There can be multiple reasons for issuing an IPO. Firstly, the company might want to be expanding and needs the capital which it will raise from IPO for growing the company or it may even be for reducing their debt. Secondly, the investors of the company might want to Offer For Sale (OFS) their share of the company, make a profit by selling their shares and move on from the company. Read the following article and learn how to apply for ipo.

Table of Contents

What is an IPO?

An IPO, also known as Initial Public Offering, is the process of taking a company from a private corporation to a public corporation. This is further done by offering shares of the company to the public in a new stock issuance. This public share issuance helps the company in raising capital from public investors. The transition period from private to public is critical for private investors to achieve maximum profits from their investment in the company. Since the IPO issuance usually comprises premium shares for a current lot of private investors too. Apart from this, public investors also partake in the process. This article explains the entire process of how one can apply for IPO.

Should you invest in IPO?

It is important to know the reason for a company going public with their IPO. This can be found through the company’s Red Herring Prospectus (RHP). RHP is a document which every company needs to file at SEBI before issuing their IPO. RHP is accessible on SEBI’s website for free. However, this document is usually very lengthy so one can find the summary of it on finance websites and blogs. This RHP details the reason behind the company’s IPO whether it is for expansion, reducing debt or OFS. One should not invest in an IPO without knowing the reason behind it.

Types of IPO

First the company decides the total percentage of their stake that they wish to issue for IPO and sell to the public. Next the company takes the help of investment banks to decide the value of their shares. There can be two types of IPO prices as follows:

1. Fixed Price Issue

For Fixed Price Issue IPO, firstly the company assesses all its assets, liabilities and other financial aspects. Then depending on their results, the company fixes a price per share issuance. This

2. Book Building Issue

For Book Building Issue of shares, there is no fixed pricing. Instead, a price range is offered, with the lowest value being the “Floor Price” and the highest value being the “Cap Price”. The price range is given on the share order document. The public investors apply for IPO with the price they are willing to pay. The final price of the share depends on all the bids.

Reservation of IPO lots

IPOs can have a duration of 3 to 10 days for public reservation. The first time a company sells their IPO to the public it is seen as the primary market. The share market is different and is seen as the secondary market. It is possible to purchase any share in single quantity in the share market but it is not possible to do so in IPO.

Furthermore, one can apply for IPO only in “lots”. Shares cannot be bought in individual numbers. This “lot” is a set of shares which the company offers for initial public offering. This size of a “lot” is also pre-decided by the company itself. A minimum on one lot has to be purchased in IPO issuance. Certain sections of the IPO lot are reserved for certain sections of buyers, as follows:

1. Qualified Institutional Buyers (QIB)

QIBs are the creme de la creme of investors. These investors do not require regulatory oversight, like regular investors, when buying IPOs because of their experience, net worth and assets under management.

2. High Networth Investors (HNI)

The HNI investors only invest upwards of Rs 2 lakhs. They play in the big numbers in the stock market.

3. Retail Investors

These are the regular investors comprising of common people. They invest for under Rs 2 lakhs.

4. Employees

If the company wants then they can have a separate quota for their own employees as well. Chances of getting IPO allotment in case of oversubscription is higher for employee quota than retail investors quota.

Oversubscription

Oversubscription of IPO occurs when the total number of shares which investors want to buy is higher than the number of shares on offer. The oversubscription number shows that the number of shares being offered by the company is less than the demand for it. For example, is a company offers 10,000 shares in an IPO and 20,000 shares are subscribed for, then we say they IPO has been two times oversubscribed. If in this case, less then 10,000 share are subscribed for, then we say there is under-subscription. As per SEBI, if any company’s IPO does not receive minimum 90% subscription, then they get cancelled.

If there is oversubscription in the retail category then the total number of share available for retail investors is divided by the minimum lot size. This determines the number of retail investors who will get the lot allocation. Additionally, if the total number of applications is more than the number of lots available then no application receives more than one lot. Furthermore, the eligibility of a lot allotment is determined by a lucky draw. This is a completely automated process and leaves no room for manipulation.

