Deferred tax refers to the tax effect that has been postponed due to the timing difference. It can be classified as deferred tax asset or deferred tax liability. In this blog, we shall discuss few basics of DTA & DTL, timing difference and its categories, how it is calculated and its impact on financial statements, as well as instances that lead to DTA & DTL.

Table of Contents

Basics of DTA & DTL

Deferred tax is created on account of timing difference, that is when there is a difference in the profit calculation between the Companies Act and Income Tax Act.

Deferred Tax Asset (DTA) – In this case, a company pays its tax liability for a future period in advance or is able to reduce its tax liability in the coming years. In simple terms, Deferred Tax Asset is created in case the profit as per income tax is more than profit as calculated as per companies act and therefore, the company pays more tax.

Deferred Tax Liability (DTL) – In this case, the tax liability of a company accrues earlier but is to be paid in the subsequent years. That is, profit calculated as per companies act is more than profit as per income tax and hence, the amount of tax paid is less.

| Particulars | Current tax payment status | Future tax payment status | DTA & DTL |

| Profit as per Companies Act > Profit as per Income Tax Act | Pays less tax in the current year | Pays more tax in the subsequent years | DTL is to be accounted |

| Profit as per Companies Act < Profit as per Income Tax Act | Pays more tax now | Set off taxes in the subsequent years | DTA is to be created. Not necessary to account for as per prudence principle of accounting (AS 22) |

