is usually written on the bank cheque book and passbook. Or you could Google “bank name_branch name IFSC code” to find yours.

- PAN card number – Along with a scanned copy of the same.

- Aadhaar card number – Along with a scanned copy of the same

- Scanned copy of your signature.

- Bank proof – This can be a scanned copy of your bank statement or a cancelled cheque.

- For investing in commodity you need to have your income proof too. This can be a copy of your income tax return in pdf format.

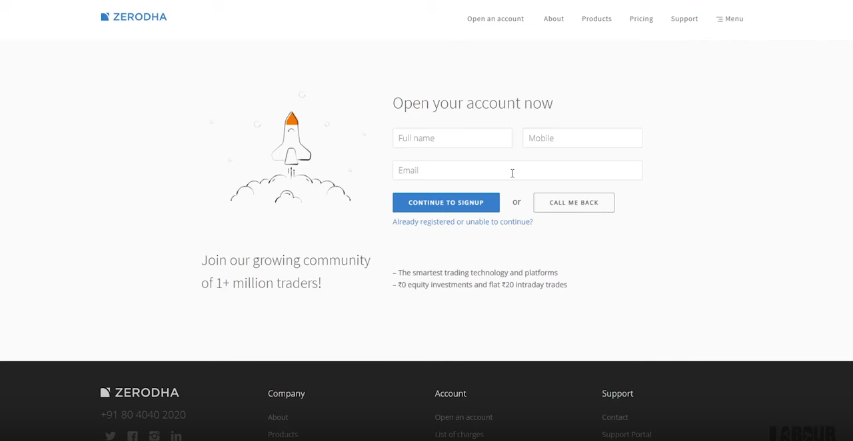

Steps to open demat account for equity investment

- Login to Zerodha.com

- Fill in your name, mobile number and email id and then click on continue to sign up.

- You will receive a 6-digit OTP. Fill that up and then click on confirm.

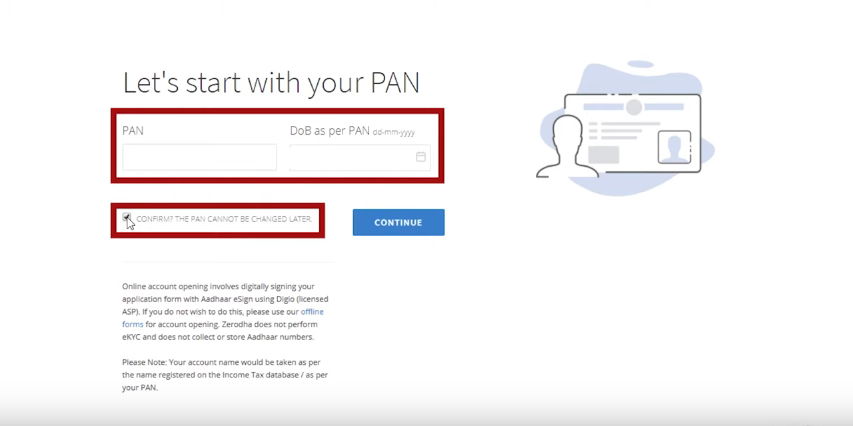

- The next screen will ask you to put in your PAN number and date of birth. Then check the box for confirming and click on continue.

- Next, you need to do your payment. This is available via all major payment options like UPI, debit card, credit card, etc. You need to choose the Equity & Currency option for Rs 300, in this case.