If one applies for an IPO from multiple demat accounts, then all of their applications are cancelled as this is considered a malpractice.

After applying for an IPO through this process, one will either get an allotment or get their money returned within 4-7 days of the IPO closing.

7 days after the allotment process, the company gets listed on the stock market. Now it is possible to buy and sell the company’s shares at any time and any number. There is no restriction of “lot size” in the stock market.

Listing Gains

Although the company’s shares will be available in the stock market eventually, people tend to be very enthusiastic about getting hold of the IPO offerings in the primary market. This is because of the listing gains. The price at which IPOs get allotted is called issuing price, while the price at which they get listed in the stock market is called listing price. If several people have subscribed for an IPO then it becomes oversubscribed. This means that demand for that IPO is high, hence the IPO opens at the stock market at a higher price. This difference between the issuing price and listing price is called the listing gain.

If one’s aim is just to make a listing gain then it is advisable not to book the IPO on the first day itself. Rather wait until the last day to see the demand for that IPO. if demand for an IPO is high then go ahead with booking it.

How to apply for IPO?

1. Demat with bank

If you have your demat account with your bank then you can apply for IPO directly from your bank. Just go to your demat account dashboard and fill in all the necessary details to apply for the IPO.

2. Physical forms

Physical forms are available with banks and brokerage firms. Collect and fill up one of them and attach it with your application cheque. Then submit it at the bank.

3. Zerodha

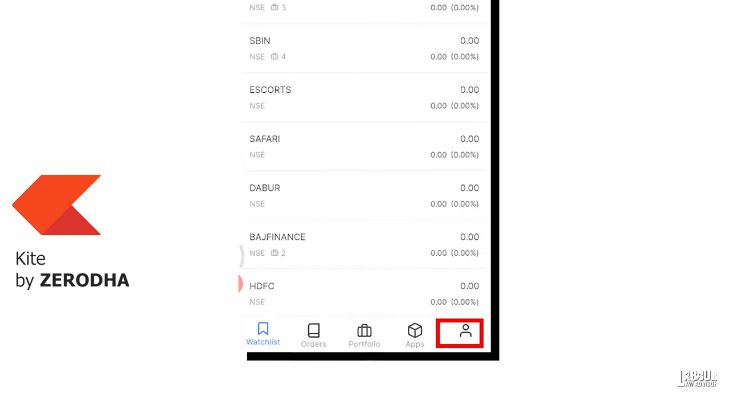

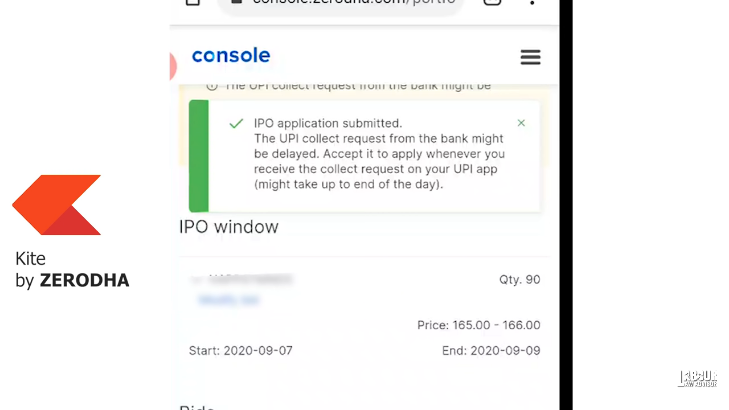

- Visit the Zerodha app

- Click on the Profile icon on the bottom right corner.

