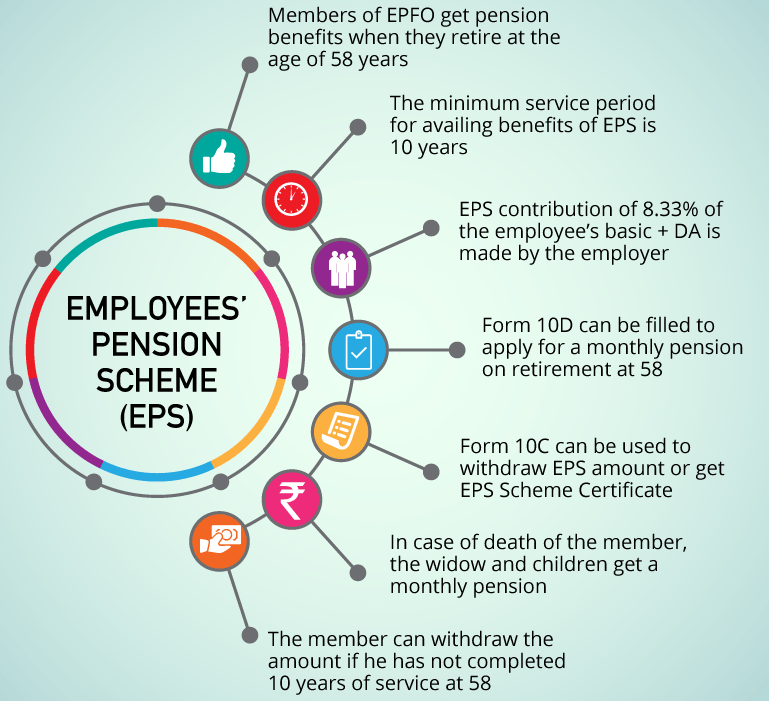

The Employees’ Pension Scheme (EPS) was launched in 1995. It is a social security scheme by the Employees’ Provident Fund Organization (EPFO). This scheme provides financial assistance to employees who have been working in an organized sector post their retirement at 58 years of age. But the scheme is only eligible for those employees who have been in service for a minimum of 10 years. This 10-year service may not be a continuous one though. In this article, we explain the various pension scheme benefits available to a PF member.

Table of Contents

Pension Scheme Benefits:

Life long unconditional pension

Once a member under the PF scheme complete 10 years of service, he automatically becomes eligible for a pension. This pension is provided for his full life, without any preset conditions. The monthly pension amount can range from Rs 1000 to Rs 7500. The Government of India is in talks to increase the bottom limit for this.

Pension scheme benefits for total disablement

If an EPFO member becomes totally and permanently disabled then he can receive his monthly pension without having completed a period of 10 years service. The member’s employer has to have deposited funds in his EPS account for a minimum of one month, for pension eligibility. The EPFO member becomes eligible for a monthly pension from his permanent disablement date. He need not wait till 58 years of age for receiving pension money. He receives PF amount as well as pension amount in this case. This pension continues for his lifetime. Although, the member may have to take a medical examination to see if he is inadequate for the job he was doing before his disablement.

Early pension scheme benefits

It is possible for the PF member to start receiving his pension amount from 50 years of age, instead of the norm of 58 years. This early pension amount will be less though, approximately 4% less annually. Once the member attains 58 years of age, he can still continue working and receiving his pension amount simultaneously.

Pension for family upon member’s death

In case of the death of the PF member, his widow will be eligible to receive his lifelong pension amount. Additionally, two of the deceased member’s kids will receive 25% of his pension amount individually. If the deceased member’s wife has also passed away then two of his kids will receive 75% of his pension until they are 25 years of age. If the deceased member has no wife or kids, then his nominee will receive his lifelong pension. This nominee can be his parents.

Watch the full video on this topic below:

Know more about Employee Pension Scheme Certificate And Application Process Of Form 10C.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!