Using Paytm wallet is convenient due to the fact that you don’t need to look for any petty cash. Most importantly it does not come at any significant extra cost for usage. But recently, while out and about at a restaurant, we were asked to pay Rs 20 extra via Paytm. This came as a surprise and upon asking for the reason we were told that Paytm charged the business owners extra for any payments they processed.

Upon enquiring further we found out that many other shops have either started this practice or have stopped using Paytm itself. Those shop owners and businessmen who are unable to stop or charge extra are bearing a loss. Most people are not aware of this. If you Google “Why Paytm is bad for the economy” or “Why you should not use Paytm”, you will not find a single article on the web. Hence, we are here to share the whole story!

Table of Contents

The history & rise of Paytm wallet:

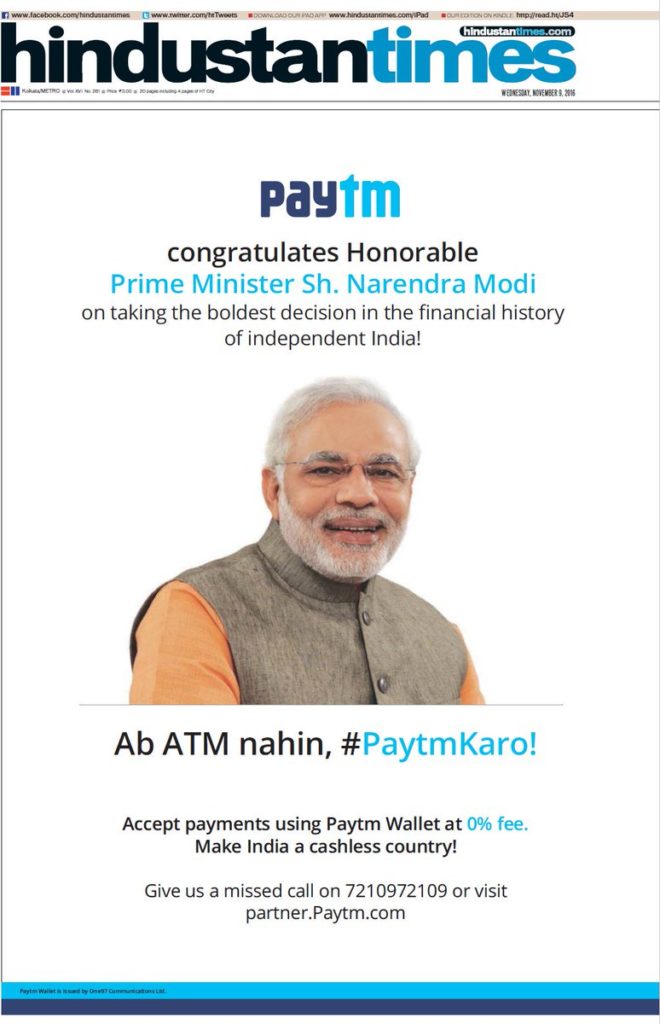

Paytm wallet started as this friendly startup, which suddenly boomed at the time of demonetisation or notebandi. The move was announced on the evening of 8th November 2016, at 8 pm by our honourable Prime Minister. It was a shocking move which brought chaos to the whole nation. But what was even more shocking was seeing full-page ads for Paytm wallet on all newspapers the very next day!

How can there possibly be so much planning in just one night? The full-page newspaper ads in all leading newspapers, the very next day, did not make much sense? Especially since the PM’s announcement on demonetisation occurred late evening. Yet all the newspapers had a full-page ad of Paytm wallet along with the image of our PM.

What is shocking here is that newspapers have a deadline of 4 pm for giving ads for print in the next day’s publishing. This is a fact for the smallest print ads. Hence, for full-page ads like these, across all papers requires planning for days if not weeks. Also using the image of the PM to promote a private company seems fishy.

Post demonetisation there was a major cash crunch. Meanwhile, Paytm offered wallet to bank and bank to wallet transactions for free. Also, other means of digital transfers such as UPI were not yet popular nor mobile-friendly. As a result, Paytm grew manifold as more and more people started using it. Merchants too had to use it for daily business. This is called network effect and FOMO.

When one merchant starts using it, others have to join in too. When users see so many merchants using it, they transfer more money to Paytm wallet. This way the cycle continues. Paytm business started booming, the company valuation increased and investment from Chinese group Alibaba and Softbank poured in billions. Today Paytm wallet has over 100 million app downloads. It also has a valuation of over Rs 70,000 crores. Compare that with India’s annual education budget for the school sector which is Rs 55,000 crores for 13 lakh schools.