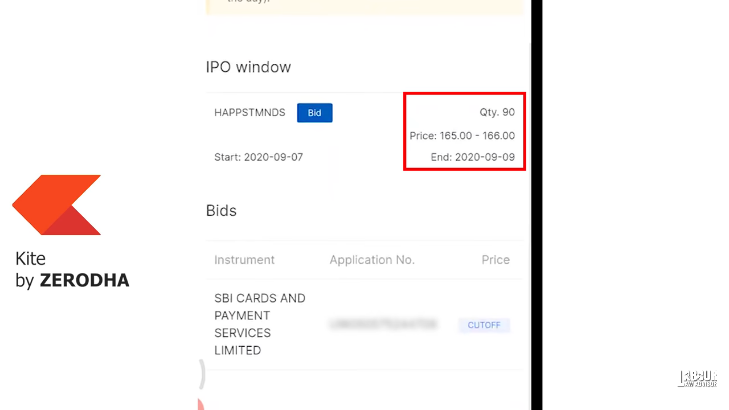

- Next, click on IPO under Console.

- This will open a new window to show all the current and upcoming IPOs available. Each IPO will detail the minimum lot size, price band and ending date of placing order.

- Click on Bid for the IPO of your choice.

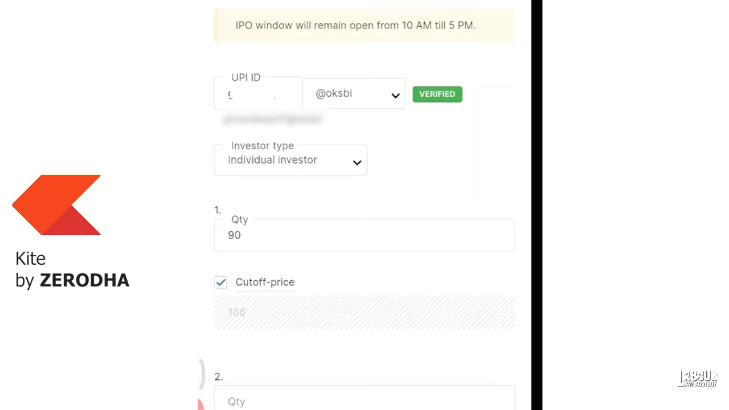

- Enter your UPI details and choose Investor Type as Individual Investor.

- Then for option1 type the number of lots you want to buy and click on the checkbox for Cut-off price.

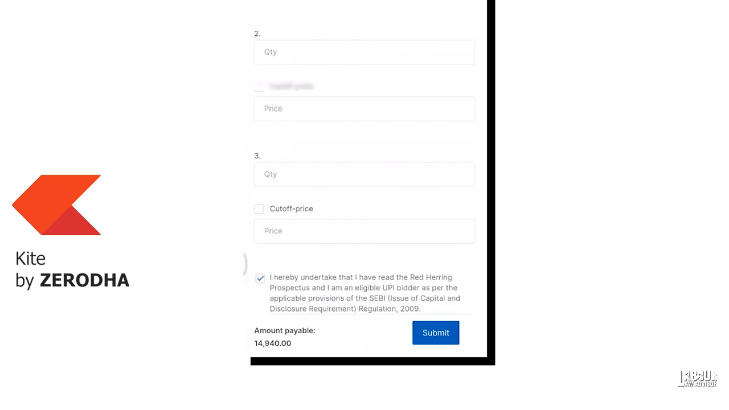

- Click on the checkbox for Declaration and click on the Submit button.

- Complete your payment procedure when you get the payment message. The UPI payment request message may take upto 1 day to come.