Timing Difference

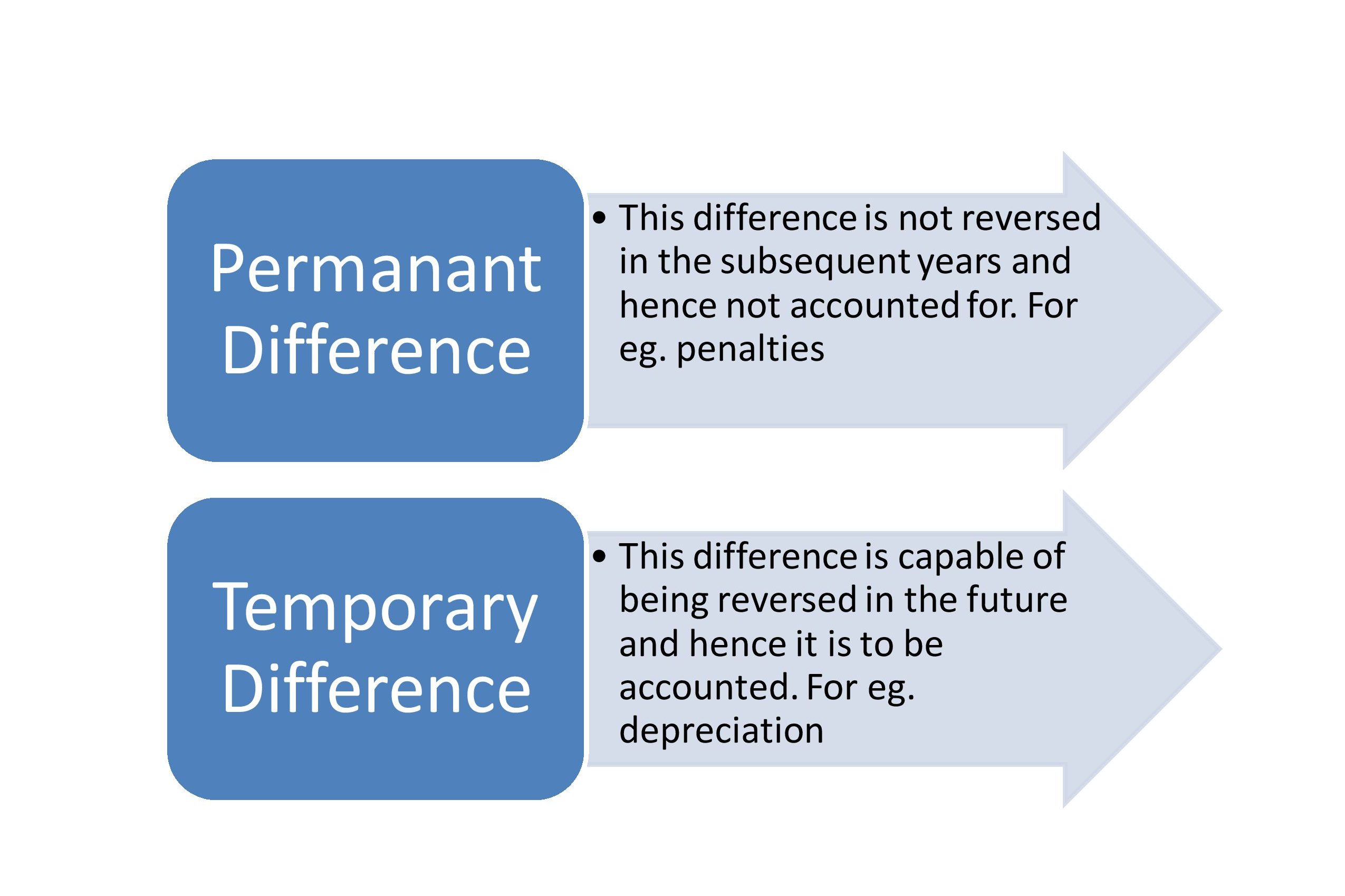

A company prepares its financial statements in accordance with the Companies Act but pays tax as per the Income Tax Act. Since there are certain expenses that are allowed and disallowed as per the income tax, it is known as the timing difference. Based on this difference, DTA & DTL are created. Timing difference can be classified as per the image given below:

Instances when DTA & DTL are to be created

There are various scenarios where DTA & DTL are to be created. Some of these are:

- The difference in the rate of depreciation

- The difference in the method of calculation of depreciation

- In case when the company suffers the loss

- Preliminary Expenses write off

- Provision for bad and doubtful debts

- Expenditure incurred for amalgamation

- Advertisement expenditure

- Expenditures under Section 43B like duty, cess, tax, etc., that are expensed when they are incurred but allowed on a payment basis.

Kindly note that MAT credit should not be considered as an instance for the creation of deferred tax as it does not arise on account of a difference in the profits rather it is the difference in the tax itself. However, the same has mixed opinions.

Also, the above list is not conclusive and exclusive.

Calculation of DTA & DTL

Let us better understand this through the following illustration.

| Particulars | Amount in Lakhs |

| Profit before depreciation and taxes | 100 |

| Less Depreciation as per Companies Act | 8 |

| Book Profit | 92 |

| Add Depreciation as per Companies Act | 8 |

| Less Depreciation as per Income Tax Act | 5 |

| Profit as per Income Tax | 95 |

| Book Profit< Income Tax, DTA | (95-92)*30% = 0.9 |

| Assuming tax rate @30% |

Thus, Rs 0.9 lakh of Deferred Tax Asset should be shown on the asset side of the balance sheet under the heading – Other Current Assets. Furthermore, since DTA & DTL are made for future liability, any change in the tax rate should also be considered.

The journal entries to be passed for recording of DTA & DTL are as follows:

| DTA | DTL |

| Profit and loss A/C Dr Deferred Tax A/C Dr To Provision for current tax (Being provision for current tax made and deferred tax reversed) | Profit and loss A/C Dr To Provision for current tax To Deferred Tax (Being provision for current tax and deferred tax made) |

Points to be cautious about

For better presentation of DTA & DTL, following points should be kept in mind:

- The balance of DTA & DTL should be reviewed at the end of every financial year.

- The balance should be shown as the net balance. That is, either DTA or DTL should be shown.

- It should reflect the amount of virtual certainty.

- It should be disclosed under the heading Other Current Assets or Other Current Liability, as the case may be, under the balance sheet.

- Since it refers to future liability, the latest tax rate should be considered for the calculation of deferred tax.

Join the LLA telegram group for frequent updates and documents.

Download the telegram group and search ‘Labour Law Advisor’ or follow the link – t.me/JoinLLA

It’s FREE!