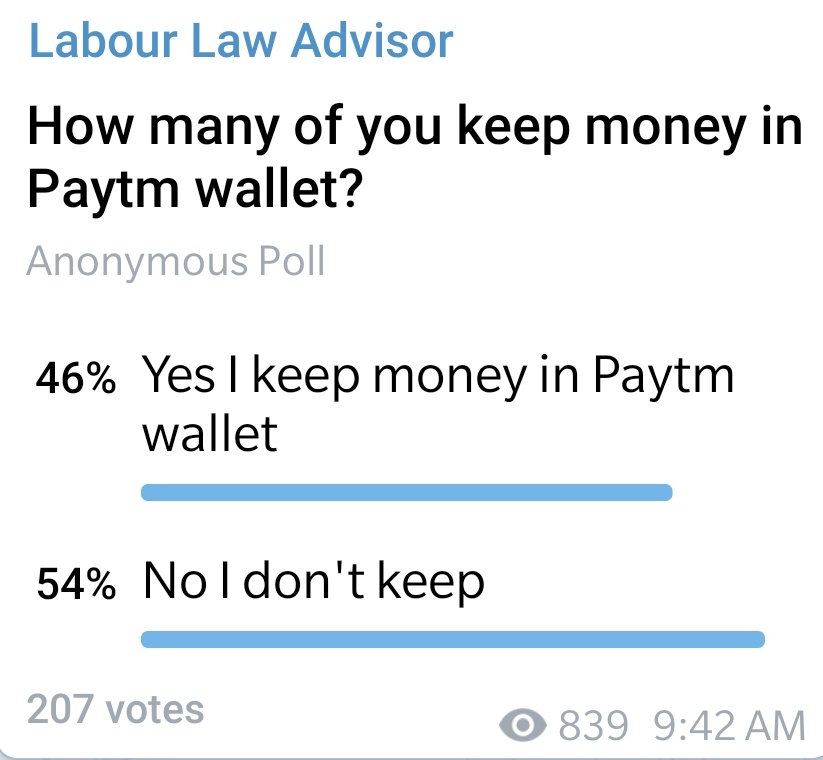

To get a sense of how many users keep money in the wallet we did a quick survey on our telegram group and over 45% said that they keep money in the Paytm wallet.

The issue:

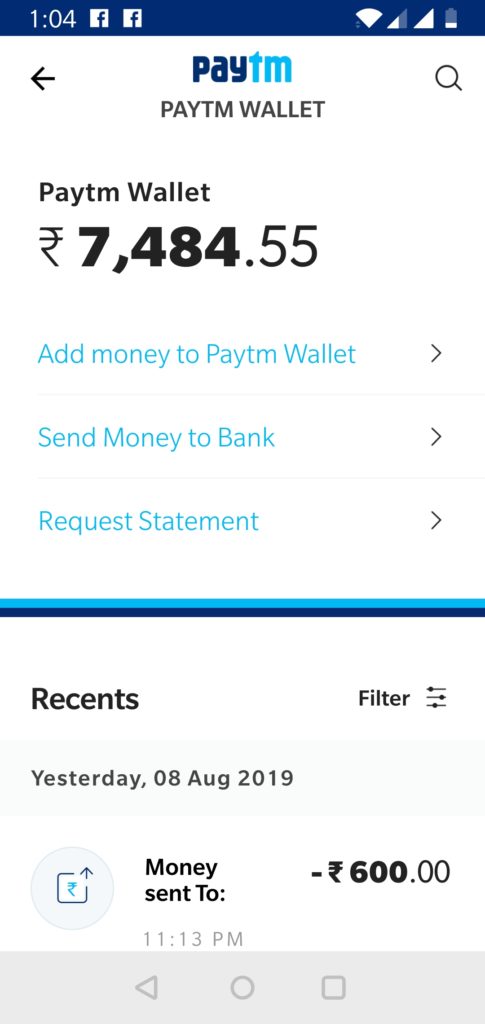

After establishing this monopoly Paytm wallet introduced heavy bank charges for transactions. This creates a massive problem. So when you have money in the Paytm wallet you can do 3 things as follows –

- Transfer it to the bank.

- Buy goods or services such as tickets, mobile recharge or goods.

- Transfer money to a merchant/shop/friend.