4. Upstox

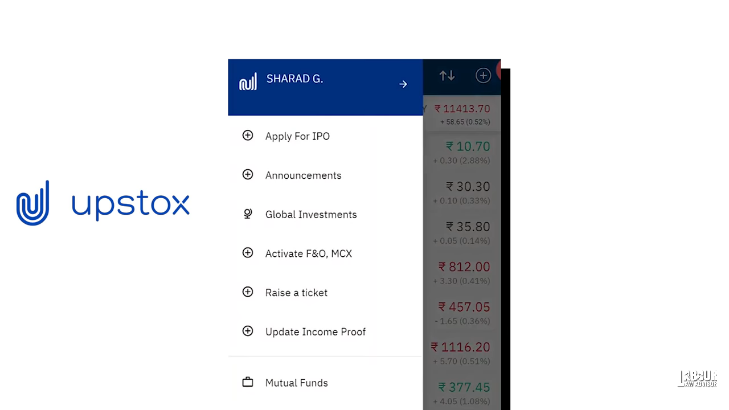

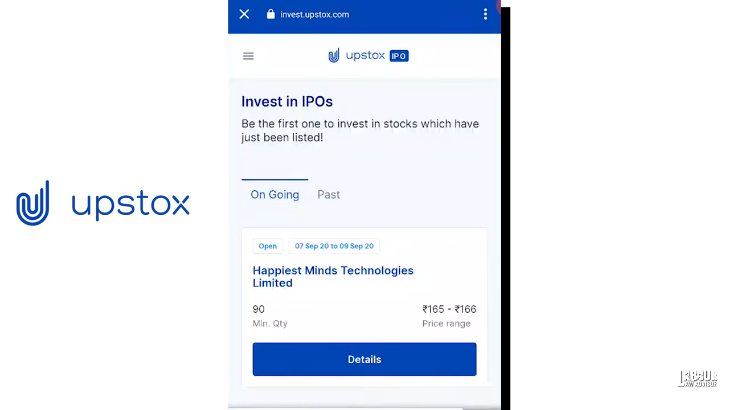

- Visit the Upstox app.

- From the top-right menu icon, select Apply For IPO option.

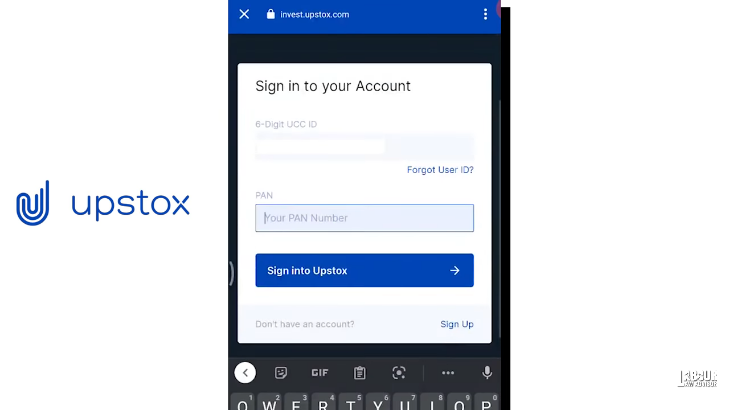

- Log in with your user ID and PAN by clicking the top right Login button.

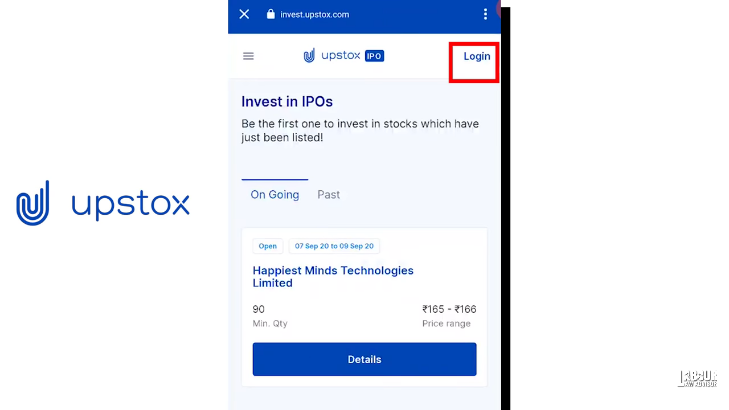

- This is now displaying all available IPOs.