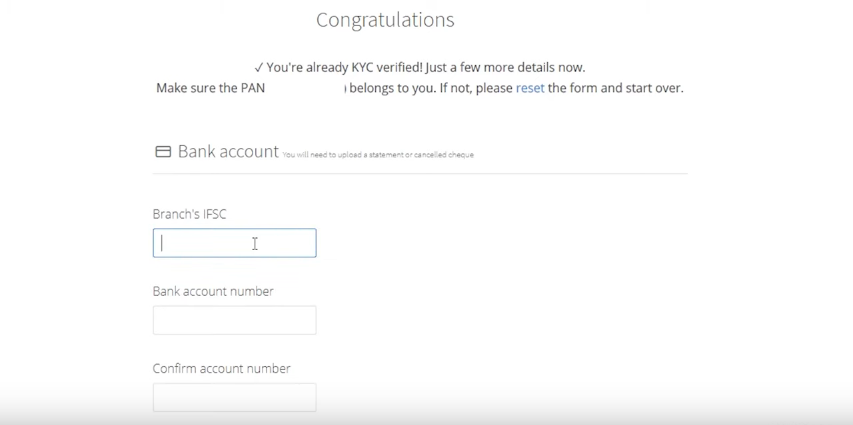

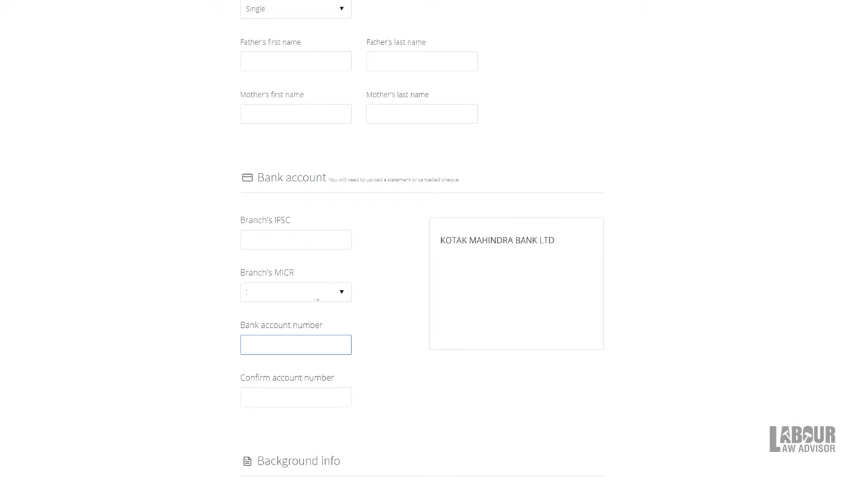

- On the next screen, fill in your bank account details like branch IFSC code, bank account number and confirming the account number. Your bank address will then appear on the right-hand side. Ensure it is the correct one.

- Scroll down to fill in your background information. This entails your mother’s name, your marital status, occupation, commodity trade classification, trading experience, annual income.

- Below there will be three checkboxes with three declarations. Read them thoroughly before ticking them and click on continue.

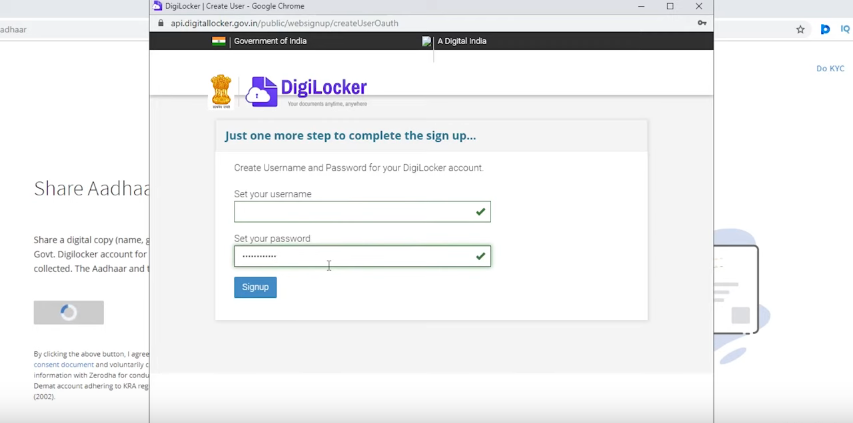

- Now you need to make your Digilocker account. Click on connect to Digilocker. Then fill in your mobile number to continue and verify with the OTP. Set your username and password and click on signup. Next, give your Aadhaar number and OTP. This will open the Digilocker dashboard.

- If you already have a Digilocker account then just link it to your Zerodha account.

- So, click on connect to Digilocker which opens a new window, asking for your Digilocker username and password. Hence, login and click on allow to give Digilocker permission to access your Zerodha account.

- Furthermore, you need to fill in all the following details again, for security reasons.

- All these details should be the same as given before by you.

