Payment of Gratuity is a ‘Defined benefit’ provided to an employee as a lump sum, on his retirement. It is the money given to an employee in recognition of his services as a parting gift.

The maximum amount of gratuity that can be paid to an employee is Rs 20 lakh. The employer can, however, pay more gratuity than the prescribed ceiling. The payment of gratuity is made either to the employee at the time of his retirement, or termination or to the legal heir in case of death of the employee.

Eligibility

The employee must be eligible for superannuation

- Temporary staff, contract workers etc., are all eligible (except ‘apprentice’) for the gratuity amount, as long as they are considered as employees of the organization

- The employee must have resigned from his/her job after continuous employment with the same organization for 5 years

- In case of death of the person or if he/she becomes disabled due to accident for sickness

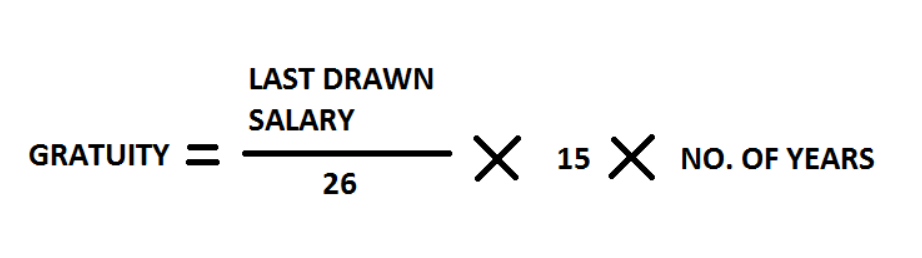

Calculation

where,

- Gratuity limit = Rs 20 lakhs

- Last drawn salary = Basic + Dearness Allowance (D.A.)

- Tenure of working/No. of years of service = 5 or more years. The time period in months is taken on the higher side if it is more than 5 months. For example, if an employee completes 7 years and 5 months in an organization, then for the purpose of the gratuity calculation formula, his no. of years of service will be 7 years. Similarly, if an employee completes 7 years and 8 months of service, then for the gratuity calculation formula, we take it as 8 years.

Gratuity Calculation Formula for Deceased Employee

| Qualifying Service | Rate |

| Less than 1 year | 2 times of basic pay |

| 1 year or more but less than five years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| Twenty years or more | Half of the emoluments (salary) for every completed 6 monthly periods subject to a maximum of 33 times of emoluments |

The full eligible amount paid as a gratuity to an employee is completely tax-free and thus attracts no tax at all.

Additionally, the word “eligible” means the amount to which an employee is legally entitled to as per the gratuity calculation formula. It means that if an employee is entitled to a sum of Rs 15 lakhs as gratuity, but his employer pays him Rs 17 lakhs, then this extra amount of Rs 2 lakhs (Rs 17 – 15 lakhs) to which the employee is not legally entitled to, attracts a tax. Furthermore, the employee has to pay a certaintaxt on this extra earned money calculated as a certain percentage.

All this calculation too difficult for you?

No worries! Here is a Gratuity Calculator to help you calculate your Gratuity at the time of retirement. 💰

Bonus: Get to know about Gratuity Calculation in detail. Watch this video here.