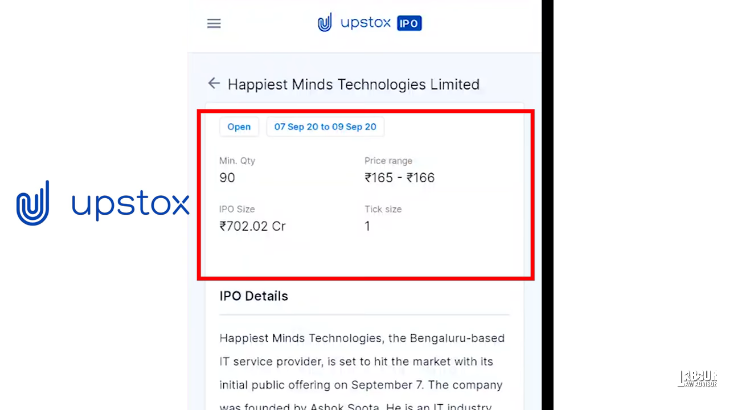

- Click on Details of the IPO to view the minimum lot quantity, price band, IPO size, etc.

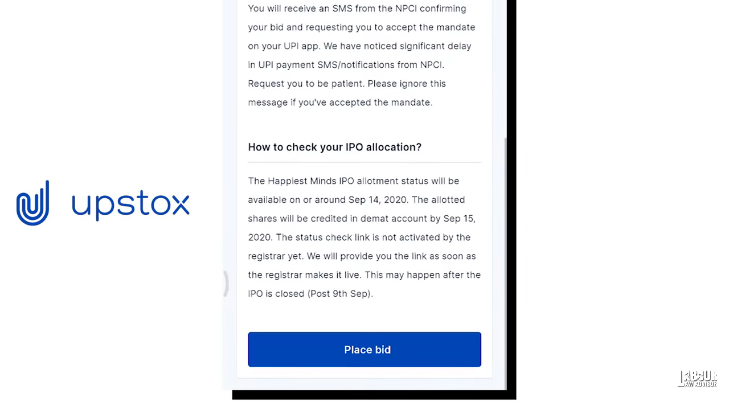

- Scroll down the page to view the Place Bid button. Click on it.

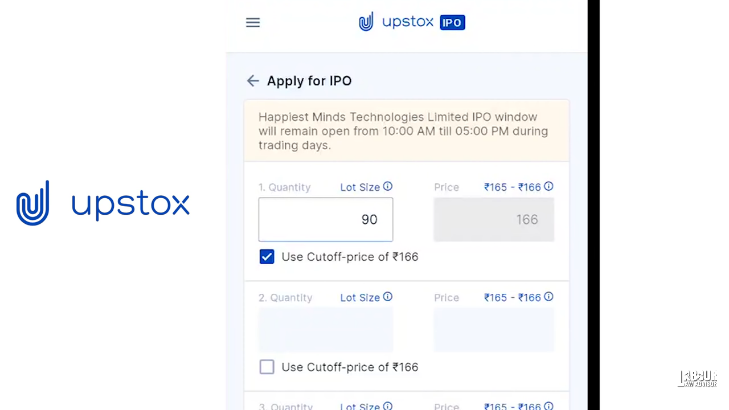

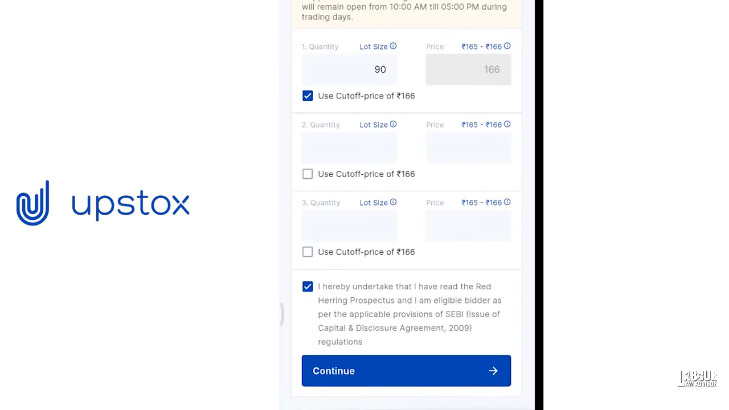

- Next page enter your UPI id, quantity of lots and check box for cut-off price.