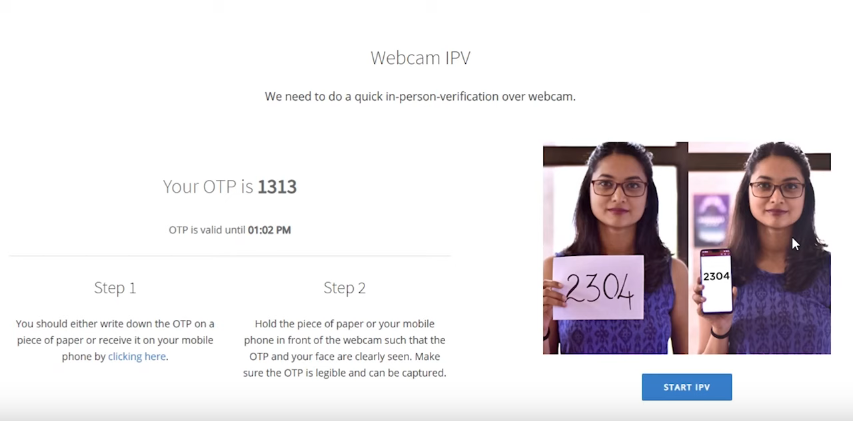

- Next, you need to give your identity proof. For this, click a picture or upload a video of yourself, with your verification OTP viewable in it. You can either write down the OTP on a paper with a

marker for clarity or send the OTP to your mobile number and holdyou mobile phone up.

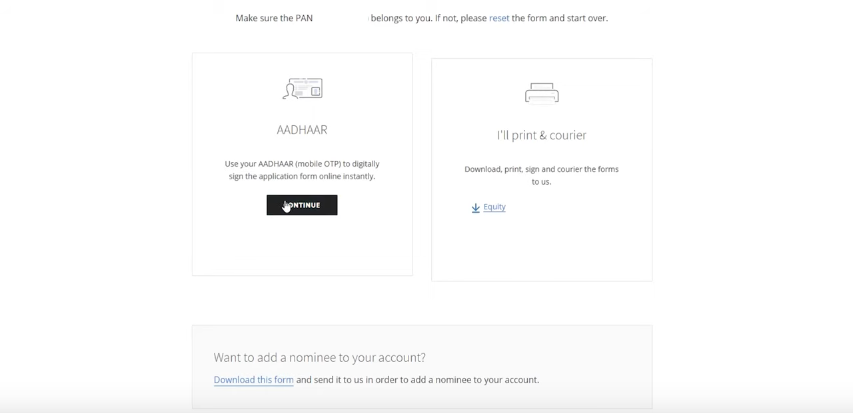

- Next up, either choose to e-sign all your documents via your Aadhaar. Or, printout all the document copies, sign them and courier them to Zerodha’s head office.

- For e-sign with Aadhaar option, click on continue. Your Aadhaar and mobile number should be linked for this.

- Now upload your bank proof as a cancelled cheque or bank statement.

- Upload your scanned signature.

- Uploading income proof is optional and not necessary for equity investment.

- Upload your PAN card scanned copy.

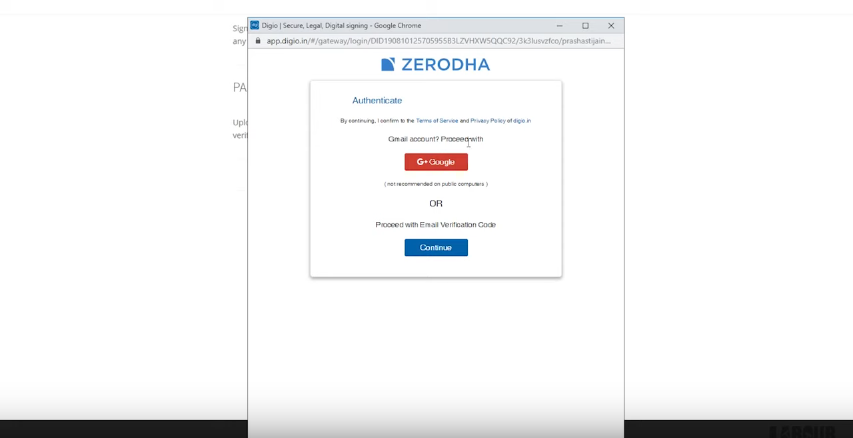

- Now, click on Time to E-Sign! It will ask if you want to e-sign via your Gmail or email. Click on either option to receive a verification code on it. Copy the code on this page and click on proceed to e-sign.

- This will redirect you to NSDL. Put your Aadhaar number here and request for OTP. Then fill in OTP and click on submit.

