Recently we sat down for an interview with the Founder of FinnovationZ, Mr Prasad Lendwe. FinnovationZ is an Indian YouTube channel relating to finance and investment, with over 6 lakh subscribers. FinnovationZ is a great stepping stone for people who have an avid interest in the field of finance and investment and wish to learn more about this topic. Prasad gave some great financial advice which should come extremely handy for beginners in the share market game. Click here to view that interview. In the second part of this interview, we spoke to Prasad on how to make money in the share market as a beginner. Read on to find out more.

Table of Contents

Why do you need to invest in the share market?

- Inflation – Inflation in the country is always at a high. You need to seek out ways to beat this high inflation. Since the value of your Rs 100 today will go down next year. If you have a savings account, then you get 3-4% interest on it. This is not sufficient to beat inflation.

- Passive income – A source of income which keeps generating money for you even when you’re not putting an effort into it.

- Retirement planning – You need a source of income even when you retire and do not have an active income, like your monthly salary.

To combat these points you need to invest into the share market.

Share market investment options:

- Fixed deposit – It gives a return of 7-7.5%. Post taxation, it comes to around the inflation rate only. Hence, there is not much return in this, but at least the value of your asset won’t decrease.

- Government bonds – These give slightly higher returns than fixed deposits. They also have additional tax benefits.

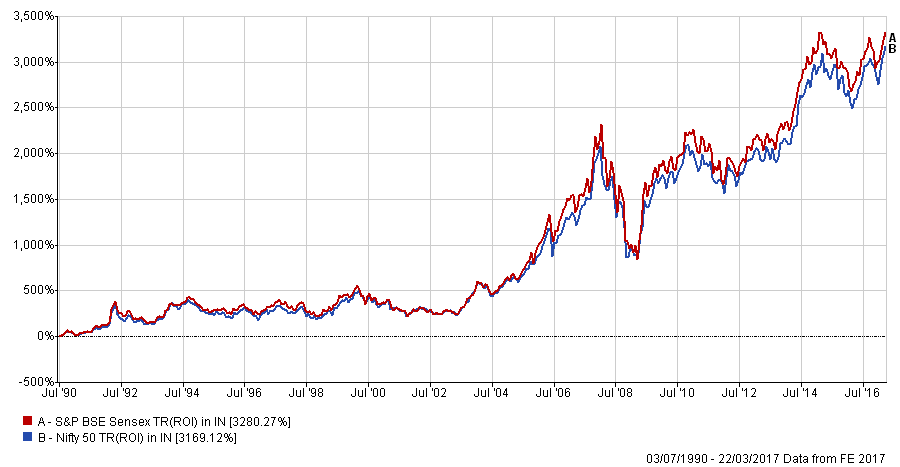

- Index funds – This is dependent on Sensex and Nifty ratings, which are integrators of the Indian economy. So if you believe that the Indian economy will grow then this is a good investment option. This gives results based on the growth of Sensex and Nifty. For Sensex, the CAGR for the last 10 years has been 15-16%.

Tips for beginners to invest in share market equity:

- Know where you are investing. Do not enter this investment for quick returns. Invest for long terms and only after a thorough analysis of the business. Only when you study the business will you get a knowledge of how it is faring and will fare in the future.

- Do not put all your eggs in one basket. Start investing with the smallest amount. Use trial and error to learn from your mistakes and make better investment choices. Don’t invest a major amount into an unknown business.

- Always enter with a long term vision. The share market has fluctuations in the short term, which is not in our hands to control. But in the long term, the share market will yield results depending on how the business is faring. So don’t invest thinking that you will get gains in a day. You need to have time and patience to hold onto the shares.

Index Fund

If you are a novice then this is a good option to enter the share market. Your investment money will go into the economy and benefit the economy. Furthermore, you will get good results too. But again, this will not yield results in 2-4 days. It is a long term play.

What is compounding?

If you reinvest the profit you earn each year, then your principal each year keeps increasing. This additionally increases the profit you receive every year. This is known as the power of compounding. For example, if you invest Rs 1 lakh in 16%, compounded annually, then it will yield you Rs 50 lakhs in a period of 25-26 years. The next 3-4 years will double this return. Hence, the longer you invest in a business, the higher returns you receive.

Watch our interview with FinnovationZ below:

Learn some more financial tips through our following blogs:

Franchise Business | Low Investment High-Profit Business Idea

Income Sources | Financial Advice To Earn More Money

EasyPlan – Investment Solutions

Meesho App – Earn Money Online Without Any Investment

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!