Paytm wallet transactional charges:

The transactional charges for Paytm wallet are as follows-

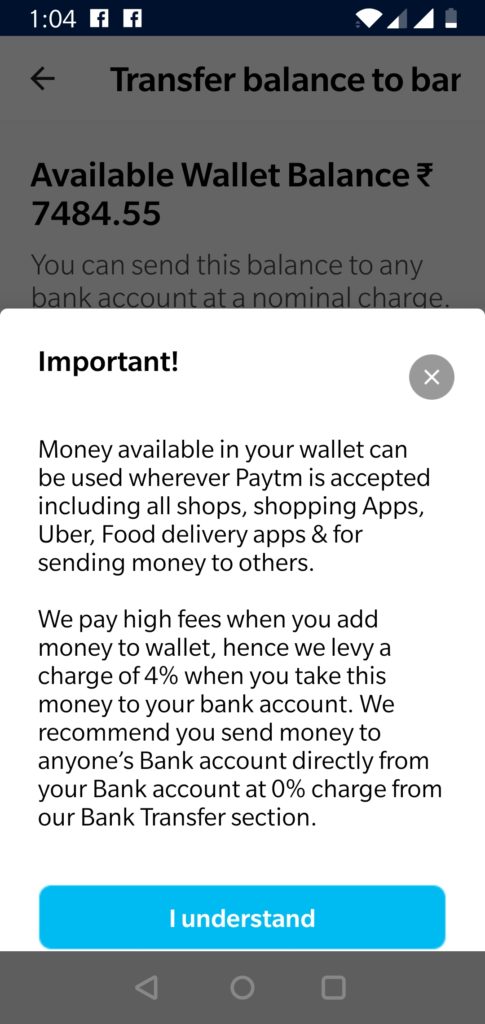

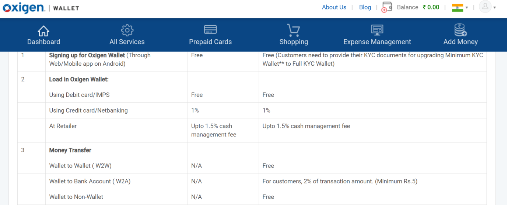

- Wallet to bank transfer –This is chargeable at 4%. So, if you want to transfer Rs 1 lakh from your Paytm wallet to your bank, you will have to pay Rs 4,000 plus GST for this. It will turn out to be close to 5%. This can sometimes be more than your profit margin, as many shopkeepers and traders have this much margin only. They have an option to directly transfer to banks as well but that too is chargeable at 1.75% plus GST and the customer obviously does not pay for that. Hence, if they use the second alternate it creates numerous small transaction entries in the bank. For instance, an ice cream shop selling 100 cups at Rs 5 a day. This brings another set of accounting challenges, bank charges, etc. So normal users do not end up transferring the Paytm wallet account balance to their bank. As a result, they try spending that wallet money in the second and third way given above.