- A vast document will appear. You may read it all if you want to. Then click on Sign now.

- You will again be redirected to NSDL. Repeat the Aadhaar number and OTP verification for finally signing in.

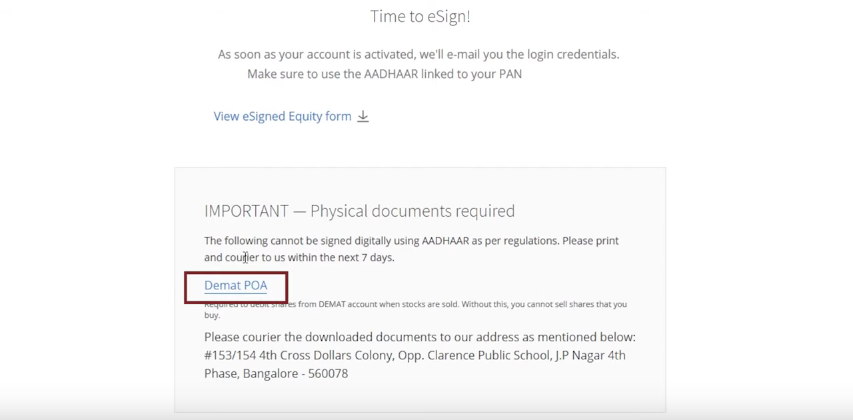

- Next, you can click on View e-signed equity form, and download it as a pdf.

- Furthermore, you can click on Demat POA and printout the power of attorney to fill in your nominee details. Additionally, you have to sign under F13 and F14 and mail this document to the Zerodha headquarters. You need to also send this within 7 days.

Watch the full video of this tutorial below.

How to activate Zerodha Kite app?

- Once your Zerodha demat account activates, you will receive Kite app’s user ID and password on your email address.

- Download and log into the Kite app with the credentials.

- Also possible to set up a pin for using the app. This switches on the two-factor authentication which gives more security.

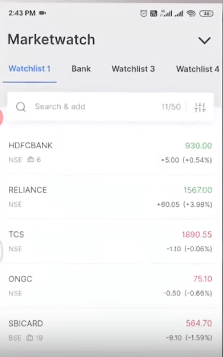

What is Marketwatch?

Once you log in to the Kite app, you will be able to see Watchlist 1 to Watchlist 5. Each Watchlist can hold up to 50 stocks. Thus, this gives you easy access to all your favourite stocks at one go. So you don’t end up wasting any time by searching for them. Furthermore, you can long-press on Watchlist and get the option to edit the name. So you can make different categories of stocks like Bank, Fuel, Tech, etc.

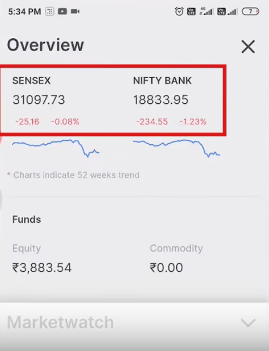

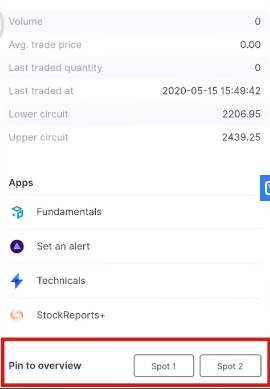

If you click on the Marketwatch down arrow, it expands to reveal the current Sensex and Nifty market values. By default, Sensex holds spot 1 and Nifty holds spot 2. But you can change this by going to your preferred stock and clicking on it. Then scroll down to see the option Pin To Overview and select Spot 1 or Spot 2. Therefore, this Overview section serves as a small window to view your top two stocks.

What is Orders?

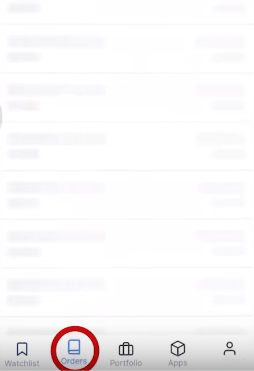

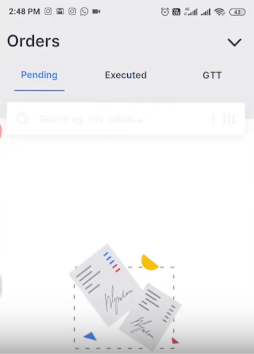

If you click on the Orders option from bottom bar, you get options to view Pending, Executed and GTT.

