Greetings of the day!

The Code on Wages Act, 2019 is expected to be implemented in September 2020. Several laws related to wages and bonuses have been amended and included in the act. This edition will provide you with an in-depth analysis of the Code on Wages Act, 2019.

The Burning Tale

Which laws does The Code on Wages, 2019 replace?

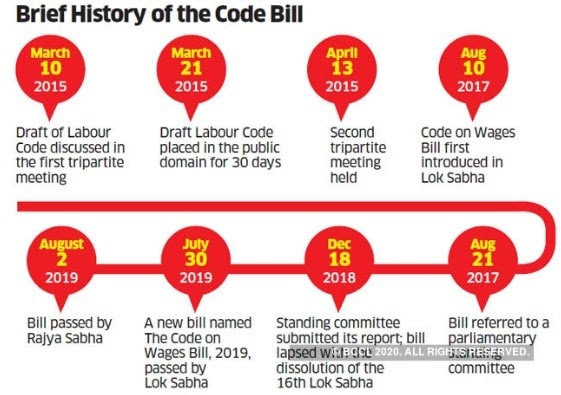

Timeline

Current Status

The Central Government has planned to implement the new set of rules for Code on Wages, 2019 by September 2020. The draft rules issued by the Union Ministry of Labour on July 7 are now included in the official gazette and the gazette is now open for public feedback for 45 days. If no issue arises, the new rules will be implemented.

Features of the Act

Definitions have been made uniform under the Act

Separate definitions of ‘worker’ and ’employee’

Working Hours

The central or state government may fix the number of hours that constitute a normal working day. In case employees work in excess of a normal working day, they will be entitled to overtime wage, which must be at least twice the normal rate of wages.

Removal of threshold limit for triggering the application of payment of wages provisions

Previously, the Payment of Wages Act read with Notification No. S.O. 2806 (E) dated August 29, 2017, issued by the Ministry of Labour and Employment, was applicable only to employees drawing wages below INR 24,000/-. This has been done away with and the Code is applicable to all employees across the board. Accordingly, the Code has raised the responsibility of an employer to ensure proper wage structuring and timely payment of such wages to all its employees.

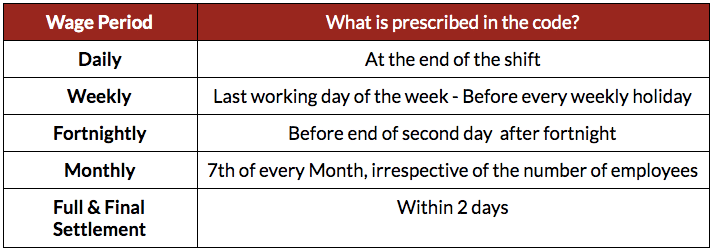

Minimum Pay and Timely Payment Guaranteed

The code has set the provision for minimum wages and timely payment as applicable to all employees across sectors and the wage ceiling.

New formula to determine the Floor Wage

State minimum wages have to be equal or more than the Floor Wage. Moreover, states are restricted from lowering the existing Minimum Wage to match the Floor Wage.

Equal Remuneration

Includes provisions prohibiting discrimination on grounds of gender. Equal pay is to be given for the same work or work of a similar nature done by employees even if they work in different units/cities/states as long as they are under the same employer.

Change in the inspection mechanism

The Code provides for the appointment of inspectors-cum-facilitators. These authorities would provide compliance advisory to employers and workers and conduct inspections.

BONUS: We have made a detailed analysis of the Code on Wages Act, 2019. Click here to watch the video.

A to Z of Payroll Processing CoursePractical course on payroll, inclusive of calculation of 10+ acts such as PF, ES, TDS.Enroll NowProfessional Tax MaharashtraPractical course on Professional Tax Maharashtra, inclusive of all calculationsEnroll NowIntroduction to Excel CourseUnderstanding the most widely used business software in the world MS-Excel.Enroll Now

Thank you for pausing from your busy day and gracing us with your precious time. We will get back to you in the next edition with more exciting and interesting updates.

Till then,

Goodbye,

Stay Safe, Stay Home