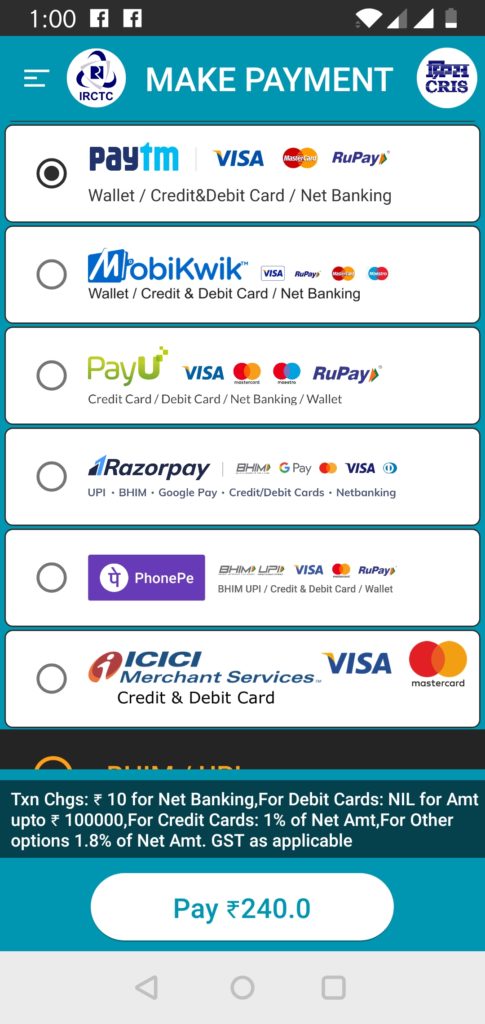

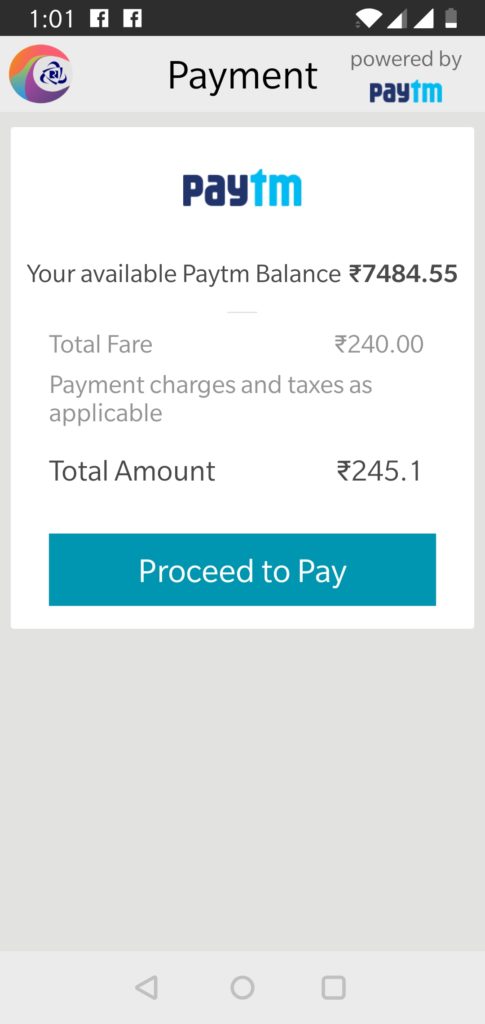

- If they buy goods or services from Paytm wallet either merchant or user is charged. For example, if you use the Paytm mall to buy a book, the merchant who is selling it has to give a cut from his profit to Paytm. For big merchants like the government or movie theatres, you have to bear the burden. Example, for IRCTC train ticket booking, the Paytm wallet transaction charge is 1.8% of net amount plus GST as applicable. If you book a movie ticket or a bus or flight ticket, then also there is a convenience fee chargeable.

- When Paytm is used for payment to a merchant or a friend, they also ultimately transfer it to the bank or use it to buy some goods or services with it. Transferring to the bank & buying most goods and services comes with an additional cost of 4-5%. So either they bear the loss or pass it on to the customer.

Why Paytm wallet is bad for the economy and for you:

- They levy a 4% charge on every bank transfer.

- It wipes out the profit margin for small merchants who take payment via Paytm wallet. So in most cases, the merchants have started charging 4% extra on every payment.

- IRCTC, movie ticket booking site, flight booking site – Paytm charges 4-10% extra as convenience fee on all websites.

- You are forced to pay via Paytm since you have balance in the wallet. This creates a loop because then the merchants have to keep it and so on. Discounts have dried out too as you have no option now.

- In a way, Paytm wallet is earning from every transaction happening on the app and this is taking money out of the system. This is the big brother of GST.

- What started as a wallet for convenience has now turned into pure loot. They just want to keep as much money with them as they have got a banking license, and obviously transferring money to Paytm bank account from the wallet is absolutely free.

- Paytm is not alone in this practice. Almost all mobile wallets are using this tactic.

- When your payment fails or you get cashback, the money is not returned to your bank account. Instead, it returns to the digital wallet, which continues the loop.

What should we do now?

- To dry a dirty pond, first, you need to stop all inflow and then you need to clear it out. So you need to stop accepting any payment in your Paytm wallet.

- Now the balance in the wallet needs to dispose of. Luckily, there are a few services where additional payment is not being taken, such as phone recharge, electricity and gas bill payments, some school fee payments, etc. If big chains like Big Bazaar, Lifestyle, etc. are accepting Paytm wallet payment then do use that.

- Stop using third-party apps for UPI payment and start using BHIM directly.

- We are also doing our part by stopping the Rs 51 cash prize payment for the YouTube quiz in the Paytm wallet. Instead, we will transfer it to the bank account.

- Share the below video, this article and message with as many people as possible with #PaytmMatKaro.

- Make a conscious choice whether this much convenience is worth 5% of your money – we know your answer will be a resounding “NO”!

Also read: RTI Amendment Bill 2019 | Unfair Play?

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA.

It’s FREE!