Pending Orders stand for ones which are yet to be completed. On the other hand, Executed Orders are completed. Meanwhile, GTT stands for Good Till Triggered. This is an excellent feature to keep track of the stock market without actually doing anything.

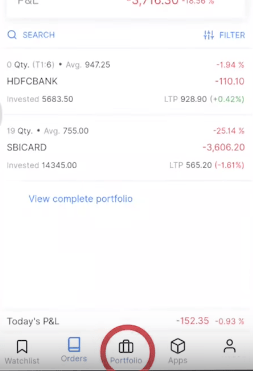

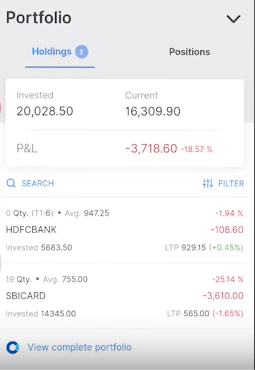

What is Portfolio?

If you click on the Portfolio option, then you can see your holdings and positions.

Holdings stand for your equity deliveries when you hold a stock for more than a day. But Positions stand for your intraday holdings when you hold a stock for less than a day.

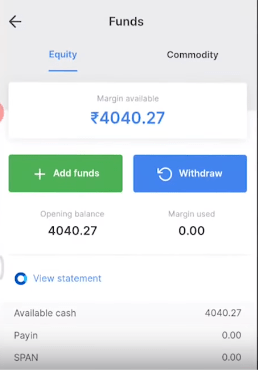

What is Funds?

Click on the extreme right corner on the profile icon to go to the option for Funds. If you want to buy shares then you must first add funds to your account. For this, click on Add Funds and enter the amount. Then select the payment option and complete the process. If you click on Withdraw option then you can transfer your funds to your bank account.

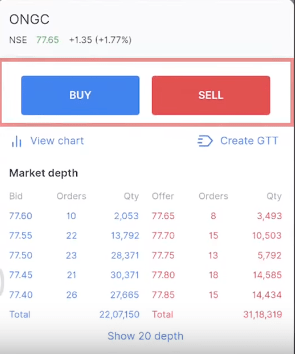

What is Placing Orders?

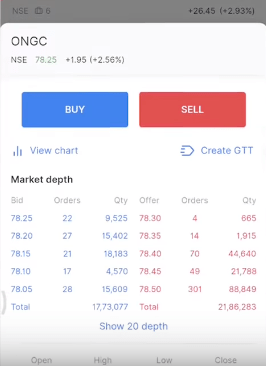

- Click on a given choice of stock you want to buy. This will show the options for Buy and Sell. Scroll down to view the Market Depth, which is how the stock is performing currently in the stock market.

- You can scroll further down to view the Fundamentals, Technicals and Stock Report of the stock. All of these give a detailed report on the stock’s past and present performance.

- To buy the stock click on Buy.

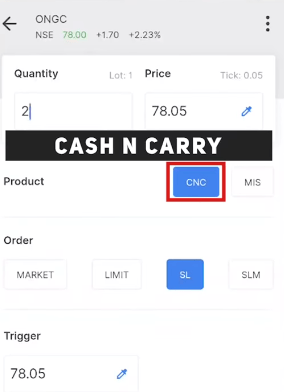

- Then for Product select either CNC which stands for Cash N Carry meaning you want to hold the share for longer than a day. Or select MIS which is Margin Intraday Square Off and means to buy and sell the stock during the same day itself.

If you opt for MIS then you have following options

- For Order type select from Market, Limit, SL or SLM.

- Market order means to buy share at the market trading price.

- Limit order means to set a price limit at which you want to buy the share. When the share falls to that price, you automatically buy it. But if the share never falls to that price then your order gets cancelled.

- SL order means Stop Loss Limit. This means setting a lowest price at which you will sell the share without incurring a huge loss.

- SLM order means Stop Loss Market. Here you can only input your Trigger value.

- Trigger means inputting a price value at which the share order gets activated. But it will only get executed at the Price you put in.

