The next article in our series of mutual funds. Learn why smallcase investment might be the key for you.

Table of Contents

What is Smallcase investment?

Financial investment in the market entails either buying individual stocks via a brokerage or depositing your money in equity funds or exchange-traded funds. But this new trend now has brokerages offering a full portfolio of stocks. Here, all stocks focus on a single sector, for investors to purchase at one go. This Smallcase investment trend is brought about about Bangalore based firm, Smallcase Technologies.

How does Smallcase investment work?

Smallcase investment requires the investor to have a brokerage account. Hence, Smallcase Technologies has joined hands with well-known brokerages in the field. These are HDFC Securities, Axis Direct, Kotak Securities, Edelweiss, Zerodha, 5paisa and Alice Blue. This direct investment in stocks requires a Demat account and a trading account. Smallcase investment means money being debited from your trading account and stocks being credited to your Demat account. Since you have direct hold of the stocks, there is no compulsory lock-in period and you can sell the stocks anytime. Thus, this is a great investment option for beginners.

Smallcase investment has four broad portfolios as follows:

- All weather investing portfolios which consist of large-cap equities, fixed income and gold. Thus, your money is widely invested in all categories and there is low risk.

- Smart beta portfolios which focus on large-cap stocks and blue chip stocks.

- Model-based portfolios which focus on established investment strategies and mid-cap and small-cap stocks. They follow the investment strategies of famous investors like Warren Buffet and Benjamin Graham.

- Thematic & sectoral portfolios which focus on a particular sector only and have higher risk.

Why is Smallcase better than Mutual Funds?

- Equity Funds and Mutual Funds investment attract an expense ratio which includes fund management, distributor’s commission and other expenses. The expense ratio is an annual deduction from your investment in the funds and is approximately equal to 1-1.5% of your investment. Meanwhile, Smallcase investment just attracts a brokerage payment. This is a transaction fee for every buying, selling and rebalancing of shares. This amount is much less when you compare it to expense ratio fees.

- Mutual Funds investment leads to allocation of fund units. While Smallcase investment gets you direct company shares in your demat account. Hence, investors have access to shareholder benefits such as bonus shares or tax-free dividends. You also have the liberty to sell those company’s shares if you feel the company running a loss.

- Mutual funds investment is stock investment based on market capitalization. Whereas Smallcase is an idea, theme or strategy based investment. For example, you can invest in the field of upcoming electric cars. Since the government is going to launch them by the year 2020. So many car companies have already begun exploration in this arena. No equity funds provide such an option.

- When you invest in Mutual Funds, you only get to view its top ten holdings. At the month-end, you receive a mail with details of all the companies where your investment went. In the case of Smallcase, you are given the list of companies for investment prior to the investment. You also get the liberty to either remove or add certain companies to your investment list, if you wish. Thus, smallcase is a transparent scheme and also provides better control.

- Withdrawal of mutual funds may or may not include an exit load. Exit load is a penalty which inhibits you from withdrawing the full amount. But there is no such condition of exit load penalty for Smallcase, even if you wish to withdraw after one day.

- Redemption request with equity mutual funds usually takes about three working days for processing. But Smallcase investors can track investments in real-time during market hours. Additionally, redemption requests are also available in real-time. Since adequate liquidity is one of the stock selection parameters used in Smallcase.

Why is Mutual Funds a better option?

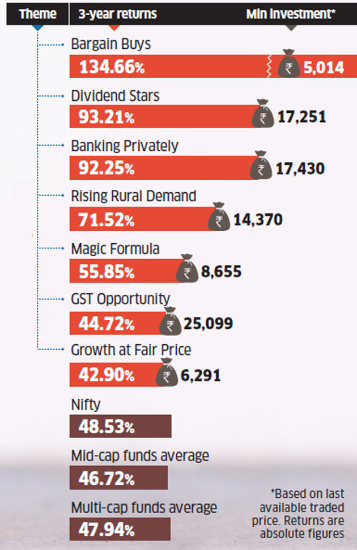

- The minimum investment for Smallcase is mostly on the higher side. This is because you are buying individual shares of multiple companies. Whereas, in mutual funds, you buy units of mutual funds. Hence, the minimum investment amount can be on the lower side.

- Smallcase incurs a tax liability. This is applicable for Short-Term or Long-Term Capital Gain. Thus, every time you rebalance your demat account, a tax payment incurs. Tax liability also incurs in mutual funds but only on withdrawal of funds.

All in all, Smallcase is an excellent investment option. Watch our detail video on Smallcase investment below.

Join the LLA telegram group for frequent updates and documents. Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!