- Tick the check box for Declaration and click on Continue.

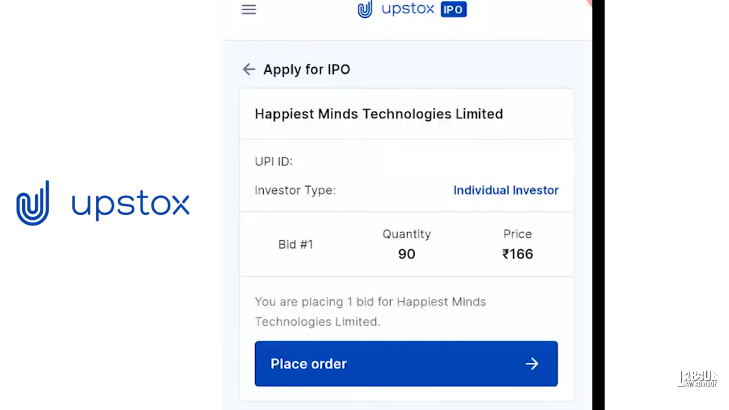

- Check all details and click on Place Order.

- You will get a message request for UPI payment. Complete it to complete your IPO order process.

5. Other broker

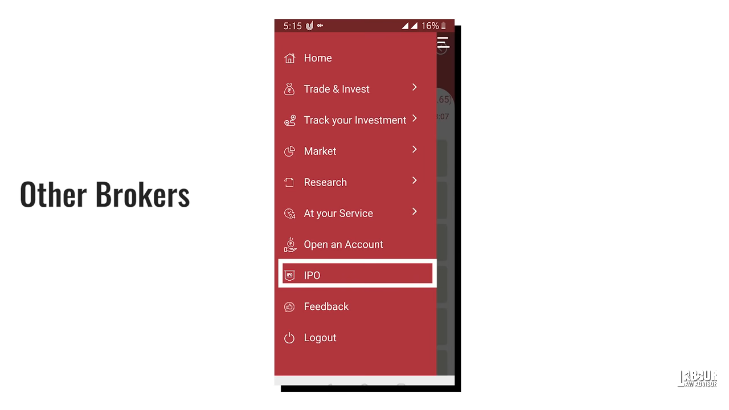

- Open the broker app and click on the menu option.

- There should be a button for IPO. Click on it.

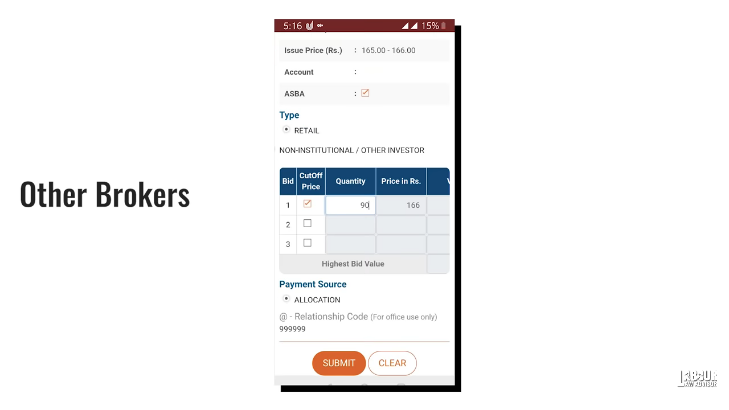

- The IPO page will mention all the available IPO details, so enter your UPI id, lot quantity for purchase and cut off bid.

- Then click on Submit and complete the payment transaction process.

6. Netbanking

- Explaining the process for netbanking with reference to SBI netbanking page.

