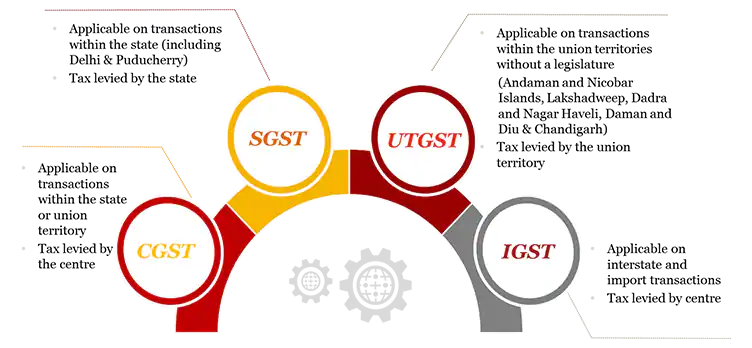

Goods and Service Tax or GST is an indirect tax which is levied on the supply of goods and services. This GST has replaced many previous taxes in India. The Goods and Service Tax act came into effect on July 1st 2017, after the bill was passed in the Indian Parliament on March 29th 2017. GST provides a multi-stage, comprehensive and destination-based tax which is levied on every value addition to the goods or service. The GST has also become one indirect tax for the complete Indian subcontinent. There are two types of GST schemes – Composite Scheme and Regular Scheme.

Table of Contents

GST Composite Scheme:

The composite scheme under GST is for small businesses so that they do not feel the burden of compliance provisions under the law. Composite scheme registration is optional and voluntary. This is valid for businesses which have a yearly turnover of fewer than 1.5 crores or 75 lakhs in some states. Although, if the turnover surpasses the given limit on any date, then the business has to move under the Regular Scheme. Sellers under the Composite Scheme are barred from charging GST to their customers, unlike Regular Scheme GST. Restaurants serving food and non-alcohol fall under the Composite Scheme. Sellers under the Composite Scheme have to file for quarterly returns instead of monthly returns, which has now become an annual return.

Unlike Regular Scheme GST, dealers do not have permission to take Input Tax Credit. There is also some concession on GST charges for Composite Scheme and they can pay a certain percentage of their turnover as the GST charges. This ranges from 1% to 5%, as usually seen in restaurants. They need not pay the exact tax.

How to check if a seller is under Composite Scheme?

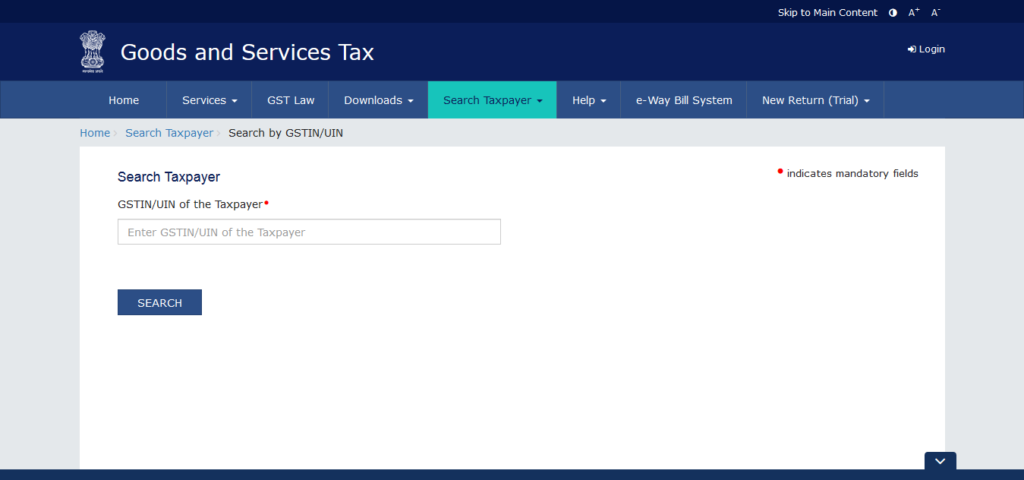

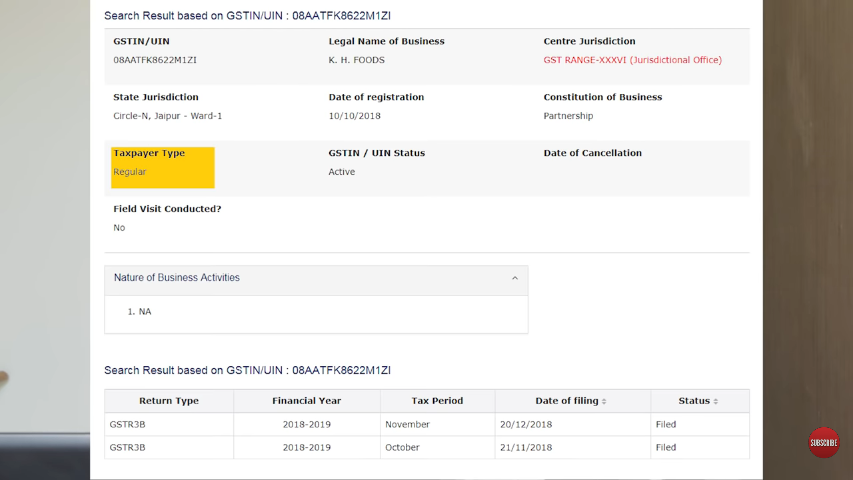

All businesses issuing and charging a GST from customers, have to mention their GST number on their bills. A GST number comprises of 15 digits. This GST number

This way you can check if a business falling under Composite S

What to do if GST is charged illegally?

- Save the bill

- Call on the GST helpline number – 01123370115

- Or call on the GST helpdesk number – 0120 4888999

- Or contact over email via helpdesk@gst.gov.in

- Mention the name of business, billing and scanned copy of bill, which charged you GST illegally.

Check our video on this topic below:

Watch our video on how to spot fake GST bills.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link –t.me/JoinLLA.

It’s FREE!