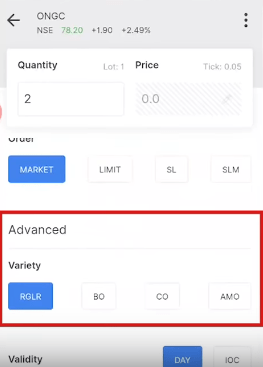

- Next is the option for Advanced orders.

- Among these, BO (Bracket Order) means putting a stop loss as well as a cap on your profit. You can do this by putting your maximum profit value under Target. Simultaneously put you Stoploss value or the maximum loss you can get on this share and the Trailing Stopleoss which maintains the difference between your Stoploss and Target values.

- If you opt for CO (Cover Order) then you get increased leverage. But you will also have to compulsorily put a Stoploss which cannot exceed 1.5% of the stock value.

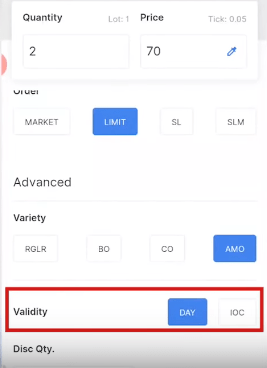

- Lastly, AMO (After Market Order) means putting in order after the share market has closed for the day. In this case, your order will be executed the next day.

- Next up is the option for Validity. Here you can opt for Day if you want your order to stay active all day long but only when you are buying shares in parts. Or you can opt for IOC (Immediate Or Cancelled) if you are okay with buying as many shares as you can get at a single time and cancelling the rest.

If you opt for CNC then you have following options

- Under CNC you can opt for either Market or Limit Order.

- For Advanced option, you can only choose from RGLR (Regular) or AMO. You cannot choose BO or CO.

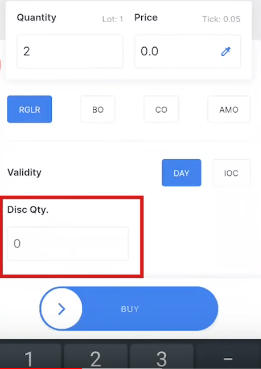

- Simultaneously you have to input a Disc. Qty (Disclosed Quantity) value. This value shows the market whatever number you input as the number of shares you are buying. While the real number of shares may be different.

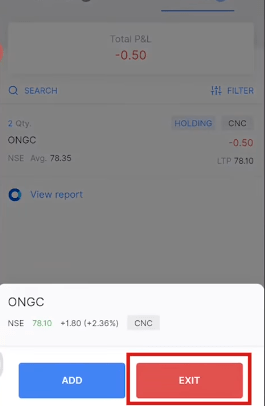

How to Sell Stocks?

- Click on the stock name and click on Exit option.

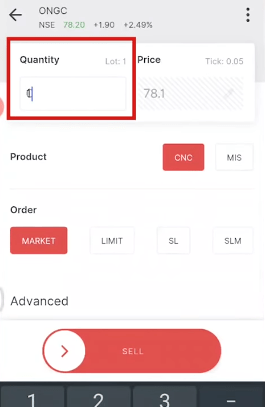

- Then you can select Quantity of shares you want to sell.

- You can also choose the Order type from – Market which will sell at the ongoing market price, Limit for the price you want to sell at when it hits, or SL or SLM.

- Similarly, you can choose for Day or IOC further down the page.

- Disclosed Quantity can also be given.

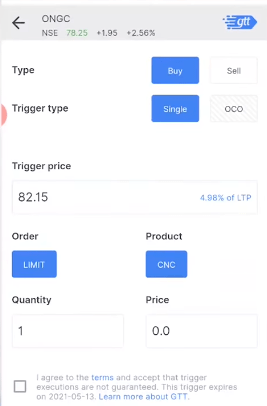

What is Good Till Triggered?

- Click on the stock name and click on Create GTT.

- GTT gives you the chance to have an order valid for one year and you can also keep 50 such orders live on the app. Meanwhile, the other orders get cancelled after the market closes if they have not been executed until then. They do not stay valid for the next day anymore.

- Input your buying value at Price and value to activate your order at Trigger Price.

- Then input your number of shares under Quantity.

- Tick the checkbox for I Agree declaration.

- Swipe right for Create GTT to place your order.

- Similarly, you can choose to either Buy or Sell under GTT option in the same manner.

If you still have some doubts then watch the step by step tutorial below or drop a comment below.

Also read: Legal Actions To Take In Case Of Cheque Bounce

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!