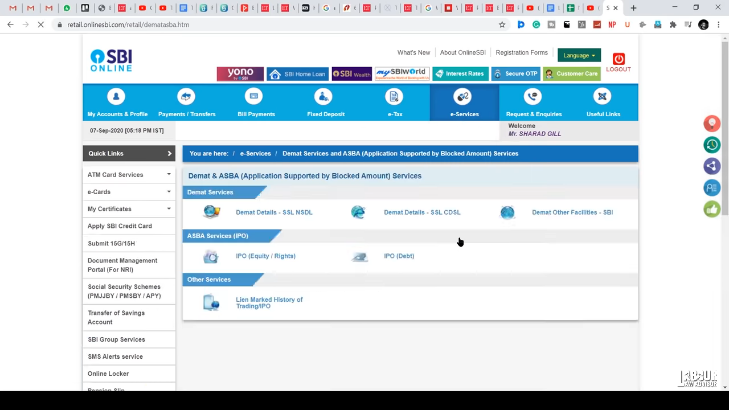

- From the e-Services tab, select Demat Services and ASBA Services option.

- Proceed to click on IPO (Equity/Rights).

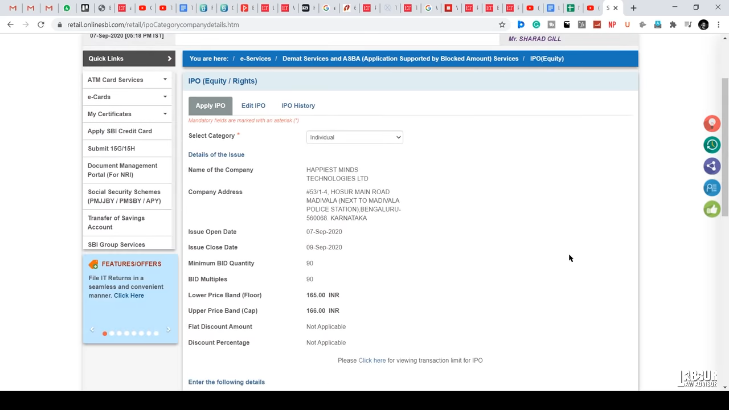

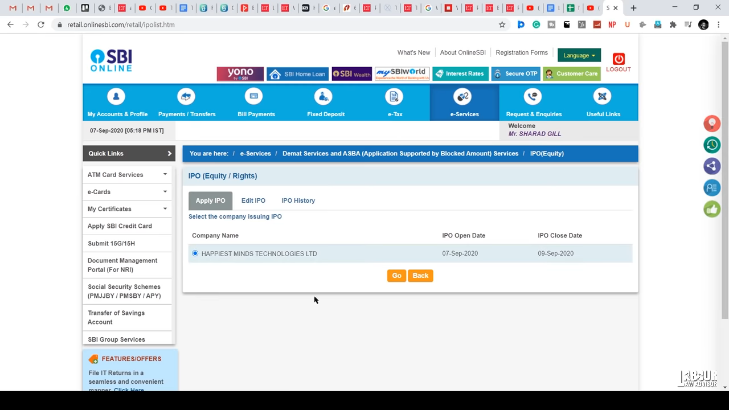

- On the next page, under the Apply IPO tab click on Accept at the bottom.

- This will reveal all available IPO listings. Select the one you want to purchase and click on the Go button.

- On the next page, click on Accept.

- On the next page, select Individual option under Select Category option. The rest of the page has details on the IPO.

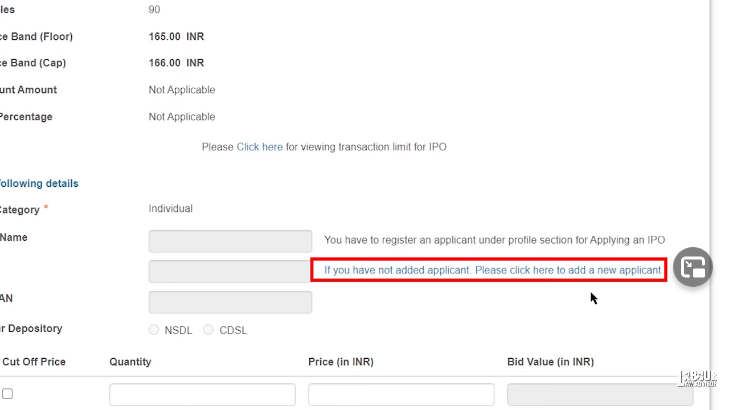

- Scroll down to click on the button, “If you have not added applicant. Please click here to add new applicant.”

