Greetings of the day!

This edition will provide you with a brief analysis of the existing EPF rules and important points related to Employee Provident Fund, Employee Pension Scheme and EDLI.

The Burning Tale

1. What is EPF?

The Employees’ Provident Fund (EPF) is a savings scheme introduced under the Employees’ Provident Fund and Miscellaneous Act, 1952. It is administered and managed by the Central Board of Trustees (CBT) that consists of representatives from three parties, namely, the government, the employers and the employees.

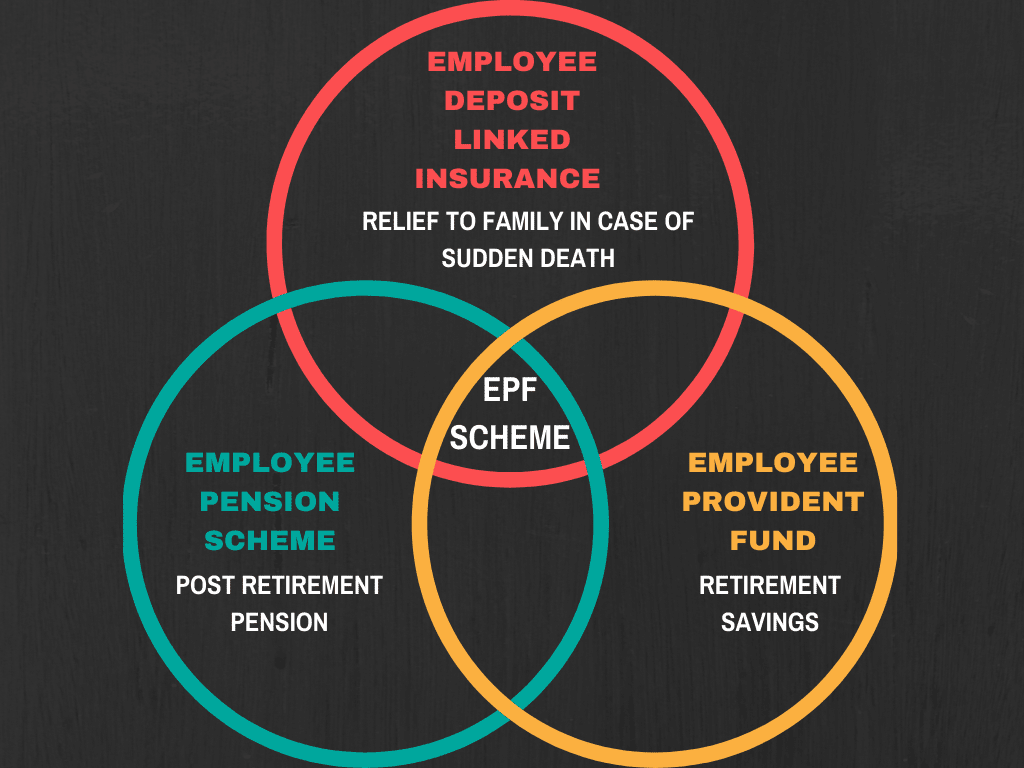

EPF consists of 3 major schemes-

2. Basic rules of contribution in EPF

PF deposits come from two sources i.e. employer’s contribution and employee’s contribution. The PF is not calculated on the total pay of the employee but on the sum amount of Basic Pay and DA. So,

PF Wage = Basic Pay + DA

3. Present Rate Contribution Bifurcation

The current rate of contribution is 12% of Rs.15000 for all organisations. The employee’s contribution is entirely deposited in the EPF account whereas the employer’s contribution is divided into different parts.

Bifurcation of Employer’s Contribution

However, EPF share of 10% is valid for the organisations–

Any establishment in which less than 20 employees are employed. Any sick industrial company and which has been declared as such by the Board for Industrial and Financial ReconstructionAny establishment which has at the end of any financial year, accumulated losses equal to or exceeding its entire net worth and Any establishment in the following industries:

(a) Jute (b) Beedi (c) Brick (d) Coir and (e) Guar gum Factories

4. Important Points Related to EPF Contributions

The contributions are payable on the maximum wage ceiling of Rs. 15000/-.The employee can pay at a higher rate and in such case, the employer is not under any obligation to pay at such a higher rate. To pay the contribution to higher wages, a joint request from Employee and employer is required [Para 26(6) of EPF Scheme]. In such a case the employer has to pay administrative charges on the higher wages (wages above 15000/-). For an International Worker, the wage ceiling of 15000/- is not applicable.

5. Important Points Related to EPS Contributions

The contribution is payable out of the employer’s share to EPS and no contribution is payable by the employee.

The pension contribution is to be paid in all cases except when an employee crosses 58 years of age and is in service or when an EPS pensioner is drawing Reduced Pension and re-joins as an employee.

In both cases, the Pension Contribution @8.33% is to be added to the Employer Share of PF.

In case an employee, who is not existing EPF/EP member joins on or after 01-09-2014 with wages above Rs 15000/- In these cases the pension contribution part will be added to employee share, EPF

6. Important Points Related to EDLI Contributions

1. Contribution to be paid on up to the maximum wage ceiling of 15000/- even if PF is paid on higher wages.

2. Each contribution is to be rounded to the nearest rupee. (Example for each employee getting wages above 15000, the amount will be 75/-)

3. EDLI contribution to be paid even if a member has crossed 58 years age and pension contribution is not payable. This is to be paid as long as the member is in service and PF is being paid.

BONUS: We have made a detailed video on important PF rules and points to note while calculating interest. Click here to watch the video.

Thank you for pausing from your busy day and gracing us with your precious time. We will get back to you in the next edition with more exciting and interesting updates.

Till then,

Goodbye,

Stay Safe, Stay Home

Editorial Team: Divyam Jain, Loveleen Kaur

Design: Anirudh Sharma