Greetings of the day!

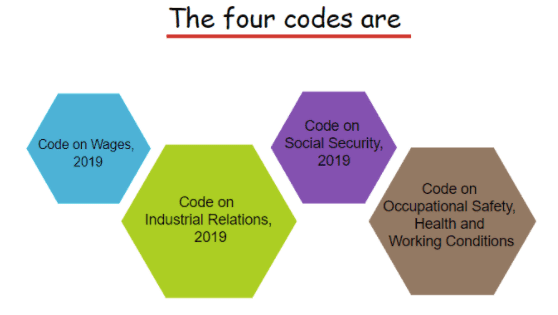

This edition will provide you with a brief analysis of the four labour codes introduced by the government in 2015 to bring about reforms and to ensure ease of business and safeguard the interests of the workers. Entering 2020, the government hoped that India would be able to implement all four codes however, it seems a distant dream.

The Burning Tale

What are the four Codes?

Why do we need these four codes?

Labor is in the concurrent list and more than 40 central laws and more than 100 state laws govern the subject which makes labour compliances too complex.

So, in the year 2002, the Second National Commission of Labour suggested reforming these outdated and complex labour laws.

Hence, the government came up with a plan to consolidate the central laws into four codes. These codes aim to improve the conditions and standards of workers, employed in both the organized as well as unorganized sectors.

Which laws will these four codes subsume?

Post enactment, the Wage Code shall repeal the four existing laws on wages, the Occupational Safety Code will amalgamate 13 existing laws on health, safety and working conditions of workers and the Social Security Code will make the present 15 laws on social security redundant.

1. Code of Wages will subsume –

a. The Payment of Wages Act, 1936 (POWA)

b. The Minimum Wages Act, 1948 (MWA)

c. The Payment of Bonus Act, 1965 (POBA)

d. The Equal Remuneration Act, 1976 (ERA)

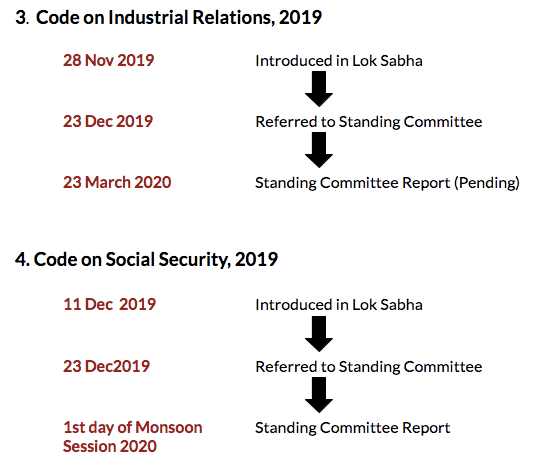

2. Code on Industrial Relations will subsume –

a. The Industrial Disputes Act, 1947

b. The Trade Unions Act, 1926

c. The Industrial Employment (Standing Orders) Act, 1946

3. Code on Social Security will subsume –

a. Employees’ Compensation Act, 1923

b. Employees’ State Insurance Act, 1948

c. Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

d. The employment exchange Act, 1959

e. Maternity Benefit Act, 1961

f. Payment of Gratuity Act, 1972

g. Cine Workers Welfare Fund Act, 1981

h. Building and Other Construction Workers Cess Act, 1996

I. Unorganized Workers’ Social Security Act, 2008

4. The Occupational Safety, Health, and Working Conditions Code will subsume –

a. Factories Act, 1948

b. Mines Act, 1952

c. Dock Workers (Safety, Health and Welfare) Act, 1986

d. Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996

e. Plantations Labour Act, 1951

f. Contract Labour (Regulation and Abolition) Act, 1970

g. Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979

h. Working Journalist and other Newspaper Employees (Conditions of Service and Miscellaneous Provision) Act, 1955

I. Working Journalist (Fixation of Rates of Wages) Act, 1958

j. Motor Transport Workers Act, 1961

k. Sales Promotion Employees (Condition of Service) Act, 1976

l. Beedi and Cigar Workers (Conditions of Employment) Act, 1966

m. Cine Workers and Cinema Theatre Workers Act, 1981

Ensuring Implementation

To monitor the implementation of labour laws at the grassroots level the Ministry of Labour and Employment has launched the ‘Santusht portal’.

The intention isto promote transparency, accountability, effective delivery of public services, and implementation of policies, schemes l through constant monitoring.

The portal would monitor the work of different bodies and wings of the ministry implementing labour laws.

It would also give credit and discredit to officials responsible for keeping or not keeping quality of service on the mark.

Labour Law Advisor now in English, check out our new channel. Explore Now

BONUS:- We have made a detailed analysis of the Labour Codes and the major changes. Click here to watch the video.

#Share this newsletter with your friends because a candle loses nothing by lighting another candle (Click Here to Subscribe >)

Look out for Affordable practical courses by LLA to boost up your career

A to Z Payroll Processing Course

Practical course on payroll, inclusive of calculation of 10+ acts such as PF, ES, TDS.Enroll Now

Professional Tax Maharashtra

Practical course on Professional Tax Maharashtra, inclusive of all calculationsEnroll Now

Introduction to Excel

Understanding the most widely used business software in the world MS-Excel.Enroll Now

Thank you for pausing from your busy day and gracing us with your precious time. We will get back to you in the next edition with more exciting and interesting updates.

Till then,

Goodbye,

Stay Safe, Stay Home.