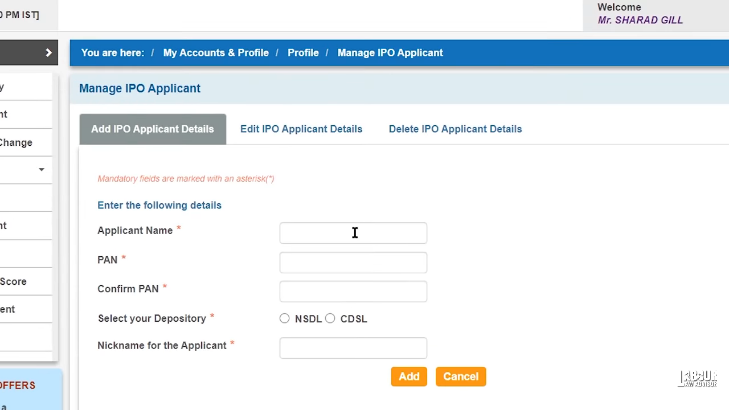

- This will open a new page where you have to enter the applicant’s Name, PAN, Confirm PAN again, Select your Depository (which you will have to ask your stockbroker for), Beneficiary DP A/C Number (which is your demat account number available on your broker app), and applicant’s Nickname (which can be same as first name). Then click on Add.

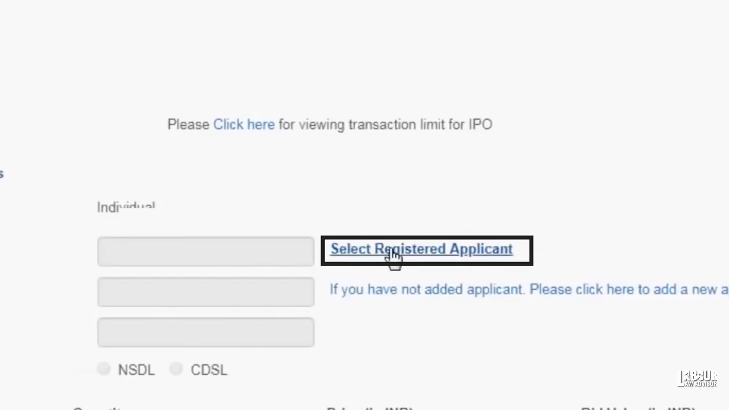

- You will now go back to the IPO screen, where you click on “Select Registered Applicant”. Then select Applicant’s name from the drop-down list menu.

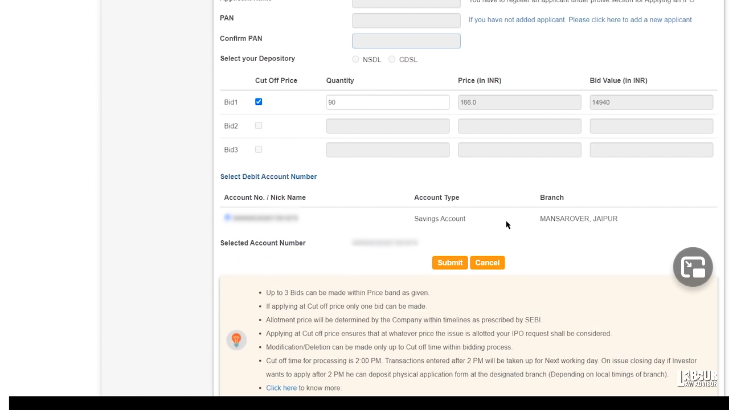

- Now tick the checkbox for Cut-Off Price and enter Quantity for the lot of shares you want to purchase.

- Click on Submit to complete your application process.

Watch our detailed tutorials below.

Also read, How To Check IRCTC IPO Shares Allotment?

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!