In ancient times, a “bonus” or “inaam”, was usually paid by the employer to the employee as a reward for his work and dedication. Traditionally, this reward was paid around Diwali as a gift so that the employees could shop and enjoy the festivities.

However, post independence as India became more industrialised and moved towards capitalization, many employers stopped paying bonuses to their employees in order to maximise their profits. So, the government introduced a regulation and made it mandatory for the employers to pay out a certain percentage of their profit as a bonus. This regulation is called the Payment of Bonus Act, 1965. As per the act, bonus should be paid at the minimum rate of 8.33% and the maximum rate of 20%.

Here is what you need to know about the act:

| Applicability | Any establishment with 20 or more employees or any factory with 10 or more employees If the establishment/company is less than 5 years old then bonus to be paid only if the establishment/company is profitable. After 5 years minimum bonus payable irrespective of profit/loss. |

| Eligibility | Employees getting Rs. 21,000 per month or less (Basic + DA, excluding other allowances) and have completed 30 working days in that financial year |

| Components of Bonus | Salary / Wages only include basic and DA for bonus payment Rest of allowances (eg, HRA, overtime, etc.) are excluded |

| Min / Max and time limits on bonus payments | Should be paid at the minimum rate of 8.33% and maximum rate of 20%. To be paid within 8 months from the close of the accounting year. |

| Disqualification of bonus | Employees can be disqualified if they are dismissed on the basis of fraud, misconduct, or any similar situation |

Exempted Establishments

The payment of bonus act will not apply to the following section of employees:

- The employees of Life Insurance company

- Seamen defined under clause 42 of the merchant shipping act 1958.

- Employees who registered or listed under the dock workers Act 1948 and employed by the registered or listed employers.

- The employees of any industry controlled by the central or state government.

- Employees from Indian red cross society or education institutions, institutions not for profit.

- Employees employed by the contractor on building operations

- Reserve Bank Of India(RBI) employees

- Employees of any financial corporation under the Section 3 or Section 3a of the State Financial Corporation act (SFC) 1951

- Employees of IFCI, Deposit Insurance Corporation, Agriculture Refinance Corporation.

- Any financial institution is an establishment in the public sector which the central government notifies.

- The employees of inland water transport establishment

Bonus Applicability Limit & Calculation Limit

Appropriate governments specify a wage limit above which statutory bonus is not mandatory. This limit is known as the Bonus Applicability Limit.

The calculation ceiling for bonus is also defined by the government wherein the employer has to pay either the amount which is specified by the government or minimum wage applicable to the employee, whichever is higher.

| 1 April, 2014 Onwards | |

| Applicability Limit | 21,000 |

| Calculation Limit | 7000 |

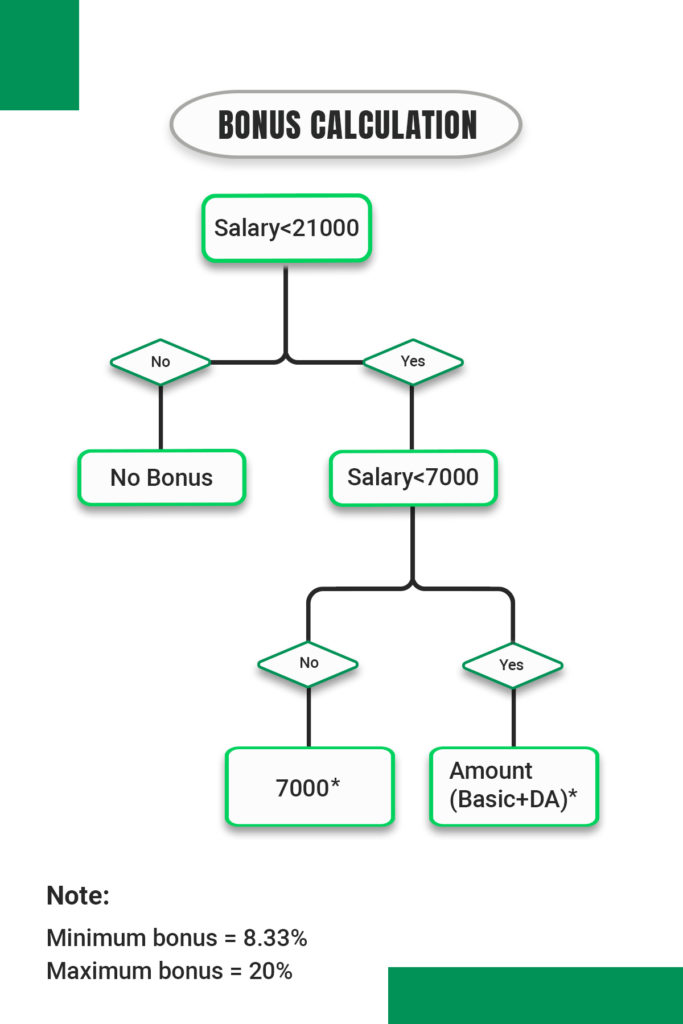

Calculation of Bonus as per Bonus Act (Amendment of 2015)

If the gross earning of your employees is below Rs.21000 you are eligible to pay a bonus. Calculation of bonus will be as follows:

- If Basic+DA is below Rs.7000 then the bonus will be calculated on the actual amount.

- If Basic+DA is above Rs.7000 then the bonus will be calculated on Rs.7000.

Examples of Calculation of Bonus

Case 1

If the Basic salary of the employee is less than or equal to Rs 7,000

Saahil is working as an engineer in a Company in Bangalore. His basic salary is Rs. 6,500 per month.

Formula: Basic Salary*8.33% = Bonus per month

6500*8.33% = 541.45 (6497.4 per annum)

Case 2

If the Basic salary of the employee is higher than Rs 7,000

Vedant is working as a Sales officer in one of the shops in Delhi. His basic salary is Rs. 18,000 per month.

Formula: Basic Salary*20% = Bonus per month

7,000*20% = 1400 per month

Case 3

If the Basic salary of the employee is higher than Rs 21,000

There is no bonus applicable to employees having a basic salary of more than Rs. 21000.

Why is it called Diwali Bonus in India?

Ans per Section 39 of Code on Wages –

“All amounts payable to an employee by way of bonus under this Code shall be paid by crediting it in the bank account of the employee by his employer within a period of eight months from the close of the accounting year”

This makes it mandatory for the companies and establishments to pay by 30th November.So, most employers usually pay it around Diwali and hence, it is called Diwali Bonus.

Tired of calculating employee bonuses? We got your back!

Here’s the Bonus Calculator to help you calculate the employee bonus just with a click.